Natural Resources, Aid, and Democratization: A Best-Case Scenario Kevin Morrison

advertisement

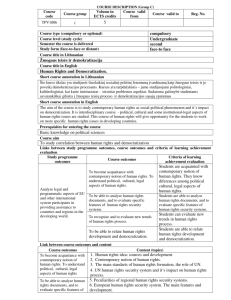

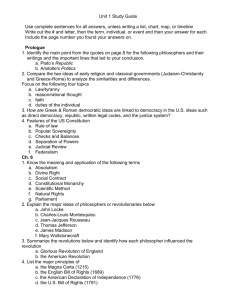

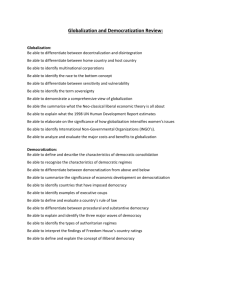

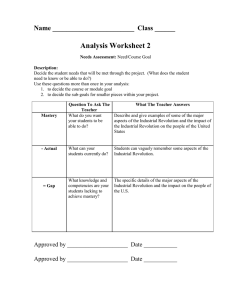

Natural Resources, Aid, and Democratization: A Best-Case Scenario Kevin Morrison Department of Political Science Duke University kevin.morrison@duke.edu http://www.duke.edu/~kmm15/ January 2005 Draft: Please do not cite Comments most welcome Abstract: Literature on the “political resource curse”—the tendency for countries rich in natural resources to be more authoritarian—indicates that the principal problem with natural resources is their discretionary use by nondemocracies. This problem is also characteristic of much foreign aid. It makes sense, therefore, to funnel these resources away from the state in nondemocracies and toward the citizens, and this is in fact being attempted in many countries. Using formal analysis and building on existing theories of democratization, this paper analyzes whether such institutional solutions are likely to be successful, even when they work perfectly (the best-case scenario). The models show that even with these institutional safeguards, these resources diminish the chances for democratization. In addition to their practical importance, the results have an important theoretical implication: the political resource curse may not be due to state use of these resources, but simply to their very existence in nondemocracies. Acknowledgments: An earlier version of this paper was presented at the Conference on Comparative Political Economy, at Yale University on May 20, 2004, and at the Annual Meeting of the American Political Science Association, in Chicago on Sept 3, 2004. I am grateful for the comments received from conference participants, and especially for the detailed comments of Daron Acemoglu and John Londregan. In addition, the paper has benefited a great deal from my discussions with Karen Remmer and David Soskice. All errors are of course mine. This paper is based upon work supported under a National Science Foundation Graduate Research Fellowship, a James B. Duke Fellowship, and a grant from the Duke University Center for International Studies. Any opinions, findings, conclusions, or recommendations expressed in this paper are those of the author and do not necessarily reflect the views of the National Science Foundation or any entity of Duke University. Natural Resources, Aid, and Democratization: A Best-Case Scenario Closely related to the economic “resource curse” literature (Ross 1999 provides a review), which studies the apparently negative effects of natural resources for economic performance, a literature has bloomed in the past decade on the political resource curse. These works have analyzed the tendency of regimes richly endowed with natural resources to be more authoritarian than those without such resources (e.g. Karl 1997; Ross 2001). While various causal mechanisms have been offered to account for this effect—from a decreased need to be accountable to citizens because of less necessary taxation, to an increase in repression—the basic theme that runs through the literature is that natural resources offer a highly fungible resource that malevolent governments can use to their advantage. As Jensen and Wantchekon state, “The key mechanism linking authoritarian rule and resource dependence, both in democratic transition and democratic consolidation, is the incumbent’s discretion over the distribution of natural resources” (2004, 821). This aspect of natural resources has recently caught the attention of scholars who work on foreign aid. Research has indicated that foreign aid is also a highly fungible resource (Feyzioglu, et al. 1998) and acts similarly to natural resources in the sense that it provides extra resources the government can use to distribute to its key constituencies without taxation (see e.g. Bratton and van de Walle 1997). For example, van de Walle argues that democratization in Africa was encouraged by a fiscal crisis resulting from, among other things, an increased willingness on the part of donors to restrict aid to countries that did not respect human rights: “With fewer resources at their disposal and an increasingly decrepit state apparatus, leaders found it harder to sustain 1 critical clientelist networks, with the result that the old political aristocracy was more likely to fractionalize” (2001, 240).1 A principal implication of both of these general arguments about aid and natural resources is that whatever negative impact these resources have results from an interaction between the resources and the existing regime’s institutions.2 To the extent that the state already has good institutions, the gains from natural resources and aid may be used to benefit citizens. However, in poorly governed societies, natural resources and aid will be used in a highly discretionary manner to the benefit of those in power. In either case, however, it is possible that these resources will strengthen the existing regime. Though he does not position his findings in this way, the result that Smith (2004) presents—that oil wealth is robustly associated with regime stability (no matter what the regime)—supports this hypothesis. If it is true that the negative impacts of these resources come from their use by the regime, there are two obvious ways in which the resources can be put to better use: through 1 Like cross-national statistical studies of the effect of natural resources on democratization, of which Ross (2001) and Jensen and Wantchekon (2004) are the principal examples, cross-national statistical studies of the effect of aid on democratization are rare. Unlike the results for natural resources (a consistently negative effect), the results on aid are inconsistent. Goldsmith (2001) finds a small but significant positive correlation between level of democracy in Africa and aid as a percentage of GNP, and Knack (2004) finds no correlation between improvements in level of democracy and aid as a percentage of either GNP or government spending. 2 The idea that it is the country’s existing institutions that create the effects of these resources is also taking hold with regard to the economic resource curse. See Robinson, et al. (2003) and Ross (1999). 2 improving the regime or taking the resources out of the hands of the regime. Neither is easily achieved, but the latter is likely to be easier than the former in the short term. Not surprisingly, this latter option is exactly the strategy that has been adopted or recommended by a number of international actors in poorly governed regimes. With regard to aid, the World Bank’s recent task force on aid to poorly governed countries (LICUS Task Force 2002) recommended that donors implement “Independent Service Authorities (ISAs)” to provide social services with aid funds. These ISAs would be transparent, largely autonomous from the government, and under intense scrutiny from donors, and would contract private companies and NGOs to provide social services to citizens. With regard to natural resources, perhaps the best example is the experience in Chad, where the World Bank financed an oil pipeline through Cameroon with the requirement that expenditures of oil revenues be approved by a monitoring body including representatives of civil society. These types of funds have also been used in Kuwait, Azerbaijan, and Venezuela. Birdsall and Subramanian (2004) argue that these funds actually do not go far enough in taking the resources out of the hands of the regime, as they are still occasionally subject to appropriation and corruption. Birdsall and Subramanian instead recommend a more extreme proposal for oil revenues in Iraq: distribute them directly to the citizens. The ability of these types of institutional mechanisms to alleviate either the economic or the political resource curse has not been tested. The findings of such a test would be of considerable importance, both from a theoretical perspective and a practical one.3 Unfortunately, 3 There is considerable interest on the part of international actors that both natural resource revenue and aid funds be used well. For example, the concern that poor countries will be a breeding ground for international terrorists has generated major attempts among international 3 such a test would likely be quite a daunting task, especially given that most of these instruments have only been developed in recent years. However, using existing theories of democratization, it is possible to devise a formal model to explore the potential effects of these institutions. This paper does just that. In particular, I build a “best-case” scenario for taking these resources out of the hands of nondemocratic regime. This best-case scenario is that all revenues from aid and natural resources go directly to public goods that benefit the poor. This is clearly quite similar to what the types of instruments described above attempt to achieve. In the scenario I create, there is no corruption, and no repression on the part of the regime. I show that even in this best-case scenario, such institutional arrangements are not able to prevent the perverse effects of natural resources and aid on democratization. This is even true in the presence of policy conditions by donors that attempt to improve the policies of the government from the perspective of the poor. To examine the effects on democratization, the paper builds on theories of democratization that focus on redistributional conflicts between socioeconomic classes. This approach to democratization has a distinguished history, including the landmark works of Moore (1966) and Rueschemeyer, Stephens, and Stephens (1992). The most important recent contributions are by Boix (2003) and Acemoglu and Robinson (Forthcoming; 2001), who have donors to outline the appropriate role of aid in poorly governed regimes. While much research indicates that aid to these countries will not be used well (e.g. Burnside and Dollar 2000), donors are now under a lot of pressure now to give aid to them. See for example the World Bank’s Low-Income Countries Under Stress Initiative (http://www.worldbank.org/licus) and the OECD’s Development Assistance Committee’s initiative on Development Effectiveness in Difficult Partnerships (http://www.oecd.org/dac). 4 used methods and theories largely developed in the social choice literature. Following the benchmark result of Meltzer and Richard (1981), who showed that in democracies the median voter would be poorer and would prefer a higher tax rate (higher redistribution) than the rich, these authors develop theories of democratization centered on the desire for the rich to avoid redistribution. In Acemoglu and Robinson’s work, nondemocracies are in fact defined as regimes in which the rich elite hold power and the poor are largely excluded, whereas democracies are regimes in which there is political equality, allowing the poor to press their demands more effectively. Democratization is seen as a solution to a commitment problem: if there is a sufficient probability that the rich in an authoritarian regime will renege on their promises of redistribution, the poor will revolt. Because the rich prefer democratization to revolution, the rich will sometimes choose to democratize because it is the only way they can credibly commit to redistribute. Within this framework, Acemoglu and Robinson develop a theory that posits various conditions under which democratization (and, later, consolidation of democracy) will take place. This theory presents an appropriate framework to study the effects of natural resources and aid, not only because of its prominence but also because the focus of social conflict in the arguments of Boix and Acemoglu and Robinson is the tax rate. As Moore (1998; 2001) has emphasized, one of the key aspects of natural resources and aid is that they are non-tax revenue. As such, they may affect these disputes over the tax rate. In fact, the available evidence indicates that these resources lead to diminished tax effort. For example, Ross (2001) presents evidence that oil’s effect on authoritarianism works through decreased tax revenue, and Remmer (2004) provides evidence that aid lowers tax effort. 5 The paper proceeds as follows. In the next section, I develop the basics of the “bestcase” scenario, in which the benefits of natural resources and aid accrue directly to the poor. In doing so, I explore the impact of natural resources and aid on the preferences of the median voter, a key aspect of democratization models based on redistribution. I posit that the principal difference between natural resources and aid is that aid can be made conditional on certain policy changes by the government. When aid is offered without such conditions (and much aid is), it acts basically identically to natural resource revenue. The rest of the paper is dedicated to exploring the effects of these resources on the strategic interaction between rich and poor. First I examine, in the third section, the effect of natural resources and unconditional aid on democratization, and then in the fourth section I examine the effect of a donor who can impose conditionality on the government with regard to the tax rate. In keeping with the “best-case” scenario, this donor is assumed to have the poor’s preferences at heart. Using these models, I derive conditions under which democratization takes place, and the way in which natural resources and aid affect prospects for democracy. The model indicates that even in this best-case scenario, and even with conditionality from donors, natural resources and aid diminish the prospects for democratization. Natural Resources, Aid, and the Median Voter in Democracies Recent redistributive theories of democratization generally begin with the assumption that there are two classes, the rich and the poor, and that the median voter in a democracy is decisive and poor. Following the result of Meltzer and Richard (1981), this median voter will prefer higher redistribution than the rich, who in fact prefer no redistribution at all. For this 6 reason, the rich, in power in a nondemocracy, will avoid democratization if at all possible. Because this conflict is at the heart of democratization in these frameworks, any analysis of democratization must begin with an understanding of the preferences of the poor median voter in a democracy. This model assumes that because the median voter in a democracy is poor, all government revenue is spent on public goods that benefit only the poor. In a non-democracy this would only be the case in a best-case scenario—and it is that scenario I am trying to explore. Therefore the utility of the poor person in both a democracy and the best-case nondemocracy is: U p = c p + ln(g + 1) , (1) where Up is the utility of a poor individual, cp is her consumption, and g is government spending (one is added to government spending inside the natural log function, to ensure that zero utility is gained from zero government spending). Government spending is assumed to be financed by tax revenues and other non-tax resources (there is no corruption, as we are in a best-case scenario, and the budget is balanced). These non-tax resources consist of two types. One is unconditional, in the sense that the resources received by the government are not tied to particular policy changes the government must make. This type includes natural resources and unconditional aid. The other is conditional, and this includes aid that is only delivered if certain policy conditions (set by a donor) are fulfilled. Therefore the government’s budget constraint is: g = τny + U + C , (2) where τ is a proportional income tax levied on all citizens, n is the number of people in the economy, y is the average income in the economy, U is the amount of unconditional non-tax resources received by the government, and C is the amount of conditional non-tax resources 7 received by the government. For the rest of the paper, I normalize the size of the population, n, to one. The rich, as opposed to the poor, are assumed not to benefit from public spending in either a democracy or a best-case nondemocracy. Thus the utility of the rich is assumed to be U r = cr , (3) where U r is the utility of a rich individual and c r is her consumption. Consumption for the rich and poor is assumed to be equal to their post-tax income, y. That is, c i = (1 − τ ) y i , (4) for i = p, r. Following Acemoglu and Robinson (Forthcoming, Chapter 4), I define the incomes of the rich and poor as follows: yp = θy λ (5) yr = (1 − θ ) y 1− λ (6) Here, λ is the share of the population that is poor, and θ is the poor’s share of the economy. Note that an increase in θ represents a fall in inequality, and that since y p < y < yr , (7) θy (1 − θ ) y < , λ 1− λ (8) which implies that θ < λ. 8 I can now plug equations (5) and (6) into (4), and then plug equations (2) and (4) into equations (1) and (3), attaining the indirect utility functions of the rich and poor (remember that the population has been normalized to one): θy V p = (1 − τ ) + ln(τy + U + C + 1) λ V r = (1 − τ ) (1 − θ ) y 1− λ (9) (10) Note that the formulation to this point preserves the important result underlying redistributional theories of democratization, that the poor will prefer a higher tax rate than the rich. We can see from equation (10) that the rich will never prefer a positive tax rate, and since tax rates are assumed to be nonnegative (there are no subsidies), the preferred tax rate of the rich is zero. To find the preferred tax rate of the poor, τ p , I need only solve equation (9) through unconstrained maximization. This yields that τp = λ U + C +1 . − θy y (11) There are a number of important implications of this equation. Let us first focus on the second term on the right hand side of the equation. The first thing to note is that the poor’s preferred tax rate declines as natural resource revenue and aid increase. However, note that, keeping the level of these resources fixed, increasing the mean income can wash out their importance. That is, as mean income goes to infinity, the second term goes to zero. This implies that the effect of a given level of natural resources and aid on the poor’s preferred tax rate will disappear in richer democracies. The first term of the right hand side of equation (11) is also illuminating. Intuitively, the poor’s preferred tax rate increases with the share of the population that is poor (λ). Note 9 however, that this term depends a great deal on the denominator. Again, as with the second term in the equation, keeping all other terms fixed, an increasing mean income will decrease the poor’s preferred tax rate. However, keeping mean income fixed and increasing inequality (i.e. decreasing θ) will increase this tax rate. The interaction between inequality and income level is therefore crucial, echoing Meltzer and Richard’s (1981) finding that “the effect of absolute income on the size of government is conditional on relative income” (p. 923). One can see this in equation (5): if average income grows, it benefits the poor, but if average income growth coincides with a decrease in the poor’s share of the economy (for example, if income growth coincides with increasing inequality), then the effect on the poor depends on the relative changes in each variable. These implications are important for both the study of the effect of natural resources and aid on taxation, and redistributional theories of democracy. First, the studies of the effects of natural resources and aid on taxation mentioned above have put a negative slant on the result that tax revenues seem to decline with natural resources and aid. This simple model indicates the normative interpretation of this evidence should be conditional on the type of governance structure. To the extent that natural resources and aid are benefiting the poor, a decline in tax revenue may actually reflect the preferences of the poor, rather than being evidence of the government’s withdrawal from society, as Ross (2001) indicates. Second, redistributional theories of democratization assume that the preferred tax rate of the poor will always be higher than that of the rich. Overall, equation (11) indicates that the preferred tax rate of the poor in a democracy will be positive if the following condition holds: λ > U + C +1 θ (12) 10 For a given level of natural resources and aid, this condition is more likely to hold the higher is the share of poor people in an economy and the more inequality there is. Note, however, that under certain conditions, natural resources and aid could make the entire redistributional argument about democratization moot: if equation (12) does not hold, the poor no longer prefer a positive tax rate.4 Distributional theories of democracy have nothing to say about what might happen in this situation. It should not be assumed that democratization would result, because while the rich no longer have anything to fear from a transition (assuming that the natural resources and aid will continue after the transition), they also have nothing to gain. To the extent that democratization depends on a variety of factors, this would simply imply that the distributional factor would not be important. While noting this important implication, I proceed in this paper by assuming that the combination of natural resources and aid are not sufficient for the poor to prefer a zero tax rate. I therefore assume that equation (12) holds: Assumption 1: λ > U + C +1 θ Under this assumption, the rich will want to avoid democratization if possible. This gives me the basic premise to build a model of democratization that incorporates the effects of natural resources and aid. 4 Note that this result does not strictly depend on the best-case scenario. Essentially what is at issue is the amount of natural resource and aid revenue that is spent on the poor. If that amount is above a certain threshold—even if a majority of the original revenue has been siphoned off to other uses—then this result holds. 11 Natural Resources, Unconditional Aid, and Democratization I now develop the basic game-theoretic model of democratization depicted in Figure 1, which is similar in structure to Acemoglu and Robinson’s (Forthcoming, Chapter 6) “baseline” model of democratization. In this first model I assume that there is no conditional aid; that is C = 0. I will add the effects of conditional aid in the next section, but these are quite a bit more complicated, given the presence of a third player in the game (a donor). The setting of the game is a nondemocratic country (i.e. a government controlled by the rich). The first two moves of the game are by Nature. The first sets the amount of natural resource revenue and aid that the country will receive in the game. This assumption is reasonable for both natural resources and unconditional aid. With the exception of surprise discoveries of natural resources or commodity price shocks, the amount of revenue that will be generated by natural resources is generally known within some margin of error. The assumption with regard to aid is also not far-fetched, as it approximates reality in donor organizations. In most donor organizations, the allocation to a particular country is decided by management and then communicated to the country officers. These country officers then decide how to use the money. In most donor organizations, however, there is no reason that the entire aid allocation would not be given, as country officers will not want to appear as if they do not need as much money for the following year (see e.g. Lancaster 1999). Bureaucratic incentives therefore lead the full allotment to usually be given. I therefore assume that once “Nature” (i.e. donor management) decides how much aid is allocated to the country, that aid will be given.5 5 Mosley (1992) makes the same assumption. 12 Once this combined level of natural resource revenue and aid (U) has been set, Nature chooses a state of “mobilization” of the poor. Scholars of democratization often to point to moments of mobilization as key to regime transition (e.g. Bratton and van de Walle 1997; Przeworski 1991). These moments are always fleeting, however, and a strength of Acemoglu and Robinson’s (Forthcoming) formulation is the incorporation of these moments into their model. Nature chooses a state (S) of mobilization: high (H) or low (L). Acemoglu and Robinson write, “We think of the branch H as corresponding to an economic or political crisis, such as during a severe recession or following a war, which will make collective action by the poor easier, more effective or less costly during such a period” (Forthcoming, 6-28). The rich’s response to this mobilization, and the corresponding threat of revolution, is either to democratize (D) or maintain a non-democracy (N). If they democratize, the government sets the tax rate to that of the median voter, who is poor. If the rich do not democratize, they still have the opportunity to redistribute some of their wealth through taxation, possibly avoiding the revolution. That is, they can set the tax rate above their most preferred rate (zero) in order to satiate the masses. After this tax-setting move (in either a democracy or a non-democracy), the poor decide whether to stage a revolution (R) or not (NR). This decision by the poor is determined by what Acemoglu and Robinson term the “revolution constraint”. It is assumed that the poor have the option of launching a socialist revolution in which the economy’s wealth is distributed among the poor (as the authors point out, the point here is not to develop a realistic model of revolution, but rather to impose a constraint on the rich). Importantly, in a revolution the rich are left with nothing (i.e. their payoff is zero), so they prefer democratization to revolution: Vr(R, µS) = 0, 13 where S = L,H. As for the poor, they are each left with a share of the economy’s wealth. However, the economy is assumed to be damaged during the revolution: specifically, (1 – µ) of the economy is destroyed. Since this is divided amongst the poor, each poor person has an indirect utility of Vp(R, µS) = µS y . λ The variable µ S thus can be seen as akin to Nature’s decision about whether mobilization is high or not at the beginning of the game. If µS is low, the chance of revolution will be low, because the returns to the poor from a revolution will be low (the economy will be largely destroyed). If, however, µS is high, the returns from a revolution are higher. A critical aspect of the Acemoglu and Robinson model is that the rich can revert on their promises after the revolutionary threat dies down. That is, if the poor decide not to revolt, the rich can break their promise and set the tax rate back to zero. This is captured in the model by giving Nature a final move: with probability (1 – p) the government reverts on its pledge and sets a zero tax rate. As Acemoglu and Robinson write, p is an institutional variable that “can be thought of as a measure of the ‘formal’ political power of the poor in nondemocracy. When p is high, even though they don’t participate in the political system, the poor can prevent the rich from reneging on their promises. For example, the presence of strong worker organizations would map into high levels of p” (Forthcoming, 6-37). This variable is crucial to Acemoglu and Robinson’s theory, because it indicates that democratization happens because it is a way for the rich to credibly commit to redistribution. Because they want to avoid revolution, it is in the rich’s interest for the poor to believe their promises. If the poor do not, they will revolt, and the rich will be worse off. As such, a low 14 value of p, perhaps counter-intuitively, makes democratization more likely. It means that the rich are very likely to revert on their pledge, which means the expected return of the poor from not revolting is lower. We can see this if we compare Vp(R, µS) to the poor’s expected utility when revolution does not take place. This expected utility is: θy θy E[V p ] = p[(1 − τˆ) + ln(τˆy + U + 1)] + (1 − p)[ + ln(U + 1)] λ λ With this equation, I can derive the specific form of the revolution constraint for this model: µ S > p[(1 − τˆ)θ + λ y ln(τˆy + U + 1)] + (1 − p)[θ + λ y ln(U + 1)] (13) When equation (13) holds, the rich are unlucky: the benefit of revolution is more than the current utility of the poor, and so the poor will revolt. “Equilibrium Revolution” We can examine the game in Figure 1 by solving for pure strategy subgame perfect Nash equilibria. Payoffs for the poor and rich are given at the end of each branch of the game tree, with the payoff for the poor coming first and the payoff for the rich coming second (the donor payoffs are irrelevant here). Using backward induction, I look first at the decision by the poor to revolt. We know that neither democracies nor nondemocracies will set the tax rate above τ p , the preferred tax rate of the poor. In democracies this will be exactly the rate set, and in nondemocracies the tax rate will only be lower. It is possible, however, that even the tax rate in democracy will not be enough to prevent revolution. This will be true when Vp(R, µS)> Vp(D), or equivalently, 15 µ S > (1 − τ p )θ + λ y ln(τ p y + U + 1) (14) Plugging in for the equilibrium value of τ p in (11) above, I can write this condition as µ S > (1 − λ U +1 λ λ + )θ + [ln( )] . θy y y θ (15) If this condition holds, even the poor’s most preferred tax rate (and democratization) cannot prevent a revolution. There is “equilibrium revolution”. Note that this situation is more likely to be avoided if the right side of the equation is higher. The rather complicated expression on the right side of the equation has a straightforward interpretation for our variable of interest. Specifically, it increases as natural resources and unconditional aid increase, indicating that these resources can help quell revolutions in both democracies and nondemocracies. Note, however, that the impact of these resources will be greater the lower inequality is and the lower average income is. I proceed from this point on by making an important assumption that adds “bite” to the first move of the game. In order to capture the effect of revolutionary threat on democratization, I assume, as Acemoglu and Robinson (Forthcoming) do, that revolution is only a threat when Nature chooses state H at the beginning of the game. This implies that the low state, µ L , will not be enough to foment revolution in a nondemocracy, whose tax rate is zero. Plugging a zero tax rate into equation (13) above indicates that this means that I assume: Assumption 2: µ L < θ + λ y ln(U + 1) . (16) By making this assumption, I know that if Nature moves “L”, the outcome of the game will be a nondemocracy in which the rich set the tax rate to zero. In other words, the payoffs will be 16 (V(yp│ τˆ =0,U), V(yr│ τˆ =0,U)), where the payoff of the poor is listed first, and the payoff of the rich second. Outcomes when mobilization is high With assumption 2, there are three possible situations, depending on the value of µ H . The first is if µH <θ + λ y ln(U + 1) . (17) If this is the case, then there is never revolution, because the poor are always better off in a nondemocracy than they would be if they revolted. Notice that as we saw above, natural resources and aid can act in this model to reduce the chance of revolution. The second possible situation is “equilibrium revolution”, that is if equation (15) holds in the high state: µ H > (1 − λ U +1 λ λ + )θ + [ln( )] θy y y θ (18) If this is the case, there will definitely be revolution, because there is no tax rate that can prevent it. Finally, the third possible situation is if: θ+ λ y ln(U + 1) < µ H < (1 − λ U +1 λ λ + )θ + [ln( )] θy y y θ (19) If condition (19) holds, then revolution is neither inevitable with any level of taxation nor avoidable with no taxation. In this situation, the possibility for democratization exists. The rich will attempt to promise a positive tax rate that avoids revolution, but because of the possibility of them backtracking on their promise (the value of p), they may have to democratize to avoid revolution. Specifically, the rich will set the tax rate so that the poor are exactly indifferent 17 between revolution and being in a nondemocracy. That tax rate is the one that meets the following condition: µ H = p[(1 − τˆ)θ + λ y ln(τˆy + U + 1)] + (1 − p)[θ + λ y ln(U + 1)] (20) Democratization will occur if the right hand side of equation (20) does not exceed the poor’s return from a revolution. Plugging in the poor’s preferred tax rate (the highest tax rate that would exist in either regime) into (20) and comparing this to Vp(R, µH), we can solve for an important value of p: p*. µ H −θ − p* = λ y [ln λ y ln(U + 1) λ λ U +1 ) − ln(U + 1)] − θ ( − θ θy y At p*, the poor get the same payoff from their preferred tax rate as revolution. If p < p * , the rich cannot make a commitment that is credible enough to avoid revolution. This means that the rich will democratize in order to avoid such an outcome. If p ≥ p * , then the elite can avoid democratization by setting a higher tax rate. This means that the higher is the value of p*, the more likely is democratization. Appendix A proves that as U rises, p* falls—in other words, as natural resource revenue and aid rise, democratization is less likely. These results can be summarized as follows. Proposition 1: The game described in this section has a unique pure strategy subgame perfect Nash equilibrium such that: a) There is no democratization when mobilization is low, and the rich set their most preferred tax rate (zero). 18 b) If µ H < θ + λ y ln(U + 1) , then even when mobilization is high, there is no democratization, and the rich set their most preferred tax rate (zero). c) If θ + λ y ln(U + 1) < µ H < θ (1 − λ U +1 λ λ + ) + [ln( )] , then the outcome depends on θy y y θ p. If p < p * , the rich democratize in order to avoid revolution, because they cannot make a credible commitment to redistribution. If p ≥ p * , then the elite avoid democratization by promising a higher tax rate (more redistribution). Crucial to the argument in this paper, an increase in natural resource revenue and/or unconditional aid makes the former outcome (democratization) less likely. d) If µ H > θ (1 − λ U +1 λ λ + ) + [ln( )] , then there is revolution, whether or not the rich θy y y θ democratize or not, and no matter which tax policy is put in place. This model gives us our first look at the effects of natural resources and aid on democratization in our best-case scenario. Higher levels of inequality will necessitate a higher level of redistribution to preserve nondemocracies. But higher levels of natural resources and unconditional aid can offset this need, leading to lower redistribution. What emerges from this first model is that as natural resource revenue and unconditional aid increase, democratization is less likely. Conditional Aid and Democratization Up to this point, aid has not been tied to any sort of policy condition. However, we know in reality that this link is often (but not always) present, and a negotiation takes place over how much policy change will be implemented in exchange for aid received. Obviously this is quite 19 different than the relatively simple dynamics resulting from natural resources and unconditional aid. Formal models of donor-recipient relations are scarce, with some exceptions being the work of Mosley (1992) and Svensson (2000; 2003). These scholars assume, consistent with empirical studies of donor motivations (e.g. Mosley, et al. 1995), that donors have an implicit desire to lend money. The reason is that if they do not spend their allotment in a given year, it is unlikely that they will be given as much money in the following budget cycle. In addition, however, they also would like to extract policy concessions from the developing country government, in order to improve the policy environment (at least from the donor’s perspective). The tension between these two goals is at the heart of why conditional aid has often been unsuccessful in promoting reform (Alesina and Dollar 2000; Mosley, et al. 1995; World Bank 1992). Recipient countries know that donors will often want to give aid even if reforms are not put into place, so there is an attraction to promise reform, then go back on the promise, and probably get the aid money anyway. Mosley (1992) analyzed this relationship and concluded that in the absence of debt, the equilibrium strategy for the donor to pursue is “random” punishment. That is, if the country deviates from its promise, the donors should withhold all funding with some positive probability, as opposed to punishing the country with a severity related to the extent of its deviations from the agreed reform program. I adopt this finding into the model, and the more complicated game is represented in Figure 2. After the government promises its tax rate, the donor gets a move in which it agrees or not to an aid deal. This aid deal is simple: if the government implements its promised tax, it gets the full amount of aid allocated by the donor management. If a deal is agreed to, and the government subsequently breaks its promise, there is a final move by Nature at 20 the end of the game. If the government does not follow through with its pledge, the donor will withhold its funds with probability q. In other words, q is a measure of donor lending restraint. The higher is q, the more willing the donor is to withhold funds when policy conditions are not met. In line with the effort to generate a best-case scenario, I assume that the donor wants the government to adopt the tax rate that maximizes the utility of the poor. This assumption also allows me to know that if an aid deal is reached with a democracy, the aid will be delivered (because the promised tax rate will be implemented)—essentially this means conditional aid in a democracy acts like unconditional aid, and the above analysis of its effect on revolution (and redistribution) in democracies holds. Specifically, I assume that the donor wants to maximize: U D = −(τˆ − τ p ) 2 + C , (21) where UD is the utility of the donor and C is the amount of conditional aid given (for simplicity I assume that donors do not give both conditional and unconditional aid). Note that this equation captures the fact that it is the distance from τ p that matters, not the particular value of τˆ . Thus the donor is not trying simply to increase redistribution to extreme levels. Note also that if I assume the donor’s reserve value is zero, this formulation ensures that in a democracy, where there are no issues of commitment, an aid deal will surely be reached. This is because the first part of the equation will be zero, and any positive amount of aid will push the donor’s utility above zero. Taking into account both p and q, I can write the expected utility of the donor as follows: E[U D ] = p[−(τˆ − τ p ) 2 + C ] + (1 − p)[−(τ p ) 2 + (1 − q)C ] 21 (22) Using this formulation we can see a couple of things.6 First, again assuming the donor’s reserve value is zero, the donor will not agree to an aid deal unless: p[−(τˆ − τ p ) 2 + C ] + (1 − p)[−(τ p ) 2 + (1 − q)C ] > 0 (23) Second, from (23) we can see that there is a condition in which no aid deal will ever be offered to a nondemocracy. This will only happen if equation (23) is not satisfied even if τ p = τˆ . This situation would occur if: (1 − p)(τ p ) 2 C< 1 − q + pq (24) If the pre-set level of aid is below this amount, no aid deal will ever be offered. Therefore I assume for the rest of the paper: Assumption 3: C ≥ 6 (1 − p)(τ p ) 2 1 − q + pq In addition, it can be shown that (23) implies the possibility of an internal tension for the donor. If the donor’s restraint is low enough, then a higher level of aid pre-set by the donor bureaucracy enables an aid deal to be struck with a lower promised tax rate from the rich. This makes sense, as the low restraint means that the donor will likely give its money regardless of what the rich do. However, if donor restraint is high, the internal donor tension disappears: the higher the aid promised, the better the rich’s promised tax policy has to be in order for a deal to go through. The proof of this is straightforward and available from the author. 22 Equilibrium Revolution” revisited Again I solve the game for pure strategy subgame perfect Nash equilibria. Working with backward induction, we see that (as in the natural resources and unconditional aid model above) we need to begin with the decision by the poor about whether or not to revolt. First we need to rewrite equation (9) to take into account the discussion in this section. In other words, we need to capture the expected utility of the poor given the probabilities p and q, which is: θy θy E[V p ] = p[(1 − τˆ) + ln(τˆy + U + C + 1)] + (1 − p)[ + q ln(U + 1) + (1 − q) ln(U + C + 1)] λ λ Using this we can rewrite the revolution constraint from (13) as: µ S > p[(1 − τˆ)θ + λ y ln(τˆy + U + C + 1)] + (1 − p )[θ + λ y (q ln(U + 1) + (1 − q) ln(U + C + 1))] (25) It is instructive for a moment to consider the situation in which there are no unconditional resources—that is, U = 0. In this case, equation (25) becomes: µ S > p[(1 − τˆ)θ + λ y ln(τˆy + C + 1)] + (1 − p )[θ + λ y (1 − q) ln(C + 1)] (26) Recall now equation (13), the revolution constraint with natural resources and unconditional aid: µ S > p[(1 − τˆ)θ + λ y ln(τˆy + U + 1)] + (1 − p)[θ + λ y ln(U + 1)] (13) Comparing (26) and (13), it is easy to see that for a given level of µ S , a given level of aid given unconditionally will have a greater dampening effect on revolution than the same level of aid given conditionally. The right hand side of (26) is less than that of (13), because of the discount factor of (1-q) resulting from the possibility that the aid will not be given. Because of the uncertainty associated with conditional aid, its benefits are discounted, making revolution and its 23 certain payoffs more attractive, all else equal. With this in mind, we will proceed without the assumption that U = 0. As above, we will assume here that revolution is only possible when Nature chooses state H. To assume this, we must find the poor’s utility at their worst outcome—when the rich set a zero tax rate and no conditional aid deal is reached—and ensure that µ L is less than that. It turns out that this is exactly what Assumption 2 says, so we use it again: Assumption 2: µ L < θ + λ y ln(U + 1) (16) This assumption performs the same role as before: now if Nature moves “L” at its second decision node, the rich will not democratize and will then set their tax rate to zero. Will they receive aid? That question depends on the amount of aid allocated in the bureaucracy and the ideal tax rate of the poor. In this case, since τˆ = 0, the utility of the donor will be (since the government is “offering” a zero tax rate, we assume that the promise cannot be broken, and thus aid is given with certainty if a deal is brokered between the government and donor): U D (τˆ = 0) = −(τ p ) 2 + C Thus, if τˆ = 0, there will only be a deal between donor and recipient if C > (τ p ) 2 (27) Therefore if equation (27) holds, there will be no reform and no democratization, and donors will give aid anyway. This might be the case, for example, if the internal bureaucracy of the donor set C very high for political reasons. The payoffs to the poor and rich will be (V(yp│ τˆ =0,C), V(yr│ τˆ =0)). If condition (27) does not hold, no aid will be offered, and the payoffs will be (V(yp│ τˆ =0), V(yr│ τˆ =0)). 24 Outcomes when mobilization is high With assumption 2, there are three possible situations, depending on the specific value of µ H . The first is if: µH <θ + λ y ln(U + 1) (28) If (28) holds, there will be no democratization and no change in the tax rate, because there is no threat of revolution. Note, however, that conditional aid will still be given if (27) holds. The second scenario is “equilibrium revolution”—that is, if there is revolution even with the poor’s best tax rate and an aid deal. That is, expanding out equation (25) and inserting τ p , λ λ λ U + C +1 λ µ H > θ + p[( ) ln( ) − θ ( − )] + (1 − p)( )[q ln(U + 1) + (1 − q) ln(U + C + 1)] y y y θ θy (29) In this situation, the poor will always revolt, and thus the payoffs will be (Vp(R, µH), Vr(R, µH)) no matter if the government democratizes or not. In the third scenario, θ+ λ y ln(U + 1) < µ H < λ λ λ U + C +1 λ θ + p[( ) ln( ) − θ ( − )] + (1 − p )( )[q ln(U + 1) + (1 − q ) ln(U + C + 1)] θ θy y y y (30) If condition (30) holds, then revolution is neither inevitable with any level of taxation nor avoidable with no taxation. As in the simpler model depicted in Figure 1, the rich will choose a positive tax rate that makes the poor exactly indifferent between revolution and being in a nondemocracy. 25 Now, however, we must more finely tune the values of µ H . Note that the rich will never want conditional aid unless they need it to avoid revolution—it does not benefit them personally, and it actually comes with conditions that will increase redistribution. There are therefore two possible situations: one in which the rich need conditional aid to avoid revolution, and the other in which they do not. By plugging a zero value for C into (30), we can find the condition under which the rich do not need a conditional aid deal to avoid revolution: θ+ λ λ λ λ (U + 1) < µ H < θ + p[( ) ln( ) − θ ( − y y θ θy U +1 λ )] + (1 − p)( )[ln(U + 1)] . y y If this holds, democratization will not take place. The rich will simply compare the value of τˆ necessary to avoid revolution with and without a conditional aid deal and choose whichever is lowest. That is, they will solve either equation (20), the situation without a conditional aid deal, µ H = p[(1 − τˆ)θ + λ y ln(τˆy + U + 1)] + (1 − p)[θ + λ y ln(U + 1)] , (20) or µ H = p[(1 − τˆ)θ + λ λ ln(τˆy + U + C + 1)] + (1 − p )[θ + ( )[q ln(U + 1) + (1 − q) ln(U + C + 1)] , (31) y y whichever value of τˆ is lower. Note that all of the parameters in (20) and (31) are known to the rich when they have to make their decision about which tax rate to promise. They can therefore calculate which τˆ is lower. If the τˆ that solves (20) is lower, the rich will promise it. If it meets the conditions for equation (23), an aid deal will be agreed. Even if an aid deal is not agreed, democratization and revolution will be avoided. However, if the τˆ that solves (31) is lower, and it meets the conditions for (23), the lower τˆ will be put in place. The other scenario is if the rich need conditional aid to avoid revolution. This is true if: 26 λ λ λ U +1 λ θ + p[( ) ln( ) − θ ( − )] + (1 − p)( )[ln(U + 1)] < µ H y θ y y θy λ λ λ U + C +1 λ µ H < θ + p[( ) ln( ) − θ ( − )] + (1 − p)( )[q ln(U + 1) + (1 − q) ln(U + C + 1)] y θ y y θy . (32) In this situation the possibility for democratization exists. The key here is that the uncertainty of both the tax promise and the aid may make it impossible for the rich to satiate the poor with a promise of redistribution. We can see the condition under which this will happen by comparing the poor’s expected utility from a revolution with their expected utility in a nondemocracy when the rich promise their preferred tax rate (remember from assumption 3 that this means that an aid deal will definitely be reached). Similar to the unconditional model above, we can define a p** such that when p = p**, these utilities are equal. It is straightforward to find that: λ µ H − θ − [q ln(U + 1) + (1 − q) ln(U + C + 1)] p ** = y λ y [ln λ λ U + C +1 ) − q ln(U + 1) + (1 − q) ln(U + C + 1)] − θ ( − y θ θy Again, this value of the credibility of the commitment by the rich is critical to the analysis. If p < p * * and (32) holds, then the rich cannot make a commitment that is credible enough to avoid revolution. This means that the rich will democratize in order to avoid such an outcome. If p ≥ p * * , then the elite can avoid democratization by setting a higher tax rate. The general effect of conditional aid, like the unconditional resources, is to lower the value of p**. That is, conditional aid always lowers the chance for democratization (the proof is almost identical to that in Appendix A). However, while the effect of conditional aid cannot be prodemocratization, the value of q works to alleviate some of these effects. That is, ∂p * * is ∂q positive. This makes sense: if the rich need conditional aid in order to avoid revolution, more 27 restraint from the donor will require a more credible commitment from the rich in order to avoid revolution. If we assume that p ≥ p * * , we know that the rich will set a tax rate so that the poor are indifferent between revolting and staying in a nondemocracy. This will be a tax rate, τˆ , that solves equation (31): µ H = p[(1 − τˆ)θ + λ λ ln(τˆy + U + C + 1)] + (1 − p )[θ + ( )[q ln(U + 1) + (1 − q) ln(U + C + 1)] . y y (31) Note that if the tax rate that solves (31) does not meet the condition (23) for the donor loan, the rich will have to increase this tax rate until it meets condition (23). We know from Assumption 3 that this will happen at a point at or below τ p . In this situation, donor involvement will raise redistribution and therefore the utility of the poor, but it will still not encourage democratization. If, however, the τˆ that solves (31) meets condition (23), that will be the tax rate set and there will be an aid deal. In fact, we can derive a particularly perverse scenario in which conditional aid allotted is so high that the rich can actually promise their preferred tax rate (zero) and still avoid revolution. That is, knowing that the donor has C to give, the government can calculate the amount of taxes it needs in order for equation (31) to be met. If we set the tax rate to zero in (31), we can derive the condition that needs to be met to resist revolution without raising taxes: C≥e y ( µ H −θ ) − ( q + pq ) ln(U +1) λ (1− q + pq ) −U −1 (33) If condition (33) is met, and equation (27) as well (so that the donor agrees to an aid deal even though the tax rate is zero), the status quo (nondemocracy and no redistribution) will be 28 preserved simply as a result of the conditional aid promised. Note that this becomes increasingly likely as the amount of unconditional resources available to the rich increase. These results can be summarized as follows. Proposition 2: The game described in this section, with both conditional and unconditional resources, has a unique pure strategy subgame perfect equilibrium such that: a) There is no democratization when mobilization is low, and the rich set their most preferred tax rate (zero). If equation (27) holds, they will still get conditional aid. b) If µ H < θ + λ y ln(U + 1) , then even when mobilization is high, there is no democratization, and the rich set their most preferred tax rate (zero). If equation (27) holds, they will still get conditional aid. c) If θ + λ λ λ λ (U + 1) < µ H < θ + p[( ) ln( ) − θ ( − y y θ θy U +1 λ )] + (1 − p)( )[ln(U + 1)] , then y y there is no democratization, but the rich will have to redistribute more. The lower the amount of conditional aid promised, and the higher the donor restraint, the more the rich will have to redistribute. λ λ λ d) If θ + p[( ) ln( ) − θ ( − y θ θy U +1 λ )] + (1 − p)( )[ln(U + 1)] < µ H but y y λ λ λ U + C +1 λ µ H < θ + p[( ) ln( ) − θ ( − )] + (1 − p)( )[q ln(U + 1) + (1 − q) ln(U + C + 1)] y θ y y θy then democratization is possible. The outcome depends on whether or not p > p**. If p < p * * and (32) holds, then the rich cannot make a commitment that is credible enough to avoid revolution. This means that the rich will democratize in order to avoid such an outcome. If p ≥ p * * , then the elite can avoid democratization by 29 setting a higher tax rate. Conditional aid, like unconditional resources, lowers the value of p**. That is, conditional aid, like unconditional resources, lowers the possibility of democratization. However, higher values of donor restraint (q) work to alleviate the effects of conditional aid. e) If λ λ λ U + C +1 λ µ H > θ + p[( ) ln( ) − θ ( − )] + (1 − p)( )[q ln(U + 1) + (1 − q) ln(U + C + 1)] y θ y y θy , then the poor will always revolt (both in democracy and nondemocracy), and the outcome is revolution. Conclusion This paper has examined the possibility that institutional mechanisms may help to alleviate the political resource curse. Given the existing literature, which has emphasized that the principal problem with natural resources and aid is their fungibility and discretionary use by the state, it was a priori plausible that by taking the resources out of the hands of the state, the political resource curse may be alleviated. This is not only what existing theory would indicate, but also what many international actors are attempting to implement in terms of institutional arrangements to guide natural resource revenue flows and aid to citizens. Building on theories of democratization that emphasize redistributional struggles, this paper has shown that these institutional mechanisms are likely to be unsuccessful in alleviating the political resource curse. The central reason running through the models is that natural resources and aid reduce the need for redistribution by the rich. In fact, an important theoretical finding of the formal analysis is that when natural resource revenue and aid are quite high, redistributional theories of democratization may be irrelevant, because the poor may no longer 30 prefer a positive tax rate. Future work that builds on redistributional arguments must take this into account. If these resources are not large enough, the analysis in this paper has shown that even in the best-case scenario constructed in these models—where the benefits of natural resources and aid (whether conditional or unconditional)—accrue purely to the poor, they will only alleviate the need for democratization. It is possible that donor conditionality will diminish the negative impacts of aid if donors can credibly commit to withholding the aid, but aid will never have a positive impact. In addition to its practical implications—that current institutional structures are unlikely to alleviate the political resource curse—this finding has theoretical importance. While most work on the political resource curse has emphasized the discretionary use of these resources by the state, this model indicates that the effect of these resources may be far more nefarious. It is not necessary to rely on state use of these resources to explain the political resource curse. It is their very existence in nondemocratic countries that constitutes the problem. While these results are powerful, their limitations should be noted. First, while a rather obvious point, the results depend on the validity of theories that emphasize redistributional struggles as the reason for democratization. Certainly other theories of democratization exist, and it is unclear how natural resources and aid would fit into them. Second, the results presented here focus exclusively on the effect of these institutional arrangements on democratization, not on the utility of the poor. It can be seen from the utility function of the poor that they will certainly benefit from institutional arrangements that funnel the benefits of natural resources and aid to them. To the extent that these arrangements reduce redistributional struggles, however, they will reduce the prospects for democracy. What these results indicate, therefore, is an 31 exceptionally difficult choice: alleviate the hardships of the poor in nondemocracies in the short term or improve the chances for democratization in the long term. Appendix A The value for p* is: µ H −θ − p* = λ y [ln λ y ln(U + 1) λ λ U +1 − ln(U + 1)] − θ ( − ) θ y θy We want to know ∂p * . Because of the possible range of p* (between zero and one) and the ∂U possible range of µ H lain out in equation (19), we know that both the numerator and denominator of p* are positive, and that the numerator is less than or equal to the denominator. The derivative of the numerator with respect to U is − denominator with respect to U is − λ y (U + 1) + θ y λ y (U + 1) , and the derivative of the . The derivative of the numerator is obviously negative, as is (less obviously) the derivative of the denominator (because of Assumption 1). Therefore, by the quotient rule, all we need in order for ∂p * to be negative is that the absolute ∂U value of the derivative of the numerator is greater than the absolute value of the derivative of the denominator. In other words, we need that λ y (U + 1) 32 > λ y (U + 1) − θ y , and this is obviously true. References Acemoglu, Daron, and James A. Robinson. Economic Origins of Dictatorship and Democracy. Cambridge: Cambridge University Press, Forthcoming. ———. "A Theory of Political Transitions." American Economic Review 91, no. September (2001): 938-63. Alesina, Alberto, and David R. Dollar. "Who Gives Foreign Aid to Whom and Why?" Journal of Economic Growth 5, no. March (2000): 33-64. Birdsall, Nancy, and Arvind Subramanian. "Saving Iraq from Its Oil." Foreign Affairs 83, no. 4 (2004): 77-89. Boix, Carles. Democracy and Redistribution. Cambridge: Cambridge University Press, 2003. Bratton, Michael, and Nicolas van de Walle. Democratic Experiments in Africa: Regime Transitions in Comparative Perspective. Cambridge: Cambridge University Press, 1997. Burnside, Craig, and David R. Dollar. "Aid, Policies, and Growth." American Economic Review 90, no. 4 (2000): 847-68. Feyzioglu, Tarhan, Vinaya Swaroop, and Min Zhu. "A Panel Data Analysis of the Fungibility of Foreign Aid." World Bank Economic Review 12 (1998): 29-58. Goldsmith, Arthur A. "Foreign Aid and Statehood in Africa." International Organization 55, no. 1 (2001): 123-48. Jensen, Nathan, and Leonard Wantchekon. "Resource Wealth and Political Regimes in Africa." Comparative Political Studies 37, no. 7 (2004): 816-41. Karl, Terry Lynn. The Paradox of Plenty: Oil Booms and Petro-States. Berkeley: University of California Press, 1997. Knack, Stephen. "Does Foreign Aid Promote Democracy?" International Studies Quarterly 48 (2004): 251-66. Lancaster, Carol. Aid to Africa: So Much to Do, So Little Done. Chicago: University of Chicago Press, 1999. LICUS Task Force. "World Bank Group Work in Low-Income Countries under Stress: A Task Force Report." Washington, DC: World Bank, 2002. Meltzer, Allan, and Scott Richard. "A Rational Theory of the Size of Government." Journal of Political Economy 89, no. 5 (1981): 914-27. Moore, Barrington. Social Origins of Dictatorship and Democracy: Lord and Peasant in the Making of the Modern World. Boston: Beacon, 1966. Moore, Mick. "Death without Taxes: Democracy, State Capacity, and Aid Dependence in the Fourth World." In The Democratic Developmental State: Politics and Institutional Design, edited by Mark Robinson and Gordon White, 84-121. Oxford: Oxford University Press, 1998. ———. "Political Underdevelopment: What Causes 'Bad Governance'." Public Management Review 3, no. 3 (2001): 385-418. Mosley, Paul. "A Theory of Conditionality." In Development Finance and Policy Reform: Essays in the Theory and Practice of Conditionality in Less Developed Countries, edited by Paul Mosley, 129-53. New York: St. Martin's Press, 1992. Mosley, Paul, Jane Harrigan, and John Toye. Aid and Power. Vol. 1. London: Routledge, 1995. Przeworski, Adam. Democracy and the Market: Political and Economic Reforms in Eastern Europe and Latin America. Cambridge: Cambridge University Press, 1991. 33 Remmer, Karen. "Does Foreign Aid Promote the Expansion of Government?" American Journal of Political Science 48, no. 1 (2004): 77-92. Robinson, James A., Ragner Torvik, and Thierry Verdier. "Political Foundations of the Resource Curse." In DELTA Working Paper No. 2003-33. Paris: Départment et Laboratoire d'Économie Théorique et Appliquée, 2003. Ross, Michael L. "Does Oil Hinder Democracy?" World Politics 53 (2001): 325-61. ———. "The Political Economy of the Resource Curse." World Politics 51 (1999): 297-322. Rueschemeyer, Dietrich, Evelyne Huber Stephens, and John D. Stephens. Capitalist Development and Democracy. Chicago: University of Chicago Press, 1992. Smith, Benjamin. "Oil Wealth and Regime Survival in the Developing World, 1960-1999." American Journal of Political Science 48, no. 2 (2004): 232-46. Svensson, Jakob. "When Is Foreign Aid Policy Credible? Aid Dependence and Conditionality." Journal of Development Economics 61 (2000): 61-84. ———. "Why Conditional Aid Does Not Work and What Can Be Done About It?" Journal of Development Economics 70 (2003): 381-402. van de Walle, Nicolas. African Economies and the Politics of Permanent Crisis, 1979-1999. New York: Cambridge University Press, 2001. World Bank. "Effective Implementation: Key to Development Impact -- Report of Portfolio Management Task Force." Washington, DC: World Bank, 1992. 34 Figure 1 Nature Error! Natural resource revenue and aid set L H Nature Rich Rich D D N Poor Rich N Poor Rich Tax Commitment Tax Commitment Poor Poor Poor NR Poor R R R NR NR p L r R L (Vp(D), Vr(D)) (Vp(R, µH), Vr(R, µH)) (V (R, µ ), V (R, µ )) (Vp(R, µL), Vr(R, µL)) (Vp(R, µH), Vr(R, µH)) Rich Rich (Vp(D), Vr(D)) Revert NR Tax Revert (V(y │ τˆ ), V(yr│ τˆ )) p p (V (N), Vr(N)) 35 (Vp (N), Vr(N)) Tax (V(yp│ τˆ ), V(yr│ τˆ )) Nature Natural resources and aid allocation Figure 2 L Rich H Nature N D N D Poor Rich Rich Poor Tax Commitment Tax Commitment Donor Donor Accept Poor R Rich Decline NR R Decline Accept NR Poor R NR R NR (Vp(R, µL), Vr(R, µL)) (Vp(R, µL), Vr(R, µL)) (Vp (D│C), Vr(D)) Accept R Decline NR R NR (Vp (D│C), Vr(D)) Decline Accept R R NR (Vp(R, µH), Vr(R, µH)) (Vp(R, µH), Vr(R, µH)) Nature (Vp(R, µL), Vr(R, µL)) Revert p (V (D), Vr(D)) Nature Tax NR Nature (Vp(R, µH), Vr(R, µH)) Tax Revert (Vp(R, µL), Vr(R, µL)) Revert p (V (D), Vr(D)) Nature Tax Revert Tax (Vp(R, µH), Vr(R, µH)) No Aid (Vp (N), Vr(N)) (Vp (N), Vr(N)) (Vp (N│C), Vr(N)) (V(yp│ τˆ ,C), V(yr│ τˆ )) No Aid (Vp (N), Vr(N)) (V(yp│ τˆ ), V(yr│ τˆ )) (Vp (N│A), Vr(N)) 36 (V(yp│ τˆ ,C), V(yr│ τˆ ,C)) (Vp (N), Vr(N)) (V(yp│ τˆ ), V(yr│ τˆ ))