The EU-Med partnership and rules of origin Patricia Augier

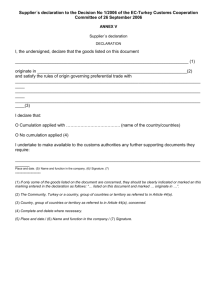

advertisement