Original March, 2010 Updated October, 2013

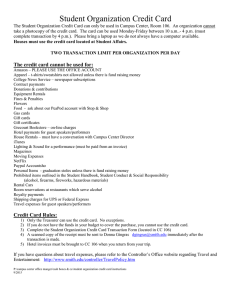

advertisement

Original March, 2010 Updated October, 2013 Revised April, 2016 (clarification of authorized/unauthorized purchases) Credit Card Orientation What is the Credit Card Program? • An effort to simplify purchasing of certain commodities through an agreement between US Bank & the System Office. The agreement provides that US Bank will issue credit cards to System Office employees for payment of certain travel related expenses, Special Expenses or Department Head expenses, or departmental purchases. • System Office employees to be issued credit cards enter into an agreement with the System Office committing to use the credit card as provided in System Procedure 7.3.3 Credit Cards. • Each credit card will be tailored to the needs of the credit card holder. How will this work? • Credit cards will be issued in the name of the employee and the employee will make purchases on behalf of the System Office. • The System Office is the responsible party and will be responsible for all payments. • As employees make purchases they enter the transaction on a credit card transaction log and obtain and retain the itemized receipt to submit with the transaction log. • The first business day after the 8th of each month, credit card holders will receive by email a statement from US Bank for their monthly credit card transactions. By the date indicated each month, the credit card holder must submit to the Business Office the credit card Transaction Log with appropriate receipts and documentation for the monthly US Bank credit card statement. • The Business Office must make payment to US Bank by the 22nd of each month. • In the event of a disputed charge a Cardholder Dispute Form is to be completed and submitted to the Business Office Manager. What are your obligations as a card holder? • Secure the credit card. • Use the credit card for MnSCU business only in accordance with your agreement with the System Office and System Procedure 7.3.3 Credit Cards. • Maintain a transaction log and appropriate documentation of the transactions. • By the date indicated each month submit to the Business Office the Transaction Log and reconciliation to the monthly bill. • Submit other necessary documentation as required by MnSCU Policy or Procedure. For example, the Out of State Travel/Special Expense approval as appropriate. • Complete a Cardholder Dispute form for any disputed charge. • Inform the vendor of MnSCU’s tax exemption status. The tax exempt ID number is printed on the card. • In the event the card is lost or stolen, call US Bank Customer Service at 1-800-393-3526 and notify the Business Office promptly. What can the credit card be used for? With proper approval, a Cardholder may be authorized to charge in such merchant categories as: • Food and non-alcoholic beverage for business-related meetings • Caterers and bakers • Discount, department and variety stores • General merchandise • Auto parking lots • Shopping/buying clubs • Electronic sales • Computer software stores • Data processing services • Computer repair • Informational retrieval services • Bookstores • Office stationary supplies • Telecommunications equipment • Photocopy and photos • Cash equivalents (gift cards, bus passes, parking vouchers if preapproved with documented distribution) When in travel status: • Hotels and motels rooms, with related taxes • Airlines • Car Rental and related gasoline • Taxis and buses • Conference and seminar registrations • Travel agencies • Parking The Purchasing Card cannot be used for the following transactions: • • • • • • • • • • • • • Items for personal use Items for non-college, non-university purposes Cash or cash advances Food and beverages for individual employee when in travel status Phone calls, personal Alcoholic beverages Weapons of any kind or explosives Relocation expenses Entertainment Recreation Capital assets and sensitive items Drugs or pharmaceutical products Items which would be given away for promotional purposes • • • • • • • • • Expenses for staff recruiting, advertising, or entertainment of prospective employees Gifts, donations, or contribution to individuals or organizations Payments to other departments Refunds of revenue Purchase of or removal of hazardous or radioactive materials Time payments Pyramiding (multiple purchases to cover same transaction) Tuition payments Any contracted services (Consulting or Professional/Technical Service, or service where a MnSCU contract must be used) How can the credit card be used? • In person in store • by telephone • via internet • fax • US mail. Who do I contact with questions or concerns? Questions regarding the Credit Card Program should be referred to the Business Office Manager.