DP Use of Grace Periods and Their Impact on Knowledge Flow:

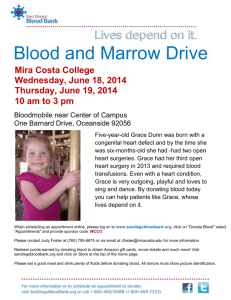

advertisement