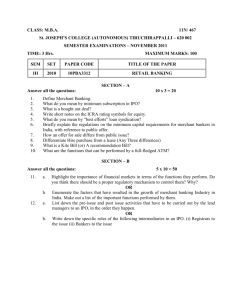

IPCC-PAPER 5: ADVANCED ACCOUNTING Review Test -3 Advanced Accounting-Full Course

advertisement

IPCC-PAPER 5: ADVANCED ACCOUNTING Review Test -3 Advanced Accounting-Full Course Date: 17/10/2015. Duration: 3 Hrs. Marks: 100 Marks. Q 1 is compulsory. Answer any 5 from the remaining 1. a) A company organizing trade fairs and exhibitions charges 5% contingency charges from the participants and outside agencies. The rent for the space booked by the participants in the trade fair includes the contingency charges. In dealing with outside agencies, the contingency charges are levied separately in the invoice. The intention of levying these charges is to meet any unforeseen liability, which may arise in future. The instances of such unforeseen liabilities may be on account of injury or loss of lift to visitors or exhibitors due to fire, terrorist attack, stampede, natural calamities and other public and third party liability. The chance of occurrence of these events is high because of large crowds that visit the fair. The decision to levy 5% contingency charges was based on assessment only as actual liability cannot be estimated. The following accounting treatment and disclosure was made by the company in its financial statements: 1) 5% contingency charges are treated as income and matching provision for the same is also made in accounts Page 1 of 11 2) A suitable disclosure to this effect is also made in the notes forming part of accounts Required: (i) Whether the creation of provision for contingencies under the facts and circumstances of the case is in conformity with AS 29 (ii) If the answer to (i) above is no then what should be the treatment of the provision which is already created in the balance sheet (5 Marks) b) Grant Medicare Ltd. acquired 5 units of Brain Scan Equipment for USD 5,00,000 in April 2010 incurring Rs.20,00,000 on sea freight and USD 12,000 per unit towards transit insurance, bank charges, etc. Purchase was partly funded by government grant of Rs.94 lakhs. Prevailing exchange rate is Rs.50 per USD. Company estimated useful life of equipment at 4 years with an estimated salvage value of approximately 13%. Grant was considered as deferred income up to 2012 – 13 and in April 2013 the company had to return the entire grant received due to non fulfillment of certain conditions. You are required to show depreciation and the grant that is to be recognized in profit and loss account for the period commencing from 2010 – 11 and onwards. What accounting entry shall be passed for return of grant in April 2013? Company follows WDV method of depreciation @ 40%. (5 Marks) c) Southern Ltd. purchased a plant on 30.09.10 with a quoted price of Rs.180 lakhs from Tatamaco Ltd. Tatamaco Ltd. offer 3 months credit with a condition that discount of 1.25% will be allowed if payment were made within one month. VAT is 12.5% on the quoted price. Company incurred 2% on transportation cost and 3% on erection cost of the quoted price. Preoperative costs amount to Rs.1.5 lakhs. To finance the purchase of the machinery company took a term bank loan of Rs.125 lakhs on 01.10.10 at 14.5% p.a. The machine was ready for use on 31.12.10. Further, expenditure of Rs.2.72 lakhs was incurred on 31.01.11. The machine was put to use on 01.04.11. At what cost shall the machine be recorded in books? Consider plant to be a qualifying asset within the meaning of AS 16. (5 Marks) Page 2 of 11 d) Annual Lease Rent = Rs.40,000 at end of each year Lease Period = 5 years Guaranteed Residual Value = Rs.14,000 Fair value at the inception of lease = Rs.1,50,000 Interest rate implicit in lease = 12.6% PVF at 12.6%: 1 – 0.89; 2 – 0.79; 3 – 0.7; 4 – 0.622; 5 – 0.552 Show the journal entry to record the asset taken on finance lease in the books of lessee. (5 Marks) 2. Ajay Enterprises, a Partnership firm in which A, B and C are three partners sharing profits and losses in the ratio of 4:3:3. The balance sheet of the firm as on 31st December, 2011 is as below: Liabilities A' Capital B's Capital C's Capital B's Loan Sundry creditors ` 15,000 7,500 15,000 4,500 16,500 58,500 Assets Factory Building Plant & Machinery Debtors Stock Cash at Bank ` 24,160 16,275 5,400 12,390 275 58,500 On balance sheet date all the three partners have decided to dissolve their partnership. Since the realization of assets was protracted, they decided to distribute amounts as and when feasible and for this purpose they appoint C who was to get as his remunerations 1% of the value of the assets realized other than cash at Bank and 10% of the amount distributed to the partners. Assets were realized piece-meal as under: Particulars First installment Second installment Third installment Last installment Dissolution expenses were provided for estimated amount of The creditors were settled finally for ` 18,650 17,320 10,000 7,000 3,000 15,900 Prepare a statement showing distribution of cash amongst the partners by ‘Highest Relative capital method’. (16 Marks) Page 3 of 11 3. a) Victory Ltd. issued 2,00,000 equity shares and got the entire issue underwritten as follows: A - 60% shares, B - 25% shares and C - 15% shares. In addition to the above-mentioned arrangement, there was the following firm underwriting: A - 10,000 shares, B - 8,000 shares and C - 6,000 shares. Total subscriptions including firm underwriting were 1,70,000 shares. Marked applications were as follows: A - 38,000 shares, B - 40,000 shares and C - 12,000 shares. The shares underwritten firm were treated as unmarked applications as benefit of firm underwriting is not given to individual underwriters. Calculate the liability of each one of the underwriters in shares. (8 marks) b) The following balances appeared in the books of Paradise Ltd on 1-4-2011: 12 % Debentures: ` 7,50,000 Balance of Sinking Fund: ` 6,00,000 Sinking Fund Investment: ` 6,00,000 (Represented by 10% ` 6,50,000 secured bonds of government of India) Annual contribution to the Sinking Fund was ` 1,20,000 made on 31st March each year. On 31-3-2012, balance at bank was ` 3,00,000 before receipt of interest. The company sold the investment at 90%, for redemption of debentures at a premium of 10% on the above date. You are required to prepare the following accounts for the year ended 31st march, 2012: 1) Debentures Account 2) Sinking Fund Account 3) Sinking Fund Investment Account 4) Bank Account 5) Debenture Holders Account (8 Marks) Page 4 of 11 4. Hari Ltd. and Narayan Ltd. are to be amalgamated into Hari Narayan Ltd. The new company is to take over all the assets and liabilities of the amalgamating companies. Assets and Liabilities of Hari Ltd. are to be taken over at book values in exchange of shares in Hari Narayan Ltd. Three shares in the new company are to be issued at a premium of 20% for every two shares of Hari Ltd. The approved scheme for Narayan Ltd. is as follows: a) 10% Preference shareholders are to be allowed two 15% Preference shares of ` 100 each in Hari Narayan Ltd. for three Preference shares held in Narayan Ltd. b) The Debentures of Narayan Ltd. are to be paid off at 5% discount by the issue of debentures of Hari Narayan Ltd. at par. c) The Equity shareholders of Narayan Ltd. are to be allowed as many shares at par in Hari Narayan Ltd. as will cover the balance on their account and for this purpose, plant and machinery is to be valued less by 15% and obsolete stock forming 10% of the overall stock value is to be treated as worthless. From the following summarised Balance Sheets of the two companies prior to amalgamation you are required to show the Journal Entries and the Balance Sheet of the amalgamated company immediately after amalgamation: Liabilities Equity Shares Hari Ltd. Narayan Ltd. Assets 6,40,000 12,50,000 Plant and Mach. of ` 10 each 10% Pref. Share Trade Debtors - 7,50,000 Inventory of ` 100 each General Res. Debentures Trade Creditors Cash and Bank 8,80,000 Hari Ltd. 12,80,000 20,00,000 1,52,000 1,25,000 1,00,000 1,50,000 1,08,000 1,00,000 - 3,50,000 - Profit & Loss A/c - 5,00,000 1,20,000 2,25,000 16,40,000 27,25,000 Narayan Ltd. 16,40,000 27,25,000 You are required to show the journal entries in the books of the amalgamated company and the balance sheet immediately after amalgamation. (16 Marks) Page 5 of 11 5. a) The following figures are extracted from the books of KLM Bank Ltd. as on 31-032012: Particulars ` Interest and discount received Interest paid on deposits Issued and subscribed capital Salaries and allowances Directors Fees and allowances Rent and taxes paid 38,00,160 22,95,360 10,00,000 2,50,000 35,000 1,00,000 Postage and telegrams Statutory reserve fund Commission, exchange and brokerage Rent received Profit on sale of investment Depreciation on assets Statutory expenses Preliminary expenses Auditor's fee 65,340 8,00,000 1,90,000 72,000 2,25,800 40,000 38,000 30,000 12,000 The following further information is given: 1) A customer to whom a sum of ` 10 lakhs was advanced has become insolvent and it is expected only 55% can be recovered from his estate. 2) There was also other debts for which a provisions of ` 2,00,000 was found necessary. 3) Rebate on bill discounted on 31-03-2011 was ` 15,000 and on 31-03-2012 was ` 20,000. 4) Income tax of ` 2,00,000 is to be provided. 5) Classification of Non Performing Advances: ` Standard 30,00,000 Sub-standard 1,20,000 Doubtful assets not covered by security 2,00,000 Doubtful assets covered by security for one year Loss Assets 50,000 2,00,000 The directors desire to declare 5% dividend. Prepare the Profit and Loss account of KLM Bank Ltd. for the year ended 31-03-2012 and also show, how the Profit and Loss account will appear in the Balance Sheet if the Profit and Loss account opening balance was NIL as on 31-03-2011. (8 Marks) Page 6 of 11 b) The following balances appeared in the books of Happy Life-Assurance Co. Balance Sheet as on 31st March 2013. Amount in Particulars Rs. lacs Claims less re-assurance paid during the year By Death 2200 By Maturity 1500 Annuities 6 Furniture and Office Equipment at cost( Including Rs. 40 Lacs bought 250 during the year) Printed Stationery 77 Cash with bank on Current Account 1350 Cash and Stamps in hand 30 Surrenders 40 Commission 250 Expense of Management 3100 Sundry Deposits with Electricity Companies etc. 1 Advance payment of Income-tax 50 Sundry Debtors 50 Agents' Balances 100 Income Tax 450 Income Tax on Interest, Dividends and Rents 500 Loan and Mortgages 150 Loans on policies 3250 Sundry investments( Rs. 250 Lacs deposited with the RBI) 52000 Building at cost (including Rs. 85 lacs added during the year) 5400 Total 70754 Share Capital 10000 Life Assurance fund at the beginning of the year 40000 Premium less reassurances 15000 Claims less reassurances outstanding at the beginning of the year By death 900 By Maturity 600 Credit Balance pending adjustment 60 Consideration for annuities granted 2 Interest, Dividends & Rents 1800 Registration and other fees 2 Page 7 of 11 Sundry Deposits 100 Taxation provisions 300 Premium Deposits 1150 Sundry Creditors 350 Contingency Reserve 150 Furniture and Office Equipment Depreciation account 40 Building Depreciation Account 300 Total 70754 From the forgoing balance and following information, prepare the Revenue Account for the year ended on that date: a) Claims less reassurances outstanding at the end of the year: By death Rs. 600 lacs; By Maturity Rs. 400 Lacs. b) Expenses outstanding Rs. 60 Lacs and prepaid Rs. 15 Lacs. c) Provide Rs. 45 Lacs for depreciation of building, Rs. 15 Lacs for depreciation of furniture and office equipment and Rs. 110 Lacs for taxation. d) Premium outstanding Rs. 2,028 Lakhs, commission thereon Rs. 65 Lacs. e) Interests, Dividends & Rents Outstanding (net) Rs. 30 Lacs and interest and rents accrued (net) Rs. 350 Lacs. (8 marks) 6. a) M/s P and Co., had four departments A, B, C and D. Each department being managed by manager whose commission was 10% of the respective departmental profit, subject to a minimum of ` 6,000 in each case. Interdepartmental transfers took place at a 'loaded' price as follows: From Department A to Department B: 10% above cost From Department A to Department D: 20% above cost From Department C to Department D: 20% above cost From Department C to Department B: 20% above cost For the year ending on 31st March, 2014 the firm had already prepared and closed the departmental Trading and Profit and Loss Account. Subsequently, it was discovered that the closing stocks of departments had included interdepartmentally transferred goods at loaded price instead of cost price. Page 8 of 11 From the following information prepare a statement re-computing the departmental profit or loss: Dept. A ` (38,000) - Particulars Final profit (loss) Inter departmental transfers incl. at loaded price in stock. departmental Dept. B ` 50,400 70,000 (` 22,000 from A & ` 48,000 from C) Dept. C ` 72,000 - Dept. D ` 1,08,000 4,800 (` 3,600 from C & ` 1,200 from A) (8 Marks) b) Ram of Chennai has a branch at Nagpur to which office; goods are invoiced at cost plus 25%. The branch makes sales both for cash and on credit. Branch expenses are paid direct from Head Office and the branch has to remit all cash received into the Head Office Bank Account at Nagpur. From the following details, relating to the year 2009, prepare the accounts in Head Office Ledger and ascertain Branch Profit as per stock and debtors method. Branch does not maintain any books of accounts, but sends weekly returns to head office: Particulars ` Goods received from head office at invoice price Returns to head office at invoice price 1,20,000 2,400 Stock at Nagpur branch on 1.1.2009 at invoice price 12,000 Sales during the year – Cash 40,000 Credit 72,000 Debtors at Nagpur branch as on 1.1.2009 14,400 Cash received from debtors 64,000 Discounts allowed to debtors 1,200 Bad debts during the year 800 Sales returns at Nagpur branch 1,600 Salaries and wages at branch 12,000 Rent, rates and taxes at branch 3,600 Office expenses at Nagpur branch 1,200 Stock at branch on 31.12.2009 at invoice price 24,000 (8 marks) Page 9 of 11 7. Answer any four: a) Win Ltd. has entered into a three year finance lease arrangement with a Sports Club in respect of fitness equipments costing ` 16,99,999.50. Annual lease payments to be made at the end of each year are structured in such a way that the sum of the Present Values of the lease payments and that of the residual value together equal to the cost of the equipments leased out. The residual value of the equipment at the expiry of the lease is estimated to be ` 1,33,500. The assets would revert to the lessor at the end of the lease. IRR is 10%. You are required to compute annual lease rent and the total unearned finance income. Consider PVF at 10 % for 3 years to be 2.486 and for 3rd year to be 0.751. (4 Marks) b) Option Ltd. is engaged in manufacturing of steel. For its steel plant, it required machineries of latest technology. It usually resorts to Long Term Foreign Currency Loans (LTFCL) for its fund requirements. On 1st April 2011, it borrowed USD 1 million from International Funding Agency, USA when exchange rate was 1 $ = ` 52. The funds were used for acquiring machines on the same date to be used in three different steel plants. The useful life of the machineries is 10 years and their residual value is ` 20,00,000. Earlier, also the company used to purchase machineries out of LTFCL. The exchange differences arising on such borrowings were charged to Profit and Loss account and were not capitalized even though the company had an option to capitalize it as per amended AS 11. Now, for this new purchase of machinery, Option Ltd. is interested to avail the option of capitalizing the same to the cost of asset. Exchange rate on 3st March 2012 is 1 $ = ` 51. Assume that on 31st March 2012, Option Ltd. is not having any old LTFCL except for the amount borrowed for machinery purchased on 1st April 2011. Can Option Ltd. capitalize the exchange difference to the cost of the asset on 31 st March 2012? If yes, calculate amount of depreciation on machineries as on 31st March 2012. Answer in lakhs of rupees. (4 Marks) Page 10 of 11 c) During the year 2012 – 13, R Ltd. was sued by competitor for Rs.15 lakhs for infringement of a trademark. Based on the advice of the company’s legal counsel, R Ltd. provided for a sum of Rs.10 lakhs in financial statements for the year ended 31st March 2013. On 18th May 2013, the Court decided in favour of the party alleging infringement of the trademark and ordered R Ltd. to pay the aggrieved party a sum of ` 14 lakhs. The financial statements were prepared by the company’s management on 30th April 2013 and approved by the board on 30th May 2013. Should R Ltd. adjust its financial statements for the year ended 31st March 2013? What would be the treatment of the above, in case the court decision was held on 1st June 2013? (4 Marks) d) What are the liabilities of designated partners in a LLP. Explain in brief. (4 Marks) e) Umesh Ltd. (a listed company) has a share capital of ` 300 lakhs in equity shares of ` 10 each. It also has free reserves worth ` 287 lakhs. It resolves to buy back maximum possible fully paid equity shares (round off to nearest Lakhs) of ` 10 each at ` 22 per share from the open market. For the purpose, it issues 1 lakh 11 % preference shares of ` 10 each at par, the entire amount being payable with applications. The company uses ` 16 lakhs of its balance in Securities Premium Account apart from its adequate balance in General Reserve to fulfill the legal requirements regarding buy-back. Give necessary journal entries to record the above transactions. (4 Marks) ---------Best of Luck-------- Please return the Question Paper along with the answer sheet. Assessed answer papers will be returned by 24th October, 2015. ________________________________________________________________________________________________________________________________________________________________________________________________ Questions and Solutions prepared by Jai Shah, CA & CFA (USA) M: +91-9601258161; website: www.ashishlalaji.net Page 11 of 11