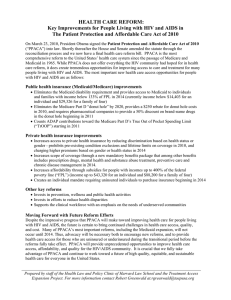

Health Care Alert Health Care Reform Client Alert Series

advertisement

Health Care Alert May 2010 Authors: Health Care Reform Client Alert Series Mary Beth Johnston marybeth.johnston@klgates.com 919.466.1181 Richard P. Church richard.church@klgates.com 919.466.1187 Stephanie D. Wall stephanie.wall@klgates.com 412.355.8364 K&L Gates includes lawyers practicing out of 36 offices located in North America, Europe, Asia and the Middle East, and represents numerous GLOBAL 500, FORTUNE 100, and FTSE 100 corporations, in addition to growth and middle market companies, entrepreneurs, capital market participants and public sector entities. For more information, visit www.klgates.com. On March 23, 2010, President Obama signed into law the comprehensive health care overhaul known as the Patient Protection and Affordable Care Act (“PPACA”), Pub. Law 111-148. 1 This wide-ranging law has far-reaching implications on the financing and delivery of health care in the United States. In addition, it contains substantial changes to federal health care program requirements, including health care fraud and abuse provisions. The following K&L Gates LLP client alert is one in a series of alerts directed to the health care provider and supplier community that are focused on particular implications of PPACA as to the payment and regulation of health care providers and suppliers. New Disclosure and Reporting Requirements Related to Manufacturers and GPOs Payments to Teaching Hospitals and Physicians Introduction PPACA institutes a new disclosure and reporting law for manufacturers and group purchasing organizations (“GPOs”) related to payments and “transfers of value” to teaching hospitals and physicians. While several states have enacted their own disclosure laws, PPACA is the first attempt to require transparency in the pharmaceutical and medical supplier industry at the federal level. Identification of potential fraudulent, excessive, and conflicted arrangements is undoubtedly the purpose behind the new requirements. 2 Pursuant to a newly enacted Section 1128G of the Social Security Act (42 U.S.C. § 1320a-7g), entitled “Transparency Reports and Reporting of Physician Ownership or Investment Interests,” the first required disclosures will be due on March 31, 2013, for the preceding calendar year. Accordingly, manufacturers and GPOs will need to start tracking the necessary information during calendar year 2012. 3 By September 30, 2013 and on June 30 of each calendar year thereafter, the submitted information will be made available to the public through an Internet website. 4 1 On March 30, 2010, President Obama signed the reconciliation bill (H.R. 4872, the "Health Care and Education Reconciliation Act of 2010" or "Reconciliation Bill"), which amended PPACA. 2 The provisions outlined herein are just one of several significant reporting requirements instituted by PPACA. For example, many drug manufacturers covered by the reporting requirements outlined herein will also be subject to the drug sample reporting requirements found in PPACA § 6004. Under that provision, beginning April 1, 2012, drug manufacturers and authorized distributors, as defined in 21 U.S.C. § 353, must report to the Secretary on the request and distribution of prescription drug samples, to the extent payment is available for such drug under Medicare or Medicaid or the Children’s Health Insurance Program state plans (or waivers of such plans), to practitioners or those acting on their behalf. 3 See PPACA § 6002. 4 See PPACA § 6002 (c). Health Care Alert While the Secretary of Health and Human Services (the “Secretary”) will be establishing procedures regarding the new disclosure and reporting requirements and also developing regulations to further define and expand on the requirements, this alert outlines the requirements of the new statutory provision in PPACA. 5 Who is Covered? The new statutory provision applies to applicable manufacturers and applicable GPOs. Applicable Manufacturers are defined to include any entity which is engaged in the production, preparation, propagation, compounding, or conversion of a covered drug, device, biological, or medical supply. The definition also includes any entity under common ownership with such entity which provides assistance or support with respect to the production, preparation, propagation, compounding, conversion, marketing, promotion, sale, or distribution of a covered drug, device, biological, or medical supply. The statute, however, only applies to manufacturers operating in the United States, or in a territory, possession, or commonwealth of the United States. 6 Covered drug, device, biological, or medical supply includes any drug, device, biological, or medical supply for which payment is available under Medicare or Medicaid or the Children’s Health Insurance Program state plans (or waivers of such plans). 7 Medical devices, for example, can range from cardiac or orthopedic implants to dental floss and toothbrushes. 8 Applicable GPOs is defined to include any GPO (as defined by the Secretary) that purchases, arranges for, or negotiates the purchase of a covered drug, device, biological, or medical supply which is operating in the United States, or in a territory, possession, or commonwealth of the United States. 9 Disclosure of Payments and Transfers of Value Effective March 31, 2013, and on the 90th day of each calendar year thereafter, any applicable manufacturer that provides a “payment or other transfer of value” to a “covered recipient” (or to an entity or individual at the request of or designated on behalf of a covered recipient) must submit to the Secretary (in an electronic form as the Secretary will require) certain information with respect to the preceding calendar year (e.g., calendar year 2012). 10 The Secretary is then directed to make such information available to the public at large. Covered Recipients is defined to include teaching hospitals and physicians and their immediate family members (other than a physician who is employed by an applicable manufacturer). Physicians generally include a doctor of medicine or osteopathy, a doctor of dental surgery or of dental medicine, a doctor of podiatric medicine, a doctor of optometry, or a chiropractor. 11 Significantly, teaching hospital is not defined. Payments or Transfers of Value is defined broadly to mean a “transfer of anything of value.” This includes not only payments for services provided (such as consulting fees, research, and speaking engagements) and returns on investment (e.g., profit distributions, dividends and option grants), but also gifts, meals and travel. 12 Recognizing the potentially broad scope of this definition, certain transfers of value are excluded, including: 5 Not later than October 1, 2011, the Secretary is required to establish procedures for applicable organizations to submit the required information. 6 See PPACA § 6002(e)(2) and (9). 7 See PPACA § 6002(e)(5). 8 www.fda.gov/MedicalDevices/DeviceRegulationandGuidance/ Overview/ClassifyYourDevice/default.htm Transfers made indirectly to a covered recipient through a third party in connection with an activity or service in the case where the applicable manufacturer is unaware of the identity of the covered recipient. 9 See PPACA § 6002(e)(1). See PPACA § 6002(a). 11 See PPACA § 6002(e)(11); 42 U.S.C. § 1395x(r). 12 See PPACA § 6002(a) and (e)(10)(A). 10 May 2010 2 Health Care Alert Transfers valued at less than $10, with an aggregate calendar year limit of $100 (with price index increases effective 2012). Product samples that are not intended to be sold and are intended for patient use. Educational materials that directly benefit patients or are intended for patient use. Loans of a covered device for a short-term trial period, not to exceed 90 days, to permit evaluation of the covered device by the covered recipient. Items or services provided under a contractual warranty, including, the replacement of a covered device, where the terms of the warranty are set forth in the purchase or lease agreement for the covered device. Transfers to a covered recipient when the covered recipient is a patient and not acting in the professional capacity of a covered recipient. Discounts (including rebates). In-kind items used for the provision of charity care. A dividend or other profit distribution from, or ownership or investment interest in, a publicly traded security and mutual fund. Payments for the provision of health care to employees under a self-insured plan offered by an applicable manufacturer. Transfers to a licensed non-medical professional solely for the non-medical professional services of such individual. Transfers to a physician in payment for services with respect to a civil or criminal action or an administrative proceeding. 13 Disclosures. The applicable manufacturer must disclose a variety of information, including, for example, the name and business address of the covered recipient; if the covered recipient is a physician, his or her specialty and NPI; and a description of the type and amount of the payment or transfer of value. If the payment or other transfer of value is related to marketing, education, or research, then the applicable manufacturer must disclose the name of the specific covered drug, device, biological or medical supply. 14 In addition, if an applicable manufacturer provides a payment or other transfer of value “at the request of or designated on behalf of” a covered recipient, then the manufacturer must disclose the information under the name of the covered recipient. 15 Delayed Public Disclosure for Product Research and Clinical Investigations. The statute does provide for delayed public disclosure by the Secretary with respect to payments or other transfers of value made to covered recipients pursuant to: A product research or development agreement for services furnished in connection with research on a potential new medical technology or a new application of an existing medical technology or the development of a new drug, device, biological, or medical supply; or A clinical investigation of a new drug, device, biological, or medical supply. 16 In such instances, the disclosed information will not be made available to the public until the earlier of (1) the date of the approval or clearance of the covered drug, device, biological, or medical supply by the Food and Drug Administration, or (2) four calendar years after the date such payment or other transfer of value was made. 17 This information is considered confidential and not subject to disclosure under the Freedom of Information Act or any other similar federal, state or local law until such times as 14 See PPACA § 6002(a)(1)(A). See PPACA § 6002(a)(1)(B). 16 See PPACA § 6002(c)(1)(E)(i). 17 See id. 15 13 See PPACA § 6002(e)(10)(B). May 2010 3 Health Care Alert the information is made available to the public under this new statutory provision. 18 Disclosure of Physician Ownership Effective March 31, 2013, and on the 90th day of each calendar year thereafter, applicable manufacturers and applicable GPOs must submit to the Secretary (in such electronic form as the Secretary will require) information regarding any “ownership or investment interest” held by a physician (or an immediate family member of a physician) in such organization during the preceding year (e.g., calendar year 2012). 19 Disclosures. An applicable manufacturer or GPO must disclose a variety of information, including, for example, the dollar amount invested and the value and terms of each ownership or investment interest. In addition, the same disclosure requirements noted above apply to an applicable GPO if there is a payment or other transfer of value to an owner/investor physician (or to any entity or individual at the request of or designated on behalf of an owner/investor physician). 20 Ownership or Investment Interest. While this term is not defined in PPACA, the statute carves out ownership or investment interests in a publicly traded security and mutual funds as defined under Stark suggesting that federal regulators will likely look to the Stark definition for purposes of rulemaking or enforcement. 21 Penalties for Non-Compliance An applicable manufacturer or applicable GPO that fails to submit information within the required deadlines is subject to a civil money penalty of not 18 See PPACA § 6002(c)(1)(E)(ii). See PPACA § 6002(a)(2). Immediate family members of a physician has the same meaning as under the federal physician self-referral law (“Stark”) and include husband or wife; birth or adoptive parent, child, or sibling; stepparent, stepchild, stepbrother or stepsister; father-in-law, mother-inlaw, son-in-law, daughter-in-law, brother-in-law, or sister-inlaw; grandparent or grandchild; and spouse of a grandparent or grandchild. See id.; 42 U.S.C. § 1395nn(a) and 42 CFR § 411.351. 20 See PPACA § 6002(a)(2). 21 See PPACA § 6002(a)(2); 42 U.S.C. § 1395nn(c). 19 less than $1,000 but no more than $10,000 for each payment or other transfer of value or ownership or investment interest not reported. There is a cap on the penalty of $150,000 applicable to each annual submission. 22 If, however, there is a “knowing” failure to submit information within the required deadlines, then the applicable organization is subject to a civil money penalty of not less than $10,000 but no more than $100,000 for each payment or other transfer of value or ownership or investment interest not reported. There is an annual cap on this penalty of $1,000,000. 23 State Laws While the applicable manufacturers will need to comply with this new federal provision, there is some reprieve from duplicative state requirements. PPACA preempts any state law that requires disclosure of the same information for any payments or transfers of value on or after January 1, 2012. However, any state law requiring disclosure or reporting of different types of information or by persons or entities other than applicable manufacturers or to persons or entities other than covered recipients as defined by PPACA is not preempted. Recommendations Given the breadth and scope of the disclosure requirements, and the increased scrutiny by the Office of Inspector General regarding their financial arrangements with teaching hospitals and physicians, covered manufacturers and GPOs should begin taking action to comply with PPACA’s requirements now. Teaching hospitals and physicians should also review their relationships, particularly with manufacturers, to assess the likely content of any reporting. It is important to note that while a particular hospital may not be a teaching hospital under this new law, hospitals that employ physicians within their systems should also review these relationships as covered manufacturers and GPOs will be reporting information about their employed physicians. 22 23 See PPACA § 6002(b)(1). See PPACA § 6002(b)(2). May 2010 4 Health Care Alert Information Gathering Systems: Applicable manufacturers and GPOs should develop the internal systems necessary to gather and report the information required under PPACA. Policies and protocols should be drafted or reviewed and amended to include the policies and procedures necessary to address the new federal requirements. Training: Staff should be trained on the scope and parameters of the new federal statute to insure that all reportable relationships are accurately identified and disclosed. Compliance Reviews: The gathering and/or disclosure of such information will inevitably trigger reviews of such arrangements, including potentially by federal regulators. Applicable manufacturers and GPOs as well as physicians and teaching hospitals should review each arrangement that will be subject to disclosure to confirm its compliance with the applicable regulatory requirements (such as Stark and the federal Anti-Kickback Statute) and company conflict of interest policies and other applicable policies of the organization. To the extent not already explicitly covered, the corporate compliance programs of teaching hospitals should require the reporting and approval of gifts and other financial relationships with manufacturers and GPOs as well as regular audits of these relationships. Additionally, such arrangements may merit public relations review to estimate the community and market reaction such disclosures required by this new law may trigger. In addition, as noted above non-teaching hospitals that employ physicians within their systems should be engaging in the same reviews of arrangements, policies and programs. For additional information, please contact: Boston Paul W. Shaw paul.shaw@klgates.com 617.261.3111 Harrisburg Ruth E. Granfors ruth.granfors@klgates.com 717.231.5835 Miami William J. Spratt william.spratt@klgates.com 305.539.3320 Newark Stephen A. Timoni stephen.timoni@klgates.com 973.848.4020 Pittsburgh Edward V. Weisgerber ed.weisgerber@klgates.com 412.355.8980 Stephanie D. Wall stephanie.wall@klgates.com 412.355.8364 Research Triangle Park Mary Beth Johnston marybeth.johnston@klgates.com 919.466.1181 Richard P. Church richard.church@klgates.com 919.466.1187 May 2010 5 Health Care Alert Anchorage Austin Beijing Berlin Boston Charlotte Chicago Dallas Dubai Fort Worth Frankfurt Harrisburg Hong Kong London Los Angeles Miami Moscow Newark New York Orange County Palo Alto Paris Pittsburgh Portland Raleigh Research Triangle Park San Diego San Francisco Seattle Shanghai Singapore Spokane/Coeur d’Alene Taipei Tokyo Warsaw Washington, D.C. K&L Gates includes lawyers practicing out of 36 offices located in North America, Europe, Asia and the Middle East, and represents numerous GLOBAL 500, FORTUNE 100, and FTSE 100 corporations, in addition to growth and middle market companies, entrepreneurs, capital market participants and public sector entities. For more information, visit www.klgates.com. K&L Gates is comprised of multiple affiliated entities: a limited liability partnership with the full name K&L Gates LLP qualified in Delaware and maintaining offices throughout the United States, in Berlin and Frankfurt, Germany, in Beijing (K&L Gates LLP Beijing Representative Office), in Dubai, U.A.E., in Shanghai (K&L Gates LLP Shanghai Representative Office), in Tokyo, and in Singapore; a limited liability partnership (also named K&L Gates LLP) incorporated in England and maintaining offices in London and Paris; a Taiwan general partnership (K&L Gates) maintaining an office in Taipei; a Hong Kong general partnership (K&L Gates, Solicitors) maintaining an office in Hong Kong; a Polish limited partnership (K&L Gates Jamka sp. k.) maintaining an office in Warsaw; and a Delaware limited liability company (K&L Gates Holdings, LLC) maintaining an office in Moscow. K&L Gates maintains appropriate registrations in the jurisdictions in which its offices are located. A list of the partners or members in each entity is available for inspection at any K&L Gates office. This publication is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon in regard to any particular facts or circumstances without first consulting a lawyer. ©2010 K&L Gates LLP. All Rights Reserved. May 2010 6