Pinnacle Academ y Mock Tests for May 2016 CA Final Examination

advertisement

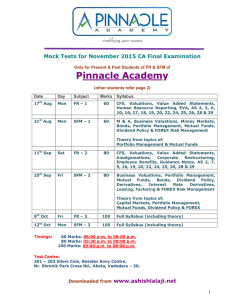

Mock Tests for May 2016 CA Final Examination Only for Present & Past Students of Pinnacle Academy Date Day Subject Marks Syllabus 6th February Sat FR – 1 60 Amalgamations, Corporate Restructuring, AS 6, 10, 11, 15, 16, 17, 18, 19, 20, 22, 24, 25, 26, 28 and 29 & Share Based Payments 27th February Sat SFM – 1 60 M & A, Business Valuations, Leasing, Factoring, Mutual Funds, Dividend Policy, Derivatives & FOREX Risk Management 12th March Sat FR – 2 80 CFS, Valuations, Value Added Statements, Amalgamations, Corporate Restructuring, Employee Benefits, EVA, NBFC and AS 1 to 29 (except AS 8) 26th March Sat SFM – 2 80 Business Valuations, Portfolio Management, Mutual Funds, Bonds, Dividend Policy, Derivatives, Leasing, Factoring, Risk Analysis in Capital Budgeting & FOREX Risk Mgmnt. Theory from topics of: Capital Markets, Portfolio Management, Mutual Funds, Dividend Policy & FOREX 14th April Thu FR – 3 100 Full Syllabus (including theory) 16th April Sat SFM – 3 100 Full Syllabus (including theory) Timings: 60 Marks: 10:00 a.m. to 12:00 p.m. 80 Marks: 10:00 a.m. to 12:30 p.m. 100 Marks: 10:00 a.m. to 01:00 p.m. Test Centre: 201 – 202 Florence Classic, Besides Unnati Vidhyalay, 10, Ashapuri Society, Jain Derasar Rd., Opp. VUDA Flats, Akota, Vadodara – 20. The above schedule shall undergo change if M. Com. Exams clash with the test dates as announced above. You are advised to check updates on website: www.ashishlalaji.net Downloaded from www.ashishlalaji.net Topics Common for both – FR and SFM: Syllabus of FR includes following topics of SFM: Business Valuations: Dividend Decisions: Mutual Funds : EVA: FCFF and FCFE Model Gordon’s Model NAV calculation and Theory of Mutual Funds Entire Topic Syllabus of SFM includes following topics of FR: Valuations: Mutual Funds : Valuation of Goodwill, Shares and Business Dividend Equalization Important Theory Questions Financial Reporting: EVA: Meaning and Uses, Shareholder Value Analysis, MVA, Financial Engineering HRA: Lev and Schwartz, Jaggi and Lau, Growing Scope of HRA Accounting of Assets: Entire summary of AS 16, Meaning of and Distinction between Operating and Finance Lease, Methods for valuation of intangible assets, Treatment of R and D expenditure, Impairment of CGU, Reversal of Impairment Loss Amalgamations: Treatment of Reserves, Purchase Method, Pooling of Interest Method, Treatment of Goodwill AS 22: Timing and Permanent Differences (Meaning and Distinction) NBFCs: NPA as per NBFC prudential norms, Provisioning rates AS 15: Objectives and types of benefits covered, Accounting of Short term compensated absences Strategic Financial Management: Financial Policy and Corporate Strategy: Functions of SFM, Interface of Financial Policy and Strategic Management, Linkage of Financial Policy with Strategic Management, Sustainable Growth Rate Mergers and Acquisitions: Distinction between Horizontal and Vertical Merger, Reverse Merger / Takeover by reverse bid, Demergers, Buy outs (especially LBO), Financial Restructuring, Free Float Market Capitalization Business Valuations: Due Diligence Dividend Decisions: Factors governing, Determinants / Practical Considerations, Forms of Dividend, Walter Model, MM Model, Lintner Model Leasing: Distinction: Leasing - HP, Cross Border Leasing Indian Capital Markets: Bought-out Deal, Functions of Secondary Market / Stock Exchanges, Distinction between Primary and Secondary Markets, Determination of Stock Market Index, Rolling Settlement, Depository and Dematerialization, Stock Lending / Borrowing Scheme, Book Building, Insider Trading, Green Shoe Option Portfolio Management: Types of Risk and Distinction, Objectives and Basic Principles, Factors affecting Investment Decision, CAPM, CML, SML, Distinction between SML and CML, Portfolio Rebalancing, Techniques of Economic Analysis Mutual Funds: Advantages, Disadvantages, Key Players, NAV, Distinction between Open Ended and Close Ended Schemes, Exchange Traded Funds, Risk of Debt Funds, Investors’ Rights and Obligations, Criteria for evaluation, Selection and Exit from mutual funds Factoring: Meaning, advantages and disadvantages, Distinction from Bills Discounting Financial Services: Meaning and Process of Credit Rating, CAMEL Model, Benefits, Precautions and Limitations of Credit Rating, Advantages of online share trading, Distinction between Commercial and Investment Banking, Functions of Investment Bank (I-Bank) Indian Money Markets: Features, Difference from Capital Markets, CP, TB, MMMFs, Securitization, Repos, Reverse Repos, IBPC, Refinancing Bond Valuation and Analysis: Interest rate risk, Re-investment Risk and Default Risk, ZCB, Duration, Risk from Government Policy Forex: Types of Exchange Rate Risk, Forward Contract, Currency swaps, Interest Rate swaps, Distinction between Currency Swap and Interest Rate Swap, PPP, IRP, Caps, Floors and Collars, Nostro, Vostro and Lorro Accounts, Swaptions, Significance of LIBOR International Financial Management: Debt Sources of Finance from International Market, FCCB, GDR, Taxation of GDR, ADR, Euro Issues, Approaches of Optimizing Cash inflows (special emphasis of Leading, Lagging, Netting and Matching), Hedge Funds and their benefits and demerits, IDR (Indian Depository Receipts) Derivatives: Distinction between Futures - Forward, Reasons for Index futures being more popular, Meaning, Mechanism, Benefits and Usage of Futures, Commodity Futures, Distinction between Futures - Options, Benefits of Trading in Options, Intrinsic and Time Value of Option, Embedded Derivatives Capital Budgeting: NPV, IRR, Distinction between NPV and IRR, Capital Rationing, Impact of Inflation, SCBA and its features, Project Report, Zero Date of Project Risk Analysis in Capital Budgeting: Sensitivity (What If) Analysis, RAD, CE, Decision Tree, Simulation, Real Options EVA (from FR Material): Meaning and Uses, Shareholder Value Analysis, MVA, Financial Engineering Downloadeded from www.ashishlalaji.net