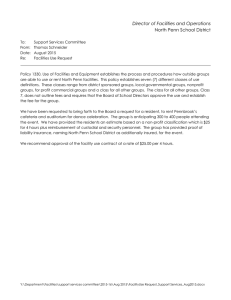

£ Mai/lie ~ NORTH PENN SCHOOL DISTRICT

advertisement