Energy Market Prediction: Papers from the 2014 AAAI Fall Symposium

Predicting Rooftop Solar Adoption Using Agent-Based Modeling

Haifeng Zhang and Yevgeniy Vorobeychik

Electrical Engineering and Computer Science

Vanderbilt University

Nashville, TN

{haifeng.zhang, yevgeniy.vorobeychik}@vanderbilt.edu

Joshua Letchford and Kiran Lakkaraju

Sandia National Laboratories

Livermore, CA

{jletchf,klakkar}@sandia.gov

Abstract

Predicting solar demands for residential customers is

challenging. First, human decision processes are essentially

dynamic and nondeterministic. Second, network effects

make consumer decisions more hard to anticipate. Lastly,

environmental variables change over time, which make reliable prediction even more difficult. Fortunately, huge

amount of data has been stored in modern databases, which

could contain many significant information involving individual solar adoptions. Our modeling approach is featured in

utilizing machine learning techniques to learn reliable models from the real data. Specifically, we rely on a logistic

regression model, which defines the conditional probability

of adoption for individuals given their observations over a

set of attributes. However, the training process is not direct,

since non-adopters in the data have fewer explicit attributes

than adopters do. Thus, we need to apply a few estimations of these unknown variables for non-adopters. Moreover, to guarantee the prediction accuracy as well as model

interoperability, we would better apply the standard methods

of model selection, i.e., step-wise regression and lasso (l1 )

regularization. The regularized logistic regression model

encompasses peer effect, net-presented values and housing

characteristics.

The goal of this study is to train an individual behavioral

model and compose multiple agents into an environment to

simulate and forecast solar adoptions in the future. In the

following sections, we will demonstrate how this methodology is applied to forecast solar demands in a typical zip

code area. A remarkable finding is that incentives appears to

have little impact on adoption rates. This finally motivated

us to seek alternative policies that could stimulate more solar adoptions. To this end we considered a free-solar seeding policy relying on peer effects. By comparing this policy

with original incentive outcomes, we demonstrate that it is

significantly more efficacious than the incentive layout with

the same budget.

In this paper we present a novel agent-based modeling methodology to predict rooftop solar adoptions in

the residential energy market. We first applied several

linear regression models to estimate missing variables

for non-adopters, so that attributes of non-adopters and

adopters could be used to train a logistic regression

model. Then, we integrated the logistic regression

model along with other predictive models into a multiagent simulation platform and validated our models

by comparing the forecast of aggregate adoptions in a

typical zip code area with its ground truth. This result shows that the agent-based model can reliably predict future adoptions. Finally, based on the validated

agent-based model, we compared the outcome of a hypothesized seeding policy with the original incentive

plan, and investigated other alternative seeding policies

which could lead to more adopters.

Introduction

The rooftop solar market in the US has experienced explosive growth over last decade. This is partly because of

the government’s incentive programs, which effectively reduced the solar system cost and successfully created number of early adopters. Given what we knew about residential

consumers and how they responded to incentives and other

economic and social factors, can we reliably predict solar

adoptions in the future? The problem is inspiring since predictions could become valuable resources for policy makers who are seeking more efficient policies to promote solar

adoptions. The predictive models may also exhibit important patterns involving individuals’ decisions on solar products. If some of the patterns can be confirmed, a policy

maker would consider to reinforce them and therefore attain

higher solar adoptions. Our modeling methodology is motivated by these scenarios, which first aims to derive individual models of decisions, and then simulate joint behaviors in

an energy market.

Predictive Modeling

We provide complete details of the modeling approach in

this section.

c 2014, Association for the Advancement of Artificial

Copyright Intelligence (www.aaai.org). All rights reserved.

44

Data

• bedrooms(numeric): The number of bedrooms in the

house

We mainly used two datasets: the California Solar Initiative (CSI) dataset (shared by the California Center for Sustainable Energy and tailored to only residential customers in

San Diego County) and assessor dataset (San Diego County

only). The CSI dataset includes information of various aspects of a typical solar photovoltaics (PV) project, such as,

system size (usually CSI rating), price, incentive amount,

ownership type (i.e., lease or buy) and several important

dates to determine solar adoption and installation. The CSI

data covers completed projects since May 2007 through

April 2013 (about 6 years, 8500 adopters). The assessor

data stores comprehensive housing characteristics for the

residential sector (about 440955 households in San Diego

County), including square footage, acreage, number of bathroom and car storage etc.

The CSI data and assessor data were merged to comply

with our modeling framework. Using the final adoption information we were able to generate historical observations

for each individual. In details, for a given month m, if someone’s adoption month was after m, we construct an observation with negative label (i.e., ”did not adopt in this month”).

If one’s adoption month happens to be the same month we

are looking at, we construct a positive observation labeled as

”adopt” instead. The positive and negative cases can be encoded by a binary class, i.e., 1 for “adopted” and 0 for “did

not adopt”, in order to fit a logistic regression model. Once

we expand individual entries by month, some original information, such as, incentive and cost will no longer be valid

since those variables change over time. But, we assume no

changes for home characteristics. We used simple linear regression models to estimate those unknown variables from

the data. The assumption behind the practice is that we suppose non-adopters make decisions over same set of variables

as adopter do, i.e., cost, economic benefits, and peer effect

measures etc. Once those unknown variables are estimated,

we are ready to train the logistic regression model. Note

that, all models were trained on data spanning the first four

years, while empirical adoptions in the last two years were

used only for evaluation.

Our previous modeling efforts revealed that one variable

involving system size is critical in determination of system

cost. As a result, our first step is to estimate this variable.

• baths(numeric): The number of bathrooms in the house

• pool(binary): 1 if the property has a private pool, otherwise 0

• numCarStorage(numeric): The sum of garage space and

private parking spaces

• totalLvg(numeric): The total number of livable square

feet

• parView(binary): 1 if the property is designated as having

a particularly pleasant (valuable) view, otherwise 0

• acreage(binary): 1 if the property has at least .25

acres,otherwise 0

• aveKwh(numeric): Average electricity utilization of the

zip that a house belongs to, measured in kilo watt per hour

We fitted adopter sub-dataset with these variables, and stepwisely eliminate those unimportant variables, i.e., step-wise

regression in statistics. The final features and their coefficients are listed in Table 1.

Table 1: CSI Rating Linear Model

Predictor

(Intercept)

ownerocc

pool

totalLvg

acreage

aveKwh

Estimate

1.592e+00

-2.547e-01

6.315e-01

7.582e-04

1.319e+00

8.249e-04

Std. Error

1.553e-01

1.149e-01

7.658e-02

3.385e-05

8.507e-02

1.913e-04

t value

10.255

-2.217

8.247

22.403

15.505

4.311

Pr(> |t|)

< 2e − 16

0.0267

< 2e − 16

< 2e − 16

< 2e − 16

1.66e − 05

The Adjusted R-squared is about 0.27, which seems pretty

low. Limited by our data we can get, this is the highest we

can get using linear regression. Although a solar system is

typical sized to a scale to compensate one’s electric usage

of higher tiers, there are many reasons why a system may

be sized differently either smaller or larger in terms of how

individual maximizes his internal rate of return (McAllister

2012). Fortunately, the subsequent modeling efforts show

that the low R-squared actually does not affect our final prediction dramatically.

Ownership Cost

CSI Rating

The two primary ways to have a solar system installed in

one’s house are buying and leasing. For people who plan to

purchase a solar system, they will usually face a large down

payment and eventually own the system. For people who

however choose to lease, they could have zero down payment, but they do not own the system. Choice between lease

or buy is an interesting research question in econometrics,

also, which is very common in many markets, such as, automobiles, house etc (Rai and Sigrin 2013).

Ownership cost is the actual payment made by a solar PV

owner. This information is available in the CSI program

database. Note that, in practice, some owners may choose

to finance a solar PVs system through bank loans. However, for now, we do not deal with this layer of complication.

CSI rating (Commission 2013) is a key parameter that measures the size and efficiency of PV system to be installed.

The choice of system size is usually the first step to go for

solar, but for a non-adopter, this value is unknown. We estimated the CSI rating based on the home characteristics, such

as, living square area, pool, bath, car storage etc. In specific,

candidate variables involve all available assessor features,

such as,

• totalVal(numeric): Total property value including both

land and building values

• ownerocc(binary): 1 if the property is occupied by the

owner, otherwise 0

45

Initial candidate variables used to train the ownership cost

model involve all assessor features and aveKwh, CSI rating

and peer effect measures, which are described as follows,

Table 2: Ownership Cost Linear Model

Predictor

Coefficient

(Intercept)

1.138391e+04

totalVal

7.377731e-04

totalLvg

1.518842e-01

csirating

6.213036e+03

totalAdoptSD -1.062339e+00

• numAdopt: The number of completed CSI applications

by the current month in the zip code the house belongs to

• numInstall: The number of completed PV installations by

the current month in the zip code the house belongs to

• fracAdopt: The fraction of houses that have completed

CSI applications in the zip code the house belongs to

50 percent of new adopters who chose to lease PV systems.

Since choice between lease and buy involves complicated financial decisions, which is out of scope the paper, we only

focus on a more general type of adoption. However, because lease is becoming an appealing option in today’s solar

energy market, we included relevant variables in our individual model. In particular, we calculated the total leasing

cost as follows:

• fracInstall: The fraction of houses that have completed

PV installations in the zip code the house belongs to

• num8Mile: The number of installations within eight mile

radius around the house

• num4Mile: The number of installations within four mile

radius around the house

• num2Mile: The number of installations within two mile

radius around the house

LeaseCost = c0 +

• numMile: The number of installations within one mile

radius around the house

c1m ∗ 12 ∗ (1 − β ∗ (1 + ξ))L

1 − β ∗ (1 + ξ)

(1)

where,

• c0 : upfront cost or lease down payment

• c1m : monthly payment in first year

• ξ: annual escalation rate

• L: lease contract length in years

• β: discounting factor, use 0.95.

These variables above are stated clearly in the solar lease

contracts. We extracted the information from a sample

(about 70 individuals) of lease contracts and fitted a linear

regression model with same set of features as we used for

ownership cost model plus incentive. Moreover, the linear

model used l1 regularization in order to pull out the most significant features from correlated features. This also helped

to avoid model over-fitting and improve predictive efficacy.

We followed the one standard error rule discussed in the

previous section, and finally chose a model with only one

feature, that is CSI rating. The coefficients of this model is

given in Table 3.

• numHalfMile: The number of installations within half

mile radius around the house

• numFourthMile: The number of installations within

fourth mile radius around the house

• numEighthMile: The number of installations within

eighth mile radius around on the house

• baseline: electricity baseline which determined by the

utility company, i.e. SDGE

• aveKwhExcessTier2: average kilo watt hours which exceeds tier 2 threshold

• totalInstallSD: total number of PV installations by the

current month in San Diego County

• totalAdoptSD: total CSI program application by the current month in San Diego County

Intuitively, the above variables are highly correlated,

which can be problematic for linear regression. Appropriate

feature selection methods need to be applied. We applied

l1 regularization, also known as lasso penalty (Friedman,

Hastie, and Tibshirani 2001), to the regular linear ownership

cost model. Moreover, parameter lambda, the weight of regularization item in the objective function, is determined by

standard cross validation.

We followed the one standard error rule (Friedman,

Hastie, and Tibshirani 2001) to pick lambda, by which we

choose a lambda as large as possible but the cross validation error is no more than one standard error of the best

model. Then, we fitted our full training data with the selected lambda and obtained a linear model with coefficients

shown as in Table 2.

Table 3: Lease Cost Linear Model

Predictor Coefficient

(Intercept) 10446.832

csirating

1658.389

Estimation of Missing Variables

After we trained CSI rating, ownership cost and least cost

models, we estimated the CSI ratings, ownership cost and

lease cost for all non-adopters. To comply with consumer

decision theory in literatures, we calculated net present values of lease and ownership separately. The net present value

of ownership (denoted by N P V.own) is computed as follows.

N P V.own = I − C o + B

(2)

Lease Cost

The solar energy market has changed dramatically since

early 2008, when solar leases first came into being. Empirical data of year 2012 reveal that there had been more than

46

where, I is incentive, C o is ownership cost and B is solar

economic benefits. The net present value of lease (denoted

by N P V.own) is computed as follows.

N P V.lease = −C l + B

(3)

where, C l is lease cost and B is solar economic benefits.

Notice that, since lease customers do not receive solar incentives (instead, installers who purchase the system will),

they are not included in the calculation of lease net present

value. In addition, solar benefits are computed as follows.

For months before year 2009, we have

(eT 1 + eT 2 ) ∗ 12 ∗ 0.95

+

1 − 0.95

(eT 3 + eT 4 + eT 5 ) ∗ 12 ∗ 0.95 ∗ 1.035

1 − 0.95 ∗ 1.035

SolarBenef its =

(4)

For months in and after year 2009, we have

T1

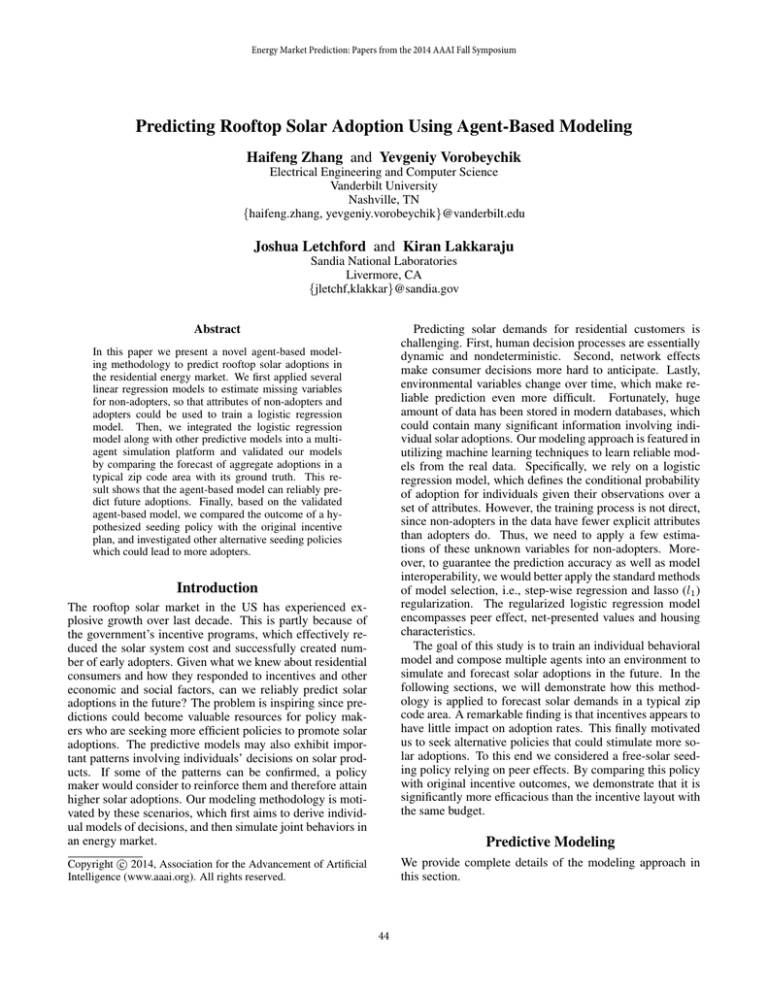

Figure 1: Logistic Regression CV errors

T2

+ e ) ∗ 12 ∗ 0.95 ∗ 1.01

+

1 − 0.95 ∗ 1.01

(5)

(eT 3 + eT 4 + eT 5 ) ∗ 12 ∗ 0.95 ∗ 1.035

1 − 0.95 ∗ 1.035

SolarBenef its =

(e

Logistic Regression

Notice many variables are correlated, a direct use of these

features as a whole can get us model with misleading coefficients. A logistic regression model with lasso regularization

was trained on a sample (30% of entire training data, around

6841501 data entries) of the training data. Due to the size

of training data, we only applied 5 folds in cross-validation.

The cross validation error is shown in Figure 1.

By one standard error rule, we chose the largest lambda

with cross validation error within one standard error of the

best model. The coefficients of this model are listed in Table

4.

Both equations suppose the solar economic benefit can

last for infinite number of years and a 3.5% of annual growth

rate for tier 3, 4 and 5 consumption groups, which is approximately the average growth rate for these tiers over the last

10 years.1 . However, they differ on the first part, where we

assume no change in tier 1 and 2 electricity consumption

categories prior to year 2009, however, 1% for months since

year 2009. We then used the actual electricity rates to calculate solar benefits according to the following equation:

M onthlySolarT ieredBenef its(et ) =

rt ∗ Seot

t ∈ {T 1, T 2, T 3, T 4, T 5}

Table 4: Logistic Regression Model

Predictor

Coefficient

(Intercept) -8.814706e+00

ownerocc

2.503317e-01

fracInstall 1.627659e+01

NPV.own

2.994175e-06

NPV.lease

7.020925e-06

(6)

where rt is tiered electricity rate and SEOt is the part solar electricity output fallen into tier t, total solar electricity

output is computed as follows,

Seo = CSIrating ∗ Hrssun

(7)

where, Hrssun denotes the full sun hours (that is the yearly

average amount of solar insolation, 5 hours is used for San

Diego County).2

Finally, other than the net present values for ownership

and lease, we also added a few dummy variables, such as,

season indicators and lease availability indicator. Our final

logistic regression model was trained on the extended set of

features.

The lasso regularization provides us with a sparse model.

Notice first that the most important feature in the group of

peer effects is at zip code level, but not the mile-based radius (weak measures are shrunk to zero coefficient). As the

cost of computing mile-based peer effect measures usually

increases by the scale of population, the benefit of shrinkage

regularization is also apparent. Finally, N P V.lease seems

stronger than N P V.own, which is informative since a large

portion of the solar market involves leased systems.

1

Some is available at SDG&E website, http://www.sdge.com/.

Note that actual tier may vary over years, we have converted non

5-tier rates into 5-tier rates

2

Sun

Hours/Day

Zone

Solar

Insolation

Map,

see

http://www.wholesalesolar.com/InformationSolarFolder/SunHoursUSMap.html

Agent-based Simulation

The models of CSI rating, ownership cost and lease cost and

logistic regression model of solar adoption propensity were

47

composed in a widely-used, open-source agent-based simulation toolkit, Repast.3

Agents

The main type of agent is named ”household”, which represents household entity in the residential solar market. It further derives two sub-types, ”adopter” and ”non-adopter”. In

addition, in order to flexibly control the execution of simulation, we defined a special type agent called ”updater”, which

is responsible for updating attributes of household agents at

each time step.

Time Step

At each tick of the simulation, updater agent first updates

predictors, i.e., ownership and lease cost, incentive and

NPVs etc for all agents based on the state of world. Lease

and ownership cost are estimated by the lease and ownership cost models respectively, and incentives imitated original CSI program rate schedule, i.e., a step function of total solar kilo watts have been reserved in San Diego County.

Next, non-adopter agents compute adoption likelihood given

a set of attributes shown as in the logistic regression model.

Stochastically, a non-adopter agent draws a random number between 0 to 1 and compares it with its own adoption

likelihood to decide whether if to adopt or not. The exactly

simulate a random event (in this case solar adoption) under

certain probability. In details, if the number is less than the

probability given by logistic regression model, it will choose

to adopt a solar system. If an agent chooses to adopt, consequently, we technically remove the non-adopter and add a

new adopter into the environment. Moreover, when we create a new adopter, we also assign an installation period of

the solar system, adopter agents will not update the number

of installation until installation is completed. The number

of months to be taken for the solar adoption to become a

visible system is uniformly distributed in 1 to 6, reflecting

the typical installation range in the CSI data. At the end

of every time step, data can be collected and output to an

user-specified file. Typical data we collected were aggregate

adoption and system cost.

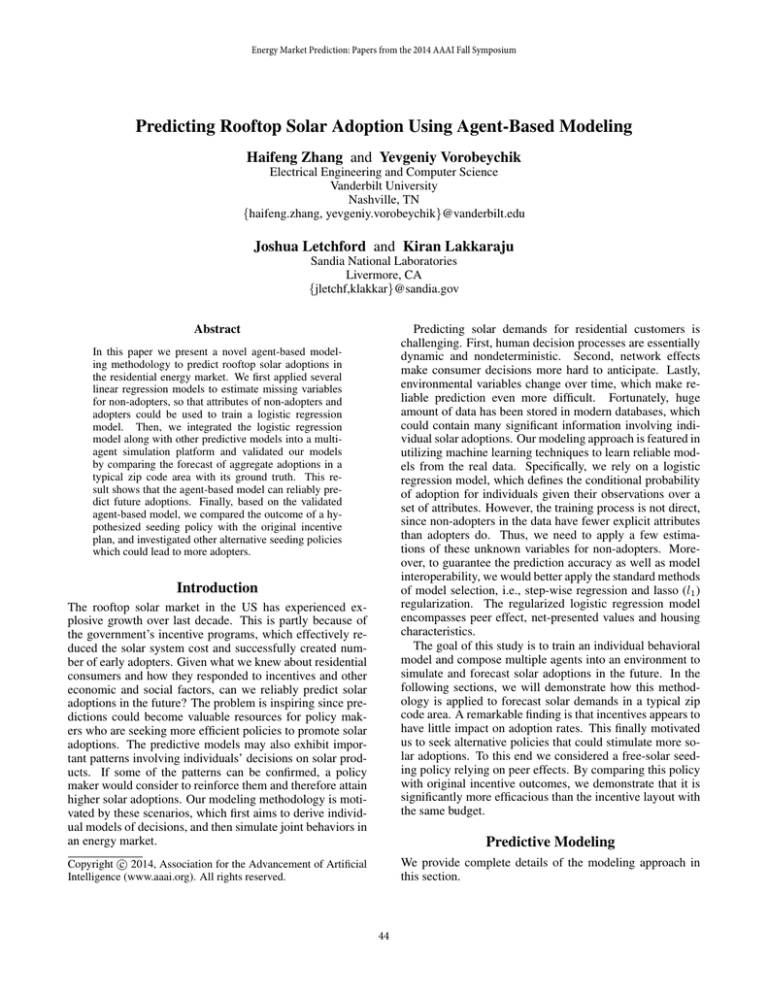

Figure 2: Average Adoptions

Figure 3: Likelihood Ratio

We took the individuals from a representative zip code

in San Diego county (approximately 13000 households) and

initialized the simulation with their assessors features as

well as adoption states, i.e., who has adopted or who has not.

We started the simulation beyond the time we trained the

predictive models. As our agent-based simulation is highly

stochastic in its nature, we averaged results of 1000 runs for

both lasso and baseline models. The results of average adoptions by month is illustrated in Figure 2.

The results generated by lasso model is more close to the

real path than the baseline model. Formally, we traced likelihood of each model in each run, and computed average

likelihood ratio (lasso/baseline) of all sample runs for each

month. As shown in Figure 3, the ratio is generally much

larger than 1, suggesting that the lasso model significantly

outperforms the baseline.

We varied original CSI incentive rates, i.e., multiplying

original rates with 2, 4, 8 and 16 etc and holding the same

Experiment Results

We present the final ABM results in this section. To validate our modeling approach, we compared it with a baseline model, which is a non-regularizated logistic regression

model with only three features. Its coefficients are shown as

in Table 5.

Table 5: Baseline Logistic Regression Model

Predictor

Coefficient

(Intercept) -8.858e+00

fracInstall 1.313e+02

NPV.own

1.142e-05

3

Repast home page, http://repast.sourceforge.net/

48

Figure 4: Varying Incentive Rates

Figure 5: Expected Adoptions Incentives vs. Seeding

amount of targeted mega watts in each step, and compared

the expected adoption with outcomes of original CSI incentive rate structure. Although a single simulation run takes a

few seconds, large number (say 1000) of sample runs would

take couple hours. To cope with the computational difficulty,

we therefore introduce a heuristic measure to approximate

expected number of adopters of very large sample runs. We

called the heuristic ”average step”. As its name suggests,

the simulation will proceed in special a manner: it generates

multiple (typically 1000) instances of one-step runs simultaneously at each time step, but only the one close to the

average number of adopters becomes the ”true” outcome. If

a simulation is run in ”average step” mode, any step can be

considered as an average outcome of the previous step. Using this new measure, the time of computing utility of a policy has been reduced from hours to minutes. The ”average

step” function is enabled by the ”updater” agent mentioned

earlier.

We applied the simple ”average-step” heuristic idea and

hoped to learn insights of how the predictive model react

to incentive changes. The average adoption over 10 sample

(”average step”) runs for each month v.s. original incentive

plans is shown in Figure 4.

This impact of incentives seems very limited, that suggests incentive may not major concern when people are considering install solar PV systems. Moreover, the interesting result also encouraged us to think of alternative policies which could be more efficacious than current incentive

schemes. This is discussed in the next section.

to give away more free systems under a fixed budget.

We compared incentives with a seeding policy that seeds

all free solar systems at very beginning subject to identical

budget constraints. A comparison of average adoptions between the seeding policy and incentives can be seen in Figure 5.

The plot shows seeding policy with the same budget as

spent on original incentives can generate more adopters.

Also, as we increase available budget of the seeding policy,

more adopters can be induced.

An interesting question is whether if it is optimal to seed

all budget at time zero or the time period right before the

last period or some fractional policy in between. We run

our simulation with different splits of fixed budget between

time period t=0 and t=T-1, and searched for optimal split

which leaded to maximum number adopters. Similarly, we

tested different budgets regarding this problem. The total

adoptions i.e., seeded and unseeded adopters are illustrated

in Figure 6, where alpha is the fraction of budget used in

period t=T-1.

For smaller budgets, seeding at period t=T-1 is more efficacious than t=0. However, for larger budget we get an internal optimal solution (some fraction of the budget should

be used at time 0, and the rest in the penultimate period).

The intuition behind this internal optimal solution is seeding

early peer effect can last longer, whereas, seeding later can

give away more free systems as cost decreases over time.

The two effects work oppositely, that implies the optimal alpha could be between 0 and 1. When budget is small, peer

effects are not strong enough, since only a few individuals

can get free solar PVs. However, large budget can create

much stronger peer effects, which makes a fractional lambda

be optimal.

A further examination of adoptions not including individuals who were seeded is shown in Figure 7. It suggests

that for same budget the more one splits expenditure to t=0,

the stronger the peer effects will be and therefore the more

Seeding Strategy

A seeding policy assumes that we can give away free solar

PV systems to qualified individuals, which is expected to

stimulate further adoption through peer effects. This is motivated by the fact that peer effect is a stronger predictor of

adoption than the net present value. Eligibility for a free solar system is assumed to be determined by system cost. We

implemented a scheme that gives free solar to households

with lowest system costs. This makes sense because it tends

49

niques (Friedman, Hastie, and Tibshirani 2001). Logistic

regression (Bishop and others 2006), an extension of linear

regression, has been successfully deployed in variety of applications.

Agent-based modeling (ABM) is recognized as a powerful tool to understand and analyze phenomena in complex systems (Bonabeau 2002). It’s one kind of micro-scale

model, bottom-up approach that captures the simultaneous

interactions of multiple agents in an attempt to recreate and

predict macro system-level events (Gustafsson and Sternad

2010). An ”agent” in ABM is any autonomous entity with its

own properties and behaviors. Due to the definition, ABM

is considered as the most natural way to model more realistic systems, say markets. Unfortunately, acceptance of this

method in traditional research communities is slow. People

criticize that ABM does not handle real data but toy problem. Nevertheless, if agent-based models are properly validated, they can add a layer of realism that is not captured by

many analytical models (Rand and Rust 2011). The highlight of our work is embedding statistical models learned

from real data into multi-agent simulation and empirically

validate the agent base model. To our knowledge, such a

rigorous use of ABM in marketing research is rarely seen.

Marketing research in solar market typically focuses on

modeling diffusion processes. It often relies on diffusion

models (Bass 2004; Geroski 2000; Rao and Kishore 2010)

with aggregate data to make predictions on adoption of

a new product or technology. These models do provide

us with intuitions but are seldom applicable to real-world

data. Besides, econometrics research provides our insights

of what affect individual decisions on solar products. Particularly, peer effects has been extensively studied in literatures to model interactions of individual decisions in a

social perspective. For solar PV market, researcher developed method to identify peer effect(Bollinger and Gillingham 2012). Moreover, individual decisions on solar technology can have impact on some system variable, i.e., system cost. Learning by doing (Arrow 1962; Harmon 2000;

McDonald and Schrattenholzer 2001) was introduced to account for the externalities in terms of how system cost evolve

over time. The inclusion of net present value in our individual model is due to rationality assumption of individuals

who treat solar purchasing as a type of investment.

A few closed work are worth mentioning. For example,

Zhai and Williams developed a fuzzy logic model, which

related purchasing probability with variables, such as, perceived cost, perceived maintenance requirement, and environmental concern. An deterministic consumer choice

model was developed by Lobel and Perakis to forecast aggregate solar adoptions. Robinson et al. developed an agentbased model which explicitly modeled social interactions in

a spatial context using GIS data.

Our work differs from these previous work in several aspects. First, our models are built on richer and larger data

set, which include up to date characteristics of solar market.

Second, we are targeted in prediction rather than descriptive

data analysis. Third, the agent-based model we developed

is highly stochastic and non deterministic, which we expect

to account for uncertainties in individual decisions. Finally,

Figure 6: Expected Adoptions

Figure 7: Expected Adoptions Non-seeded Individuals

adopters induced finally. It also indicates peer effects increase as available budget increases. These initial findings

based on our validated agent-based model provided insights

of timing strategies in seeding policy. However, the search

space of the optimal seeding policy problem is still large,

i.e., how about seeding in the months between t=0 and t=T1? Does seeding to lowest cost individuals guarantee an

optimal solution? These are all interesting questions worth

deep investigation in the future.

Related Work

Our predictive modeling methodology is highly influenced

by methods in fields of machine learning and statistics. Feature selection (Guyon and Elisseeff 2003) is a common problem in almost any data analysis with a large set of variables.

Stepwise regression, lasso regularization with tuned parameter by cross validation are widely-employed standard tech-

50

our experiments on optimal seeding policies compared with

original incentives are rarely seen in the literatures so far.

Guyon, I., and Elisseeff, A. 2003. An introduction to variable and feature selection. The Journal of Machine Learning

Research 3:1157–1182.

Harmon, C. 2000. Experience curves of photovoltaic technology. Laxenburg, IIASA 17.

Kwan, C. L. 2012. Influence of local environmental, social,

economic and political variables on the spatial distribution

of residential solar pv arrays across the united states. Energy

Policy 47:332–344.

Lobel, R., and Perakis, G. 2011. Consumer choice model for

forecasting demand and designing incentives for solar technology. Social Science Research Network, MIT, Cambridge.

McAllister, J. A. 2012. Solar adoption and energy consumption in the residential sector.

McDonald, A., and Schrattenholzer, L. 2001. Learning rates

for energy technologies. Energy policy 29(4):255–261.

Rai, V., and Sigrin, B. 2013. Diffusion of environmentallyfriendly energy technologies: buy versus lease differences

in residential pv markets. Environmental Research Letters

8(1):014022.

Rand, W., and Rust, R. T. 2011. Agent-based modeling in

marketing: Guidelines for rigor. International Journal of

Research in Marketing 28(3):181–193.

Rao, K. U., and Kishore, V. 2010. A review of technology

diffusion models with special reference to renewable energy

technologies. Renewable and Sustainable Energy Reviews

14(3):1070–1078.

Robinson, S. A.; Stringer, M.; Rai, V.; and Tondon, A. 2013.

Gis-integrated agent-based model of residential solar pv diffusion.

Zhai, P., and Williams, E. D. 2012. Analyzing consumer

acceptance of photovoltaics (pv) using fuzzy logic model.

Renewable Energy 41:350–357.

Conclusion

In summary, we claim two major contributions in this paper.

First, we developed a reliable agent-based model to predict

solar demands in the residential market. Second, we proposed an alternative policy which could potentially outperforms the current CSI incentive scheme.

Despite of the accomplishment, in the future, we still

need to address a few problems. We have demonstrated

in the paper that ABM successfully forecast adoptions in a

zip code area with thousands individuals. More convincing work would need us to run ABM for the entire studied

area, San Diego county, which has about 80 times of current

population. Second, our model can be further improved by

adding more meaningful features. For example, human decisions on solar products is also influenced by environmental, social, economic and political variables (Kwan 2012;

Gromet, Kunreuther, and Larrick 2013). Also, better prediction on CSI rating could dramatically improve overall modeling processes. Finally, the minor impact of incentive suggests that the relationship between individual adoptions and

subsidies might need further investigation.

References

Arrow, K. J. 1962. The economic implications of learning

by doing. The review of economic studies 155–173.

Bass, F. M. 2004. Comments on ?a new product growth

for model consumer durables the bass model?. Management

science 50(12 supplement):1833–1840.

Bishop, C. M., et al. 2006. Pattern recognition and machine

learning, volume 1. springer New York.

Bollinger, B., and Gillingham, K. 2012. Peer effects in the

diffusion of solar photovoltaic panels. Marketing Science

31(6):900–912.

Bonabeau, E. 2002. Agent-based modeling: Methods and

techniques for simulating human systems. Proceedings of

the National Academy of Sciences of the United States of

America 99(Suppl 3):7280–7287.

Commission, C. P. U. 2013. California solar initiative program handbook.

Friedman, J.; Hastie, T.; and Tibshirani, R. 2001. The elements of statistical learning, volume 1. Springer Series in

Statistics New York.

Geroski, P. A. 2000. Models of technology diffusion. Research policy 29(4):603–625.

Gromet, D. M.; Kunreuther, H.; and Larrick, R. P. 2013.

Political ideology affects energy-efficiency attitudes and

choices. Proceedings of the National Academy of Sciences

110(23):9314–9319.

Gustafsson, L., and Sternad, M. 2010. Consistent micro,

macro and state-based population modelling. Mathematical

biosciences 225(2):94–107.

51