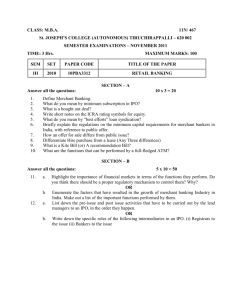

IPCC-PAPER 5: ADVANCED ACCOUNTING Mock Test -2 Accounting Standards

advertisement

IPCC-PAPER 5: ADVANCED ACCOUNTING Mock Test -2 Accounting Standards Date: 06 / 10 / 15 Duration: 1 Hr. Marks: 30 Marks. Q1 (a) Sun Ltd. has entered into a sale contract of Rs.5 crores with X Ltd. during 2011 – 12 financial year. The profit on this transaction is Rs.1 crore. The delivery of goods is to take place during the first month of 2012 – 13 financial year. In case of failure of Sun Ltd. to deliver within the schedule, a compensation of Rs.1.5 crores is to be paid to X Ltd. Sun Ltd. planned to manufacture the goods during the last month of 2011 – 12. As on the balance sheet date (31.03.12) the goods were not manufactured and it was unlikely that Sun Ltd. will be in a position to meet the contractual obligation. (i) Should Sun Ltd. provide for contingency as per AS 29? (ii) Should provision be measured as the excess of compensation to be paid over the profit? (4 Marks) (b) Tiger Motor Car Limited signed an agreement with its employees union for revision of wages on 01.07.2011. The revision of wages is with retrospective effect from 01.04.2008. The arrear wages up to 31.3.2011 amounts to Rs. 40,00,000 and that for the period from 01.04.2011 to 01.07.2011 amount to Rs. 3,50,000. In view of the provisions of AS 5 “Net Profit or Loss for the period, Prior Period Items and Changes in Accounting Policies”, decide whether a separate disclosure of arrear wages is required while preparing financial statements for the year ending 31.3.2012. (4 Marks) (Assessed answer papers shall be returned on 17th October 2015) [Question paper and solution shall be hosted on: www.ashishlalaji.net] Page 1 of 5 (c) From the following information relating to X Ltd., calculate Diluted Earnings Per Share as per AS 20: Net Profit for the current year Rs.2,00,00,000 Number of equity shares outstanding 40,00,000 Basic earnings per share Rs.5.00 Number of 11% convertible debentures of Rs.100 each 50,000 Each debenture is convertible into 8 equity shares. Interest expense for the current year Rs.5,50,000 Tax saving relating to interest expense (30%) Rs.1,65,000 (4 Marks) (d) A Company follows April to March as its financial year. The Company recognizes cheques dated 31st March or before, received from customers after balance sheet date, but before approval of financial statement by debiting ‘Cheques in hand account’ and crediting ‘Debtors account’. The ‘cheques in hand’ is shown in the Balance Sheet as an item of cash and cash equivalents. All cheques in hand are presented to bank in the month of April and are also realised in the same month in normal course after deposit in the bank. State with reasons, whether the collection of cheques bearing date 31st March or before, but received after Balance Sheet date is an adjusting event and how this fact is to be disclosed by the company? (4 Marks) Q2 (a) Plymouth Ltd. is engaged in research on a new process design for its product. It had incurred Rs.10 lakhs on research during first 5 months of the financial year 2012-13. The development of the process began on 1st September, 2012 and upto 31st March, 2013, a sum of Rs. 8 lakhs was incurred as Development Phase Expenditure, which meets assets recognition criteria. From 1st April, 2013, the Company has implemented the new process design and it is likely that this will result in after tax saving of Rs.2 lakhs per annum for next five years. The cost of capital is 10%. The present value of annuity factor of Rs. 1 for 5 years @ 10% is 3.7908. Decide the treatment of Research and Development Cost of the project. (6 Marks) (b) Sky Ltd. wishes to obtain a machine costing Rs.30 lakhs by way of lease. The effective life of the machine is 14 years, while the lease period shall be 5 years. The lease rent shall be Rs.3 lakhs p.a. in the first three years and Rs.5 lakhs in the remaining two. Implicit interest rate in the lease is 15%. How should the lease be classified and treated? (8 Marks) Questions and Solutions prepared by CA Ashish Lalaji M: 98258 56 1 55; Website: www.ashishlalaji.net -------Best of Luck--------Page 2 of 5 IPCC-PAPER 5: ADVANCED ACCOUNTING Solution to Mock Test -2 Accounting Standards Date: 06 / 10 / 15 Q1 (a) (i) As per AS 29, a provision should be recognized if an enterprise has present obligation on account of past event that probably requires an outflow of resources and a reliable estimate can be made of the amount of obligation. Sun Ltd. has the obligation to deliver the goods within the scheduled time as per the contract. It is probable that Sun Ltd. will fail to deliver the goods within the stipulated time period. Thus, Sun Ltd. should recognize a provision for the best estimate of the amount of compensation payable. (2 Marks) (ii) The goods are not yet manufactured as on the balance sheet date and hence no profit has accrued. Provision should be recognized for the full amount of compensation payable, which is Rs.1.5 crores. (2 Marks) (b) It is given that revision of wages took place in July, 2011 with retrospective effect from 1.4.2008. The arrear wages payable for the period from 1.4.2008 to 31.3.2011 cannot be taken as an error or omission in the preparation of financial statements and hence this expenditure cannot be taken as a prior period item. Additional wages liability of Rs.40,00,000 (from 1.4.2008 to 31.3.2011) should be included in current year’s wages. It may be mentioned that additional wages is an expense arising from the ordinary activities of the company. (2 Marks) Although abnormal in amount, such an expense does not qualify as an extraordinary item. However, as per AS 5, when items of income and expense within profit or loss from ordinary activities are of such size, nature or incidence that their disclosure is relevant to explain the performance of the enterprise for the period, the nature and amount of such items should be disclosed separately. However, wages payable for the current year (from 1.4.2011 to 1.7.2011) amounting Rs.3,50,000 is not a prior period item hence need not be disclosed separately. This may be shown as current year wages. (2 Marks) Solution prepared by Page 3 of 5 CA. Ashish Lalaji (c) Adjusted Net profit for the current year = 2,00,00,000 + 5,50,000 – 1,65,000 = Rs.2,03,85,000 Number of equity shares resulting from conversion of debentures = 50,000 × 8 = 4,00,000 equity shares (2 Marks) Total number of equity shares resulting from conversion of debentures = 40,00,000 + 4,00,000 = 44,00,000 shares Diluted Earnings per share = 2,03,85,000 / 44,00,000= Rs.4.63 (2 Marks) (d) Even if the cheques bear the date 31st March or before, the cheques received after 31st March does not represent any condition existing on the balance sheet date i.e. 31st March. Thus, the collection of cheques after balance sheet date is not an adjusting event. (2 Marks) Cheques that are received after the balance sheet date should be accounted for in the period in which they are received even though the same may be dated 31st March or before as per AS 4. Moreover, the collection of cheques after balance sheet date does not represent any material change affecting financial position of the enterprise, so no disclosure is necessary. (2 Marks) Q 2 (a) Research Expenditure – According to AS 26 ‘Intangible Assets’, the expenditure on research of new process design for its product Rs.10 lakhs should be charged to Profit and Loss Account in the year in which it is incurred. It is presumed that the entire expenditure is incurred in the financial year 2012-13. Hence, it should be written off as an expense in that year itself. (2 Marks) Cost of internally generated intangible asset – it is given that development phase expenditure amounting Rs.8 lakhs incurred up to 31st March, 2013 meets asset recognition criteria. As per AS 26, for measurement of such internally generated intangible asset, fair value should be estimated by discounting estimated future net cash flows. This is determined as under: Savings (after tax) from implementation of new design for next 5 years Rs.2 lakhs p.a. Company’s cost of capital 10 % Annuity factor @ 10% for 5 years 3.7908 Present value of net cash flows Rs.7.582 lakhs (2 lakhs x 3.7908) The cost of an internally generated intangible asset would be lower of cost value Rs. 8 lakhs or present value of future net cash flows Rs. 7.582 lakhs. (2 Marks) Page 4 of 5 Hence, cost of an internally generated intangible asset will be Rs. 7.582 lakhs. The difference of Rs.0.418 lakhs (i.e. 8 lakhs – 7.582 lakhs) will be amortized by Plymouth for the financial year 2012-13. Amortisation - The company can amortise Rs.7.582 lakhs over a period of five years by charging Rs. 1.516 lakhs per annum from the financial year 2013-2014 onwards. (2 Marks) (b) As per AS 19 “Leases”, a lease agreement should be classified into a finance lease or operating lease at the inception of the lease agreement. One of the situations, where a lease gets classified as finance lease is where the lease term covers major part of useful life of the asset. In the given case, the lease covers only 5 years out of 14 years of useful life, which means lease does not cover major part of useful life. One more situation, where a lease gets classified as finance lease is when present value of Minimum Lease Payments (MLP) substantially covers the fair value of the asset leased. PV of MLP is determined as under: Year Lease Payments 1–3 3 4–5 5 PVF PV (15%) 2.283 6.85 1.069 5.35 12.20 (4 Marks) PV of MLP covers 40.67 % (12.2 / 30) of fair value, which is not substantial (as less than 90%). Thus, the given lease shall be classified as operating lease. Lease payments under operating lease should be recognized as an expense in the statement of profit and loss on straight line basis unless another systematic basis is available. In the given case, the total lease rent for the period of 5 years is Rs.19 lakhs [(3 X 3 years) + (5 X 2 years)]. Hence, each year an expense of Rs.3.8 lakhs (19 / 5) should be recognized. (4 Marks) Solution prepared by CA. Ashish Lalaji ________________________________________________________________________________________________________________________________________________________________________________________________ Questions and Solutions prepared by CA Ashish Lalaji M: 98258 56 1 55; Website: www.ashishlalaji.net Page 5 of 5