Lecture 6: The reintegration of the world economy, 1

advertisement

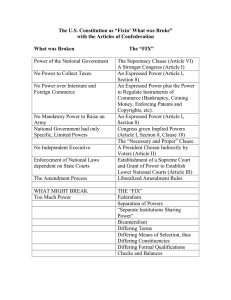

Lecture 6: The reintegration of the world economy, 1939 AD to the present 1 As noted before, “de-globalization” from 1914 to 1950, but “re-globalization” from there forward: Global trade/GDP from 14% to 42% in 2010; Foreign assets/GDP from 5% to 150% in 2010; Foreign-born from 8 to 14% in 2010. For this week: what were main developments in the world economy which caused this transition? Introduction Chronology of World War II is a little bit more murky than that for World War I. Started in 1939 with German invasion of Poland? Or in 1938 with Austrian annexation? In 1937 with the Marco Polo Bridge incident? Or in 1931 with the invasion of Manchuria? World War II By December 1941, however, the alignment of powers becomes clear… World War II End result pretty clear as well… World War II World War II 6 World War II 7 Like WWI, there were also big political effects: 1.) Extension of Soviet control in E. Europe; 2.) Extension of US control/influence in W. Europe and Japan; 3.) Calls for the end of colonialism, especially in India and SE Asia; World War II What sets the aftermath of WWII apart from WWI is the reaction of the US. But why should this matter? In 1949, the US: 1.) was involved in 65% of world trade; 2.) held 60% of the world’s capital stock; World War II Rather than retreat again into isolationism, the US becomes actively involved with reordering the global economy from 1945. The US as a hegemon which provided the needed infrastructure of international law and order in the Western world. World War II Following US’s lead, many countries commit themselves to resurrecting the world economy. At the heart of this transformation were a number of key institutional developments. Even before WWII’s end, delegates from 44 nations meet in Bretton Woods, NH during 1944. Differing responses: Western nations Bretton Woods (BW) built on the consensus that the disaster of the interwar period was to be avoided at all costs and required coordination. Strong role for activist macroeconomic policies to maintain full employment. Chief feature: the role of the US dollar as anchor Differing responses: Western nations BW also notable for the establishment of two inter-governmental bodies to aid coordination. First, the International Bank for Reconstruction and Development (IBRD), better known as the World Bank. With limited reserves, how to finance trade deficits needed to import goods? Differing responses: Western nations Second, the International Monetary Fund (IMF), designed to alleviate problems associated with the gold exchange standard. Financing in the face of balance of payments crises and coordination of changes in the valuations of currencies. Currency stability plus flexibility: gold backing via US dollar Differing responses: Western nations Running parallel, post-war period saw the rise of the General Agreement on Tariffs and Trade (GATT) in 1947 (succeeded by WTO in 1995). Precedent of US’s Reciprocal Trade Agreements Act of 1934.; two building blocks: reciprocity and most-favored-nation (MFN) status→ liberalization as the only outcome. Differing responses: Western nations Finally, the post-war period saw attempts to promote regional trade integration. Most notably in Europe: customs union by 1958; no internal tariffs by 1968 in six core countries. Culminates in the EU in 1993: on the heels of golden age; role of similar resource endowments. Developments partially mirrored elsewhere: Differing responses: Western nations With obvious implications for trade flows... Differing responses: Western nations 17 For all this, the global economy was not so global all the way into the 1970s/1980s. Three “Worlds” World War II Most obvious exception was “second world”: areas under Soviet/CCP control/influence. Emphasis on internal development with only limited ties to other socialist/communist nations. Then, there was the “third world”: any nation not “rich” nor explicitly in Soviet/Chinese orbit. Differing responses: ROW The majority of third world countries turned away from the global economy from 1945 (or even earlier). Most remained somewhat market-oriented. At the same time, China and USSR provided an example of “development from within”. Differing responses: ISI Coincided with two major developments: 1.) Disastrous interwar period for export-oriented nations in LA: trade bust erodes profits and, thus, power of ruling elites… 2.) WWII demonstrates weakness of the big three European empires: add to this the US’s hostility to empires… Differing responses: ISI Correlation of liberal trade policies and the “Great Specialization” Differing responses: ISI Although generated by very different conditions, there was a common response: importsubstitution-industrialization (ISI) as the dominant paradigm for third world development. Based on protection of domestic industry through tariffs, quotas/licensing, and ER controls. Differing responses: ISI The record for ISI up to 1975… Differing responses: ISI What is more, growth would prove temporary. Just as in the Soviet Union, rapidly diminishing marginal returns from capital after a while. Also, rent seeking plus thin domestic markets lead to a decided lack of innovation. Dependence on imported inputs and capital goods Differing responses: ISI But an alternative did exist in the form of export driven growth (EDG). As most countries flirted with ISI and fled world markets, a few looked to the global economy to promote growth in the 1950s and 60s. Most prominent (early) examples were the Four East Asian Tigers of Hong Kong, Singapore, South Korea, and Taiwan. Differing responses: EDG Exploited abundant (cheap) labor forces, education reform, high savings rates, and technology transfer. Primary markets for production were rich industrialized nations, not domestic markets. Not a hands-off approach: Differing responses: EDG EDG dominates Differing responses: ISI In 1975, global openness ratio ≈2.5x than 1950. Impressive as majority of world (75%) remained closed to global markets (but limited integration of K and L markets…on which, more later). In 2013, majority of world lives in “open” economies, even excluding China and India. The global economy in 1975 The global economy from 1975 30 The global economy from 1975 31 The global economy from 1975 32 So what explains post-1975 global trade growth: 1.) Declines in transport costs? 2.) Developing countries going open? 3.) Declines in developed countries’ tariffs? 4.) Changes in the structure of production? The global economy from 1975 Mixed evidence: 1.) Declines in transport costs? In 1980s, debt and subsequent macroeconomic crises hit developing nations. Macro reform as a political necessity or as a consequence of IMF/WB conditionality? Also unilateral moves in China (1978) and India (1991) as well as the collapse of USSR and its satellites in the late 80s/early 90s. 2.) Developing countries going open? 3.) Declines in developed countries’ tariffs 3.) Declines in developed countries’ tariffs Rising role of multinational corporations: now responsible for 70% of world trade. Vertical specialization as one aspect of “fragmentation of production” in which countries specialize in stages of the production process. Trade in tasks, rather than trade in goods, coordinated by MNCs. 4.) Changes in the structure of production? An example of VS? Raw materials: chips, plastic, and hair from Taiwan and Japan. Assembly in China but from molds produced in the United States and paints from Europe. Other than labor, China supplies 4.) Changes in the structure of production? Export value in HK = $4 $0.70 for labor; $1.30 for (imported) materials; $2.00 for transport & overhead plus profits earned in HK. Retail price in Canada = $45 $39 for transportation, marketing, wholesaling, and retailing; Mattel earns $6. 4.) Changes in the structure of production? Period from 1939 witnessed resurgence of global economy to unprecedented heights. But trajectories remained diffuse up to 1975 and prospects uncertain, especially given shocks of early 1970s. Conclusion 41