Investment Management Alert

January 2010

Authors:

SEC Releases Amended Custody Rule

Michael Caccese

michael.caccese@klgates.com

+1.617.261.3133

Rebecca O’Brien Radford

On December 30, 2009, the Securities and Exchange Commission (“SEC”) released

its final amendments to Rule 206(4)-2 of the Investment Advisers Act of 1940 (the

“Amended Rule”).1 The amendments are intended to better safeguard client funds

held by registered investment advisers.

rebecca.radford@klgates.com

+1.617.261.3244

Pamela Grossetti

pamela.grossetti@klgates.com

+1.617.951.9194

K&L Gates is a global law firm with

lawyers in 33 offices located in North

America, Europe, Asia and the Middle

East, and represents numerous GLOBAL

500, FORTUNE 100, and FTSE 100

corporations, in addition to growth and

middle market companies,

entrepreneurs, capital market

participants and public sector entities.

For more information, visit

www.klgates.com.

The custody rule currently requires that an adviser with custody of client assets: (1)

maintain the assets with a qualified custodian, such as a broker-dealer or bank, (2)

notify clients of certain information if the adviser opens an account with a custodian

on the client’s behalf and (3) have a reasonable belief that the qualified custodian

sends account statements directly to clients or alternatively send quarterly statements

to clients and undergo an annual surprise audit. Instead of sending account

statements to investors in unregistered pooled investment vehicles, advisers to such

pools may send annual audited financial statements to the pool’s investors within 120

days of the pool’s fiscal year end (or 180 days for funds of funds).

Under both the current Rule and the Amended Rule, an investment adviser is deemed

to have custody of client assets when it holds “directly or indirectly, client funds or

securities or [has] any authority to obtain possession of them.”2 Thus, the Rule

provides that an adviser has custody by holding client assets or if it has the authority

to possess client assets, either by deducting advisory fees or withdrawing funds on a

client’s behalf.

In addition, an investment adviser is deemed to have custody where it acts in any

capacity that gives it legal ownership of, or access to, client funds or securities, such

as the general partner of a limited partnership or a manager of a limited liability

company. Additionally, the Amended Rule provides that an adviser has custody of

client assets that are directly or indirectly held by a related person. A “related

person” is defined by the Amended Rule as a person directly or indirectly controlling

or controlled by the adviser and any person under common control with the adviser.

In order to strengthen the custodial controls on advisers with custody of client funds

or securities, the Amended Rule provides that a registered investment adviser with

custody of client funds or securities (with significant exceptions) is required, among

other things:

•

to undergo an annual surprise examination by an independent public accountant

to verify client assets;

•

to have the qualified custodian maintaining client funds and securities send

account statements directly to the advisory clients (eliminating the option for the

adviser to send them itself); and

1

Custody of Funds or Securities of Clients by Investment Advisers, Investment Advisers Act Rel. No.

2968 (December 30, 2009) (the “Adopting Release”).

2

Rule 206(4)-2(d)(2).

Investment Management Alert

•

unless client assets are maintained by an

independent custodian, to obtain a report of the

custodian’s internal controls relating to the

custody of those assets (typically a SAS-70

Report) from an independent public accountant

registered with the Public Company Accounting

Oversight Board (“PCAOB”).

Amended Rule, a related person with custody of

client assets would be presumed not to be

operationally independent of the adviser unless the

adviser can meet the Amended Rule’s conditions for

“operational independence” and no other

circumstances exist that can reasonably be expected

to compromise its operational independence.5

The majority of the SEC’s proposed changes

discussed in our Client Alert released on May 27,

20093 were adopted. The following discussion

covers key portions of the Amended Rule, including

modifications from the proposed rule.

Unregistered Pooled Investment Vehicles

The Amended Rule also exempts from the annual

surprise examination requirement an adviser to an

unregistered pooled investment vehicle that is

subject to an annual financial statement audit by an

independent public accountant, and that distributes

audited financial statements prepared in accordance

with generally accepted accounting principles to the

pool’s investors. Such audits will satisfy the annual

surprise examination requirement only if they are

performed by a PCAOB-registered independent

public accountant. Upon the liquidation of the pool,

advisers that distribute a pool’s audited financial

statements to investors must obtain a final audit of

the pool’s financial statements and distribute the

statements to investors promptly after the audit is

complete. The liquidation audit is in addition to

obtaining an annual audit.

Annual Surprise Examination

The Amended Rule requires that investment advisers

with custody of client assets undergo an annual

surprise examination by an independent public

accountant to verify those assets.

In a significant departure from the proposed Rule,

the SEC has created exceptions from the annual

surprise examination for the following groups:

Advisers “Operationally Independent” of

Related Custodians

Where an adviser is deemed to have custody merely

as a result of a related person acting as custodian, the

adviser will not be required to undergo the annual

surprise examination if: (i) the adviser is deemed to

have custody solely because its related person holds

client assets; and (ii) the adviser is “operationally

independent”4 of its related custodian. Under the

3

SEC Proposes Amendments to Custody Rule (May 27, 2009)

http://www.klgates.com/newsstand/Detail.aspx?publication=56

67

4

See Amended Rule 206(4)-2(d)(5) (defining “operationally

independent”). The conditions set out in the Rule are: (i) client

assets in the custody of the related person are not subject to

claims of the adviser’s creditors; (ii) advisory personnel do not

have custody or possession of, or direct or indirect access to,

client assets of which the related person has custody, or the

power to control the disposition of such client assets to third

parties for the benefit of the adviser or its related persons, or

otherwise have the opportunity to misappropriate such client

assets; (iii) advisory personnel and personnel of the related

person who have access to advisory client assets are not

under common supervision; and (iv) advisory personnel do not

hold any position with the related person or share premises

with the related person.

Advisers Deemed to Have Custody Solely

Because of Fee Deduction

Advisers deemed to have custody of client funds

and securities solely because they have authority to

withdraw advisory fees from client accounts are not

required to undergo a surprise annual examination.

The SEC noted that it was convinced by many

commenters that requiring an annual surprise

examination for advisers deemed to have custody

solely because of fee deduction would not provide

materially greater protection to advisory clients.

The Rule provides that such advisers must have a

reasonable belief that a qualified custodian provides

5

The SEC staff has withdrawn the Crocker Investment

Management Corp., No-Action Letter (April 14, 1978)

(“Crocker”) and its progeny. Crocker set forth factors the SEC

staff would consider in determining whether an adviser has

indirect custody through its related person. An adviser who

relied on these letters in the past must comply with the

Amended Rule.

January 2010

2

Investment Management Alert

account statements directly to clients, as discussed

below.6

Delivery of Account Statements

The Amended Rule generally provides that advisory

clients must receive account statements directly

from the qualified custodian. This requirement

applies to advisers deemed to have custody solely

because of fee withdrawals. This amendment

eliminates the alternative delivery method, whereby

an adviser could send quarterly account statements

to clients if it underwent a surprise examination by

an independent public accountant at least annually.

As discussed above, advisers must have a reasonable

belief formed after “due inquiry” that a qualified

custodian provides account statements directly to

clients.7 The SEC did not require a specific method

for establishing a reasonable belief after “due

inquiry,” stating rather that advisers may determine

how best to meet this requirement. Nonetheless, as

an example, it stated that one method would be for

the custodian to provide the adviser with a copy of

the account statement that was delivered to the

client. Advisers to unregistered pooled investment

vehicles, however, are exempt from this requirement

if they undergo annual audits by an independent

public accountant registered with the PCAOB and

their audited financial statements are distributed to

all investors in the pool within 120 days of the

pool’s fiscal year end (or 180 days for funds of

funds). If a pool does not distribute the audited

financial statements within 120 days (or 180 days

for fund of funds), the adviser must obtain an annual

surprise examination and must have a reasonable

basis, after due inquiry, for believing that the

qualified custodian sends account statements to pool

investors.

6

The SEC also stated that advisers should have policies and

procedures that take into account how and when clients will be

billed and that are designed to ensure the accuracy of the fees

billed.

7

The SEC addressed concerns raised by commentators that

delivery of account statements by a custodian may hinder a

client’s desire for privacy. The SEC stated that in light of

recent frauds, the protections provided by direct delivery of

account statements by custodians are of substantially greater

value than privacy and confidentiality concerns, which could be

addressed contractually.

Internal Control Reports

An adviser or related person who acts as a qualified

custodian, such as a broker-dealer or bank that is

under common control with the adviser, is required

to obtain or to receive from its related person a

written report relating to custody of client assets.8

The internal control report must contain a

description of control objectives, controls, an

accountant’s tests of the controls, and the results of

those tests. A report describing both the controls

placed in operation and the tests of the controls’

effectiveness (commonly referred to as a “SAS-70

Report”) would satisfy this requirement. However,

the SEC is not requiring a specific type of report, as

long as the objectives detailed in the Rule’s

proposing release9 are addressed. Therefore, an

accountant may leverage audit work already

performed to satisfy existing regulatory

requirements or work performed for client reporting

in complying with this requirement.10 The adviser

must maintain the internal control report in its

records and make it available to the SEC staff upon

request.

Privately Offered Securities

The Rule provides that privately offered securities

will now be subject to verification under the annual

surprise examination requirement and are only

exempt from the requirement that they be

maintained by a qualified custodian. In other

words, if an adviser has custody of privately offered

securities, the adviser will be subject to the annual

surprise examination requirement.11 In a

8

The Adopting Release clarifies that an adviser whose

related person has custody of the adviser’s clients’ assets

must obtain from its related custodian an internal control

report even in cases where the related custodian is

operationally independent of the adviser.

9

Custody of Funds or Securities of Clients by Investment

Advisers, Investment Advisers Act Rel. No. 2876 (May 20,

2009).

10

In addition to the SAS 70, the SEC identified another

report that would satisfy this requirement: a report issued in

conjunction with an examination in accordance with the

American Institute of Certified Public Accountants’ standards

AT Section 601, Compliance Attestation (“AT 601”). AT 601

provides guidance to accountants for engagements related to

either a firm’s compliance with the requirements of particular

laws or rules, or the effectiveness of the firm’s internal controls

over compliance with those particular requirements.

11

However, in the Adopting Release, the SEC clarified that

an adviser may maintain custody of privately offered securities

January 2010

3

Investment Management Alert

companion release, the SEC instructed auditors to

confirm the privately offered securities with their

issuer or counterparty.12 If confirmation cannot be

obtained, the auditors must establish alternative

procedures.13

Compliance Policies and Procedures

The SEC instructed advisers with custody of client

assets to adopt and implement written policies and

procedures reasonably designed to prevent violations

of the Rule.

Form ADV

The SEC adopted changes to Form ADV, Items 7 of

Part 1A and 9 of Part 1A, and Section 7.A of

Schedule D. The amendments require registered

advisers to provide more detailed information about

their custody practices in their registration form.

Item 7 of Part 1A requires an adviser to report all

related persons who are broker-dealers and to

identify those that serve as qualified custodians with

respect to client assets. Item 9 of Part 1A requires

an adviser with custody, including one deemed to

have custody through related persons, to report the

amount of client assets and the number of clients for

whom the adviser has custody. Advisers deemed to

have custody solely due to fee deduction may

continue to answer “no” to Item 9.A (“Do you have

custody of any advising clients’ cash or bank

accounts [or] securities?”). Schedule D of Form

ADV includes additional items requiring advisers to

identify accountants that perform audits, surprise

examinations and internal control reports, as well as

to list related persons that serve as qualified

custodians.

without being subject to the new requirements that apply to

advisers that maintain custody of client assets as qualified

custodians (set forth in paragraph (a)(6) of the Rule), including

obtaining an Internal Control Report, because the adviser need

not be a qualified custodian to maintain custody of those

securities.

12

Commission Guidance Regarding Independent Public

Accountant Engagements Performed Pursuant to Rule 206(4)2 Under the Investment Advisers Act of 1940, Investment

Advisers Act Rel. No. 2969 (December 30, 2009) (“Guidance

for Accountants”).

13

Id.

Form ADV-E

The SEC adopted the following three amendments

to the instructions to Form ADV-E, the form used

as a cover page for a certificate of accounting of an

adviser: (i) the form and the accompanying

accountant’s examination certificate must be filed

electronically through the Investment Adviser

Registration Depository (“IARD”); (ii) the surprise

examination certificate must be filed within 120

days of the time chosen by the accountant for the

surprise examination; and (iii) a termination

statement must be filed by an accountant within four

business days of its resignation, dismissal, or

removal. The latter amounts to a “noisy

withdrawal” intended to alert the SEC to the

accountant’s resignation on the theory that it might

signal irregularities.

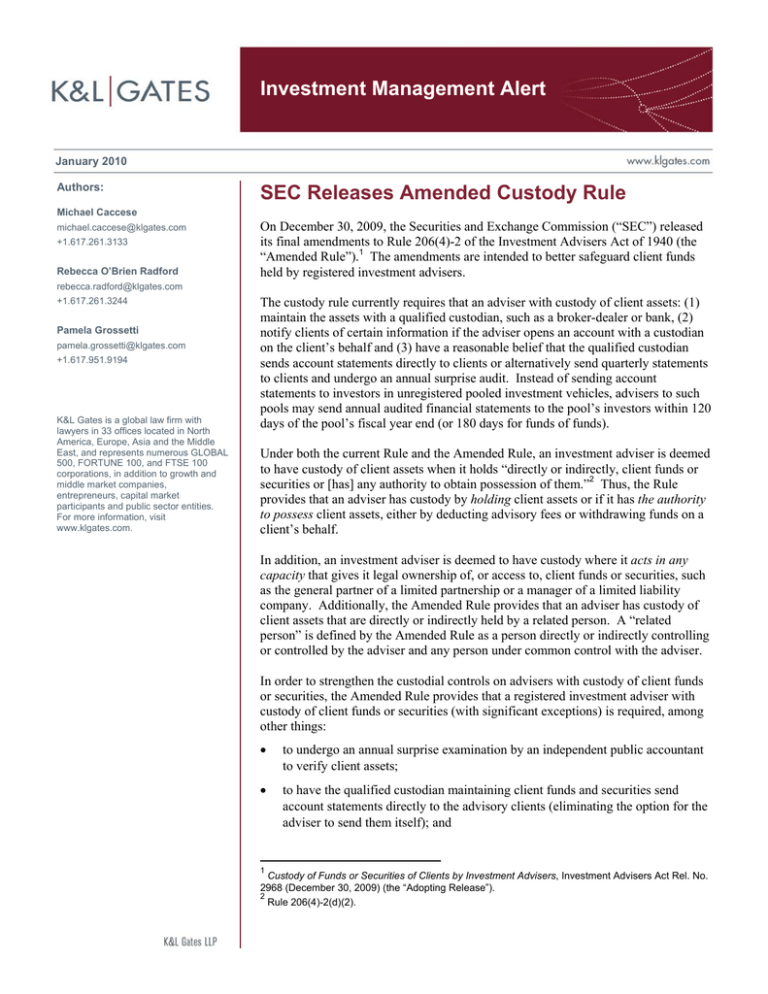

Effective and Compliance Dates

The SEC maintains that the Rule, together with its

accompanying guidance for accountants,14 will

provide for a more robust set of controls designed to

prevent client assets from being lost, misused and

misappropriated. The Amended Rule’s effective

date is March 12, 2010 (the “Effective Date”). The

following chart outlines compliance dates for

various provisions of the Rule:

14

Guidance for Accountants, the companion release to the

Adopting Release, updates examination methodology dating

back to 1966 that required verification of all client assets. The

SEC believes the new guidance will help lower the cost of

complying with the Amended Rule.

January 2010

4

Investment Management Alert

Adviser Type or Rule

Compliance Date

Amended Rules 206(4)-2, 204-2, and

Forms ADV and ADV-E (generally)

On and after the Effective Date of the Rule amendments.

Investment advisers required to obtain

surprise examinations

(a) First surprise examination must take place by December 31,

2010.

(b) For advisers that become subject to the Rule after the

Effective Date: within six months of becoming subject to the

requirement.

(c) If an adviser maintains client assets as a Qualified Custodian,

the first surprise examination must occur no later than six months

after obtaining the internal control report.

Investment advisers required to obtain or

receive an internal control report

Advisers to pooled investment vehicles

Forms ADV and ADV-E

The adviser must obtain or receive from its related person an

internal control report within six months of becoming subject to

the requirement.

The adviser may rely on the annual audit provision if the adviser

(or a related person) becomes contractually obligated to obtain an

audit of financial statements for fiscal years beginning on or after

January 1, 2010.

Advisers must provide responses to Form ADV in their first

annual amendment after January 1, 2011. Until the IARD system

is updated, accountants performing surprise examinations must

continue to file Form ADV-E in paper form.

Anchorage Austin Beijing Berlin Boston Charlotte Chicago Dallas Dubai Fort Worth Frankfurt Harrisburg Hong Kong London

Los Angeles Miami Newark New York Orange County Palo Alto Paris Pittsburgh Portland Raleigh Research Triangle Park

San Diego San Francisco Seattle Shanghai Singapore Spokane/Coeur d’Alene Taipei Washington, D.C.

K&L Gates is a global law firm with lawyers in 33 offices located in North America, Europe, Asia and the Middle East, and represents numerous

GLOBAL 500, FORTUNE 100, and FTSE 100 corporations, in addition to growth and middle market companies, entrepreneurs, capital market

participants and public sector entities. For more information, visit www.klgates.com.

K&L Gates comprises multiple affiliated partnerships: a limited liability partnership with the full name K&L Gates LLP qualified in Delaware and

maintaining offices throughout the United States, in Berlin and Frankfurt, Germany, in Beijing (K&L Gates LLP Beijing Representative Office), in

Dubai, U.A.E., in Shanghai (K&L Gates LLP Shanghai Representative Office), and in Singapore; a limited liability partnership (also named K&L

Gates LLP) incorporated in England and maintaining offices in London and Paris; a Taiwan general partnership (K&L Gates) maintaining an office in

Taipei; and a Hong Kong general partnership (K&L Gates, Solicitors) maintaining an office in Hong Kong. K&L Gates maintains appropriate

registrations in the jurisdictions in which its offices are located. A list of the partners in each entity is available for inspection at any K&L Gates office.

This publication is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon

in regard to any particular facts or circumstances without first consulting a lawyer.

©2009 K&L Gates LLP. All Rights Reserved.

January 2010

5

Custody Analysis by K&L Gates LLP of

Rule 206(4)-2 under the Investment Advisers Act of 1940 (the “Custody Rule”)

A. DO YOU HAVE

CUSTODY?

Do you have:

a. possession of

client funds or

securities;

b. arrangement

under which you

are authorized

to withdraw

client funds or

permitted to

withdraw client

funds or

securities

maintained with

a custodian

NO

NO

c. any capacity that

gives you or your

supervised

person legal

ownership of or

access to client

funds or

securities (e.g.,

general partner

and investment

adviser)?

YES

YES

YES

If the Custody

Rule applies,

you must obtain

an Internal

Control Report.

NO

d. a Related Person

that holds, directly

or indirectly, client

funds or securities,

or has any authority

to obtain

possession of

them, in connection

with advisory

services you

provide to clients?

YES

Go to B to determine if

the Custody Rule

applies.

If the Custody Rule

applies, you are excepted

from the Surprise Annual

Examination.

Go to B to determine if

the Custody Rule applies.

Do you: (i) have custody solely as a result

of a related person holding client assets;

and (ii) is your related person

“operationally independent” of you?

NO

YES

B. DOES THE CUSTODY RULE APPLY?

Is your client a registered investment company?

YES

NO

You are not required to

comply with the Custody

Rule with respect to the

account of a registered

investment company.

C. Is your client an unregistered

pooled investment vehicle?

If the Custody Rule applies,

you are excepted from the

Surprise Annual

Examination. Go to B to

determine if the Custody

Rule applies.

YES

NO

D. Do you advise your client with respect to “privately

offered securities”?

YES

NO

You must comply with the

Custody Rule; however, you are

not required to maintain

investments in privately offered

securities with a Qualified

Custodian. Privately offered

securities are subject to the

Surprise Annual Examination.

Financial Statement Audit

Does the pooled investment

vehicle:

undergo an audit at least

annually; and

distribute its audited financial

statements prepared in

accordance with GAAP within

120 days of the end of its fiscal

year (or 180 days if the pooled

investment vehicle is a “Fund

of Funds”)?

NO

YES

You are excepted from the Surprise Annual Examination

and distribution of statements by a Qualified Custodian

Does the pooled investment vehicle invest in

“privately offered securities”?

E. Do you advise your client with respect to mutual fund

shares?

YES

YES

You must comply with the

Custody Rule, although you

may use a transfer agent or a

Qualified Custodian. Mutual

fund shares are subject to the

Surprise Annual Examination.

NO

You must comply with the Custody Rule;

however, if you comply with the Financial

Statement Audit, you are not required to

maintain investments in privately offered

securities with a Qualified Custodian (or have

the Qualified Custodian distribute account

statements). Privately offered securities are

subject to the Surprise Annual Examination.

F. You must comply with the Custody Rule.

NO

You do

not have

to comply

with the

Custody

Rule.

NO

Go to E.

If the

Custody

Rule

applies, you

must obtain

an Internal

Control

Report from

your

Related

Person. Go

to B to

determine if

the Custody

Rule

applies.

APPENDIX: Definitions

1. Financial Statement Audit: Pooled investment vehicle is subject to audit by an independent public

accountant registered with the Public Company Accounting Oversight Board at least annually and

distributes audited financial statements prepared in accordance with GAAP to all beneficial owners

within 120 days of the end of its fiscal year or, in the case of a Fund of Funds, within 180 days of the

end of its fiscal year. Additionally, upon liquidation the pooled investment vehicle is subject to audit

and distributes audited financial statements prepared in accordance with GAAP to all beneficial

owners promptly after the completion of the audit. Non-US based funds may prepare their audited

financial statements in accordance with local GAAP, so long as differences to US GAAP are

reconciled.

2. Fund of Funds: A limited partnership, limited liability company, or another type of pooled investment

vehicle that invests 10% or more of its assets in other pooled investment vehicles that are not, and

are not advised by, a related person of the limited partnership, its general partner, or its adviser.

3. Internal Control Report: When an adviser or its related person serves as a Qualified Custodian for

advisory client funds or securities, the adviser must obtain, or receive from its related person, no less

frequently than once each calendar year, a written report, which includes an opinion from an

independent public account with respect to the adviser’s or related person’s controls relating to

custody of client assets, such as a Type II SAS 70 report.

4.

Operationally Independent: A related person is “operationally independent” of the adviser: if: (i)

client assets in the custody of the related person are not subject to claims of the adviser’s creditors;

(ii) advisory personnel do not have custody or possession of, or direct or indirect access to, client

assets of which the related person has custody, or the power to control the disposition of such client

assets to third parties for the benefit of the adviser or its related persons, or otherwise have the

opportunity to misappropriate such client assets; (iii) advisory personnel and personnel of the related

person who have access to advisory client assets are not under common supervision; and (iv)

advisory personnel do not hold any position with the related person or share premises with the related

person.

5. Privately Offered Securities: Securities that are:

a. Acquired from the issuer in a transaction or chain of transactions not involving any public offering;

b. Uncertificated, and ownership thereof is recorded only on the books of the issuer or its transfer

agent in the name of the client; and

c. Transferable only with the prior consent of the issuer or holders of the outstanding securities of

the issuer.

6. Related Person: A related person means any person, directly or indirectly, controlling or controlled

by the adviser, and any person that is under common control with the adviser.

7. Surprise Annual Examination: Client funds and securities for which the adviser has custody are

verified by actual examination at least once during each calendar year, except as provided below, by

an independent public accountant, pursuant to a written agreement, at a time that is chosen by the

accountant without prior notice or announcement and that is irregular from year to year. Advisers

currently subject to the Custody Rule must have their first surprise annual examination conducted

before December 31, 2010.

The written agreement must provide for the first examination to occur within six months of becoming

subject to the Amended Rule (if you become subject to the Rule after the Effective Date), except that,

if client funds or securities are maintained at a qualified custodian, the agreement must provide for

the first examination to occur no later than six months after obtaining the internal control report. The

written agreement must require the accountant to:

(i) file a certificate on Form ADV-E with the Securities and Exchange Commission (“SEC”) within

120 days of the time chosen by the accountant;

(ii) upon finding any material discrepancies during the course of the examination, notify the SEC

within one business day of the finding; and

(iii) upon resignation or dismissal from, or other termination of, the engagement, or upon

removing itself or being removed from consideration for being reappointed, file within four

business days Form ADV-E accompanied by a statement that includes:

(A) the date of such resignation, dismissal, removal, or other termination, and the name,

address, and contact information of the accountant; and

(B) an explanation of any problems relating to examination scope or procedure that

contributed to such resignation, dismissal, removal, or other termination.

8. Qualified Custodian: A qualified custodian means (i) a bank as defined in section 202(a)(2) of the

Investment Advisers Act of 1940 or a savings association as defined in section 3(b)(1) of the Federal

Deposit Insurance Act that has deposits insured by the Federal Deposit Insurance Corporation

under the Federal Deposit Insurance Act ; (ii) a broker-dealer registered under section 15(b)(1) of the

Securities Exchange Act of 1934, holding the client assets in customer accounts; (iii) a futures

commission merchant registered under section 4f(a) of the Commodity Exchange, holding the client

assets in customer accounts, but only with respect to clients’ funds and security futures, or other

securities incidental to transactions in contracts for the purchase or sale of a commodity for future

delivery and options thereon; and (iv) a foreign financial institution that customarily holds financial

assets for its customers, provided that the foreign financial institution keeps the advisory clients’

assets in customer accounts segregated from its proprietary assets.