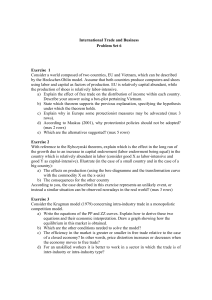

Monopolistic Competition and Trade: Does the Theory Carry Any Empirical ‘Weight’?

advertisement