Jobs and Unemployment in Macroeconomic Theory: A Turbulence Laboratory Lars Ljungqvist

advertisement

Jobs and Unemployment in Macroeconomic

Theory: A Turbulence Laboratory

Thomas J. Sargent∗

Lars Ljungqvist

August 26, 2005

Abstract

We use three general equilibrium frameworks with jobs and unemployed workers

to study the effects of government mandated unemployment insurance (UI) and employment protection (EP). To illuminate the forces in these models, we study how UI

and EP affect outcomes when there is higher ‘turbulence’ in the sense of worse skill

transition probabilities for workers who suffer involuntary layoffs. Matching and searchisland models have labor market frictions and incomplete markets. The representative

family model with employment lotteries has no labor market frictions and complete

markets. The adverse welfare state dynamics coming from high UI indexed to past

earnings that were isolated by Ljungqvist and Sargent (1998) are so strong that they

determine outcomes in all three frameworks. Another force stressed by Ljungqvist and

Sargent (2005), through which higher layoff taxes suppress frictional unemployment in

less turbulent times, prevails in the models with labor market frictions, but not in the

frictionless representative family model. In addition, the high aggregate labor supply

elasticity that emerges from employment lotteries and complete insurance markets in

the representative family model makes it impossible to include generous governmentsupplied unemployment insurance in that model without getting the unrealistic result

that economic activity virtually shuts down.

Key words: Job, search, matching, lotteries, skills, turbulence, unemployment, unemployment insurance, employment protection, discouraged worker.

Ljungqvist: Stockholm School of Economics and CEPR (email: lars.ljungqvist@hhs.se); Sargent: New

York University and Hoover Institution (email: thomas.sargent@nyu.edu). We are thankful to Riccardo

Colacito, Constantino Hevia, Kevin Kallock, Sagiri Kitao, and Alejandro Rodriguez for excellent research

assistance. For useful comments on earlier drafts, we thank David Backus, Gadi Barlevy, Marco Bassetto,

Jeffrey Campbell, Dirk Krueger, Mariacristina De Nardi, Wouter DenHaan, David Domeij, Jesus FernandezVillaverde, Timothy Kehoe, Narayana Kocherlakota, Lisa Lynch, Edward C. Prescott, Richard Rogerson,

François Velde, and seminar participants at Georgetown University, New York University, the Federal Reserve

Banks of Chicago and New York, ITAM, the Stockholm School of Economics, the University of Helsinki,

the University of Oregon, and the European University Institute. Ljungqvist’s research was supported by a

grant from the Jan Wallander and Tom Hedelius Foundation. Sargent’s research was supported by a grant

to the National Bureau of Economic Research from the National Science Foundation.

∗

1

1

Introduction

Lucas (1987, p. 50) noted that real business cycle and other competitive equilibrium models

have “. . . no sense in which anyone . . . can be said to ‘have a job’ or lose, seek or find a job.”1

For analyzing positive and normative questions about unemployment compensation, Lucas

wanted a theory that includes reasons ‘why people allocate time to a particular activity –

like unemployment . . .’ (p. 54), and also why there are ‘jobs’ in the sense of long term

employee-employer relationships between particular workers and particular capitalists.

Macroeconomists disagree about the best models of jobs and the workers who do and

don’t have them. But we have several promising models. This paper compares three stochastic general equilibrium models containing jobs and uses them to study the effects of government supplied unemployment insurance (UI in the language of Mortensen and Pissarides

(1999)) and employment protection provisions (EP in the language of Mortensen and Pissarides (1999)). To illuminate the economic forces stressed within each model, we study how

increases in UI and EP interact with an increase in the probability of skill deterioration after

involuntary layoffs, where following Ljungqvist and Sargent (1998), we refer to an enlarged

skill deterioration probability as an increase in turbulence.

The models are (1) a suite of matching models inspired by Mortensen and Pissarides

(1999) and DenHaan et al. (2001); (2) a variant of a search-island model of Alvarez and

Veracierto (2001); and (3) an employment lotteries model with comprehensive economy-wide

insurance arrangements in the spirit of Hansen (1985), Rogerson (1988), and Prescott (2002).

The models share the same stochastic skill accumulation and deterioration technologies, but

differ with respect to labor market frictions and arrangements for allocating risks. Each

model has a theory of a job and of why unemployed workers choose to spend time in an

activity that can be called unemployment.2 In the matching models, workers without jobs

wait in a matching function. In the search-island model, depending on their financial assets,

human capital, and entitlement to benefits, some people spend more time unemployed than

others because they exert less effort searching. In the representative family lotteries model,

unemployed workers have won a lottery telling them to specialize in leisure.

1. The matching models have risk neutral workers, no asset accumulation decisions, an

attenuated allocative role for wages, and a significant allocative role for the ratio of

vacancies to unemployed workers.3 They feature adverse congestion effects that unemployed workers impose on each other and that firms with vacancies impose on each

1

Labor economists often use models in which there are no jobs. A useful example is the Rosen schooling

model that is estimated by Ryoo and Rosen (2004).

2

Because it has no theory of jobs, Lucas (1987, p. 53, footnote 4) indicated that he regarded the HansenRogerson model to be an inappropriate tool for analyzing policy questions concerning UI. We extend the

Hansen-Rogerson model to contain jobs. We include it among our suite of models partly because Prescott

(2002), Rogerson (2005a), and Rogerson (2005b, text for SED plenary lecture) have forcefully advocated it

as a vehicle for explaining the most pertinent European labor market outcomes, and also because we want

to determine whether the interaction between turbulence and UI that we featured in Ljungqvist and Sargent

(1998) also comes through in this environment.

3

Hosios (1990) describes the matching framework as follows. “Though wages in the matching-bargaining

2

other, a wage bargaining process, and waiting times as equilibrating signals that reconcile the decisions of firms and workers.

2. The search-island model has risk averse workers whose decisions about how intensively

to search when unemployed depend on their skills and benefit entitlements as well

as their accumulations of a risk-free asset, the only savings vehicle available to them.

The model features incomplete risk sharing through self-insurance against both unemployment and uncertain life spans in retirement. The wage rate is determined in a

competitive labor market but is constrained to remain fixed in the face of idiosyncratic

productivity shocks: workers receive a fixed wage per unit of skill for the duration of

a job. As a result, there are socially wasteful separations.

3. In the lotteries model, risk averse agents have access to complete markets in historycontingent consumption claims. Labor contracts are identical to those in the searchisland model. An indivisibility in the choice set of each worker requires him either to

work a fixed number of hours or not at all. That would confront the individual worker

with a nonconvexity in his opportunity set if he were isolated from other workers. But

he is not. He is a member of an economy-wide representative family that uses lotteries

to convexify its production opportunity set by assigning fractions of its members to

specialize in work and in leisure. The employment lottery yields a high aggregate labor

supply elasticity that makes the fraction of the national family that works respond

sensitively to both tax wedges and UI benefits.

These alternative labor market arrangements create different avenues through which UI and

EP influence outcomes, not just for unemployment, but for individual workers’ consumption

and labor market experiences including the incidence of long-term unemployment.

Our frameworks share some common limitations. First, we ignore the intensive margin

of the labor supply decision by assuming that workers are either unemployed or employed

full-time and working the same number of hours. Second, if it were not for the labor market

frictions in the matching and search-island models and the labor indivisibility in the representative family employment lotteries model, under laissez-faire everyone of working-age

would be employed. Hence, we are ignoring such non-market activities as education, child

rearing, and other types of homework that explain why some people of working-age do not

participate in the labor market.4

models are completely flexible, these wages have nonetheless been denuded of any allocating or signaling

function: this is because matching takes place before bargaining and so search effectively precedes wagesetting. . . . In conventional market situations, by contrast, firms design their wage offers in competition with

other firms to profitably attract employees; that is, wage-setting occurs prior to search so that firms’ offers

can influence workers’ search behavior and, in this way, firms’ offers can influence the allocation of resources

in the market.”

4

This means that we calibrate the representative family employment lotteries model under laissez faire

to explain an unemployment rate rather than the employment/population ratio that is more often taken as

the target by researchers using that model. See section 1.3.1 for elaboration of this point.

3

1.1

Why should macro economists care about unemployment?

Recent contributions by Prescott (2002, 2004), and Rogerson (2005a) compel us to face

a modeling issue that Lucas (1987, pp. 67-68) posed sharply when he asked “. . . whether

modeling aggregative employment in a competitive way as in the Kydland and Prescott

model (and, hence, lumping unemployment together with ‘leisure’ and all other non-work

activities) is a serious strategic error in trying to account for business cycles. I see no reason

to believe that it is. If the hours people work – choose to work – are fluctuating, it is

because they are substituting into some other activity. For some purposes, – designing an

unemployment compensation scheme, for example – it will clearly be essential to break nonwork hours into finer categories, including as one ‘activity’ unemployment. But such a finer

breakdown need not substantially alter the problem Kydland and Prescott have tried to face

of finding a parameterization of preferences over goods and hours that is consistent with

observed employment movements.”

Prescott (2002, 2004), and Rogerson (2005a) have extrapolated Lucas’s reasoning by

using a model that contains neither jobs nor a separate activity called unemployment to

explain observed differences in per capita hours in terms of differences in measures of the

pertinent flat-rate tax wedge across time and countries.5 Although UI is substantial in many

of the countries in their sample, Prescott’s and Rogerson’s calculations set UI to zero. Was

that a good idea? We think not because the big labor supply elasticities that in their models

make tax wedges so important also imply that UI will have big effects, making calculations

that ignore UI misleading.6

Prescott and Rogerson abstract from frictional unemployment. In their frictionless

economies, the idleness of some workers emerges from the combined workings of employment lotteries and complete markets for contingent claims. The random process that assigns people to work or to leisure and the complete sharing of labor income risk achieve

an economy-wide coordination of decisions absent from the other two labor market models.

Perhaps assuming such complete social cohesion is a good way to model employment fluctuations over the business cycle because, for example, U.S. companies resort to temporary

5

They also postulate that tax revenues are handed back to households either as transfers or as goods and

services, i.e., they isolate the substitution effect of taxation by arresting the wealth effect that would follow

if the revenues of those taxes were not to be rebated lump sum.

6

Hansen (1985) shows that the allocation in the employment lottery framework can be interpreted as the

outcome of a competitive equilibrium in which households can purchase arbitrary amounts of UI. Hansen’s

argument pertains to private insurance, where the representative household properly internalizes the costs

and benefits of the insurance arrangement. In contrast, when the household collects government supplied

UI, it does not internalize the costs, and this makes a big difference in outcomes. In particular, since the

representative household takes tax rates as given and independent of its own use of government supplied UI,

the household will “abuse” the UI system by choosing a socially inefficiently high probability of not working:

because the government subsidizes unemployment (leisure), households spend too much time unemployed.

As we show below, the effect is large because the labor supply elasticity is so high in the representative

family employment lotteries model. Hence, it is a mistake to think that government supplied UI facilitates

implementing an optimal allocation either by completing markets or by substituting for private insurance in

the employment lottery framework.

4

layoffs in downturns and because the experience rating in the U.S. UI system means that

the private sector at least partially facilitates consumption sharing between those who are

employed and unemployed.7 But we doubt that the abstraction of complete social cohesion

is also appropriate for understanding differences in employment observed on different sides

of the Atlantic. It is difficult for us to believe that private contractual arrangements are

what has required furloughing large numbers of European workers into extended periods of

idleness, sometimes even into absorbing states of life-time idleness. The widespread sharing

across all individuals in society that is achieved by the smooth functioning of employment

lotteries and the elaborate private transfers between households in the representative family

model contrast markedly with the friction-laded, individualistic worlds of the matching and

search-island models. We will argue that European households today are more likely to

empathize with the choices faced by workers in those latter two models, where households

must fend for themselves and seek their own fortunes in labor markets (or in government

welfare programs) while trading a limited array of financial assets that cannot replicate the

outcomes of transactions in employment lotteries and consumption claims contingent on the

outcomes of those household specific lotteries.8

To elaborate further about why macroeconomists should want to model unemployment,

consider the following two issues. First, the nature of the activities that we call unemployment and the details of the process through which jobs and workers find each other can

matter for aggregative labor market analysis. Analyzing the aggregate effects of layoff taxes

provides one good example. Lucas and Prescott (1974) concluded that a layoff tax reduces

unemployment in the search-island model, while Hopenhayn and Rogerson (1993) reached

the opposite conclusion in the representative family model with employment lotteries. We

shall investigate why the frictionless model in the latter study yields an opposite outcome

from models that embody frictional unemployment. Second, as already mentioned, designating a worker as unemployed can entitle him or her to government-provided UI that is

quite substantial in some countries. Without explicitly modelling these entitlements and

the associated labor market dynamics, we cannot properly address some puzzling observations. For example, OECD (1994, chap. 8) reports that there was a negative cross-country

correlation between UI benefit levels and unemployment in the 1960s and early 1970s. In

the early 1960s, the lower unemployment in Europe, notwithstanding UI benefits that were

more generous than in the US, attracted the attention of the Kennedy administration. The

President’s Committee to Appraise Employment and Unemployment Statistics (1962) concluded that differences in statistical methods and definitions did not explain the observed

differences and, hence, European unemployment rates were indeed lower than that of the

U.S.9 But as we know, the picture changed in the late 1970s. The deterioration of European

7

See footnote 6.

For another critical evaluation of the aggregation theory in the representative family lotteries model, see

Ljungqvist and Sargent (2004b).

9

The Committee’s verification of lower unemployment in Europe prompted Deputy Commissioner Myers

(1964, pp. 172–173) at the Bureau of Labor Statistics to write: “From 1958 to 1962, when joblessness in

[France, former West Germany, Great Britain, Italy and Sweden] was hovering around 1, 2, or 3 per cent,

[the U.S.] rate never fell below 5 per cent and averaged 6 per cent. . . . The difference between [the U.S.]

8

5

labor market outcomes is probably worse than indicated by the unemployment statistics because many unemployed Europeans have left unemployment by entering other government

programs such as disability insurance and early retirement.10

The Prescott and Rogerson versions of the representative family framework lacks frictional unemployment and government-provided UI benefits, two features that we think are

crucial for understanding the European employment experience. Instead, Prescott and

Rogerson stress employment lotteries and trading of a complete set of consumption claims

contingent on the outcomes of those lotteries, features that we find virtually impossible to

combine with realistically calibrated government-provided UI benefits in Europe: when faced

with generous government supplied UI benefits, the representative family with its high labor

supply elasticity would simply furlough far too many workers into leisure.11

1.2

An excuse for using turbulence as a laboratory

We use turbulence as our laboratory because we believe that it, along with government

supplied UI and EP, truly is an important ingredient in understanding labor market outcomes

in Europe and the U.S.12 During the 1950s and 1960s, unemployment rates were lower in

Europe than in the United States, but during the 1980s and 1990s, they became persistently

higher. In Ljungqvist and Sargent (2005), we reproduced those outcomes within models of an

artificial ‘Europe’ and an artificial ‘U.S.’ that contain identical peoples and technologies but

different labor market institutions. In Europe, as an employment protection device, there is

a tax on job destruction that is absent in the U.S., and in Europe unemployment insurance

benefits are longer and more generous than in the U.S. Our model imputes both the lower

unemployment rate and the average for these European countries was only a little more than 3 percentage

points. But, if we could wipe out that difference, it would mean 2 million more jobs, and perhaps $40 to $50

billion in Gross National Product. We can surely be excused for looking enviously at our European friends

to see how they do it. We have profited much in the past from exchange of ideas with Europe. It would be

short-sighted indeed to ignore Europe’s recent success in holding down unemployment.”

10

For example, Edling (2005) reported that in 2004 early retirees comprised 10% of the working age

population in Sweden and in 2003 2.4% had been sick for more than a year. Edling asked rhetorically

whether “unemployment is hidden in accounts other than those originally intended for the unemployed?”

The incendiary nature of his question became clear when Edling’s employer refused to publish the report,

prompting Edling to resign after having served 18 years as an investigator at the largest trade union in

Sweden.

11

The impossibility of incorporating European sized social insurance in the employment lottery framework

causes us to question the appropriateness of that abstraction for understanding the European employment

experience. Prescott (2004, p. 8) voices no such concerns but instead lauds an apparent modelling success:

“I am surprised that virtually all the large differences between the U.S. labor supply and those of Germany

and France are due to differences in tax systems. I expected institutional constraints on the operation of

labor markets and the nature of the unemployment benefit system to be of major importance.”

12

For other models of labor market institutions and turbulence, see Bertola and Ichino (1995) and Marimon

and Zilibotti (1999). Bertola and Ichino show that high EP and a rigid wage can explain why unemployment

increases in response to more volatile local demand shocks. Marimon and Zilibotti explore how high UI can

cause unemployment to rise when there is an increase in the value of forming the ‘correct matches’ between

heterogeneous workers and firms.

6

European unemployment of the 50s and 60s and the higher European unemployment of the

80s and 90s to these labor market institutions and how workers chose to respond to more

‘turbulent’ labor market prospects in the later period. We modelled turbulence by increasing

a parameter that determines an instantaneous loss of human capital by workers who suffer

an ‘involuntary’ job dissolution.13 That representation of more turbulence also generates the

increased volatilities of permanent and transitory components of earnings that have been

documented by Gottschalk and Moffitt (1994), among others.14,15

We designed our model to focus on adverse incentives and to ignore the benefits in terms

of consumption smoothing provided by social insurance: our risk-neutral workers care only

about present values of after-tax earnings and benefits.16 In the spirit of McCall (1970), our

model takes a fixed distribution of wages as exogenous: there are no firms, no bargaining

over wages, and no theory of endogenous wage determination. We added dynamics for skills

to McCall’s model and took earnings to be a wage draw times a skill level. Skills accrue

during episodes of employment and deteriorate during periods of unemployment.

Because it omits many conceivable general equilibrium effects, our extended McCall

model is fair game for criticism. How would outcomes differ in general equilibrium models that incorporate some of the features missing from our model, e.g., a matching function

that captures adverse congestion effects, firms that post vacancies, equilibrium wages that

emerge from bargaining, and a Beveridge curve; or risk-averse workers who engage in precautionary saving because of incomplete markets, firms that invest in physical capital, and a

13

Pavoni (2003) reviews a substantial body of evidence bearing witness to such human capital loss. Heckman (2003) provides a broad ranging portrayal of the European labor market institutions and outcomes that

is consistent with the idea that what we call turbulence has increased in recent decades and that that has

had adverse effects on outcomes emerging from European labor markets.

14

For a survey of the empirical evidence on increased earnings volatility, see Katz and Autor (1999).

For the United States, there is evidence that between the 1980s to the 1990s, job losses were more likely

to be associated with permanent separations rather than temporary layoffs, to cause displaced workers to

switch industries, and prompt workers to move to smaller firms which meant on average incurring permanent

losses in their wage levels. All of these indicate losses of job-specific human capital. Also, the incidence of

permanent job loss among high wage workers became larger. See Farber (1997, 2005).

15

Friedman (2005) is full of anecdotes about how reductions in communication costs and lower political

barriers, a process that can be called globalization, can lead to rapid depreciation of recently valued human

capital. For example, on page 20, Friedman quotes David Schlesinger, head of Reuters America, as saying

about New London, Connecticut: “ . . . Jobs went; jobs were created. Skills went out of use; new skills

were required. The region changed; people changed.” On page 294, Friedman remarks that workers are

paid for “general skills and specific skills” and “when you switch jobs you quickly discover which is which.”

See Jovanovic and Nyarko (1996) for an information theoretic model of human capital in which experienceacquired knowledge about parameters that calibrate a ‘task’ forms an important component of human capital

that can be destroyed when technology changes.

16

We justified the linear utility specification by referring to the very high levels of government provided

insurance in Europe. Benefits with high replacement rates and indefinite duration drastically reduce the

consumption risk faced by individual workers. Hence, our decision to abstract from risk aversion did not

seem to be too confining in the European context. The focus of our risk-neutral workers’ on the present

values of benefits can also be compared to a finding by Cole and Kocherlakota (2001) who describe a setting

in which their access to a private storage technology makes risk-averse agents evaluate alternative social

insurance contracts in terms of the present values of income that they yield.

7

competitively determined labor market? And what about the calculations by Prescott (2002,

2004) and Rogerson (2005a) that show that one can ignore the differences across countries

in UI and EP and use a model in which willing workers immediately get work with firms to

explain the important differences between labor market outcomes in Europe and the United

States?

The quantitative models in this paper answer these questions by including these general

equilibrium effects. Common features in their physical environments allow us to represent the

interactions between the transition dynamics for skills and both the unemployment benefit

levels and the job destruction taxes that Ljungqvist and Sargent (2005) focussed on, and

to assess the sensitivity of outcomes to the models’ distinct features, such as the presence

or absence of congestion effects, wage bargaining, risk aversion, and complete or incomplete

markets.

1.3

1.3.1

Calibrations

Unemployment versus an employment-population ratio

The issues about UI that preoccupy us prompt us to calibrate the labor-leisure tradeoff in

the representative family employment lotteries model to match an unemployment rate rather

than the employment to population ratio that is more often the target in the real business

cycle literature. In the laissez-faire version of the model, these different calibration targets

would have no substantial consequences other than to scale up or down the fraction of the

population of working age that is employed. However, these differences do matter in the

welfare-state versions of the model because we assume that those who are not employed are

entitled to government supplied UI. The distortionary tax rate needed to finance the UI

system is increasing in the number of people counted as unemployed. For that reason, our

decision to take the unemployment rate as the calibration target seems to be appropriate for

studying the issues about UI addressed in this paper.

1.3.2

Microfoundations

It is appropriate to issue a couple of warnings about the microeconomic foundations of the

quantitative results presented in this paper. To set out our first warning, recall how Lucas

(1987, pp. 46–47) praised Kydland and Prescott (1982) for specifying their model in terms

of parameters of preferences and technology because that enabled them to use extraneous

microeconomic evidence to calibrate its parameters. “This is the point of ‘microeconomic

foundations’ of macroeconomic models: to discover parameterizations that have interpretations in terms of specific aspects of preferences or of technology, so that the broadest range

of evidence can be brought to bear on their magnitudes and their stability under various

possible conditions. . . . here is a macroeconomic model that actually makes contact with

microeconomic studies in labor economics!”17

17

Browning et al. (1999) question calibrations of the real business cycle model for sometimes not faithfully

importing micro estimates. They also describe aggregate implications of general equilibrium theory that raise

8

However, “making contact with microeconomic studies in labor economics”, in the sense

of endowing their representative agents with the labor supply behavior of a typical individual

detected in the micro studies, was certainly not the purpose of Hansen (1985) and Rogerson

(1988) when they proposed their employment lotteries model. Instead, they showed that nonconvexities at the household level in combination with well-functioning private insurance

markets that smooth out the impact of those non-convexities on the households’ budget

constraints give rise to a high economy-wide labor supply elasticity even when the labor

supply elasticity of each of the households being aggregated is small. That makes the labor

supply elasticities that micro labor economists have estimated irrelevant for aggregative labor

market analysis.

Now for our second warning. Parts of our three models are so highly stylized that they

cannot readily be connected to micro evidence. For example, we arbitrarily specify truncated

normal distributions of productivity levels rather than calibrate them to data. However, we

can and do calibrate other parameters to match some micro observations. For example, the

earnings potential of a high skill worker is twice that of a low skill one, and it takes 10 years

on average to work your way from low skill to high skill. Note that our parameterization

for the time it takes to accumulate skills pertains both to new inexperienced workers and to

workers who have suffered skill loss and want to regain their earnings potential (see footnote

29).

1.3.3

Common parameterizations

We reiterate parameter values from previous studies but also, as far as possible, retain

common parameterizations across models. Our practice of keeping parameters fixed across

different frameworks can be criticized because the same values of these parameters imply

different outcomes in the different frameworks. This is easy to see for the discount factor,

which implies different outcomes for the risk-free interest rate in the search-island model,

where precautionary savings motives are in play, and in the representative family model,

where there are complete insurance markets.

Our justification for keeping common parameters, including the discount factor and the

variance of the productivity distribution, is that it best serves our goal of focusing attention on the economic forces at work in the alternative frameworks. And despite the single

parameterization in our study, we will argue that those economic forces are robust within a

framework either by appealing to evidence accumulated from earlier studies in the literature

or by noting that the pertinent quantitative effects are so large that no reasonable change in

parameter values can make a substantial difference. An example of the latter is our finding

that the representative family employment lotteries model delivers quantitatively unrealistic

responses to government supplied UI. This finding stems from the high aggregate labor supply elasticity that characterizes the employment lotteries model and is relatively insensitive

to the choice of parameter values.

doubts about whether the cross section and other micro empirical studies are pertinent for the parameters

of aggregative models, thereby updating arguments made by Kuh and Meyer (1957).

9

1.4

Conversations

Concerning the study of unemployment, Lucas (1987) reserved his highest praise for the

McCall search model. “Indeed, the model’s explicitness invites hard questioning.” (p. 56).

“Questioning a McCall worker is like having a conversation with an out-of-work friend:

‘Maybe you are setting your sights too high’, or ‘Why did you quit your old job before you

had a new one lined up?’ This is real social science: an attempt to model, to understand ,

human behavior by visualizing the situation people find themselves in, the options they face

and the pros and cons as they themselves see them.” We too listen to the workers and firms

in our models, especially in section 10, where we use these conversations as a way to make

up our own minds about which models ring truest in terms of the choice problems faced by

unemployed workers.18

1.5

Organization

Section 2 describes features that transcend the environments of all of our models. These

include: (1) two transition matrices for workers’ skill levels, one for workers whose jobs

continue or end voluntarily, another for workers whose jobs terminate involuntarily; (2) a

probability distribution for drawing productivity levels of new workers and transition matrices for the productivity levels of workers whose jobs continue; and (3) parameters that

define a replacement ratio for UI and a layoff tax for EP. Section 3 describes the additional

features that complete the matching models: a risk-neutral utility functional of consumption; and four sets of matching functions that define alternative market structures for sorting

workers and firms into pools where workers wait for jobs and firms post vacancies. Beyond

the common features reported in section 2, section 4 describes the additional features in the

search-island model: a discounted risk-averse functional that is separable across consumption, search effort, time, and states and that imparts a precautionary savings motive; and

firm-owned technologies for creating jobs and for converting labor and capital into output.

Section 5 describes the special features of the representative family model. Firms face the

same problem that they do in the search-island model. But there are complete markets to

smooth consumption across states and time. An infinitely lived representative family consists of a continuum of lineages composed of workers who value leisure, consumption, and

their offsprings’ welfare. Section 6 describes calibrations of the three models. Sections 7, 8,

and 9 describe calibrated outcomes in the matching, search-island, and representative family

models, respectively. Section 10 critically evaluates the mechanisms at work in the three

types of models, comments on the transcendence of the forces stressed by Ljungqvist and

Sargent (1998, 2005), and critically evaluates the representative family model and its high

labor aggregate supply elasticity as a vehicle for understanding cross-country differences in

labor market outcomes. Three appendixes, one for each model, describe Bellman equations

and equilibrium conditions.

18

Ljungqvist and Sargent (2003) reported imaginary conversations with a European and American worker

who had experienced identical sequences of labor market shocks, but who behaved differently at the ends of

their lives.

10

2

Common features of our environments

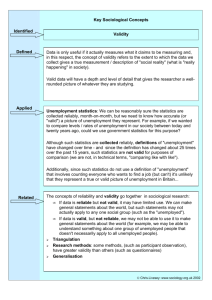

Figures 1 and 2 show the within-period timing of our models. The top halves of these

figures are identical. In all models, each of a continuum of potential workers faces a constant

probability ρ of exiting the labor force. In the matching model, a worker immediately exits

the model upon leaving the labor force while, in the other two frameworks, ρ is the probability

that a worker will retire and become unable to work, and σ is the probability that a retired

worker dies. To keep the total population and the shares of workers and retirees constant

over time, people who exit a model are replaced by newborn workers.

There are three other exogenous sources of uncertainty. First, an employed worker faces

a probability π o that his job terminates. Second, workers experience stochastic accumulation

or deterioration of skills, conditional on employment status and instances of exogenous job

terminations. Third, idiosyncratic shocks impinge on employed workers’ productivity.19

2.1

Skill dynamics

There are two possible skill levels, indexed by h ∈ {0, H}. All newborn workers enter the

labor force with the low skill index, h = 0. An employed worker with skill index h faces a

probability pn (h, h0 ) that his skill at the beginning of next period is h0 , conditional on no

exogenous job termination. In the event of an exogenous job termination, a laid off worker

with last period’s skill h faces a probability po (h, h0 ) that his skill becomes h0 . A worker’s

skill remains unchanged during an unemployment spell. The skill transition matrices are:

1 − πu πu

n

,

(1)

p =

0

1

1

0

o

.

(2)

p =

πd 1 − πd

2.2

Firm formation and productivity

The process of uniting firms and workers differs across the three frameworks but has several

common features. Firms incur a cost µ when posting a vacancy in the matching model or

when creating a job in the other two frameworks. We model a new job opportunity as a

draw of productivity z from a distribution Qoh (z). The productivity of an ongoing job is

governed by a Markov process: Qh (z, z 0 ) is the probability that next period’s productivity is

z 0 , given current productivity z. For any two productivity levels z and ẑ < z, the conditional

probability distribution Qh (z, z 0 ) first-order stochastically dominates Qh (ẑ, z 0 ), meaning that

X

X

Qh (z, z 0 ) <

Qh (ẑ, z 0 ),

for all z̄.

(3)

z 0 ≤z̄

z 0 ≤z̄

19

Endogenous job separations will impose additional risks on individual workers. Whether the workers

can fully insure against such risks varies across our models.

11

The probability distributions, Qoh (z) and Qh (z, z 0 ), depend on the worker’s skill h in the

matching model, but not in the other two frameworks.

2.3

Government mandated UI and EP

The government levies layoff taxes on job destruction and provides benefits to the unemployed. It imposes a layoff tax Ω on every endogenous job separation and on every exogenous

job termination except retirement. The government pays unemployment benefits equal to

a replacement rate η times a measure of past income. In all three models, it will suffice to

keep track of a worker’s skill in his last employment, to determine his benefit entitlement.

Newborn workers are entitled to the lowest benefit level in the economy. The government

finances unemployment benefits with revenues from the layoff tax and other model-specific

taxes.

3

Matching models

Like DenHaan et al. (2001), we include skill dynamics in a matching framework.20 The probability distributions of the productivity levels for high-skilled (h = H) workers stochastically

dominate corresponding probability distributions of low-skilled (h = 0) workers , i.e.,

X

X

X

X

QoH (z 0 ) <

Qo0 (z 0 )

and

QH (z, z 0 ) <

Q0 (z, z 0 ),

(4)

z 0 ≤z̄

z 0 ≤z̄

z 0 ≤z̄

z 0 ≤z̄

for all z̄, given that z is a permissible productivity level for both low-skilled and high-skilled

workers. We follow DenHaan et al. (2001) and assume that benefits are determined by a

replacement rate η on the average after-tax labor income in the worker’s skill category when

last employed.21 Hence, we can index a worker’s benefit entitlement by his skill in his last

employment spell, b ∈ {0, H}, so that his benefit entitlement is some function b̃(b). Let

u(h, b) be the number of unemployed workers with skill level h and skill during his previous

employment spell of b. The total number of unemployed workers is then

X

ū =

u(h, b).

(5)

h,b

20

We thank Wouter DenHaan, Christian Haefke, and Garey Ramey for generously donating their computer

code, which we have adapted. The matching framework originated in works of Diamond (1982), Mortensen

(1982), and Pissarides (2000).

21

We make two simplifications to DenHaan, Haefke, and Ramey’s specification of the benefit system. First,

newborn workers are entitled to the lowest benefit level without first having to work one period. Second,

workers who experience an upgrade in skills are immediately entitled to the higher benefit level, even if

the match breaks up immediately. These assumptions simplify solving the model. The second assumption

enables us also to discard DenHaan, Haefke and Ramey’s simplifying, but questionable, assumption that

a skill upgrade is accompanied with a new productivity draw where the lower bound on possible draws

is the reservation productivity of an ongoing match with a high-skilled worker. In our model, exogenous

distributions from which productivities are drawn do not change with endogenous reservation productivities.

12

We drop the assumption of DenHaan et al. (2001) that there is an exogenous number of

firms and instead impose a zero-profit condition that expresses the outcome of free entry.

Let v be the endogenous number of vacancies and let M (v, ū) be an increasing, concave, and

linearly homogeneous matching function:

v M (v, ū) = ū M

, 1 ≡ ū m(θ),

(6)

ū

where the ratio θ ≡ v/ū is the endogenously determined degree of “market tightness.” The

probability of finding a job, M/ū = m(θ), is an increasing function of market tightness,

and the probability of filling a vacancy, M/v = m(θ)/θ, is a decreasing function of market

tightness. We first assume a single matching function for all vacancies and all unemployed

workers, but later consider multiple matching functions.22 For various technical details, see

appendix A.

We form three models with separate matching functions (1) for unemployed workers

with different skill levels, yielding equilibrium vacancies v(h) for each h ∈ {0, H}; (2) for

unemployed workers having different benefit entitlements, yielding equilibrium vacancies v(b)

for each b ∈ {0, H}; and (3) for unemployed workers indexed by both their current skill h

and their skill b in their last employment, yielding equilibrium vacancies v(h, b) for each pair

of values (h, b) ∈ {0, H} × {0, H}. The last setup has only three matching functions because,

given our specification of the benefit system, there are no high-skilled unemployed workers

with low benefits.

We keep DenHaan, Haefke, and Ramey’s specification that workers are risk neutral.

Workers’ preferences are ordered by

E0

∞

X

β t (1 − ρ)t ct ,

(7)

t=0

where the worker discounts future utilities by the subjective discount factor β ∈ (0, 1) and

the survival probability (1 − ρ). The government finances the unemployment compensation

scheme with the revenues that it receives from the layoff tax and a flat-rate tax τ on firms’

output.

Figure 1 shows the within-period timing of events in our matching model.

3.1

Conversation with a worker and a firm

In the spirit of the conversations with McCall workers in Lucas (1987) and Ljungqvist and

Sargent (2003), it is informative to discuss the choices that confront our Diamond-MortensenPissarides worker. He likes to consume, but is indifferent to when because his utility is linear

in consumption and the inverse of the equilibrium gross interest rate equals his subjective

22

Hornstein et al. (2003) use a matching model with one matching function, workers with one skill level,

but physical capital of different vintages, as a tool for studying how different rates of embodied technical

change impinge on equilibrium outcomes, including wage distributions.

13

End of period t-1

Period t

1. Exogenous job destruction

retirement shock

exogenous job termination

2. Skill evolution

exogenously laid off

not exogenously laid off

ρ

πo

po(h, h')

pn(h, h')

3. Endogenous job formation and destruction

Firms invest in

vacancies

Unemployed wait in

matching function

Labor market, M(v, u)

old firms, Qh'(z, z')

• bilateral meetings

• firm-worker pair, Qho(z)

• Nash bargaining

So(h, z, b)

agree

Surplus functions

disagree

(no layoff tax)

S(h', z')

continue

match

lay off

(tax Ω)

Figure 1: Matching model

discount factor times his constant survival probability. When employed, he works effortlessly.

When unemployed, he waits and collects unemployment benefits without effort. When there

are more unemployed workers, he waits longer, given the number of vacancies. After being

newly matched, a firm and worker bargain about a wage. An acceptable initial bargain

commences a worker-firm relationship that lasts until one of three events occur. First, a

worker might retire. Second, nature might dissolve the match. Third, a worker and a firm

might agree to dissolve a match in response to an idiosyncratic productivity shock. In each

period that a worker and a firm remain matched, they bargain over how to split the match

surplus. UI and EP influence the surpluses for both new and continuing matches, albeit

in somewhat different ways because firms pay layoff taxes only if they had previously hired

a worker. By increasing a worker’s threat point, unemployment benefits also have a direct

impact on bargaining.

Firms choose a number of vacancies to post at a constant per-vacancy resource cost. The

matching function imposes congestion effects on both firms and workers. An increase in

vacancies decreases the waiting time between matches for each unemployed worker and increases the waiting time between matches for each vacancy, given the number of unemployed

workers. Free entry implies that firms that post vacancies can expect to earn zero profits.

Therefore, the expected discounted cost of filling a vacancy equals the expected discounted

value of a firm’s share of future match surpluses.

14

4

Search-island model

Our search-island model with incomplete markets features risk-averse workers who engage

in precautionary saving; a non trivial choice of search effort by unemployed workers; and a

competitive labor market for workers whose job searches are successful. The only vehicle

for savings is a single risk-free one-period security. Labor contracts cannot depend on the

history of a firm’s productivity. We consign various technical details to appendix B.

We create our model by altering the model of Alvarez and Veracierto (2001).23 We adopt

their specification of a worker’s preferences:

E0

∞

X

t=0

(1 − st )γ − 1

β (1 − ot ) log(ct ) + A

,

γ

t

t

with A > 0, γ > −1,

(8)

where (1 − ot ) is the survival probability with ot = ρ if the worker is of working age and

ot = σ if the worker is retired; and st ∈ [0, 1) is the worker’s choice of search intensity

if he is unemployed and of working age. A search intensity st determines an unemployed

worker’s probability sξt of finding a centralized labor market in the next period, where 0 ≤

ξ ≤ 1. Workers who find the labor market get a job paying a market-clearing wage rate. To

accommodate the feature, not present in Alvarez and Veracierto (2001), that workers differ

in their skills, we let w∗ denote the wage rate per unit of skill, where the skill level of a

low-skilled worker is normalized to one and the skill level of a high-skilled worker is 1 + H.

Hence, a low-skilled worker earns w∗ and a high-skilled worker earns (1 + H)w∗ .

4.1

Firms

We suppress Alvarez and Veracierto’s firm size dynamics and, in the spirit of our matching

model, let each firm employ only one worker. Each firm also rents physical capital. The

firm’s production function is

zt ktα (1 + ht )1−α ,

with α ∈ (0, 1),

(9)

where zt is the current productivity level, ht ∈ {0, H} is the skill index of the firm’s worker,

and kt is physical capital that depreciates at the rate δ. Output can be devoted to consumption, investment in physical capital, and startup costs. The rest of Alvarez and Veracierto’s

model of firms enters our framework as follows. Incurring a startup cost µ at time t allows a

firm to create a job opportunity at t + 1 by drawing a productivity level z from the distribution Qo (z). After seeing z, a firm decides whether to hire a worker from the centralized labor

23

The antecedent of this search-island framework is a model of Lucas and Prescott (1974) in which riskneutral workers engage in effortless but time-consuming search across a large number of spatially distinct

islands with idiosyncratic productivity shocks. The only search cost in that model is the opportunity cost of

labor income foregone when moving between islands. Alonso-Borrego et al. (2004) use a two-market version

of the Alvarez and Veracierto (2001) model to study how legal regulations that exempt fixed term labor

contracts from layoff taxes affect equilibrium outcomes.

15

market. We retain Alvarez and Veracierto’s key assumption that firms and workers first meet

under a veil of ignorance about their partner’s state vector: the firm hires a worker drawn

randomly from a single pool of unemployed workers with a mix of low-skilled and high-skilled

workers. Once hired, a firm observes a worker’s skill, hires the appropriate physical capital,

and pays the worker the market wage of w∗ per unit of skill. A firm must retain a worker

for at least one period.

Notice that the wage cannot be indexed by the history of shocks z t . Under a veil of

ignorance, all unemployed workers who have been successful in their job search efforts are

randomly matched with firms that have decided to create new jobs. The assumption that

the market-determined wage rate per unit of skill is unchanged throughout an employment

spell is restrictive. To avoid layoffs, workers would be willing to accept wage cuts in response

to some adverse productivity shocks.24

4.2

Other features

Besides markets for goods and for renting labor and capital, workers can acquire non-negative

holdings of risk-free assets that earn a net interest rate i. Following Alvarez and Veracierto

(2001), we postulate a competitive banking sector that accepts deposits that it invests in

physical capital and claims on firms. The banking sector rents physical capital to firms at

the competitive rental rate i + δ. Banks hold a diversified portfolio of all firms and so bear

no risk.

In the spirit of Alvarez and Veracierto, we assume that a worker who dies is replaced by

a newborn unemployed worker, to whom he is indifferent, but who nevertheless inherits his

assets. Newborn workers have the low skill index, h = 0.

The government pays unemployment compensation equal to a replacement rate η times

an unemployed worker’s last labor earnings net of taxes. Newborn workers are entitled to

the lowest benefit level in the economy. The government receives revenues from layoff taxes

and other revenues from an income tax whose rate we represent in terms of the difference

between before-tax and after-tax wage rates, (w∗ − w). The government balances its budget.

Figure 2 shows the within-period timing of events in our search-island model.

4.3

Conversations with a worker and a firm

Differentiated by their skill, benefit entitlements, assets, and employment-unemploymentretirement status, workers save or dissave. Employed workers supply labor effortlessly. Unemployed workers suffer more disutility when they search more intensively. After a successful

search, a worker receives a job that pays a competitively determined wage. Although the

wage rate per unit of skill is the same across all firms, a worker cares about the productivity

24

A main purpose of Alvarez and Veracierto (2001) is to quantify the potential welfare gains of a tax on

job destruction that reduces socially wasteful separations. They acknowledge that the rigidity they impose

on labor contracts and their assumption of no disutility from work cause them to overestimate those welfare

gains.

16

End of period t-1

Period t

1. Exogenous job destruction

retirement shock

exogenous job termination

2. Skill evolution

exogenously laid off

not exogenously laid off

ρ

πo

po(h, h')

pn(h, h')

3. Endogenous job formation and destruction

Firms invest in

job creation

new firms, Qo(z)

Unemployed choose

search intensities

Labor market

wage w*

Precautionary and

life-cycle savings;

risk-free asset

old firms, Q(z, z')

exit

continue

exit ≡

lay off

(tax Ω)

4. Capital rental

Capital market

(Intermediary holds

all equity and capital)

Figure 2: Search-island model

of the firm employing him. A firm’s idiosyncratic productivity shock determines when a

worker is cast into unemployment. An unemployed worker incurs the disutility from searching for a new job and consumes from his savings and whatever unemployment insurance he

is entitled to.

At a constant per-job resource cost, firms create new jobs. Free entry ensures that all

job creating firms can expect to earn zero profits. After observing the productivity of a new

job, a firm decides whether to hire a worker at the market-clearing wage rate per unit of

skill. There are no congestion effects. An unemployed worker inflicts no injury on other job

seekers beyond what a seller of a good ordinarily imposes on his competitors.

5

Representative family model with lotteries

This section describes our representative family model with lotteries, with technical details

consigned to appendix C. We make these changes to our search-island model: (1) agents care

about their offspring, so that each lineage of agents has an infinite-horizon utility function

where the survival probability is equal to one; (2) a disutility of working replaces a disutility

of search; (3) no search, or other kinds of frictions impede workers from immediately finding

the competitive labor market; and (4) agents have access to complete markets in all possible

history-contingent consumption claims. We retain the assumption of the search-island and

17

matching models that there is no ‘intensive’ margin for an agent’s choice of work, i.e., each

working-age agent faces a {0, 1} choice of working or not working an exogenously amount

of time in any given period. This indivisibility in agents’ labor supply in combination with

complete contingent claims markets can give rise to equilibrium outcomes with employment

lotteries and following Hansen (1985), and Rogerson (1988), we model the economy as a

representative family. Otherwise, from firms’ viewpoint, the labor market is identical to that

of the search-island model.

The representative family consists of a continuum of lineages indexed on the unit interval.

Each lineage consists of an infinite sequence of workers, only one of whom is alive at any

time. Each worker retires with probability ρ, then dies with probability σ. In each lineage,

a newborn worker immediately replaces a deceased worker. The representative family has a

utility function over consumption and the work of all of its lineage members:25

Z 1X

Z 1X

∞

∞

h

i

h

i

j

j

t

β log(ct ) − v(nt ) dj =

β t log(cjt ) − njt B dj ,

(10)

0

0

t=0

t=0

where cjt is lineage j’s consumption at time t and njt equals one if the current member of

lineage j is working and equals zero otherwise. We assume that v(n) increases with increases

in n. The indivisibility of the individual worker’s labor supply makes v(0) and v(1) the only

pertinent values. We let v(0) = 0 and v(1) = B, so the parameter B > 0 captures the

disutility of working.

The technology and choices of a typical firm are identical with those in the search-island

model described in section 4.1. So while there are no search or matching frictions for workers,

a friction in the form of the job-creation cost µ still confronts firms. In each period, the arrival

order of shocks is 1) exogenous job destruction due to retirement shock with probability ρ

and exogenous job termination with probability π o , and 2) skill evolution. Then firms and

families take actions, and job seekers are matched with vacancies immediately and without

friction. A firm hires a worker under a veil of ignorance about his skill and rents physical

capital after seeing the worker’s skill.

5.1

Conversations with a worker and a firm

Each family member does what he is told.26 A collective entity called ‘the family’ determines

fractions Rt , U0t , U4t , UHt , N0t , NHt of workers who are retired, unemployed with low skills

and low benefits, unemployed with low skills and high benefits, unemployed with high skills

and high benefits, employed with low skills, and employed with high skills, respectively;

Rt + U0t + U4t + UHt + N0t + NHt = 1. The family adjusts these fractions in response to wage

25

It is rewarding to compare the representative family model of Hansen (1985) and Rogerson (1988) with

the household labor supply model of Chiappori (1992, 1997), and Browning and Chiappori (1998), and how

differently they draw the line that separates families. In the representative family model, a family is an

aggregate (national) economy. In applications of the household labor supply model, a family consists of

what we usually think of as a nuclear family.

26

Alternatively, the family member responds to equilibrium prices. See Hansen (1985).

18

rates, unemployment benefits and taxes. Each worker participates in an employment lottery

that determines whether he works as his personal history of skill and benefit entitlement

unfolds. Winners of the lottery do not work. As in the models of Hansen (1985) and Rogerson

(1988), the employment lotteries enlarge the aggregate labor supply elasticity relative to what

would be chosen by an individual worker with preferences under the integral sign on the left

side of (10) who did not face the {0, 1} restriction on his choice of njt .27

Because (10) is additively separable, the family assigns the same consumption c̄t to every

family member. The family assigns an unretired person to work with a probability that

depends on his or her skill and benefit entitlement.28 The unconditional expected utility of

a lineage in the representative family is

∞

X

t=0

h

i

β t log(c̄t ) − n̄t B ,

(11)

where n̄t is the unconditional probability that a member of the lineage works in period

t, which equals the fraction of all family members of both skill levels sent to work, n̄t =

N0t + NHt . Reformulation (11) of the family’s utility function (10) embeds the outcomes

of both the work-sharing lottery and trades in a comprehensive set of markets in history

contingent claims to consumption.

The technologies and choices confronting firms are the same as in the search-island model.

At a cost µ, a new one-job firm can be formed. After observing the productivity of new jobs,

firms can choose to hire workers under a veil of ignorance and pay a market-clearing wage

rate per unit of skill. Upon a non-retirement separation from a worker, a firm pays the layoff

tax.

6

Calibrations

An employed worker keeps his productivity from last period with probability (1 − π) and

draws a new productivity with probability π from the distribution Qoh (z 0 ), so that new

productivities on existing jobs are drawn from the same distribution as the productivities at

the time of job creation; Qoh (z 0 ) depends on the worker’s current skill index h in the matching

model, but not in the other two frameworks.

27

The aggregate labor supply elasticity will be altered if we expand the number of points in the set of hours

that an individual worker is allowed to work, thereby somewhat relaxing the severe indivisibility imposed in

the original models of Hansen (1985) and Rogerson (1988). See the extension to handle straight-time and

overtime work by Hansen and Sargent (1988).

28

Relative to Hansen (1985) and Rogerson (1988), we extend the objects that the employment lottery

randomizes across to include entire histories (actually, it is better to call them ‘futures’) of skills and benefit

entitlements that a worker might experience. For example, a worker who experiences a skill upgrade will

never again be assigned to enjoy leisure, at least as long as he does not suffer an involuntary layoff with skill

loss. In the spirit of Lucas (1987, p. 67, footnote 13) when he remarked that “in the Hansen and Rogerson

papers, [unemployed] workers are happier than those who draw employment!,” we can say that the real losers

of our lotteries are the workers who have had successful careers with skill accumulation because they enjoy

the same consumption as everyone else but none of the leisure. (For details, see appendix C.7.)

19

We turn first to a set of parameter values that are common to all models. Thereafter,

we report calibrations of features that are unique to each framework. As far as possible,

we reiterate parameter values from previous studies. For calibrating labor market frictions

and disutilities of searching and working, we target a laissez-faire unemployment rate in the

range of 4 to 5%.

6.1

Parameter values common to all models

Following Alvarez and Veracierto (2001), we set the model period equal to half a quarter,

and specify a discount factor β = 0.99425 and a probability of retiring ρ = 0.0031 that

are the same in all three frameworks. People of working age have an annualized subjective

discount rate of 4.7%. On average, they spend 40 years in the labor force.

Table 1 shows that the skill accumulation process is the same across models. We set

transition probabilities to make the average durations of skill acquisition and skill deterioration agree with those in Ljungqvist and Sargent (1998, 2005), who let it take a long time to

acquire the highest skill level in order to match realistic shapes of wage-experience profiles.29

We set a semiquarterly probability of upgrading skills π u = 0.0125, so that it takes on average 10 years to move from low to high skill, conditional on no job loss. Exogenous layoffs

occur with probability π o = 0.005, i.e., on average once every 25 years. The probability of a

productivity switch on the job equals π = 0.05, so that a worker expects to retain a given

productivity level for 2.5 years.

Another common assumption is that productivities are drawn from a truncated normal

distribution with mean 1.0 and standard deviation 1.0. Model-specific assumptions dictate

how these productivity draws enter the production technology.

6.2

Matching models

Here we adopt most of the parameter values of Ljungqvist and Sargent (2004a), who modify

the matching framework of DenHaan et al. (2001). The calibration is reported in Table 1.

The main substantial departures from Ljungqvist and Sargent (2004a) are that (1) we replace

the earlier uniform productivity distributions by truncated normal distributions; (2) instead

of a fixed number of firms, we assume free entry; and (3) we introduce a Cobb-Douglas

matching function and a vacancy cost µ.30

High-skilled workers’ productivity distribution is a truncated N (2, 1) and low-skilled

workers’ productivity distribution is a truncated N (1, 1), both of which are rescaled to inte29

We thank Dan Hamermesh for conversations about his data explorations of wage-experience profiles.

Our assumption that work experience alone can double a worker’s earnings seems to line up well with data

for full-time male workers in the U.S. manufacturing industry. But the time required to attain such earnings

gains are longer than what we assume. Note that the speed of skill accumulation in our model pertains to

both new inexperienced workers and workers who have suffered skill loss and want to regain their earnings

potential.

30

To ensure that the Cobb-Douglas matching technology generates permissible matching probabilities

inside the unit interval, we assume that the number of matches equals min{M (v, ū), v, ū}.

20

Parameters common to all models

Discount factor β

Retirement probability ρ

Probability of upgrading skills, π u

Probability of exogenous breakup, π o

Probability of productivity change, π

Productivity distribution

0.99425

0.0031

0.0125

0.005

0.05

truncated N (1, 1)

Additional parameters in matching models

Matching function, M (v, u)

0.45 v 0.5 u0.5

Vacancy cost, µ

0.5

Worker’s bargaining weight, ψ

0.5

Low-skilled workers’ productivity:

truncated N (1, 1)

High-skilled workers’ productivity:

truncated N (2, 1)

Parameters common to search-island and representative family model

Probability of dying, σ

0.0083

Capital share parameter, α

0.333

Depreciation rate, δ

0.011

Job creation cost, µ

5.0

Low skill level

1.0

High skill level, (1 + H)

2.0

Additional parameters in search-island model

Disutility of search, A

5.0

γ

0.98

Search technology, ξ

0.98

Additional parameter in representative family model

Disutility of working, B

1.01

Table 1: Parameter values (one period is half a quarter)

21

grate to one. Both distributions are truncated to a range of 4 units where the midpoint of

the range is the mean of the corresponding untruncated distributions. Thus, the range for

high-skilled workers’ productivities is [0,4] and the range for low-skilled workers’ productivities is [-1,3]. The high-skilled workers’ distribution is the low-skilled workers’ distribution

shifted to the right.

Table 1 shows that our parameterization of the matching technology and the Nash bargaining between workers and firms is fairly standard. Workers’ bargaining weight equals

ψ = 0.5, which also equals the matching elasticity of the Cobb-Douglas matching function.

By computing the expected cost θµ/m(θ) of filling a vacancy, we can interpret the semiquarterly vacancy cost µ = 0.5. In the laissez-faire economy, this average recruitment cost

equals 3.4, which can be compared to the average semiquarterly output of 2.3 goods per all

workers. Our calibration of the matching model yields a laissez-faire unemployment rate of

5.0%.

6.3

Search-island model

In addition to the discount factor and the probability of retiring, we take several other

parameter values from Alvarez and Veracierto (2001): see our Table 1. We take the following

survival, technology, and preference parameters from them: {σ, δ, ξ, γ}. Since the model

period equals half a quarter and the survival probability in retirement equals σ = 0.0083, the

average duration of retirement is 15 years. The semiquarterly depreciation rate is δ = 0.011.

Our settings of exponents on the search technology (ξ = 0.98) and on the disutility of search

(γ = 0.98), respectively, make these close to linear.

One-worker firms operate a constant-returns-to-scale Cobb-Douglas production technology with a capital share parameter α = 0.333. Each firm has an idiosyncratic multiplicative

productivity shock that is drawn from a distribution that is generated by truncating N (1, 1)

to the interval [0,2] and then rescaling it to integrate to one. Low-skilled workers have one

unit of human capital while high-skilled workers have twice that amount, (1 + H) = 2.

The cost of starting a firm, i.e., of drawing anew from the distribution of productivities,

equals 5. This can be measured against the laissez-faire outcome that only about 20% of all

such draws exceed the optimally chosen reservation productivity when the firm hires a worker

at a semiquarterly equilibrium wage rate equal to 6.4 for low-skilled workers. Hence, the

average cost of recruiting a worker is approximately 6 months of the wage paid a low-skilled

worker.

The disutility parameter A for job search equals 5, which generates a laissez-faire unemployment rate of 4.4%.

6.4

Representative family model with lotteries

Table 1 shows that the representative family model and the search-island model are calibrated

alike, except for parameters pertaining to job search. There is neither a search technology

22

nor a disutility of searching. Instead, the new parameter B represents disutility of working.

Setting B = 1.01 makes the laissez-faire unemployment rate be 4.7%.

7

Quantitative findings in matching models

This section reports the effects of increases in turbulence on equilibrium outcomes in four

matching models that differ in how they sort workers before assigning them to a matching

function. How outcomes in these four models respond to increased turbulence illuminates the

economic forces that equilibrate labor markets within matching models. Matching models

feature adverse congestion effects that job-seeking workers impose on each other and that

worker-seeking firms impose on each other. Unmatched workers and firms are concerned

about both matching probabilities that are affected by the total stocks of unemployment

and vacancies, and the bargaining situation that they will face in future matches. Within

a labor pool defined by a matching function, market tightness, v/u ≡ θ, is an important

equilibrating variable that the invisible hand uses to reconcile the decisions of firms and

workers.

7.1

Single matching function

In the model with a single matching function, figure 3 shows that the unemployment rate

is positively related to the replacement rate in the unemployment insurance system. This

result emerges in almost any model of unemployment, but it is useful to recall the forces

that produce this outcome in the matching model. Unemployment benefits raise the value

of a workers’ outside option in the wage bargaining with employers. If nothing else changed,

a higher threat point for workers would cause wages and the reservation productivity to

rise. That would deteriorate firms’ bargaining positions, leaving them unable to recover the

expected cost of filling vacancies if their probability of encountering unemployed workers

were to remain unchanged. Therefore, the invisible hand restores the profitability of firms

by lowering the number of vacancies relative to the number of unemployed workers, i.e.,

the equilibrium measure of market tightness falls, which in turns implies a longer average

duration of unemployment spells. Hence, unemployment rises because the duration and

incidence of unemployment both increase.

Although UI benefits necessarily increase unemployment in the matching model, layoff

taxes have countervailing effects on unemployment. Mortensen and Pissarides (1999) pointed

out that layoff taxes reduce incentives both to create jobs and to destroy them. They show

that the net effect of these forces on market tightness, and consequently on unemployment

duration, is ambiguous, but that the reservation productivity for existing jobs decreases and

therefore so does the incidence of unemployment.31 Figure 4 shows that in our calibrated

31

The ambiguous effect of layoff taxes upon unemployment is compounded further in our framework

because we model a new job opportunity as a draw from a productivity distribution, so that there is an

endogenous reservation productivity in job creation. In contrast, Mortensen and Pissarides (1999) assume

that all new jobs begin with the same productivity level.

23

12

Unemployment rate (per cent)

10

8

6

4

2

0

0

0.1

0.2

0.3

0.4

Replacement rate η

0.5

0.6

0.7

Figure 3: (Matching model) Unemployment rates for different replacement rates η, given

tranquil economic times and no layoff taxes.

matching model with one matching function there is a strong negative relationship between

layoff taxes and unemployment. This is also true for the calibration of Mortensen and

Pissarides (1999). Unemployment falls because layoff taxes reduce labor reallocation and

lock workers into their jobs, so that frictional unemployment falls. Although this negative

relationship between layoff taxes and unemployment is the predominant outcome in the

matching literature, there are exceptions, most notably Millard and Mortensen (1997). As

explained by Ljungqvist (2002), such contradictory quantitative findings in the matching

literature come not from differences in parameter values but from different assumptions

about bargaining strengths. Millard and Mortensen (1997) assume that firms must also

pay layoff taxes after encounters with job seekers who are not hired. That dramatically

increases workers’ bargaining strengths, making equilibrium market tightness plummet in

order to level the playing field for firms. Under the more typical assumption that firms pay

layoff taxes only for the workers they had chosen to hire and then had subsequently laid

off, Ljungqvist (2002) concludes on the basis of a wide range of simulations that there is a

presumption that layoff taxes reduce unemployment in the matching model.32

7.1.1

High layoff taxes and high benefits

As noted by Mortensen and Pissarides (1999), the countervailing forces of unemployment

benefits and layoff taxes in the matching model can explain why the unemployment rate in

a welfare state need not be high. For low values of the turbulence parameter π d , a more

32

Unlike Millard and Mortensen (1997), our models obey the dictum, “If a firm does not hire, it does not

have to fire.”

24

5.5

5

Unemployment rate (per cent)

4.5

4

3.5

3

2.5

2

1.5

1

0.5

0

0

5

10

Layoff tax Ω

15

20

25

Figure 4: (Matching model) Unemployment rates for different layoff taxes Ω, given tranquil

economic times and no benefits. The magnitude of the layoff tax can be compared to an

average semiquarterly output of 2.3 goods per worker in the laissez-faire economy, i.e., a

layoff tax equal to 19 corresponds to approximately one year’s of a worker’s output.

generous unemployment insurance system can accompany higher layoff taxes, leaving the

equilibrium unemployment rate unchanged or even lower than the laissez-faire outcome. To

illustrate this outcome, we pick a replacement rate of 70%, which on its own would have