IRS-11 - University of California, Davis

advertisement

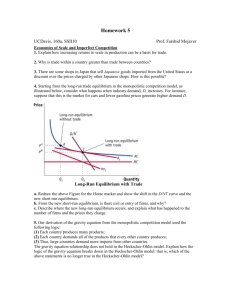

Homework 5 UCDavis, 160a, SSII11 Prof. Farshid Mojaver Economies of Scale and Imperfect Competition 1. Explain how increasing returns to scale in production can be a basis for trade. 2. Why is trade within a country greater than trade between countries? 3. There are some shops in Japan that sell Japanese goods imported from the United States at a discount over the prices charged by other Japanese shops. How is this possible? 4. Starting from the long-run trade equilibrium in the monopolistic competition model, as illustrated below, consider what happens when industry demand, D, increases. For instance, suppose that this is the market for cars and lower gasoline prices generate higher demand D. Long-Run Equilibrium with Trade a. Redraw the above Figure for the Home market and show the shift in the D/NT curve and the new short-run equilibrium. b. From the new short-run equilibrium, is there exit or entry of firms, and why? c. Describe where the new long-run equilibrium occurs, and explain what has happened to the number of firms and the prices they charge. 5. Our derivation of the gravity equation from the monopolistic competition model used the following logic: (1) Each country produces many products; (2) Each country demands all of the products that every other country produces; (3) Thus, large countries demand more imports from other countries. The gravity equation relationship does not hold in the Heckscher-Ohlin model. Explain how the logic of the gravity equation breaks down in the Heckscher-Ohlin model: that is, which of the above statements is no longer true in the Heckscher-Ohlin model? 6. The United States, France, and Italy are among the world’s largest producers. To answer the following questions, assume that their markets are monopolistically competitive, and use the gravity equation with B = 93 and n = 1.25. a. Using the gravity equation, compare the expected level of trade between the United States and France and between the United States and Italy. b. (Note: These numbers are larger than is realistic because we are using the gravity equation estimated on the United States and Canada state/provincial trade, rather than the equation estimated on international trade.) c. The distance between Paris and Rome is 694 miles. Would you expect more French trade with Italy or with the United States? Explain what variable (i.e., country size or distance) drives your result. 7. What evidence is there that Canada is better off under the free-trade agreement with the United States? 8. Consider the long-run trade equilibrium in the monopolistic competition model as illustrated below. Consider a situation where the foreign and domestic demand for a particular good increase. For instance, suppose that this is the market for cars and lower gasoline prices generates higher demand. a. Redraw the Figure below and show what happens when this change in demand occurs. Specifically, show which curve(s) shift. b. If the old equilibrium is at point C, describe where the new long run equilibrium occurs, and what has happened to the number of firms and the price they charge. 9. Intra-Industry Trade a. Of two products, rice and paintings, which product do you expect to have a higher index of intra-industry trade? Why? b. Access the U. S. TradeStats Express Web site http://tse.export.gov/. Click on “National Trade Data” then “Global Patterns of U. S. Merchandise Trade.” Under the “Product” section, change the item to rice (HS 1006) and obtain the export and import values. Do the same for paintings (HS 9701), and then calculate the intra-industry trade index for rice and paintings in 2009. Do your calculations confirm your expectation from part (a)? If your answers did not confirm your expectation, explain. 10. Suppose the Home firm is considering whether to enter the Foreign market. Assume that the Home firm has the following costs and demand: Fixed Costs = $140 Marginal Costs = $10/unit Local Price = $25 Local Quantity = 20 Export Price = $15 Export Quantity = 10 a. Calculate the firm’s total costs from selling only in the local market. b. What is the firm’s average cost from selling only in the local market? c. Calculate the firm’s profit from selling only in the local market. d. Should the Home firm enter the Foreign market? Briefly explain why. e. Calculate the firm’s profit from selling to both markets. f. Is the Home firm dumping? Briefly explain. 11. Suppose consumers at Home have the following demand: P = 50 – 0.5Q a. Write the Home monopolist’s marginal revenue equation. b. Assuming that marginal costs and average costs both equal $10 per unit, what is the firm’s profit-maximizing level of output and price? c. Calculate the Home firm’s profit.