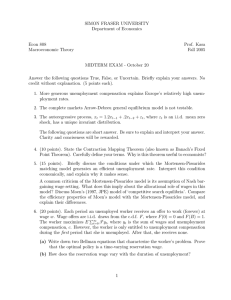

T Unemployment and Vacancy Fluctuations in the Matching Model:

advertisement