PANOLA COLLEGE COMPREHENSIVE ANNUAL FINANCIAL REPORT

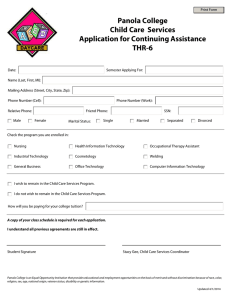

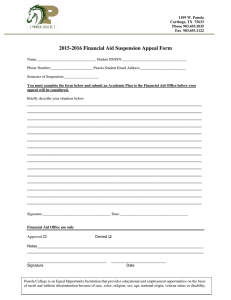

advertisement