Health Care Alert

November 2010

Authors:

Mary Beth Johnston

marybeth.johnston@klgates.com

919.466.1181

Amy O. Garrigues

amy.garrigues@klgates.com

919.466.1275

Amy L. Mackin

amy.mackin@klgates.com

919.466.1240

K&L Gates includes lawyers practicing out

of 36 offices located in North America,

Europe, Asia and the Middle East, and

represents numerous GLOBAL 500,

FORTUNE 100, and FTSE 100

corporations, in addition to growth and

middle market companies, entrepreneurs,

capital market participants and public

sector entities. For more information,

visit www.klgates.com.

THIRD UPDATE: Are You Ready? The Clock

is Ticking on MSP Mandatory Reporting

Requirements

The K&L Gates Health Care practice group has issued three prior Alerts addressing

Medicare Secondary Payer Mandatory Reporting for Non-Group Health Plans. Click

here to view the original Alert published on July 9, 2009, here to view the First

Update published on March 25, 2010, and here to view the Second Update published

on June 15, 2010.

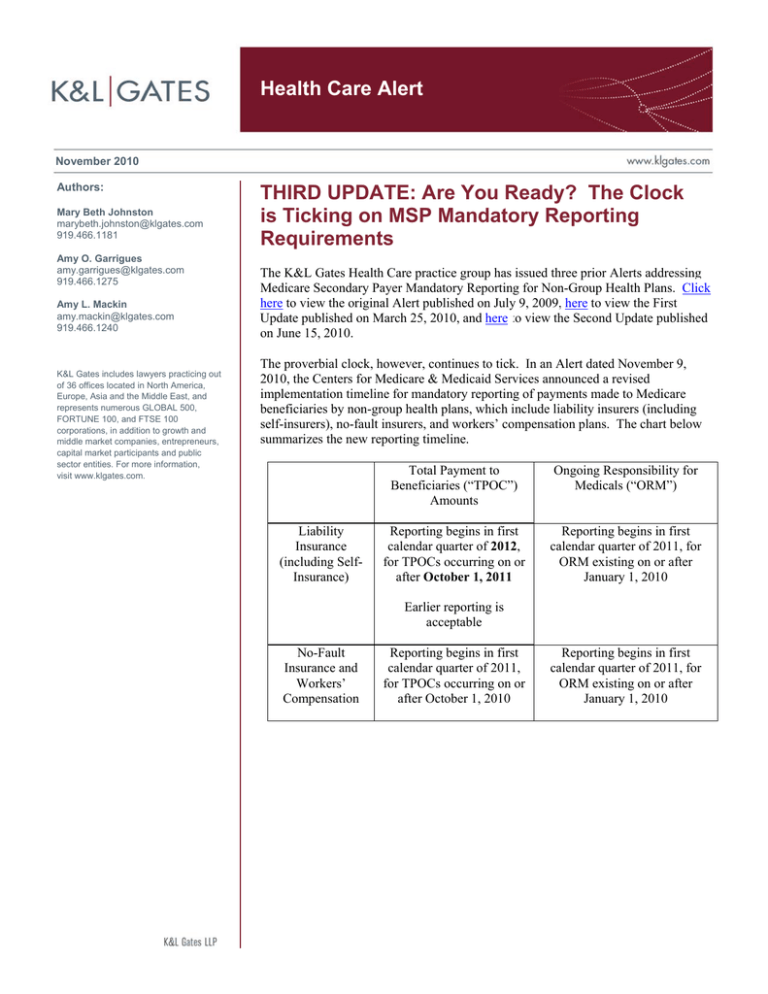

The proverbial clock, however, continues to tick. In an Alert dated November 9,

2010, the Centers for Medicare & Medicaid Services announced a revised

implementation timeline for mandatory reporting of payments made to Medicare

beneficiaries by non-group health plans, which include liability insurers (including

self-insurers), no-fault insurers, and workers’ compensation plans. The chart below

summarizes the new reporting timeline.

Liability

Insurance

(including SelfInsurance)

Total Payment to

Beneficiaries (“TPOC”)

Amounts

Ongoing Responsibility for

Medicals (“ORM”)

Reporting begins in first

calendar quarter of 2012,

for TPOCs occurring on or

after October 1, 2011

Reporting begins in first

calendar quarter of 2011, for

ORM existing on or after

January 1, 2010

Earlier reporting is

acceptable

No-Fault

Insurance and

Workers’

Compensation

Reporting begins in first

calendar quarter of 2011,

for TPOCs occurring on or

after October 1, 2010

Reporting begins in first

calendar quarter of 2011, for

ORM existing on or after

January 1, 2010

Health Care Alert

The interim reporting thresholds have also been extended by one calendar year. In particular, certain

workers’ compensation ORMs totaling $750 or less do not have to be reported until January 1, 2013.1 In

addition, liability insurance and workers’ compensation TPOCs only have to be reported if they exceed the

following phase-in thresholds:

$5,000 for claim reports where the most recent TPOC date is on or before December 31, 2012

$2,000 for claim reports where the most recent TPOC date is in calendar year 2013

$600 for claim reports where the most recent TPOC date is in calendar year 2014

Registration is currently open for both the file submission process and the direct data entry (“DDE”) option.

Entities planning to use the file submission process should already be in “testing status,” with reporting

beginning on January 7, 2011 for the claims required in the first quarter of 2011 pursuant to the chart above.

DDE reporting will begin on January 10, 2011.2

Please consult our prior Alerts for detailed explanations of this reporting program. In addition, please note

that the CMS Section 111 website at http://www.cms.gov/mandatoryinsrep has been reorganized and now

includes User Guide 3.1, which was issued July 12, 2010.

Anchorage Austin Beijing Berlin Boston Charlotte Chicago Dallas Dubai Fort Worth Frankfurt Harrisburg Hong Kong London

Los Angeles Miami Moscow Newark New York Orange County Palo Alto Paris Pittsburgh Portland Raleigh Research Triangle Park

San Diego San Francisco Seattle Shanghai Singapore Spokane/Coeur d’Alene Taipei Tokyo Warsaw

Washington, D.C.

K&L Gates includes lawyers practicing out of 36 offices located in North America, Europe, Asia and the Middle East, and represents numerous

GLOBAL 500, FORTUNE 100, and FTSE 100 corporations, in addition to growth and middle market companies, entrepreneurs, capital market

participants and public sector entities. For more information, visit www.klgates.com.

K&L Gates is comprised of multiple affiliated entities: a limited liability partnership with the full name K&L Gates LLP qualified in Delaware and

maintaining offices throughout the United States, in Berlin and Frankfurt, Germany, in Beijing (K&L Gates LLP Beijing Representative Office), in

Dubai, U.A.E., in Shanghai (K&L Gates LLP Shanghai Representative Office), in Tokyo, and in Singapore; a limited liability partnership (also named

K&L Gates LLP) incorporated in England and maintaining offices in London and Paris; a Taiwan general partnership (K&L Gates) maintaining an

office in Taipei; a Hong Kong general partnership (K&L Gates, Solicitors) maintaining an office in Hong Kong; a Polish limited partnership (K&L

Gates Jamka sp. k.) maintaining an office in Warsaw; and a Delaware limited liability company (K&L Gates Holdings, LLC) maintaining an office in

Moscow. K&L Gates maintains appropriate registrations in the jurisdictions in which its offices are located. A list of the partners or members in each

entity is available for inspection at any K&L Gates office.

This publication is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon

in regard to any particular facts or circumstances without first consulting a lawyer.

©2010 K&L Gates LLP. All Rights Reserved

1

For a list of the other requirements for this exception, see Centers for Medicare & Medicaid Services, MMSEA Section 111

Medicare Secondary Payer Mandatory Reporting Liability Insurance (Including Self-Insurance), No-Fault Insurance, and

Workers’ Compensation User Guide 3.1, § 11.4 (July 12, 2010).

2

Entities using the file submission process are assigned a week within the quarter to report their claims, and those using the

DDE option should report each claim within 45 calendar days of the TPOC date or the assumption of ORM.

November 2010

2