Public Policy and Law Alert

April 2010

Authors:

Tim L. Peckinpaugh

tim.peckinpaugh@klgates.com

+1.202.661.6265

Michael J. O'Neil

mike.oneil@klgates.com

+1.202.661.6226

Stephen P. Roberts

steve.roberts@klgates.com

+1.202.778.9357

K&L Gates includes lawyers practicing out

of 36 offices located in North America,

Europe, Asia and the Middle East, and

represents numerous GLOBAL 500,

FORTUNE 100, and FTSE 100

corporations, in addition to growth and

middle market companies, entrepreneurs,

capital market participants and public

sector entities. For more information,

visit www.klgates.com.

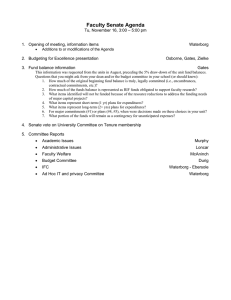

Courts Repeal Contribution Limits for ThirdParty “Independent Expenditure Committees”

and Uphold Soft Money Ban

Two decisions issued almost simultaneously on March 26, 2010 in different courts

amplified the potential impact of the Supreme Court’s recent decision in Citizens

United v. FEC. In Speechnow.org v. FEC, No. 08-5223 (D.C. Cir., Mar. 26, 2010),

the D.C. Circuit Court of Appeals held that contribution limits do not apply to an

independent group that makes only independent expenditures. It also held that such

a group would be required to register as a political committee with the FEC and

submit to the disclosure requirements associated with such status. On the same day,

in Republican Nat’l Comm. v. FEC, No. 08-1953 (D.D.C., Mar. 26, 2010), a threejudge panel of the U.S. District Court for the District of Columbia upheld the

prohibition on soft-money contributions to state and local political parties for

activities that affect federal campaigns and to national political parties generally.

Taken together, these holdings reinforce the likelihood of a potentially significant

increase in independent organizations’ ability to influence federal campaigns.

Potential Impact

These two decisions combine to bolster the conclusion of Citizens United; now, an

individual, corporation, labor union, or even another committee may make unlimited

contributions to a political committee that exclusively makes independent

expenditures, but contributions to national parties are strictly limited.

In Speechnow.org, the Court held that a group not directly affiliated with a political

candidate that made only independent expenditures could raise contributions from

individuals in unlimited amounts. With the Citizens United holding, the impact of

this case will likely be to make contribution limits for “independent expenditure

committees” unenforceable.

Contrast this decision with the Court’s holding in RNC that maintained the ban on all

soft money to political parties. Since the passage of the Bipartisan Campaign

Reform Act of 2002 (BCRA), national parties have been prohibited from raising

non-federal contributions (so-called “soft money”) in any amount. The Court’s

holding in RNC affirmed the Supreme Court’s decision in McConnell v. FEC by

stating that soft money fundraising restrictions still applied notwithstanding Citizens

United’s rejection of an anti-corruption rationale for prohibiting certain contributions

to be used for independent expenditures. Accordingly, contributions to national

parties still may not exceed $30,400 per year (the current limit), and they may only

be made by individuals, PACs or other committees.

Public Policy and Law Alert

Speechnow.org v. FEC

In Speechnow.org, the D.C. Circuit Court of Appeals

reviewed a challenge to a draft FEC advisory

opinion by a so-called 527 group that held that the

group must register as a political committee under

the Federal Election Campaign Act (FECA) and

comply with contribution limits and disclosure

requirements for such groups. Citing Citizens

United’s rejection of an anti-corruption rationale, the

Court of Appeals overturned the FEC’s conclusion,

holding that contribution limits are unconstitutional

as applied to individuals’ contributions to

Speechnow. Noting that the “Supreme Court has

[previously] recognized only one interest sufficiently

important to outweigh the First Amendment interests

implicated by contributions for political speech:

preventing corruption or the appearance of

corruption,” the Court held that such an analysis no

longer applied after Citizens United, which held that

the government has no anti-corruption interest in

limiting independent expenditures. The Court,

however, upheld the FEC’s conclusion that the

organization would be required to register as a

political committee and disclose its activities.

RNC v. FEC

Alternately, in RNC v. FEC, the Supreme Court’s

rejection of that same anti-corruption rationale in

Citizens United did not lead to the District Court

overturning the existing ban on soft money

contributions in BCRA (as upheld by McConnell).

In RNC, the Republican National Committee, along

with the California Republican Party, the Republican

Party of San Diego, and the RNC Chairman

challenged their respective inability to raise and

spend unlimited soft money by: (1) the national

party for use in activities that do not target federal

candidates; (2) the state and local parties for use in

activities that do not target federal candidates; and

(3) the RNC Chairman, in his official capacity, for

use by state and local parties and candidates. In

each case, the District Court found that the Supreme

Court’s holding in McConnell prevented the relevant

entity from raising and spending soft money. The

District Court held, in particular, that the Citizens

United analysis is not applicable to national parties,

affirming that decision’s explicit holding that it “is

about independent expenditures, not soft money.”

While the District Court held that Citizens United

“undermines any theory of limiting contributions to

political parties that might have rested on the idea

that large contributions to parties create gratitude

from, facilitate access to, or generate influence over

federal officeholders or candidates,” it further held

that fact alone “is not enough for the RNC to

prevail. . .” This, in part, was because the

McConnell court found that the RNC previously

sold access in exchange for soft-money

contributions, and maintained a “close relationship

between federal officeholders and the national

parties.” However, in RNC, the District Court left

open the possibility for the Supreme Court to later

overturn its decision, noting that the Supreme Court

will have the opportunity to “clarify or refine this

aspect of McConnell as the Court sees fit.”

The District Court further found that state and local

parties could not raise and spend unlimited soft

money that in any way provided a direct benefit to

federal candidates, including voter drives and

generic campaign activities in support of any

election with a federal candidate on the ballot.

Similarly, the District Court upheld the prohibition

on the RNC Chairman raising soft money for state

or local parties in his official capacity because,

similar to contributions made directly to national

parties, soft money raised by the RNC Chairman

has the “potential ability to produce corruption or

the appearance of corruption” under a similar

analysis as contributions made directly to national

parties.

Conclusion

Taken together, these decisions extend the impact of

Citizens United by greatly expanding the financial

ability of third-party organizations to raise and

spend unlimited contributions for independent

expenditures while prohibiting national party

organizations from raising soft money in any

amount. While the RNC has already filed for

certiorari with the Supreme Court to appeal the

decision upholding McConnell as applied, under

current law national parties will be limited in their

ability to financially impact campaigns during the

2010 cycle relative to non-party independent

expenditure committees. Third-party organizations

making independent expenditures, however, will be

required to register with the FEC as a political

committee and, therefore, will be subject to relevant

April 2010 2

Public Policy and Law Alert

FEC disclosure requirements for independent

expenditures and electioneering communications.

This is subject, however, to further modification.

Forthcoming rulemakings by the FEC will determine

the scope and application of the holding in

Speechnow.org. Congress may also consider

legislation supported by the Obama Administration

that attempts to temper spending on independent

expenditures that could affect the 2010 election

cycle.

While the direction described in this analysis may

seem predictable, much remains uncertain and

you should consult a K&L Gates Political Ethics

attorney for more information before beginning any

independent expenditure campaign.

.

Anchorage Austin Beijing Berlin Boston Charlotte Chicago Dallas Dubai Fort Worth Frankfurt Harrisburg Hong Kong London

Los Angeles Miami Moscow Newark New York Orange County Palo Alto Paris Pittsburgh Portland Raleigh Research Triangle Park

San Diego San Francisco Seattle Shanghai Singapore Spokane/Coeur d’Alene Taipei Tokyo Warsaw

Washington, D.C.

K&L Gates includes lawyers practicing out of 36 offices located in North America, Europe, Asia and the Middle East, and represents numerous

GLOBAL 500, FORTUNE 100, and FTSE 100 corporations, in addition to growth and middle market companies, entrepreneurs, capital market

participants and public sector entities. For more information, visit www.klgates.com.

K&L Gates is comprised of multiple affiliated entities: a limited liability partnership with the full name K&L Gates LLP qualified in Delaware and

maintaining offices throughout the United States, in Berlin and Frankfurt, Germany, in Beijing (K&L Gates LLP Beijing Representative Office), in

Dubai, U.A.E., in Shanghai (K&L Gates LLP Shanghai Representative Office), in Tokyo, and in Singapore; a limited liability partnership (also named

K&L Gates LLP) incorporated in England and maintaining offices in London and Paris; a Taiwan general partnership (K&L Gates) maintaining an

office in Taipei; a Hong Kong general partnership (K&L Gates, Solicitors) maintaining an office in Hong Kong; a Polish limited partnership (K&L

Gates Jamka sp. k.) maintaining an office in Warsaw; and a Delaware limited liability company (K&L Gates Holdings, LLC) maintaining an office in

Moscow. K&L Gates maintains appropriate registrations in the jurisdictions in which its offices are located. A list of the partners or members in each

entity is available for inspection at any K&L Gates office.

This publication is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon

in regard to any particular facts or circumstances without first consulting a lawyer.

©2010 K&L Gates LLP. All Rights Reserved.

April 2010 3