– Completing a Worksheet Lesson Plan 2.4 Course Title Lesson Purpose

advertisement

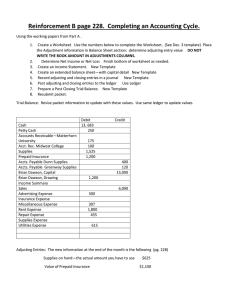

Lesson Plan 2.4 – Completing a Worksheet Course Title – Accounting I Lesson Purpose - Complete a worksheet for the end of fiscal period. Behavioral Objectives Analyze adjusting entries. Extend income statement accounts on a worksheet. Extend balance sheet accounts on a worksheet. Calculate net income or net loss. Prove net income or loss. Preparation OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C: 1.a. - describe the purpose of accounting 1.b. - apply information from source documents 1.h. - calculate and record end-ofperiod adjustments; 7.a. - follow oral and written instructions; 7.b. - develop time management skills by setting priorities for completing work as scheduled 7.c. - make decisions using appropriate accounting concepts; 7.g. - demonstrate use of the numeric keypad by touch This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C: 3.i. – journalize and post adjusting and closing entries TAKS Correlation: MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Materials, Equipment and Resources: Textbook Lesson 2-4 – Completing a Worksheet Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 M & M’s or paperclips Construction paper Marker Teaching Strategies: Demonstration Observation Lesson 2-4 – Completing a Worksheet Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Learner Preparation: Give each student a bag of M & M’s (or about 20 paperclips). Draw two “T” accounts on the construction paper. Label them Supplies and Supplies Expense. Have your students put 5 M & M’s on the left side of the Supplies account. Tell them each M & M represents $100.00 in supplies so they started the fiscal period with $500.00 balance. Tell them that a few weeks into the fiscal period, the business spent $200.00 more on supplies. What is the balance now? ($700.00) A few weeks later, they spent $200 more on supplies. Now what is the balance? ($900.00) Now it is the end of the fiscal period and the business bought more supplies, but they used some of those supplies. Subtracting from the supplies account every time they used a paperclip would require too much time and paperwork; instead businesses wait until the end of the fiscal period and do an inventory to see how much is left. The inventory shows $300.00 in supplies left. So remove all the M & M’s except for 3. Where do those you removed go? They go to the Supplies Expense account. Expenses are a debit so place them on the debit side. What is the credit part of that entry? Lesson Content: Introduce students to adjusting entries, extending balance sheet and income statement accounts on the worksheet and figuring net income or net loss. Assessment: Observation Verbal Checking for Understanding Graded Assignments Additional Resources: Textbooks: Guerrieri, Donald J., Haber, Hoyt, Turner. Glencoe Accounting RealWorld Applications and Connections. Glencoe McGraw-Hill 2000. ISBN/ISSN 0-02-815004-X. Ross, Kenton, Gilbertson, Lehman, and Hanson. Century 21 Accounting Multicolumn Journal Anniversary Edition, 1st Year Course. SouthWestern Educational and Professional Publishing, 2003. ISBN/ISSN: 0-538-43524-0 Ross, Kenton, Gilbertson, Lehman, and Hanson. Century 21 General Journal Accounting Anniversary Edition, 7th Edition. SouthWestern Educational and Professional Publishing, 2003. ISBN/ISSN: 0-538-43529-1. Websites: Learning Materials – Accounting. Biz/ed 2009 http://www.bized.co.uk/. Lesson 2-4 – Completing a Worksheet Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 2.4.1 – Preparing Adjusting Entries Course Title – Accounting I Lesson Title – Completing a Worksheet Activity Purpose – Demonstrate ability to adjust supplies and prepaid insurance for the fiscal period. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C: 1.b. - Apply basic accounting 130.166.C: concepts and terminology; 1.h. - calculate and record end-ofperiod adjustments; 7.a. - follow oral and written instructions; 7.b. - develop time management skills by setting priorities for completing work as scheduled 7.c. - make decisions using appropriate accounting concepts; 7.e. - perform accounting procedures using manual and automated methods. 3.i. – journalize and post adjusting and closing entries TAKS Correlation: MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Materials, Equipment and Resources: Textbook Index cards 4 Clear jars Marbles Activity 2.4.1 – Preparing Adjusting Entries Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING I Teaching Strategies: Demonstration Observation Activity 2.4.1 – Preparing Adjusting Entries Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING I Activity Outline: Have your students add these terms to their index cards on a ring: worksheet Trial Balance net income income statement profit adjustments net loss Demonstrate adjusting entries using 4 clear jars. Label them: Supplies Expense, Insurance Expense, Supplies, and Prepaid Insurance. Have some marbles available and place them in the Prepaid Insurance jar and the Supplies jar. Explain as you add the marbles that we have purchased some insurance that is considered an asset, because we prepaid it. Supplies are also prepaid, because we haven’t used those yet so they are also an asset. At the end of the fiscal period though, we do not have as many supplies and some of the insurance has expired. We need to adjust. In accounting, we are guided by concepts and we must follow the concept Matching Expenses with Revenue during the fiscal period. We can not wait until another fiscal period to show the use of those supplies. Ask the class, “How can we show that we have fewer supplies?” Take some marbles out of the supplies jar. We are crediting supplies to take them out, but what account would be debited? Do a similar demonstration with insurance. Have your students complete the drill on calculating the adjustments. Problem 1: Supplies Inventory at the end of the fiscal period, $180.00 Prepaid Insurance valuation at the end of the fiscal period, $1000.00 1 2 3 4 5 6 Trial Balance Debit Credit 1400 500 Prepaid Insurance Supplies Adjustments Debit Credit Insurance Expense Supplies Expense Totals Problem 2: Supplies Inventory at the end of the fiscal period, $700.00 Prepaid Insurance valuation at the end of the fiscal period, $1000.00 Activity 2.4.1 – Preparing Adjusting Entries Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING I 1 2 3 4 5 6 Trial Balance Debit Credit 1500 1200 Prepaid Insurance Supplies Adjustments Debit Credit Insurance Expense Supplies Expense Totals Problem 3: Supplies Inventory at the end of the fiscal period, $125.00 Prepaid Insurance valuation at the end of the fiscal period, $600.00 1 2 3 4 5 6 Trial Balance Debit Credit 900 435 Prepaid Insurance Supplies Adjustments Debit Credit Insurance Expense Supplies Expense Totals Assessment: Observation Adjusting Entries Quiz Activity 2.4.1 – Preparing Adjusting Entries Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING I ADJUSTING ENTRIES QUIZ 1. What is the concept that requires showing expenses during the same fiscal period as the one in which the revenue is earned? a. Going Concern b. Business Entity c. Matching Expenses with Revenue d. Historical Cost 2. To adjust supplies, what account is debited? a. Supplies b. Supplies Expense c. Prepaid Insurance d. Insurance Expense 3. To adjust supplies, what account is credited? a. Supplies b. Supplies Expense c. Prepaid Insurance d. Insurance Expense 4. To adjust Prepaid Insurance, what account is debited? a. Supplies b. Supplies Expense c. Prepaid Insurance d. Insurance Expense 5. To adjust Prepaid Insurance, what account is credited? a. Supplies b. Supplies Expense c. Prepaid Insurance d. Insurance Expense 6. The Trial Balance shows $520 in supplies, but the ending inventory shows $500. What is the amount of the adjustment? a. 500 b. 520 c. 20 d. None of the above 7. The Trial Balance shows $1200 in Prepaid Insurance, but the insurance report valuation shows its value at $980.00. What is the amount of the adjustment? a. $1200 b. $980 c. 320 d. 230 8. If there were no adjusting entries made, what impact would that have on net income? a. more b. less 2.4.1 – Quiz on Adjusting Entries Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING I ADJUSTING ENTRIES QUIZ - KEY 1. What is the concept that requires showing expenses during the same fiscal period as the one in which the revenue is earned? b. Going Concern c. Business Entity c. Matching Expenses with Revenue d. Historical Cost 2. To adjust supplies, what account is debited? d. Supplies b. Supplies Expense c. Prepaid Insurance d. Insurance Expense 3. To adjust supplies, what account is credited? a. Supplies b. Supplies Expense c. Prepaid Insurance d. Insurance Expense 4. To adjust Prepaid Insurance, what account is debited? a. Supplies b. Supplies Expense c. Prepaid Insurance d. Insurance Expense 5. To adjust Prepaid Insurance, what account is credited? a. Supplies b. Supplies Expense c. Prepaid Insurance d. Insurance Expense 6. The Trial Balance shows $520 in supplies, but the ending inventory shows $500. What is the amount of the adjustment? a. $500 b. $520 c. $20 d. None of the above 7. The Trial Balance shows $1200 in Prepaid Insurance, but the insurance report valuation shows its value at $980.00. What is the amount of the adjustment? a. $1200 b. $980 c. $320 d. $230 8. If there were no adjusting entries made, what impact would that have on net income? a. more b. less 2.4.1 – Quiz on Adjusting Entries Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING I Activity 2.4.2 – Income Statement and Balance Sheet Accounts Course Title – Accounting I Lesson Title – Completing a Worksheet Activity Purpose – Classify income statement and balance sheet accounts and sort them correctly. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C: 1.b. - Apply basic accounting concepts and terminology; 1.i. – update accounts through adjusting and closing entries 7.a. - follow oral and written instructions; 7.b. - develop time management skills by setting priorities for completing work as scheduled 7.c. - make decisions using appropriate accounting concepts; 7.e. - perform accounting procedures using manual and automated methods. This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C: 3.a. – classify, record, and summarize financial data; 3.i. - journalize and post adjusting and closing entries TAKS Correlation: WRITING Objective 6: The student will demonstrate the ability to revise and proofread to improve the clarity and effectiveness of a piece of writing. MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Activity 2.4.2 – Income Statement and Balance Sheet Accounts Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING I Materials, Equipment and Resources: Textbook Teaching Strategies: Demonstration Observation Activity 2.4.2 – Income Statement and Balance Sheet Accounts Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING I Activity Outline: Sort accounts by whether they are found on the balance sheet or income statement. Remind students that they prepared a balance sheet before. See if they can tell you what classification of accounts are on the balance sheet. What type of accounts are these? Are they permanent or temporary? What two things affect net income or loss? These are the accounts extended to the income statement section of the worksheet. Demonstrate moving the balances over to the balance sheet. Emphasize recalculating the supplies and insurance balance. Have your students check the number of accounts to be sure they did not leave any out and recheck to make sure they have not made common errors like slides, transpositions or putting the amount on the wrong side. Checking now might prevent them from losing a lot of time later. Demonstrate moving the balances for revenue and expenses over to the income statement section of the worksheet. Again, emphasize checking for errors carefully. Have your students check their knowledge by completing this exercise. Ask them to place an “X” in all columns in which the account would appear. Account Name Trial Balance dr cr Adjustments dr cr Income Statement dr cr Balance Sheet dr cr 1 Insurance Expense 2 Cash 3 Sylvia Morales, Capital 4 Fees Earned 5 Supplies 6 Prepaid Insurance 7 Advertising Expense 8 Miscellaneous Expense 9 Sylvia Morales, Drawing 10 Bank of Liberty Activity 2.4.2 – Income Statement and Balance Sheet Accounts Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING I Assessment: Observation Graded Assignment Number Grade Correct 22 100% 21 95% 20 91% 19 86% 18 82% 17 77% 16 73% 15 68% 14 64% 13 59% 12 55% 11 50% Activity 2.4.2 – Income Statement and Balance Sheet Accounts Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING I Activity 2.4.3 – Calculating Net Income or Loss Course Title – Accounting I Lesson Title – Completing a Worksheet Activity Purpose - Demonstrate skill in calculating net income or loss. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C: 1.b. - Apply basic accounting concepts and terminology; 7.a. - follow oral and written instructions; 7.b. - develop time management skills by setting priorities for completing work as scheduled 7.c. - make decisions using appropriate accounting concepts; 7.e. - perform accounting procedures using manual and automated methods. This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C: 3.k. - prepare work sheets 3.o. – calculate business profitability; 3.p. – prepare income statements TAKS Correlation: MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Materials, Equipment and Resources: Textbook Teaching Strategies: Demonstration Observation Activity 2.4.3 – Calculating Net Income and Net Loss Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity Outline: 1. Have students define net income and net loss. 2. Demonstrate calculating the net income and net loss with an Income or Loss presentation. 3. Have students take this quiz: Problem 1: Income Statement Balance Sheet DR CR DR CR 2100.00 3085.00 1500.00 515.00 Problem 2: Income Statement DR CR Balance Sheet DR CR 1400.00 1435.00 2135.00 700.00 Problem 3: Income Statement DR CR Balance Sheet DR CR 410.00 1320.00 1025.00 705.00 Assessment: Observation Graded Assignment Activity 2.4.3 – Calculating Net Income and Net Loss Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1