Performance Indicators Q1 2010/11 Index

advertisement

ANALYST KPIs Q1 1011

Performance Indicators Q1 2010/11

Index

-

Group income statement and free cash flow

-

Revenue analysis

-

Revenue trends

-

Line of business statistics

-

Line of business trends

-

Broadband statistics

-

Broadband trends

-

Costs

For further information please contact

BT Investor Relations

Phone

+44 (0)20 7356 4909

Email

bt.investorrelations@bt.com

While BT believes the information contained in this document to be reliable, BT does not warrant the accuracy, completeness or validity of the information,

figures or calculations that follow, and shall not be liable in any way for loss or damage arising out of the use of the information, or any errors or omissions in its content

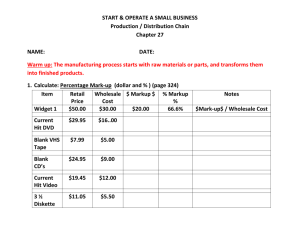

ANALYST KPIs Q1 1011

Year on year

Change

%

2010/11

Q1

Actual

Restated

2,079

2,068

1,126

1,255

12

(1,305)

5,235

(3.5)

(6.9)

(6.0)

(4.4)

(8.3)

(8.4)

(4.4)

2,007

1,925

1,059

1,200

11

(1,196)

5,006

2,024

2,019

1,109

1,234

10

(1,274)

5,122

2,118

2,020

1,075

1,241

7

(1,263)

5,198

2,292

2,017

1,078

1,230

11

(1,272)

5,356

BT Global Services

BT Retail

BT Wholesale

Openreach

Other

Total

BT Global Services contract and financial review charges

EBITDA pre specific items

62

452

338

475

(1)

1,326

0

1,326

109.7

(2.2)

0.3

7.6

n/m

5.5

5.5

130

442

339

511

(23)

1,399

0

1,399

95

451

344

507

18

1,415

0

1,415

123

436

337

488

2

1,386

0

1,386

Depreciation and amortisation

(738)

(1.2)

(729)

(759)

588

13.9

670

(214)

6.5

Group income statement

£m unless stated

Restated

Adjusted revenue

Adjusted EBITDA

3

2009/10

Q2

2009/10

Q3

Year on year

Change

%

Restated

8,587

8,491

4,638

5,069

41

(5,436)

21,390

(0.9)

(4.3)

(5.4)

(2.2)

(2.4)

(5.9)

(2.2)

8,513

8,124

4,388

4,960

40

(5,114)

20,911

177

438

334

490

73

1,512

0

1,512

261

1,585

1,356

1,996

40

5,238

(1,639)

3,599

75.1

12.1

(0.2)

(1.8)

130.0

7.7

56.7

457

1,777

1,353

1,960

92

5,639

0

5,639

(754)

(788)

(2,890)

5.2

(3,039)

656

632

724

709

266.7

2,600

(228)

(225)

(223)

(228)

(933)

(4.6)

(890)

4

9

(1)

9

39

446

440

408

505

(185)

(51)

(20)

(71)

(95)

(70)

(165)

(130)

(69)

(199)

(183)

(71)

(254)

(372)

313

(59)

375

275

209

251

(244)

(109)

18

24.5%

0

(103)

256

23.4%

0

(94)

63

23.0%

0

(113)

71

22.4%

(1)

98

(45)

53.0%

(2)

3

Restated

2009/10

Q4

3

Restated

2008/9

Full Year

3

Restated

3

2009/10

Full Year

1

BT Global Services

BT Retail

BT Wholesale

Openreach

Other

Eliminations

Total

2

Operating profit pre specific items

Net finance expense (before specific items)

Share of post tax profits/losses of associates & joint ventures

PBT pre specific items

8

382

Specific items (before net interest on pensions)

Net interest on pensions

Specific Items: net gains (losses)

Reported PBT

16.8

(41)

(69)

(110)

272

Tax - excluding specific tax

Tax on specific items

Tax rate

Memo: Minorities

37.9

(88)

30

23.0%

0

Net Income

Adjusted EPS

2009/10

Q1

2

Reported EPS

Dividend per share

Average number of shares in issue

25

(1,037.8)

1,735

(449)

(279)

(728)

(512.7)

1,007

(398)

420

22.9%

(1)

214

32.7

284

428

178

209

(191)

(638.7)

1,029

3.8

2.8

7,735

15.8

32.1

4.4

3.7

7,745

4.3

5.5

2.3

7,739

4.1

2.3

7,743

5.0

2.7

4.6

7,743

14.1

(2.5)

6.5

7,724

22.7

(632.0)

17.3

13.3

6.9

7,740

1,399

(610)

(295)

(5)

1,415

(555)

(152)

201 4

1,386

(548)

(314)

(44)

1,512

(699)

(190)

(18)

5,238

(3,038)

(937)

(228)

966.0

(140)

110

459

(86)

(53)

770

44

2

526

478

6

1,089

(462)

199 5

772

440.2

(44)

415

(65)

705

(221)

305

(44)

1,045

(35)

737

0

705

(525)

(220)

0

1,045

9,878

10,112

9,283

Group free cash flow

Adjusted EBITDA

2

Capital expenditure

Interest

Tax

1,326

(678)

(284)

4

210

Change in working capital

Other

Free cash flow (pre gross pension deficit payment and specific items)

(599)

(28)

(53)

Specific items (cash)

Free cash flow (pre gross pension deficit payment)

(69)

(122)

Gross pension deficit payment

Free cash flow (post gross pension deficit payment)

0

(122)

440.2

0

415

10,517

(15.6)

8,879

Net debt

Operating cash flow by line of business

BT Global Services

BT Retail

BT Wholesale

Openreach

(10.0)

3.9

202.1

(163)

(73)

2,332

162.3

(399)

1,933

0

737

91.0

(525)

1,408

10,361

(10.4)

9,283

Change £m

(465)

328

121

229

427

(35)

96

(4)

(18.4)

0.3

5,639

(2,480)

(940)

349

Change £m

(38)

293

217

225

(111)

429

213

280

(34)

371

223

321

128

438

361

337

(912)

1,064

824

1,079

430

502

94

88

1

2008/9 and 2009/10 revenue adjusted for changes in the internal trading model. The group's internal trading model has been simplified with effect from 1 April 2010. This adjustment has the impact of reducing internal revenue in both BT Wholesale and Openreach by about £51m per quarter in

2009/10 (£40m in 2008/9). There is no impact from these changes on total group revenue.

2

before specific items and BT Global Services contract and financial review charges

3

revenue and EBITDA restated for customer account moves from BT Retail to BT Wholesale effective 1 April 2010

4

includes HMRC tax repayments of £210m in Q1 2009/10 and £215m in Q2 2009/10

5

includes £110m non-cash share based payment adjustment

(482)

1,566

918

1,167

3

ANALYST KPIs Q1 1011

12

Revenue analysis

Q1

2008/9

Q3

Q2

12

Q4

FY

Q1

2009/10

Q3

Q2

Q4

2010/11

Q1

FY

£m

ICT & Managed Networks

BT Global Services

BT Retail

BT Wholesale

926

141

81

1,148

974

147

108

1,229

1,065

149

166

1,380

1,121

154

163

1,438

BT Global Services

247

286

276

BT Global Services

BT Retail

BT Wholesale

1,173

141

81

1,395

67

305

143

120

635

1,260

147

108

1,515

73

316

135

120

644

BT Global Services

BT Retail

133

772

905

BT Global Services

BT Retail

6

4,086

591

518

5,195

895

135

167

1,197

916

140

180

1,236

980

141

180

1,301

1,128

162

188

1,478

3,919

578

715

5,212

954

149

199

1,302

337

1,146

326

361

333

342

1,362

343

1,341

149

166

1,656

89

318

134

134

675

1,458

154

163

1,775

92

314

131

127

664

5,232

591

518

6,341

321

1,253

543

501

2,618

1,221

135

167

1,523

82

312

131

131

656

1,277

140

180

1,597

83

314

125

143

665

1,313

141

180

1,634

84

317

117

162

680

1,470

162

188

1,820

85

315

115

161

676

5,281

578

715

6,574

334

1,258

488

597

2,677

1,297

149

199

1,645

76

324

93

180

673

130

767

897

127

751

878

121

724

845

511

3,014

3,525

122

762

884

117

707

824

116

685

801

117

676

793

472

2,830

3,302

109

663

772

51

572

623

50

543

593

51

541

592

48

509

557

200

2,165

2,365

48

511

559

46

492

538

43

505

548

47

473

520

184

1,981

2,165

39

455

494

BT Global Services

BT Retail

BT Wholesale

94

43

107

244

88

44

116

248

83

43

87

213

79

37

88

204

344

167

398

909

78

38

90

206

78

34

74

186

75

36

80

191

69

34

72

175

300

142

316

758

68

31

59

158

BT Global Services

BT Retail

BT Wholesale

278

1,387

107

1,772

268

1,354

116

1,738

261

1,335

87

1,683

248

1,270

88

1,606

1,055

5,346

398

6,799

248

1,311

90

1,649

241

1,233

74

1,548

234

1,226

80

1,540

233

1,183

72

1,488

956

4,953

316

6,225

216

1,149

59

1,424

BT Global Services

BT Wholesale

Openreach

265

484

124

873

273

478

130

881

280

464

138

882

288

436

149

873

1,106

1,862

541

3,509

246

425

157

828

244

393

163

800

261

370

161

792

260

366

163

789

1,011

1,554

644

3,209

231

386

151

768

BT Global Services

BT Retail

BT Wholesale

211

216

68

495

221

236

57

514

223

245

62

530

218

261

64

543

873

958

251

2,082

282

227

58

567

179

242

81

502

226

247

72

545

244

246

82

572

931

962

293

2,186

187

218

80

485

BT Global Services

BT Retail

BT Wholesale

Openreach

476

216

552

124

1,368

494

236

535

130

1,395

503

245

526

138

1,412

506

261

500

149

1,416

1,979

958

2,113

541

5,591

528

227

483

157

1,395

423

242

474

163

1,302

487

247

442

161

1,337

504

246

448

163

1,361

1,942

962

1,847

644

5,395

418

218

466

151

1,253

BT Retail

BT Wholesale

Openreach

68

267

1,022

1,356

82

268

1,013

1,362

88

267

1,017

1,371

105

266

977

1,347

343

1,066

4,027

5,436

83

255

967

1,305

90

256

928

1,274

89

256

918

1,263

111

255

906

1,272

373

1,022

3,719

5,114

85

242

869

1,196

1,994

2,117

1,150

1,266

7

(1,356)

5,177

2,095

2,135

1,162

1,263

11

(1,362)

5,303

2,194

2,135

1,180

1,289

11

(1,371)

5,437

2,304

2,104

1,148

1,253

12

(1,347)

5,473

8,587

8,491

4,638

5,069

41

(5,436)

21,390

2,079

2,068

1,126

1,255

12

(1,305)

5,235

2,024

2,019

1,109

1,234

10

(1,274)

5,122

2,118

2,020

1,075

1,241

7

(1,263)

5,198

2,292

2,017

1,078

1,230

11

(1,272)

5,356

8,513

8,124

4,388

4,960

40

(5,114)

20,911

2,007

1,925

1,059

1,200

11

(1,196)

5,006

MPLS

Total

Total Managed Solutions

BT Global Services

BT Retail

BT Wholesale

Openreach

3

Broadband (incl. LLU) and Convergence

4

Lines

Calls

Private Circuits

Total

Total Calls and Lines

Transit, conveyance, interconnect circuits, WLR,

global carrier and other wholesale

5

Other

Total

Total Other

Internal revenue

Total internal revenue

Total line of business revenue

BT Global Services

BT Retail

BT Wholesale

Openreach

Other

Eliminations

Total group revenue

1

adjusted for changes in the internal trading model.

2

restated to reflect Q1 2010/11 customer account moves between BT Retail and BT Wholesale

3

includes VOIP and BT Vision revenues

4

includes connection and rental fees

5

includes BT Global Services revenue from non-UK global products and BT Retail revenue from conferencing, directories, payphones and other select services

6

revenue as reported - shown after BT Global Services contract and financial review charges of £41m in Q4 2008/9

ANALYST KPIs Q1 1011

Revenue trends

Q1

Q2

2009/10

Q3

Q4

2010/11

Q1

FY

ICT & Managed Networks

BT Global Services

BT Retail

BT Wholesale

(3.3)%

(4.3)%

106.2%

4.3%

(6.0)%

(4.8)%

66.7%

0.6%

(8.0)%

(5.4)%

8.4%

(5.7)%

0.6%

5.2%

15.3%

2.8%

(4.1)%

(2.2)%

38.0%

0.3%

6.6%

10.4%

19.2%

8.8%

BT Global Services

32.0%

26.2%

20.7%

1.5%

18.8%

5.2%

BT Global Services

BT Retail

BT Wholesale

4.1%

(4.3)%

106.2%

9.2%

22.4%

2.3%

(8.4)%

9.2%

3.3%

1.3%

(4.8)%

66.7%

5.4%

13.7%

(0.6)%

(7.4)%

19.2%

3.3%

(2.1)%

(5.4)%

8.4%

(1.3)%

(5.6)%

(0.3)%

(12.7)%

20.9%

0.7%

0.8%

5.2%

15.3%

2.5%

(7.6)%

0.3%

(12.2)%

26.8%

1.8%

0.9%

(2.2)%

38.0%

3.7%

4.0%

0.4%

(10.1)%

19.2%

2.3%

6.2%

10.4%

19.2%

8.0%

(7.3)%

3.8%

(29.0)%

37.4%

2.6%

BT Global Services

BT Retail

(8.3)%

(1.3)%

(2.3)%

(10.0)%

(7.8)%

(8.1)%

(8.7)%

(8.8)%

(8.8)%

(3.3)%

(6.6)%

(6.2)%

(7.6)%

(6.1)%

(6.3)%

(10.7)%

(13.0)%

(12.7)%

BT Global Services

BT Retail

(5.9)%

(10.7)%

(10.3)%

(8.0)%

(9.4)%

(9.3)%

(15.7)%

(6.7)%

(7.4)%

(2.1)%

(7.1)%

(6.6)%

(8.0)%

(8.5)%

(8.5)%

(18.8)%

(11.0)%

(11.6)%

BT Global Services

BT Retail

BT Wholesale

(17.0)%

(11.6)%

(15.9)%

(15.6)%

(11.4)%

(22.7)%

(36.2)%

(25.0)%

(9.6)%

(16.3)%

(8.0)%

(10.3)%

(12.7)%

(8.1)%

(18.2)%

(14.2)%

(12.8)%

(15.0)%

(20.6)%

(16.6)%

(12.8)%

(18.4)%

(34.4)%

(23.3)%

BT Global Services

BT Retail

BT Wholesale

(10.8)%

(5.5)%

(15.9)%

(6.9)%

(10.1)%

(8.9)%

(36.2)%

(10.9)%

(10.3)%

(8.2)%

(8.0)%

(8.5)%

(6.0)%

(6.9)%

(18.2)%

(7.3)%

(9.4)%

(7.4)%

(20.6)%

(8.4)%

(12.9)%

(12.4)%

(34.4)%

(13.6)%

BT Global Services

BT Wholesale

Openreach

(7.2)%

(12.2)%

26.6%

(5.2)%

(10.6)%

(17.8)%

25.4%

(9.2)%

(6.8)%

(20.3)%

16.7%

(10.2)%

(9.7)%

(16.1)%

9.4%

(9.6)%

(8.6)%

(16.5)%

19.0%

(8.5)%

(6.1)%

(9.2)%

(3.8)%

(7.2)%

BT Global Services

BT Retail

BT Wholesale

33.6%

5.1%

(14.7)%

14.5%

(19.0)%

2.5%

42.1%

(2.3)%

1.3%

0.8%

16.1%

2.8%

11.9%

(5.7)%

28.1%

5.3%

6.6%

0.4%

16.7%

5.0%

(33.7)%

(4.0)%

37.9%

(14.5)%

BT Global Services

BT Retail

BT Wholesale

Openreach

10.9%

5.1%

(12.5)%

26.6%

2.0%

(14.4)%

2.5%

(11.4)%

25.4%

(6.7)%

(3.2)%

0.8%

(16.0)%

16.7%

(5.3)%

(0.4)%

(5.7)%

(10.4)%

9.4%

(3.9)%

(1.9)%

0.4%

(12.6)%

19.0%

(3.5)%

(20.8)%

(4.0)%

(3.5)%

(3.8)%

(10.2)%

BT Retail

BT Wholesale

Openreach

22.1%

(4.3)%

(5.3)%

(3.8)%

9.8%

(4.3)%

(8.3)%

(6.5)%

1.1%

(3.9)%

(9.7)%

(7.9)%

5.7%

(4.0)%

(7.2)%

(5.6)%

8.7%

(4.1)%

(7.6)%

(5.9)%

2.4%

(5.1)%

(10.1)%

(8.4)%

BT Global Services

BT Retail

BT Wholesale

Openreach

4.3%

(2.3)%

(2.0)%

(0.8)%

1.1%

(3.4)%

(5.4)%

(4.5)%

(2.3)%

(3.4)%

(3.5)%

(5.4)%

(8.9)%

(3.7)%

(4.4)%

(0.5)%

(4.1)%

(6.1)%

(1.8)%

(2.1)%

(0.9)%

(4.3)%

(5.4)%

(2.2)%

(2.2)%

(3.5)%

(6.9)%

(6.0)%

(4.4)%

(4.4)%

MPLS

Total

Total Managed Solutions

BT Global Services

BT Retail

BT Wholesale

Openreach

Broadband (incl. LLU) and Convergence

Lines

Calls

Private Circuits

Total

Total Calls and Lines

Transit, conveyance, interconnect circuits, WLR,

global carrier and other wholesale

Other

Total

Total Other

Internal revenue

Total internal revenue

Total line of business revenue

Total group revenue

ANALYST KPIs Q1 1011

Line of business statistics

Q1

2008/9

Q3

Q2

Q4

FY

Q1

2009/10

Q3

Q2

Q4

2010/11

Q1

FY

Global Services

Order intake (£m)

1,868

1,772

1,745

2,532

1,411

1,436

1,550

2,234

1,552

Retail

1

Business unit revenue (£m)

Consumer

1,121

1,105

1,096

1,040

4,362

1,105

1,042

1,056

1,020

4,223

999

Business

664

662

652

658

2,636

607

601

602

611

2,421

584

Enterprises

135

174

184

209

702

164

182

176

193

715

163

Ireland

198

194

202

205

799

198

200

201

202

801

185

(1)

0

1

(8)

(8)

(6)

(6)

(15)

(9)

(36)

(6)

2,117

2,135

2,135

2,104

8,491

2,068

2,019

2,020

2,017

8,124

1,925

4.02

3.81

3.50

3.40

14.73

3.13

3.05

2.87

2.81

11.86

2.62

Geographic

10.79

10.47

10.45

10.35

42.06

9.32

9.15

9.40

9.44

37.31

8.33

Total

14.81

14.28

13.95

13.75

56.79

12.45

12.20

12.27

12.25

49.17

10.95

278

283

285

287

290

296

301

309

12,416

12,229

12,043

11,789

11,583

11,388

11,251

11,113

282

320

376

423

433

451

467

481

68

38

56

47

31

18

15

16

14

4,853

5,077

5,323

5,647

5,972

6,138

6,051

6,028

6,036

Consumer

15,527

15,289

14,954

14,514

14,104

13,696

13,330

13,051

Business

Total

6,547

22,074

6,362

21,651

6,167

21,121

5,992

20,506

5,835

19,939

5,679

19,375

5,513

18,843

5,367

18,418

5,225

17,926

Total exchange lines ('000)

26,927

26,728

26,444

26,153

25,911

25,513

24,894

24,446

23,962

Other (incl. eliminations)

Total

Calls (mins bn)

Non geographic

2

Consumer ARPU (£)

3

Active Consumer lines ('000)

BT Vision installed base ('000)

Net adds in quarter

5

436

5

314

4

10,932

Openreach

External WLR lines ('000)

Lines sold through BT lines of business ('000)

1

4

12,701

restated to reflect Q1 2010/11 customer account moves between BT Retail and BT Wholesale

12 month rolling consumer revenue, less mobile POLOs, divided by number of primary lines. Note: Q1, Q2, Q3 & Q4 2009/10 figures show underlying ARPU, excluding £3 relating to Q1 2009/10 one-off benefit relating to prior periods.

3

'Active consumer lines' represents the number of lines over which BT is the call provider (excl. NI, incl. Plusnet from Q3 2009/10)

4

includes a favourable adjustment of 72k to Active Consumer lines and 79k to Group Consumer lines to write back bad debtors previously written off in Q2 2009/10 and Q3 2009/10. There is no impact on the full year figure.

5

net adds in Q1 2009/10 and Q2 2009/10 are before the reported data cleanses of the BT Vision installed base. These reduced the customer base by c.22k in Q1 2009/10 and c.15k in Q2 2009/10. Q1 2009/10 net adds have been adjusted for customer churn of 7k.

2

ANALYST KPIs Q1 1011

Line of business trends

2009/10

Q3

Q4

2010/11

Q1

Q1

Q2

FY

(24.5)%

(19.0)%

(11.2)%

(11.8)%

Consumer

(1.4)%

(5.7)%

(3.6)%

(1.9)%

(3.2)%

(9.6)%

Business

(8.6)%

(9.2)%

(7.7)%

(7.1)%

(8.2)%

(3.8)%

Enterprises

21.5%

4.6%

(4.3)%

(7.7)%

1.9%

(0.6)%

0.0%

3.1%

(0.5)%

(1.5)%

0.3%

(6.6)%

(2.3)%

(5.4)%

(5.4)%

(4.1)%

(4.3)%

(6.9)%

Non geographic

(22.1)%

(19.9)%

(18.0)%

(17.4)%

(19.5)%

(16.3)%

Geographic

(13.6)%

(12.6)%

(10.0)%

(8.8)%

(11.3)%

(10.6)%

Total

(15.9)%

(14.6)%

(12.0)%

(10.9)%

(13.4)%

(12.0)%

4.3%

4.6%

5.6%

7.7%

8.3%

Active Consumer lines

(6.7)%

(6.9)%

(6.6)%

(5.7)%

(5.6)%

BT Vision installed base

53.5%

36.3%

19.9%

10.4%

11.1%

23.1%

20.9%

13.7%

6.7%

1.1%

Consumer

(9.2)%

(10.4)%

(10.9)%

(10.1)%

(9.9)%

Business

(10.9)%

(9.7)%

(10.7)%

(10.5)%

(10.6)%

(10.8)%

(10.4)%

(10.2)%

(10.5)%

(10.1)%

(3.8)%

(4.5)%

(5.9)%

(6.5)%

(7.5)%

Global Services

Order intake

10.0%

Retail

Business unit revenue

Ireland

Other (incl. eliminations)

Total

Calls (mins bn)

Consumer ARPU

Openreach

External WLR lines

Lines sold through BT lines of business

Total

Total exchange lines

ANALYST KPIs Q1 1011

2008/9

Broadband statistics

Q1

Q2

2009/10

Q3

Q4

Q1

Q2

Q3

2010/11

Q1

Q4

000s

Retail

Total Broadband

4,505

4,574

4,658

4,757

4,835

4,906

5,008

5,132

5,227

103

69

83

99

78

72

102

123

96

31%

35%

26%

34%

28%

34%

42%

34%

46%

35%

43%

35%

42%

35%

44%

35%

40%

35%

Total Wholesale Broadband

8,261

8,196

8,074

8,062

8,026

8,031

8,044

8,057

8,013

Net adds in quarter

(123)

(65)

(122)

(12)

(36)

5

14

13

(45)

External Wholesale

3,756

(227)

3,622

(134)

3,416

(206)

3,305

(110)

3,191

(114)

3,124

(67)

3,036

(88)

2,926

(110)

2,785

(141)

Full loops (MPF)

1,345

1,448

1,595

1,714

1,808

2,064

2,567

2,966

3,387

Shared loops (SMPF)

3,411

3,635

3,906

4,036

4,150

4,057

3,786

3,654

3,519

Total

4,756

5,084

5,501

5,750

5,957

6,121

6,352

6,620

6,906

456

328

417

249

208

164

231

268

286

13,017

13,280

13,575

13,812

13,983

14,152

14,397

14,677

14,918

333

263

295

237

172

169

245

281

241

Net adds in quarter

Retail share of DSL + LLU net adds

Retail share of DSL + LLU installed base

Wholesale

Net adds in quarter

Openreach

External LLU Volumes ('000)

Net adds in quarter

Group

Total DSL + LLU

Net adds in quarter

ANALYST KPIs Q1 1011

2009/10

Broadband trends

Q1

Q2

Q3

Q4

2010/11

Q1

Retail

Total Broadband

Net adds in quarter

7.3%

7.3%

7.5%

7.9%

8.1%

(24.5)%

3.8%

22.3%

24.5%

22.7%

(2.9)%

(2.0)%

(0.4)%

(0.1)%

(0.2)%

70.7%

107.5%

111.2%

211.5%

(24.2)%

(15.0)%

49.6%

(13.7)%

50.3%

(11.1)%

57.1%

(11.5)%

0.3%

(12.7)%

(23.2)%

34.4%

42.5%

60.9%

73.0%

87.3%

21.7%

25.3%

(54.5)%

11.6%

20.4%

(50.1)%

(3.1)%

15.5%

(44.6)%

(9.5)%

15.1%

7.7%

(15.2)%

15.9%

37.5%

7.4%

6.6%

6.1%

6.3%

6.7%

(48.5)%

(35.8)%

(16.9)%

18.4%

40.4%

Wholesale

Total Wholesale Broadband

Net adds in quarter

External Wholesale

Net adds in quarter

Openreach

External LLU Volumes

Full loops (MPF)

Shared loops (SMPF)

Total

Net adds in quarter

Group

Total DSL + LLU

Net adds in quarter

ANALYST KPIs Q1 1011

Costs

Q1

2008/9

Q3

Q2

Q4

FY

Q1

2009/10

Q3

Q2

Q4

2010/11

Q1

FY

£m

Summary cost analysis

Staff costs before leaver costs

1,386

1,344

1,352

1,330

5,412

1,266

1,206

1,214

1,176

4,862

1,243

(158)

(155)

(192)

(168)

(673)

(144)

(133)

(143)

(155)

(575)

(152)

1,228

1,189

1,160

1,162

4,739

1,122

1,073

1,071

1,021

4,287

1,091

73

36

33

62

204

45

21

58

18

142

10

Total staff costs incl. leaver costs

1,301

1,225

1,193

1,224

4,943

1,167

1,094

1,129

1,039

4,429

1,101

Other operating costs

1,585

1,771

2,289

3,289

8,934

1,773

1,666

1,697

2,002

7,138

1,633

Sub total

2,886

2,996

3,482

4,513

13,877

2,940

2,760

2,826

3,041

11,567

2,734

POLO's

1,037

1,043

1,094

1,092

4,266

1,048

1,040

1,066

929

4,083

961

680

672

702

774

2,828

722

747

742

774

2,985

716

11

13

21

17

62

16

12

12

14

54

13

4,614

4,724

5,299

6,396

21,033

4,726

4,559

4,646

4,758

18,689

4,424

Platform/Network

329

333

287

311

1,260

207

217

241

470

1,135

230

Line of Business

233

200

223

216

873

130

131

128

171

560

119

Access

171

167

166

159

663

143

130

138

155

566

136

Regulatory & compliance

53

50

59

65

227

59

56

40

51

206

36

Support functions

16

15

26

7

65

20

24

7

15

66

2

802

766

762

758

3,088

559

558

554

862

2,533

523

BT Global Services

245

213

208

220

886

131

131

120

217

599

103

BT Retail

127

117

110

117

471

81

82

90

164

417

85

BT Wholesale

120

119

99

97

435

71

69

71

114

325

67

Openreach

227

230

246

248

951

203

200

226

278

907

236

Other

83

87

99

76

345

73

76

47

89

285

32

Total

802

766

762

758

3,088

559

558

554

862

2,533

523

Own work capitalised

Net staff costs before leavers

Leaver costs

Depreciation and amortisation

Amortisation of acquired intangibles

Total costs

1

1

before specific items

Capital expenditure

Total

Capital expenditure by line of business