Center for Global Development June 14, 2006

advertisement

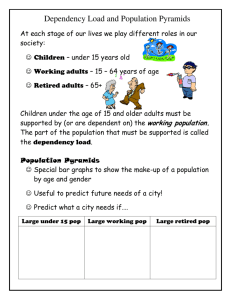

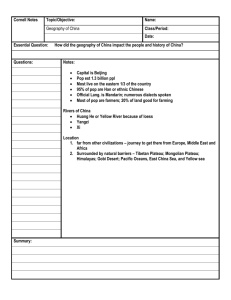

Center for Global Development June 14, 2006 Safe Safe Harbor Harbor Statement Statement The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for certain forward-looking statements so long as such information is identified as forward-looking and is accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those projected in the information. The use of words such as “may”, “might”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “project”, “intend”, “future”, “potential” or “continue”, and other similar expressions are intended to identify forward-looking statements. All of these forward-looking statements are based on estimates and assumptions by our management that, although we believe to be reasonable, are inherently uncertain. Forwardlooking statements involve risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of our control, that may cause our business, industry, strategy or actual results to differ materially from the forward-looking statements. These risks and uncertainties may include those discussed in the Company’s annual report on Form 10-K for the year ended June 30, 2005 on file with the Securities and Exchange Commission, and other factors which may not be known to us. Any forward-looking statement speaks only as of its date. We undertake no obligation to publicly update or revise any forwardlooking statement, whether as a result of new information, future events or otherwise, except as required by law. 2 Our Our Mission Mission Provide a secure and affordable electronic transaction platform as well as financial services for the world’s unbanked and under-banked 3 Traditional Traditional Systems Systems Do Do Not Not Meet Meet the the Needs Needs of of the the Unbanked Unbanked Limited purchasing power Lack of choice Little immediate value Must use cash 4 Our Our Solution Solution ¾ Low Cost ¾ Banked ¾ Offline ¾ Choice ¾ Reliable ¾ Competitive services ¾ Secure ¾ Multiple Products ¾ Cashless ¾ Peace of mind 5 UEPS UEPS Platform Platform ¾ Works offline ¾ Recoverable Enroll ¾ Multiple applications Load ¾ Robust data Spend Settle ¾ Biometric authentication 6 UEPS Operation Cardholder Merchant Mainframe 7 Multiple Multiple Products Products Systems: Welfare, Wage, Medical, Voting Utility Services: Pre-paid Electricity, Water, Telephone, Transportation Extended Applications: Loyalty, Marketing, Identification, Public Records Services: Lending, Insurance, Savings, Money Transfers Payment Applications: Spending 3rd-party payments Debit orders 8 Benefits Benefits of of Our Our Solution Solution 9 South South African African UEPS UEPS Cardholders Cardholders 3.6 MM Cardholders 2,832 Limpopo 4,607 801 North West KwaZulu-Natal 402 Northern Cape 2,089 Eastern Cape Grants, in thousands, paid in the three months ending 10 March 31, 2006 UEPS UEPS Adoption Adoption at at the the Point Point of of Sale Sale Card Holder Transactions: Merchant Loads Each Calendar Month 1,000,000 900,000 800,000 700,000 600,000 500,000 400,000 300,000 200,000 100,000 0 Jan-05 Feb-05 Mar-05 Apr-05 May-05 Jun-05 Jul-05 Aug-05 Sep-05 Oct-05 Nov-05 Dec-05 Jan-06 Feb-06 Mar-06 11 Namibia Namibia and and Botswana Botswana ¾ New entry point Banking ¾ Potential to demonstrate full platform Financial services Wage payment Money transfer Government welfare Social security Healthcare services Namibia Botswana 12 Healthcare: Healthcare: HIV HIV // AIDS AIDS Client Doctor Pharmacy Hospital Clinic Outreach Reporting Mainframe 13 Africa Africa –– Strong Strong Focus Focus Kenya (pop. 34MM) Nigeria (pop. 129MM) Tanzania (pop. 37MM) Zambia (pop. 11MM) Namibia (pop. 2MM) South Africa (pop. 44MM) Botswana (pop. 1.6MM) 14 Large Large Need Need China India Mexico Malaysia Brazil Indonesia 15 Interoperability Interoperability UEPS Offline V/MC EMV Gift Card Online 16 Mobile Mobile Payments Payments 17 Program Program Evaluation Evaluation Evaluation Information Donor / NGO Government Assistance Individuals 18 Financial Financial Characteristics Characteristics ¾ Low capital costs ¾ Low operating costs ¾ Broad channel for additional products ¾ Supports micro-enterprise 19 Strong Strong Revenue Revenue Revenue ($MM) 200 176.3 147.9 150 134.9 131.1 100 74.9 51.8 50 0 FY2002 FY2003 FY2004 FY2005 9 Mo. FY2005 9 Mo. FY2006 20 Strong Strong Net Net Income Income Earnings Growth ($MM) 50.0 40.0 30.0 44.6 20.0 11.1 10.0 43.7 34.4 13.1 13.3 FY2002 FY2003 FY2004 FY2005 9 Mo. FY2005 9 Mo. FY2006 0.27 0.37 0.38 0.80 0.62 0.76 8.5 0.0 Diluted EPS ($US) Earnings to shareholders Reorganization costs 21 Center for Global Development June 14, 2006