Goldman Sachs: The American bank giving British

advertisement

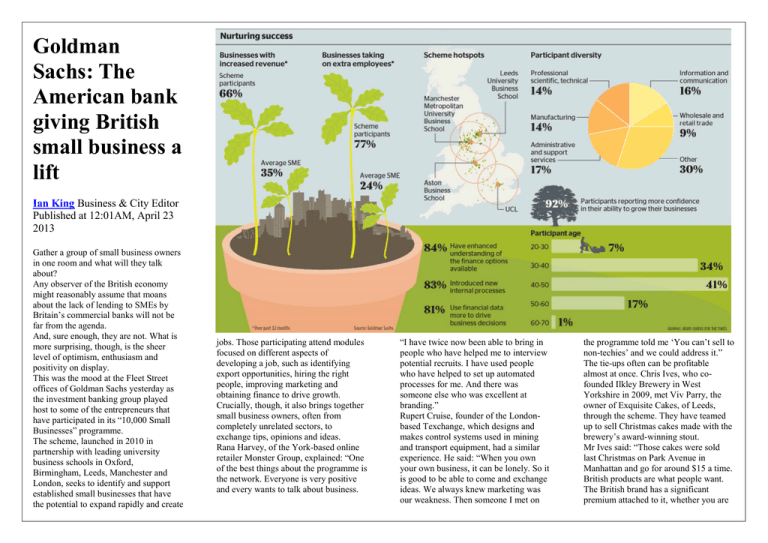

Goldman Sachs: The American bank giving British small business a lift Ian King Business & City Editor Published at 12:01AM, April 23 2013 Gather a group of small business owners in one room and what will they talk about? Any observer of the British economy might reasonably assume that moans about the lack of lending to SMEs by Britain’s commercial banks will not be far from the agenda. And, sure enough, they are not. What is more surprising, though, is the sheer level of optimism, enthusiasm and positivity on display. This was the mood at the Fleet Street offices of Goldman Sachs yesterday as the investment banking group played host to some of the entrepreneurs that have participated in its “10,000 Small Businesses” programme. The scheme, launched in 2010 in partnership with leading university business schools in Oxford, Birmingham, Leeds, Manchester and London, seeks to identify and support established small businesses that have the potential to expand rapidly and create jobs. Those participating attend modules focused on different aspects of developing a job, such as identifying export opportunities, hiring the right people, improving marketing and obtaining finance to drive growth. Crucially, though, it also brings together small business owners, often from completely unrelated sectors, to exchange tips, opinions and ideas. Rana Harvey, of the York-based online retailer Monster Group, explained: “One of the best things about the programme is the network. Everyone is very positive and every wants to talk about business. “I have twice now been able to bring in people who have helped me to interview potential recruits. I have used people who have helped to set up automated processes for me. And there was someone else who was excellent at branding.” Rupert Cruise, founder of the Londonbased Texchange, which designs and makes control systems used in mining and transport equipment, had a similar experience. He said: “When you own your own business, it can be lonely. So it is good to be able to come and exchange ideas. We always knew marketing was our weakness. Then someone I met on the programme told me ‘You can’t sell to non-techies’ and we could address it.” The tie-ups often can be profitable almost at once. Chris Ives, who cofounded Ilkley Brewery in West Yorkshire in 2009, met Viv Parry, the owner of Exquisite Cakes, of Leeds, through the scheme. They have teamed up to sell Christmas cakes made with the brewery’s award-winning stout. Mr Ives said: “Those cakes were sold last Christmas on Park Avenue in Manhattan and go for around $15 a time. British products are what people want. The British brand has a significant premium attached to it, whether you are selling handbags, shoes, beer or meat — there is an open door for exporters.” This was also the experience of Diane Burridge, chief financial officer of Moneyline, a not-for-profit social enterprise from Blackburn that offers small unsecured loans. Through the scheme, she met Andy Simpson, who runs a Doncaster-based social enterprise that sells second-hand furniture: “I have worked with him to put pop-up shops in his stores and that has widened our access to customers, while his customers have access to short-term financing.” One of the key aims of the programme, to support job creation, appears to be working. Analysis by the business schools suggests that 77 per cent of the small businesses taking part in the programme have hired more staff during the past year, compared with 23 per cent for the average SME. Susanna Lawson, operations director of Citrus Lounge, a Manchester-based software development company, said: “We have gone from 19 employees to 29 and we have three vacancies at present.” Ms Lawson said it was particularly pleasing that her business was able to bring work to parts of Manchester, such as Newton Heath and Harpurhey, that traditionally have been afflicted with high levels of long-term unemployment. She finds it depressing that, despite being a force for good in society, entrepreneurs often are still treated with suspicion, as “Del Boy” characters. “Entrepreneurs are still seen as negative,” she said, “but for a lot of us, it wasn’t a case of thinking ‘here’s something I can sell to someone else’, it has been growing a business from something we were passionate about.” Mr Cruise agreed: “In the US, they understand what it’s about. It is OK to fail, so people take more risks. Here, there is a huge stigma attached to failure.” Access to capital remains a challenge for many of the businesses. Mr Ives argues that the attitude of the commercial banks remains “shocking.” He added: “We still can’t get the access to the finance that we want without offering the type of security that the banks want and that I am not prepared to give them.” According to others, access to finance is only one of a number of challenges that small business owners face. Mr Cruise said: “There are many factors that drive the growth of a business, although it was definitely easier to raise capital before the financial crisis than has been post the crisis. “And there are other things, such as research and development tax credits, that help. The Government is doing its bit.” Ms Burridge added: “One problem that a lot of small businesses and social enterprises have is that they are not investment-ready. The banks are prepared to lend but they will not lend to you if, for example, you do not have a business plan. “Doing this programme has helped me to pitch the business to our social investors. It has made the business investmentready.” Equally pertinent to the debate, perhaps, is why it has been left to a Wall Streetbased investment bank that does not do SME lending to run a programme like this for British SMEs, rather than, say, a British commercial bank. Richard Gnodde, co-chief executive of the bank’s European division, said: “This is a global programme. We’re also doing this in the US. But Britain has been a great home for us. I started here 26 years ago when we only had a couple of hundred people — now we have 6,500. “Our business is about helping economic growth and driving employment and this is aligned to that. We are not a small business lender but, hope fully, we can equip people with the skills to receive lending. “And we are recruiting for talent — this is the right thing to do. The kind of people we are recruiting want to see us do things like this. It makes Goldman Sachs a more interesting place to work.”