Distressed Real Estate Roundtable Materials November 4, 2010

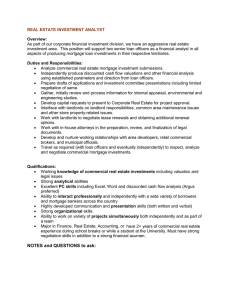

advertisement