MICROSTRUCTURE NOISE AND PRICE DISCOVERY IN OPTION MARKETS: Michal Czerwonko*

advertisement

MICROSTRUCTURE NOISE AND PRICE DISCOVERY IN OPTION MARKETS:

THEORY AND EMPIRICAL EVIDENCE

Michal Czerwonko*

Nabil Khoury**

Stylianos Perrakis***

Marko Savor****

JEL CODE: G14, G15

KEYWORDS: contingent claims, market microstructure, volatility inversion, price

discovery, tick size, informed trading

This version: May 2012

*Postdoctoral Fellow, McGill University, Concordia University and University of Quebec in Montreal; **

Professor of Finance, University of Quebec in Montreal; ***RBC Distinguished Professor of Financial Derivatives,

Concordia University; ****Associate Professor of Finance, University of Quebec in Montreal. Financial support

from the Social Sciences and Humanities Research Council of Canada, the Autorité des marchés financiers, the

Desjardins Chair in the Management of Derivative Products, and the RBC Distinguished Professorship in Financial

Derivatives, is gratefully acknowledged. The authors are also grateful to participants at the 2011 Montreal

Mathematical Finance Days, the 2011 European Financial Management Conference, and the 24th Australasian

Banking and Finance Conference 2011, for their constructive remarks.

1

MICROSTRUCTURE NOISE AND PRICE DISCOVERY IN OPTION MARKETS:

THEORY AND EMPIRICAL EVIDENCE

Abstract

We document theoretically a major dependence of the Information Shares (IS) price discovery metrics of a financial

market on its microstructure noise, as well as on parameter estimation errors. We then study the impact of the tick

size reduction in the option market on the discovery process in that market by introducing a new inversion

methodology. In contrast with previous studies, we find that equity options showed negligible price discovery before

the tick reduction but exhibit major increases in IS thereafter. Last, we present event-type empirical evidence of

informed trading in the equity option market after the tick change.

2

MICROSTRUCTURE NOISE AND PRICE DISCOVERY IN OPTION MARKETS:

THEORY AND EMPIRICAL EVIDENCE

I. Introduction

Price discovery refers to the process by which new information is embodied in trading activity. For

optioned stocks such discovery can take place either in the option market or in the market for the

underlying asset. The study of price discovery (or informed trading) through the option market goes

back to at least thirty years, starting with Manaster and Rendleman (1982), with important

contributions by Vijh (1990), Stephan and Whaley (1990), Easley, O’Hara and Srinivas (EOS, 1998),

and Chakravarty, Gulen and Mayhew (CGM, 2004). These studies followed a wide variety of

methodological approaches and reached radically different conclusions: the early and the later studies

concluded that significant price discovery was taking place in the option market, while the two 1990

studies alleged that all such discovery was taking place in the market for the underlying asset. The

methodological approaches also shifted over time, from lead-lag analysis between the two markets to

the Information Shares (IS) method presented in the influential study of Hasbrouk (1995), who argued

persuasively that the earlier method was misspecified. The IS approach forms currently the standard in

price discovery studies between different markets, and almost all its applications in the pair of

underlying and option markets conclude that a significant amount of discovery occurs through the

option market.1

In this paper we focus on the applications of the IS methodology in assessing the price discovery

process in the option and underlying asset markets. The main contributions of the study are as follows.

First we show theoretically under plausible structural models of the microstructure errors, and with

asset dynamics consistent with the available empirical techniques, that the size (as measured by the

1

See CGM (2004), Holowczak et al (2006), Anand and Chakravarty (2007), Hsieh et al (2008), and Chen and Gau (2009).

3

variance) of existing microstructure noise in the option market has a major negative impact on the IS

metric in that market. We conclude that an accurate assessment of price discovery in the option market

should strive to preserve as far as possible the existing microstructure noise without distorting it by the

empirical design. We identify two major sources of such distortion in earlier studies, arising

respectively out of the implied price estimation through volatility inversion, and from the method of

estimating the IS metric. We develop alternative volatility inversion methods and a statistical

framework to a priori appraise such methods under plausible and relatively weak assumptions, be it in

simulated or in real data.2 We then apply the IS estimation in ways that avoid both distortions. We

show with our unbiased approach that the earlier studies gave a highly misleading picture of price

discovery in the option market, which was virtually nonexistent for equity options prior to 2007. As a

robustness check, we also validate our findings by using the alternative Component Shares (CS)

approach of Gonzalo and Granger (1995) that yielded qualitatively identical results.

We confirm our main theoretical result empirically by analyzing the effects of a new policy that

reduced the microstructure noise in the option market. On January 26, 2007 the Chicago Board of

Options Exchange (CBOE) introduced the first phase of its experimental Penny Pilot Program for 13

option classes that reduced the minimum tick size from $0.05 to $0.01 for option series trading below

$3 and from $0.1 to $0.05 for series trading above that level. 3 The tick size for all option series on the

QQQ and the DFX indexes was also similarly reduced. A second phase of the program was introduced

on September 28, 2007 for 24 additional option classes4 which are the subject of this study.5 Since such

2

Our paper is the first to consider the basic time series properties of the implied price both in simulated data when the

option pricing model is fully specified and in real data when such model is left unspecified. See sections 2.3, 2.5 and 4.1

later on.

3

CBOE Regulatory Circular RG07-09, Penny Pilot Program, January 18, 2007.

4

CBOE Information Circular IC07-150 SEC Approval of Penny Pilot Expansion, September 27, 2007.

5

The Penny Pilot Program was subsequently extended to 300 new option classes in 2009,and 2010, while delisted classes

were replaced by new ones. At present (May 2012) there are 370 option classes participating in the program. See CBOE

Information Circulars RG09121, RG10 004, RG10 16, RG10 51 and RG10 87.

4

a tick size reduction is expected to improve option market liquidity6 and reduce the implied price error,

it should obviously affect the price discovery process. 7 Indeed, we show that this tick size reduction

resulted in a major increase in the option market discovery metrics for all volatility inversion methods,

the ones proposed in this paper as well as the ones used in earlier studies. Last but not least, we present

an event-type study that confirms the fact that the tick size reduction resulted in a major increase in

informed trading through the equity option market, with extreme values of the option market’s price

discovery metrics leading abnormal returns in the underlying asset market by as much as seven days.8

Although, as already noted, several studies investigated various metrics of price discovery in markets

for options, there are relatively few theoretical studies of this discovery. Such studies have noted that

the lower liquidity of the option market is counterbalanced by its higher leverage in maximizing the

advantages that can be achieved by informed trading. The EOS (1998) study develops conditions under

which informed traders choose the option rather than the underlying asset market to exploit their

informational advantages. Nonetheless, their empirical results refer mainly to option trading volume as

a signal for informed trading, without any analysis of the simultaneous pricing in the two markets.

Other theoretical studies are by Biais and Hillion (1994) and Capelle-Blancard (2003).

The currently dominant IS approach to the price discovery process involving more than one market for

the price of a given financial asset was first presented in the pioneering work of Hasbrouck (1995). 9

Hasbrouck assumes that new information in each market is embodied in a common efficient or “true”

6

The proportional option bid-ask spreads are typically more than twenty times as large as the equivalent spreads for the

underlying assets, even for the most liquid index options; see also note 11.

7

Very few studies have dealt with this topic, and only Chen and Gau (2009) has studied option markets.

8

Similar tick size reductions have been introduced and studied earlier in other financial markets. In almost all published

studies the focus was on the effect that these changes had on market liquidity. These studies concluded that tick size

changes did have some impact on various liquidity measures such as bid-ask spread, trading volume and market depth, but

that its size and significance were unclear. See, for instance, Bacidore (1997), Bessembinder (2003), Bollen and Busse

(2006), Jones and Lipson (2001), and other references discussed later on in the text.

9

Earlier empirical studies had adopted the lead-lag analysis, which is a less robust methodology for this study. For an

example of such a study see Stephen and Whaley (1990).

5

asset price, together with independent error terms around that price when it is observed in the various

markets. He then focuses on a particular representation of this efficient price known as the Vector Error

Correction Model (VECM), originally developed by Engle and Granger (1987). The IS metrics are

defined as the contributions of each market to the variance of the efficient price, evaluated from the

VECM. An alternative metric, the Component Shares (CS), was developed by Gonzalo and Granger

(1995). Most studies have used primarily IS in the study of simultaneous pricing of cross-listed

securities in two different markets.10 In our case we focus on IS with CS used as a robustness check. It

turns out that both measures yield virtually identical conclusions in all cases.

There are several objective factors that make the application of the IS method difficult and imprecise.

First of all, option markets are generally characterized by lower liquidity and wider bid-ask

proportional spreads compared to their equity counterparts. While trading takes place within the quoted

bid-ask spread, the effective spreads that result from observed trades are also very wide, thus rendering

the concept of a unique implied stock price difficult to define.11 Second and most important, the

recovery of the underlying implied stock price from the observed option price is also fraught with

imprecision, as discussed extensively in the next section. Note that these difficulties in the implied

price estimation are peculiar to the option markets and do not affect, for instance, the futures markets,

for which the inversion of the cost-of-carry model is straightforward and does not involve unknown

parameters or large errors.12

10

See, for instance, Bacidore and Sofianos (2002), Eun and Sabherwal (2003) and Normandin (2004). For the relative

merits of the two metrics see below, note 29.

11

In the option sample used by Khoury, Perrakis and Savor (2011) the average option price was $1.33 for the period 20022004, while the quoted and effective average bid-ask spreads never fell below 0.16 and 0.13 respectively, yielding

respective proportional spreads of 12% and 10%. By contrast, in Fleming et al (1996) the average spread for stocks in their

sample was 0.58%.

12

For instance, Constantinides et al (2011) report that for 1990-2002 the S&P 500 index futures basis risk error was less

than 0.5% for 95% of the observations.

6

There are two issues that arise in the derivation of the option-implied underlying asset price, both of

which affect the option market microstructure error and through it the IS estimation. First, there are

several option contracts on the same underlying asset with differing strike prices and exercise dates

trading simultaneously, each one of which can define an implied price. In deriving the IS metric we

need to decide on the number of such implied prices to be aggregated in order to define the “average”

option market implied price. This is important, since any averaging obviously reduces the error of the

implied price and increases the IS metric as the number of averaged contracts increases, as we show in

this paper with both simulated and actual data. The practice varies in previous studies,13 and in this

paper we present the results for both a fixed number of contracts and all contracts that pass our minimal

liquidity filters.

The second issue concerns the method of implied price estimation, which starts with the option bid-ask

spread midpoint as an estimate of the option price. There are two alternative approaches to the

extraction of the implied underlying price estimation from this option price. CGM (2004) use the

Black-Scholes-Merton implied volatility as a simple translation device in order to estimate the option

implied stock price. Since using the contemporaneous stock and option prices to find the implied

volatility would result in a tautology, they invert the option price using a half hour lag to estimate the

implied volatility, thus assuming that this volatility remains constant during that lag. With the time

series of the observed stock prices and options’ implied prices, CGM estimated the Hasbrouck IS

metric and concluded that the option market’s contribution to price discovery was about 17.5% on

average. We shall call the CGM inversion method the Lagged Implied Volatility (LIV) method. 14

13

CGM (2004) do not mention the number of contracts, while Hsieh et al (2008) have used only the nearest at-the-money

contract, and Holowczak et al (2006) use the most actively traded option that may differ between observations.

14

The LIV method is also used for part of the empirical results of Anand and Chakravarty (2007), which, however, involve

the analysis of relative price discovery between implied price series of different options on the same underlying asset,

differentiated by volume. The underlying market does not enter the comparisons.

7

An alternative IS estimation is by the so-called “portfolio approach”, which relies on put-call parity

(PCP) and estimates the implied price as the difference between a call and a put option with equal

strike prices and times to estimation.15 This approach has its own problems, stemming from the fact

that PCP does not hold in the presence of transaction costs. Indeed, Muravyev et al (2012) document

many cases where there is absolutely no overlap between the spreads of the underlying and implied

prices. Further, all North American equity options are American, for which PCP holds only

approximately. Since our simulation experiments cannot accommodate American options, we do not

use the PCP approach in this paper and concentrate on the implied volatility.

Our study shows that that the IS estimates for the sample of firms used by CGM are highly misleading,

insofar as they are subject to two systematic biases that go in opposite directions but still yield results

that are far too high for the market conditions of the CGM data. By using the LIV inversion and a

statistical averaging technique followed by CGM that is described in detail in Hasbrouk (2002b, 2003

note 9) and Anand and Chakravarty (2007) we find almost the identical CGM result for the average

option market IS.16 When, however, this averaging technique is not adopted, the average option market

IS falls to between 0.9 and 2.2% for equities depending on the sample and the volatility conditions; our

proposed new inversion methods raise these numbers to 1.2-4.2%. For exchange traded funds (ETF)

these numbers become 9.1% and 10.8% under LIV and rise to 17% and 14.7% under the new inversion

methods. In all cases these numbers are a far cry from the CGM results. There was, thus, virtually no

price discovery taking place in the equity option market prior to the tick size change. 17 The misleading

results in CGM, and similar misleading results in several other earlier studies, are fully consistent with

our theoretical finding: since averaging techniques reduce the existing microstructure noise in the

15

See Holowczak et al (2006), Hiseh et al (2008), and Muravyev et al (2012).

This technique consists in reducing distant lags to moving average terms that subsequently enter the VECM model.

17

A recent study by Muravyev et al (2011) that appeared almost simultaneously with the early versions of this paper

reaches the identical conclusion with a totally different method, based on the portfolio approach of implied price

determination. We discuss this study extensively further on in this paper.

16

8

option market, which is much larger than the noise in the underlying market, they increase the IS

metric of the option market and falsely attribute price discovery to that market.

Since the averaging technique bias can easily be avoided, we concentrate on the volatility inversion

issue, for which we develop two new estimation and averaging methods. Given the importance of the

accuracy of such inversion methods, we develop a statistical framework to a priori appraise them. In

deriving this framework, we assume the stochastic volatility dynamics for the underlying price 18

without using any equilibrium arguments necessary for the derivation of the option price. Specifically,

we adopt a discrete time formulation of the underlying and option price dynamics that includes

microstructure errors and converges to the assumed continuous time dynamics in the absence of such

errors. In such a framework we define the volatility of the implied price and its correlation with the

option price in accordance with the observed option market dynamics but independently of the

inversion method. We develop benchmarks for these two parameters in terms of observable statistics in

simulated data, but also in the actual data. We then compare these two parameters to the derived

benchmarks under various alternative inversion methods.

We demonstrate that the LIV inversion method as applied by CGM produces estimates of the option

market’s contributions to IS that are as little as half their “true” measures. We provide clear evidence

that the source of this bias lies in the extraneous noise or the measurement error of the parameters’

estimation inherent in the this method. For this reason we apply smoothing to the parameters used in

the inversion methods applied in this study, which efficiently aggregates the microstructure noise

present in point-in-time estimates such as the LIV method. We test this smoothing with simulated data

and find that it eliminates the error arising out of the parameters necessary for a given inversion

18

We assume the stochastic volatility framework to be sufficient for the objectives of this work since jumps either in the

underlying security or in the volatility are rare events. Carr and Wu (2009) derive relatively low estimates for the error

resulting from neglecting jumps in deriving the variance swap rate from the option prices.

9

method, while preserving this microstructure noise of the option market which should play a role in the

price discovery. We also confirm that our smoothing satisfies with the real data the earlier developed

benchmarks.

The smoothing - or filtering we apply consists of using the median value for a set of the inversion

parameters estimated within a lagged moving window relative to each time point of our implied price

series.19,20 We apply this filter to the LIV inversion method and call the result the Median LIV (MLIV),

which yields the best results in simulated data. We also develop and apply a new inversion method

based on the assumption of the homogeneity of the option price with respect to the underlying and

strike prices which is preserved under most stochastic volatility and jump-diffusion models, termed the

Homogeneity Inversion (HI), whose parameters are also smoothed. Although the MLIV method is

slightly better in our simulation experiments, both methods yield remarkably similar estimates of the

implied price and remarkably similar results with respect to the contribution of the option market

according to the IS metric. As noted earlier, this contribution is more than twice the estimate from the

conventional LIV method. This is true both before and after the change in tick size.

Turning now to the tick size reduction effect, Seppi (1997), Anshuman and Kalay (1998) and Sandas

(2001) presented stylized equilibrium models of competitive market making in which tick size and

other trading restrictions play a role. Surprisingly, the tick size reduction does not always result in more

liquid markets in these models; e.g. as Seppi (p. 104) noted, the relation between the tick size and

liquidity is non-monotone and discontinuous.

19

Data smoothing by using a running median achieves two important goals for the problem at hand: first, it aggregates the

measurement errors on the inversion parameters; second, it deals with the expected non-normality of those parameters as

opposed to a running mean. See Bowman and Azzalini (1997).

20

The underlying plausible assumption is that over a short time interval the variation in parameters governing a given

stochastic process is relatively small compared to the variation in those parameters induced by the microstructure noise.

10

Although there are several empirical studies on the impact of tick size reduction on price discovery in

equity and futures markets,21 only one of them, by Chen and Gau (2009), examined the role of options

in this discovery. The authors use the CGM methodology and examine the IS metric before and after

the tick size reduction in the underlying Taiwan index tracking fund. They assess the impact of this

reduction on the corresponding markets for the index tracking fund itself as well as for the markets of

its options and futures and report that the tick size reduction in the tracking fund’s market significantly

increased its IS at the expense of both the futures and options. They attribute this finding to the lower

transaction costs in the tracking fund induced by the smaller tick size. We note that the adoption of the

CGM averaging technique by Chen and Gau (2009) may have also introduced difficult to assess errors

in relative magnitudes of the IS metric before and after the tick reduction.

To complete the analysis, we also explore one of the reasons for the large increase in IS in the option

market following the tick size change, by examining the link between our metrics of informed trading

in options with the future information in the underlying market. Following a large literature that relates

volatility to the flow of information and by using a powerful non-parametric statistical technique

introduced by Corrado (1989), we show that abnormal values of option market’s IS lead to significant

increases in the volatility of the underlying asset following the event, after but not before the tick size

change; this effect is confined to equity options. We conclude that the tick size caused a migration of

informed traders from the underlying to the option market, contributing to an increase in IS.

The remainder of the paper is organized as follows. In the next section we present the price discovery

model, including the IS and CS metrics, the impact of the microstructure noise, as well as our analysis

of the new option price inversion methods in the context of the stochastic volatility option pricing

model. Section III then presents the data and section IV the corresponding empirical analysis, which

21

See Section III for more details.

11

includes the comparison of the inversion methods with respect to the information shares of the option

market, the impact of the tick size reduction and various robustness checks of the results; this section

also includes a comparison with the results of previous studies. Section V presents the event study of

the increase in informed trading via the option market following the tick size change. Section VI

concludes the paper.

II. Methodology

A fundamental issue in price discovery involving simultaneous pricing in stock and option markets is

the inversion of the option price. In the CGM study the LIV inversion method for the option implied

price was largely motivated by ‘tautology avoidance’, i.e. by the fact that no model may be estimated

when the implied price is equal to the underlying price. In a variant of the Black-Scholes-Merton

(BSM) model a lagged implied volatility was used to invert the present price of an option into its

implied price. Since the BSM expression was used merely as a translation device, this approach is free

of the option model misspecification error.22 Nonetheless, there is a major concern regarding this

inversion method due to the empirical properties of its critical parameter, the lagged IV: if the volatility

is not constant but random or time- and/or state-dependent then the LIV estimate contains errors. As a

result, while the LIV method uses an unbiased IV estimate, the error variance of this quantity is

expected to add to the noise of the implied price estimates.

We begin this section with a presentation of the total error of the option implied price that includes

microstructure noise as well as errors in the derivation of that price. This is followed by a description of

the econometric methods used to estimate the IS and CS metrics and then by a theoretical analysis of

the impact of the total error on these metrics. Next we present a framework for gauging the accuracy of

22

See Berkowitz (2010) for an asymptotic justification of the practitioners’ BSM model, whose variant the LIV inversion

method explores.

12

the implied price derivation methods under the commonly assumed model of stochastic volatility asset

dynamics in option pricing. The section concludes with the presentation of new volatility inversion

methods and their comparison with LIV. One of these methods turns out to be superior, and is used for

most subsequent results.

2.1 The IS and CS price discovery metrics

Consider high-frequency time series of a derivative f and its underlying security S. Hasbrouck (1995)

and Gonzalo and Granger (1995) present econometric frameworks for the estimation of the

contribution of each trading venue to the price discovery process for a single security traded in multiple

venues. Since either framework requires that the prices in those venues be cointegrated, we can’t

directly estimate the price discovery from the observables. However, since the possibility of arbitrage

closely links option and underlying security prices, the inversion of the option prices yields time series

cointegrated with the underlying price with a known cointegrating vector. We denote this series by I t :

It h( ft ,t ) ,

(1)

where h(.) is a function yielding the implied underlying price and θ is a set of parameters necessary for

the inversion, assumed known exactly. Since this is clearly not a valid assumption, the series I t is

evaluated under an estimate ˆt of t . The effect of this estimation is a major new element in this

paper, with the impact of possible estimation errors on the price discovery process discussed at length

further on.

First we examine the estimation of the IS and CS metrics. For some well specified inverting function

h(.) we have the following order-one cointegrated price vector:

13

St Et S ,t

Pt

.

I t Et I ,t

(2)

In (2) E denotes the (unobservable) common efficient price,23 which is assumed to follow a random

walk:

Et Et 1 vt ,

(3)

where E (vt ) 0 , E (vt2 ) v2 and E (vt , vs ) 0 for

t s . The term S ,t represents the microstructure

noise of the underlying asset market, while I ,t is the total error in the option implied price, namely the

microstructure noise plus possible errors in its derivation. Microstructure noise denotes transient

microstructure effects in the two markets in the form of random variables with zero mean whose k-th

order autocovariance matrices depend only on k. In this paper we focus on the two particular sources of

the option implied price total error which are aggregated together in the term I ,t , namely option

market microstructure noise arising out of the tick size and possible errors from the implied price

estimation.

Under the Granger Representation Theorem we have the following Vector Error Correction Model

(VECM) specification:

l

Pt l ' Pt 1 Ai Pt i et ,

(4)

i 1

where

and

are [2x1] matrices respectively containing adjustment parameters and cointegrating

vectors, the [2x2] matrices Ai describe the short-term dynamics of the process, l is the optimal number

23

The order-one cointegration follows from the assumption that there is a single common trend, the efficient price. See

Stock and Watson (1988).

14

of lags. We also denote by the covariance of the serially-uncorrelated error terms et . The term

' Pt 1 represents the equilibrium dynamics between the prices.

The IS metrics are derived by a decomposition of the random walk variance, which may be estimated

even though the common efficient price is not observable:

2

RW

' ,

(5)

where are the (identical) rows of a [2x2] matrix given by24

1

1 0 l

Ai ,

0 1 i1

the [2x1] matrices and are non-trivial orthogonal complements to

(6)

and in (4) and the Ai

matrices are as in (4).25 The IS metric for a given market is defined26 as the proportion of the random

walk variance that is attributable to the innovations in that market. If the covariance matrix is

diagonal, then we have a clean decomposition into contributions of each market to the total variance of

the permanent component, with the contribution for the j-th market equal to

2j jj

. This diagonal

2

RW

property will hold if the underlying random walk hypothesis is well satisfied by the data, i.e. if there is

little contemporaneous correlation between the residuals in (4). If the off-diagonal elements are nonzero, which prevails in empirical work, then we apply the Cholesky decomposition to the covariance

24

See Johansen (1990).

See Johansen (1995) for the estimation methods of these orthogonal complements. Note also that by using (6), we avoid

estimating the matrix via an impulse-response function with a priori unknown convergence properties. In fact, for our

data those functions may require an excessive number of iterations to achieve any reasonable convergence.

26

See Hasbrouck (1995).

25

15

matrix and derive the lower and upper bounds on IS since this quantity varies with each ordering of

variables in the Cholesky decomposition.

The Gonzalo and Granger (1995) decomposition into the permanent and transitory components starts

with the same VECM model (3). Then we have the following decomposition of the price vector:

Pt C1 gt C2 Zt ,

(7)

where g t and Z t respectively represent the permanent and transitory components, C1 and C2 are

loading matrices, and gt Pt and Zt Pt with and as before. Note that here the efficient

price and the integrated of order one permanent component g t need not be random walks. Of interest

to us is the [2x1] matrix . Under the additional assumption that Z t does not Granger-cause27 g t

this matrix may be identified up to a non-singular multiplication matrix. The interpretation of the

permanent component g t is that it is a weighted average (linear combination) of the observed prices

with the component weights in . Booth et al. (1999) and Harris et al. (1995) suggest measuring price

discovery by defining CS as normalized to 1 elements of . The interpretation of the CS metric is

that the market which reacts the least to the innovations in the other market will display the highest

relative weight in the permanent component. An attractive feature of the Gonzalo-Granger (1995)

approach is that statistical hypotheses may be tested by a χ2(1) test, which we apply in our empirical

work.

27

See Granger (1980).

16

2.2

Microstructure noise and the IS metric

To assess the effect of microstructure noise on the option market IS metric we need to provide some

structure to the error terms S ,t and I ,t of the time series ( St , I t ) and their relationship to the random

walk. We use two alternative such structural models. In the first one there is no informed trading and

the error terms are mutually independent random variables and independent of the random walk term vt

, with respective variances S2 and I2 . The second one is a modified version of a model presented in

Hasbrouk (2007, Ch. 9), itself an adaptation of the Roll (1984) microstructure model, that recognizes

the presence of informed trading and possible momentum effects. Our main result holds under both

assumptions, but our detailed proof will be given under the simpler assumption that S ,t and I ,t are

time-independent and uncorrelated random error terms. In both cases the inversion error

ˆI ,t h ft ,t h ft ,ˆt

can be considered part of the term

I ,t

, together with the tick size and other

unspecified microstructure noise.

Under the Hasbrouk-Roll model the randomness of the microstructure noise affects the efficient price

revisions vt , which becomes now the sum of a pure random walk term ut and a component driven by

the direction of trade. Following Roll (1984), this direction is represented by the variable qt , which

determines both the location within the bid-ask spread but also possibly reflects private information and

affects, therefore, the efficient price. The two components of the time series ( St , I t ) have each one its

own revision proportional to the direction of trade. Analytically, while (3) still holds we now have:

vt ut wt , qt wt , St Et cS wt , It Et cI wt It .

(8)

17

In (8) the variables ut and wt represent the underlying asset market noise and information trading

respectively, while the term It , with E ( It ) 0, Var ( It ) I2 , Cov( It vt ) 0, Cov( It It j ) 0 j 0 ,

is again the option implied price total error that includes ˆIt ,. For both models (2)-(3) and (2)-(8) we

prove in the appendix the following result.

Proposition 1: The higher the variance I2 of the error term It in models (2)-(3) and (2)-(8) the lower

the information shares attributed to I t . The width of the information shares’ bounds also increases with

I2 .

As noted earlier, the parameters of the structural model are not observable, and the price discovery

effects have to be assessed through the IS and CS metrics evaluated from (4). To compare these

metrics, we note that IS measures the impact of innovations on the random walk variance, whereas CS

is concerned with the linear impact of the innovations. Although the IS metric is more popular in the

market microstructure literature and probably more relevant for price discovery, a recent study

recommended using both metrics because the IS metric is subject to microstructure noise from high

frequency data.28 In addition, CS does not rely on the random walk assumption, which is usually not

satisfied by the data.29 In our results we focus on IS, with CS presented as an extension and robustness

check.

To estimate system (4), which forms the basis for the estimation of our metrics, we use the Johansen

(1990) maximum likelihood approach, which was shown to have clearly superior properties among

28

See Yan and Zivot (2010).

There is an ongoing debate in the market microstructure and the related econometric literature about the relative merits of

the Hasbrouck (1995) and Gonzalo and Granger (1995) approaches. As De Jong (2002) points out, CS for a given market

ignores the variance of an innovation in this market while it measures the weight of this innovation in the increment of the

efficient price. On the other hand, IS measures the share in the total estimated variance of the efficient price contributed by a

given market.

29

18

alternative VECM estimation methods.30 We discuss in Section 4 the important issue of the differences

in the results induced by the VECM estimation when it is done by applying the polynomial distributed

lag (PDL) with moving average terms (MA), as suggested by Hasbrouk (2002b) and adopted by CGM,

Anand and Chakravarty (2007) and Chen and Gau (2009). Before proceeding with the estimates,

however, we must deal with the microstructure noise issues, which in view of Proposition 1 need to be

addressed. Since the error I ,t contains both the inversion error and microstructure noise such as tick

size effects, the implied price estimation should strive to minimize the former, which is added by the

empirical design and contaminates the IS metric, while preserving the latter, which belongs to the

discovery process. The procedures used can only be tested in simulated data that tracks the two errors

separately. In the next subsection we simulate the option implied price under a plausible and popular

model of asset dynamics in the presence of microstructure noise only and without any inversion error,

and derive diagnostic relations that should be satisfied by the implied price moments. Subsequent

sections introduce the volatility inversion methods and verify with the simulated data whether the

errors they introduce are sufficiently “small” to preserve these diagnostic relations.

2.3 Tick Size and the Accuracy of the Inversion Methods

We evaluate the accuracy of the inversion methods applied in this paper under the assumption of

stochastic volatility asset dynamics, with the inclusion of microstructure noise. As we argued in the

introduction, we assume that it is a sufficient framework for the analysis of the inversion problem.

Although our results hold for any type of noise, we limit ourselves to tick size noise in our simulated

data, since it is the most clearly defined and the focus of our empirical work. The state variables, that

is, the underlying price St and its volatility t vary according to the following bivariate diffusion:

30

See Gonzalo (1992).

19

dSt t St dt t St dw1

d t2 t dt t dw2

(9)

cov dw1 , dw2 dt

where dw1 , dw2 are elementary Wiener processes and t is a function at most of the stock price, while

the parameters t and t are generally functions of t but not of St or of past stock prices.31 We

assume that the correlation coefficient is negative, in line with most econometric results.32 We

apply Ito’s lemma to a derivative f t resulting from (9) by an unspecified risk neutral valuation

process. In the absence of microstructure noise f t is a known function f (St , t2 ) . We have, by Ito’s

Lemma:

dft ft ( S ) St t dw1 ft ( )t dw2 other terms ,

(10)

where we use only those terms that contribute to the quadratic and cross variations, the superscripts

denote partial derivatives, and the ‘other terms’ clearly do not contain either Wiener process. Those

‘other terms’ will vanish in all further derivations.

Now we state and prove four lemmas that establish statistical benchmarks by which we assess the

accuracy of the inversion methods applied in this paper. We assume for simplicity and without loss of

generality that there is no microstructure noise in the market for the underlying asset and that the

parameter t2 is known, but that the tick size induces a microstructure noise component TS , uncorrelated

with the error components of the diffusion, such that at time t t the derivative price becomes

31

It is possible to state a more general stochastic volatility process with respect to the functional dependence of the

parameters of this process. The presented specification is consistent with the homogeneity assumption that we use further

on in Lemma 3 and in one of the new inversion methods.

32

See, for instance, Christoffersen et al (2010, p. 14).

20

fˆt t f (St t TS , t2t ) f ( It t , t2t ) .

(11)

Setting St I t , we rewrite the discretized version of (10) as follows:

fˆt t ft ( S ) St t t tt t t TS ft ( )t t t 1 2t t

t o(t ) , (12)

wheret t and t t are mutually independent and N(0,1) error terms, and

St (t t tt t t ) TS St t TS It t .

Let also

(13)

ft ( ) t

; this variable is negative for calls and positive for puts. We may now prove the

St f t ( S )

following results:

Lemma 1

Under the state variables’ dynamics (9) and in the absence of microstructure noise we have the

following restriction on the correlation coefficients fS of the underlying and the derivative prices, and

IS of the inverted and underlying prices:

fS IS 1

(14)

Proof : By taking the appropriate quadratic and cross variations of the state dynamics (9) and the

stochastic differential of the option price (10), we have:

fS

df , dS

df , df

dS , dS

a b

df , df

a b

a 2 2 ab b2

,

(15)

21

where a St ft ( S ) t and b ft ( ) t . It immediately follows that fS 1 since the denominator exceeds

(a b)2 , QED.

We can rewrite the left hand side (LHS) of (15) as follows:

fS

2

(1 2 )

a 2 2 ab 2b 2

2

.

1

2

a 2 2 ab b 2

2

t 2 t 2

(16)

Note that in the simple univariate diffusion, in which the second random term in (10) disappears, both

sides of (14) are equal to 1. The importance of the result stems from the fact that under (9) the

cointegrated price series clearly deviate from the random walk implied by the simple diffusion process.

Hence, the size of the correlation fS is an indicator of such deviations. We assess its importance in the

numerical results further on in this section.

The next result is more important in establishing criteria to judge the effects of the tick size-induced

microstructure noise.

Lemma 2

Let ˆ fS indicate the correlation of the derivative price given by (11) with the underlying price. Then,

under the state dynamics (9) and in the presence of tick size microstructure noise, we have the

following relation between the correlation coefficients and the variances of the error terms:

IS

1

1

2

TS

2 2

t t

S t

,

ˆ fS

fS

1

1

TS2

,

(17)

2

2 2

2

S t

t

t

2 t

22

2

where TS

is the variance of TS .

Proof : We use the discretized version of (9), set for simplicity t 1 , and let 2f denote the variance of

2

df and I the variance of I t t from (13). We have

IS

Cov(St t , I t t )

( t St )2

( t St ) 2

,

2

t St I

( t St )2 TS

t St ( t St )2 TS2

(18)

from which the first part of (17) follows obviously. Similarly, if ˆ f denotes the volatility of fˆt t we

have from (12) for the second part

ˆ fS

Cov(fˆt t , St t )

a b

.

2

t Stˆ f

f ( ft ( S ) )2 TS2

(19)

Dividing now (19) by (15) and rearranging, we get the second part of (17), QED.

Next we establish a benchmark for the volatility of the implied price, but only for put options and only

under an additional assumption which, however, holds for most option models. Specifically we assume

that under the risk neutral transformation of the stochastic volatility asset dynamics (9) the option price

is linear homogeneous in ( St , X ) , where X denotes the strike price. This implies that the following

relation holds:

ft ft ( S ) St ft ( X ) X

(20)

We can then prove the following:

Lemma 3

23

2

Let I ( t St )2 TS

denote the volatility of the implied price. Then, under the homogeneity

assumption of the option price the following relation holds for put options

2

I

ˆ 2f

( ft ( S ) )2

(ˆ f St )2

( ft Xft ( X ) )2

(21)

Proof: Taking the variance on both sides of (12), we have

ˆ 2f ( ft ( S ) )2 I2 ( ft ( ) )2 2 2 ft ( S ) ft ( ) t St

(22)

Solving and re-arranging, we get

2

I

ˆ 2f

2

2

2 2 t St

(S ) 2

( ft )

(23)

(21) then follows immediately if we note that is positive for put options, QED.

The last result also establishes a lower bound for the all-important correlation between the underlying

and implied prices, depending again on the value of .

Lemma 4

For call options, if 2 t 0 33 then in the presence of microstructure noise we have IS ˆ fS .

Proof:

From the RHS of (18) it is clear that IS 0 ; it suffices, therefore, to show that ( IS )2 ( ˆ fS )2 .

Rewriting this last relation taking into account (18) and (19), we find that it holds if and only if

33

This condition is equivalent to a positive sign for the covariance of the call option stochastic differential with the similar

differential for the underlying price.

24

( 2 1)b2

0 . Since the numerator is obviously negative, the relation holds if the denominator is

a 2 ( a b) 2

positive, which holds if 2 t 0 , QED.

The variable plays an important role in establishing benchmarks for the volatility inversion methods

in our empirical work. We observe in (17) that the right-hand-side (RHS) of the second relation

exceeds the RHS of the first second one, with the difference depending on the size of . Similarly, in

(16) determines the difference between 1 and | fS | . On the other hand, there are reasons to believe

that

makes a small contribution to these relations. By approximating the ratio of partial derivatives

in by the Black-Scholes (1973) model quantities derived at the values of implied volatility, maturity

and moneyeness in our data at which

reaches its highest absolute value, we find this value to be

lower than | t | . As for the volatility of the volatility κ, it is clearly model-dependent; however, its

magnitude is generally low because of the documented persistence in volatility. 34 Hence, the highest

2

value of the quantity for all options is lower than 2 t2 , which is clearly of a lower order of

magnitude than the term t2 St2 . We expect, therefore, that in our data the RHS of the two equations in

(17) will be approximately equal and that Lemma 4 will hold, while to a lesser extent the correlation in

(16) will be close to 1 and (21) may also hold approximately for call options as well as exactly for put

options.

Since the sample counterparts of the quantities in (17) and (21) and of the correlations in Lemma 4 may

be easily estimated from the data, Lemmas 2, 3 and 4 establish powerful statistical benchmarks to

assess the accuracy of the inversion methods in simulated data. Note also that any additional errors

34

See Christoffersen at al. (2010), who find values of this quantity in the range 0.5-12.5% for the S&P 500 index at

different specifications.

25

from volatility inversion can also be considered as an additional factor increasing the error variance

TS2 , resulting possibly in violations of (21) for put options in the actual data. In the following

subsections, as well as in Section IV, we use Lemmas 2, 3 and 4 in numerical results demonstrating the

superiority of our proposed new inversion methods. Last, we note from (17) that the correlation IS

increases when the underlying price and its volatility are high. This establishes St as a determinant of

IS or CS for the option market for use in a later section.

2.4 Volatility Inversion Methods

Most empirical studies such as CGM and others approximate I t by setting It hˆ(.) BSM S1 ft , IVt ,

with BSM and IVt denoting the Black-Scholes-Merton price and implied volatility respectively,

observed by necessity at some earlier time t-τ; this corresponds to an estimate ˆt of t . As noted in the

beginning of this section, the key observation leading to an improvement over the LIV inversion

method is the fact that the parameter set as defined in equation (1) is subject to measurement error.

We also saw that the error in measuring reduces the price discovery metrics for that market.

Unlike microstructure noise, the parameter measurement error arising out of the volatility inversion

does not belong to the discovery process and needs to be eliminated. The “optimal” parameter

measurement is by polynomial fitting of the cross section of options on the same underlying asset at

any given time with respect to the strike price and time to expiration;35 we term this method the

Regression Implied Volatility or RIV. Unfortunately, RIV cannot be applied uniformly to our data set,

since the number of available options differs between stocks; further, the computational burden is

35

This was first applied in empirical option research by Dumas, Fleming and Whaley (1998). See also Christoffersen,

Heston and Jacobs (2010) and Berkowitz (2010).

26

prohibitively heavy if we want to do data smoothing. For this reason we examine this method only as a

benchmark and discuss its performance further on in this section.

We deal with the measurement error problem by data smoothing, 36 which leads to canceling out or

aggregation of the errors on . In practice, the data smoothing we apply consists in using a running

median for the inversion parameter set rather than a single lagged observation as in the earlier

studies. The use of the median is motivated by its ability to deal with the non-normality and with

possible data errors (outliers) that may still be present even after the screening that we apply. We also

show that our inversion methods compared to LIV admit shorter estimation windows, thereby allowing

the incorporation of more variability in the unobservable state variables. The relative performance of

the smoothing technique in reducing the volatility inversion error while leaving the microstructure error

unaffected is examined in the next subsection. Our main results focus on the smoothed LIV method or

MLIV, with the HI method described in the appendix and used as an extension.

The choice of the length of the moving window to estimate the inversion parameters involves balancing

several opposing effects. For the main results of this paper we used a five minute window, with 300

past observations in one-second intervals to estimate the inversion parameters. Such a relatively short

time interval that allows sufficient aggregation of the microstructure noise while admitting a relatively

high variation in the "true" parameters of the stochastic process appears to be the optimal choice for the

problem at hand.37

36

See Bowman and Azzalini (1997). Our smoothing is very similar to the one termed pre-averaging and described in detail

in Jacod et al (2009).

37

The risk of inducing a serial correlation in the error of the efficient price in equation (2) is small since by construction the

time series of the inversion parameters is smooth. Further, the optimal number of lags in the VECM model (3) is always

significantly lower than the length of a moving window. Note also that the earlier studies admitted relatively low variation

in those "true" parameters by selecting significantly higher lags.

27

2.5

The Relative Performance of the Volatility Inversion Methods

As noted, a volatility inversion method must minimize the parameter measurement error while leaving

intact the microstructure error. In order to test whether the proposed inversion methods achieve this

objective we use simulations that mimic more or less the characteristics of our data. In these

simulations we first assume the parameters known and use an option pricing model yielding a closed

form solution. In that model we introduce microstructure errors arising out of the minimum tick size

and examine the correlations between the underlying and implied prices. Next, we assume that the

option price parameters are unknown and compute the implied price series according to one of the

volatility inversion methods under consideration. A “satisfactory” inversion method should produce

implied price series that satisfy Lemmas 1-4 and have similar correlations with the underlying price

series as the ones arising out of the microstructure noise when the parameters are known.

For the simulations we choose the Heston (1993) model, which is the most popular stochastic volatility

model in option pricing and has a closed form solution. In that model the stock price instantaneous

mean is constant, while in (9) t is mean-reverting and t is proportional to t . The model is an

“incomplete markets” one, which admits a closed form solution only if we assume that the market price

of volatility risk is proportional to t . We use the following parameters for the base case: initial

volatility equal to its long-term mean of 0.3, volatility of volatility 0.4, speed of mean reversion 1,

correlation of Wiener processes -0.6, riskless rate 4%, stock drift 8%, price of volatility risk -5% and

initial underlying price 100.

Simulations of 300 paths for the stock were generated in one-second intervals for one trading day,

which totals 31,000 seconds. For these paths 15 option prices valued according to the Heston (1993)

model ('true prices') were generated for maturities of 1, 2 and 3 months and with five equally spaced

28

strike prices from 0.9 to 1.1 of the initial underlying price. We only simulated put option prices since

from those prices we may derive the upper bound on the implied price volatility (21). In the second

step, the prices for tick rules of 0.05 (below $3) and 0.1 (above $3) were derived from the model prices.

For the tick-adjusted or quoted midpoint prices, this price at time t was set equal to the quoted midpoint

price at t - 1 unless the midpoint price was at least one tick away from the model price. In this latter

case the quoted midpoint price moved by a minimal number of ticks so as to at least exceed (be below)

the 'true' price for an upward (downward) movement in the model price.

In the above setup it is apparent that the true implied price is simply the underlying price, since there is

no model or parameter uncertainty and the sole factor that may cause those prices to diverge is the

presence of frictions in the option market; we assume that there are no frictions in the underlying

market. The prices were inverted for HI, LIV and MLIV model with the interval or lag of 300 seconds.

In addition, the RIV model in the spirit of Berkowitz (2010), and Christoffersen et al (2010) was

applied. In that model, for the same lag as for LIV, we fit a least squares regression of the implied

volatility (IV) against a constant, the time to maturity, the strike price, and the squares of the latter two

variables. Finally, the fitted value for IV at time t was used for the inversion. We also added the best

estimate for the implied price without model or parameter uncertainty ('true implied price') denoted by

I, a quantity estimated by inverting the Heston (1993) model at the true parameters but for the option

prices affected by the tick rules as described above. The results for the performance of the inversion

methods are presented in Tables 2.1 and 2.2 below.38

[Table 2.1 approximately here]

[Table 2.2 approximately here]

38

For comparability purposes, we used only nine contracts for the HI, I, LIV and MLIV estimates, while all fifteen contracts

were used in the regression for the RIV inversion, since the inversion for the HI method was not possible at the extremes of

moneyness for each maturity.

29

In Table 2.1 we first note that all values of the true implied price volatility I satisfy the upper bound

(21) of Lemma 3,39 thus validating its use as an indicator of performance of the inversion methods with

the real data. As for the methods themselves, the MLIV performance is excellent, with all results very

close to I at the contract level in all cases. The HI results are somewhat higher but still close to the

benchmark for most contracts, while the LIV and RIV results are much higher than the benchmark in

all cases. On the other hand, at the aggregate level which is a simple average over all contracts, the

results for MLIV and HI closely bracket the similar average for I from above and below respectively,

while those of the other two methods are, as expected, much higher.

In Table 2.2 we first observe that in the absence of frictions the correlation fS between the derivative

price and the underlying price is lower than 1, as predicted by Lemma 1. It is, however, very close to 1

in all cases, as in the BSM model, implying that the latter model, with its random walk assumption,

may approximate quite well the more complex Heston model asset dynamics from the price discovery

point of view.40 Second, the microstructure noise arising out of the minimum tick size lowers

dramatically the size of the correlation ˆ fS , thus illustrating the importance of microstructure noise in

the price discovery metrics.41 We also note that this quantity is almost exactly equal to the “true”

correlation IS , a result that is not surprising and fully consistent with the fact that the correlation

39

The upper bound in (21) was adjusted to account for microstructure noise, since it was estimated by using the time t

values of f | f f X | that contain that noise.

40

A similar set of simulations for the BSM model, available from the authors on request, shows that the correlations

between the underlying and its derivative were always very close to 1, as predicted by the theory.

41

As an aside, we note that this dramatic drop in the correlation of underlying and implied prices as a result of the simple

tick size noise and without any other microstructure effects raises serious questions about the widespread practice of

estimating the underlying price’s risk neutral distribution from a cross section of option prices. Our results imply that such

an estimation is subject to major noise, even though it is the basis of several well-known studies such as, for instance, Carr

and Wu (2009).

(X)

30

between the underlying price and the frictionless derivative price is close to 1. Indeed, Lemma 2 shows

that when the variable is low the RHS of both relations in (17) are equal.

The acid test of a volatility inversion method is the consistency of the correlation of the underlying

price with the implied price that it produces with the “true” correlation IS that preserves the

microstructure but eliminates the inversion noise. As Table 2.2 shows, the MLIV results are virtually

indistinguishable from those of IS , while the HI results are very close to them. On the other hand, the

LIV and RIV values are much lower than IS in all cases, showing the contamination of the implied

price by the inversion method noise. For robustness check purposes, we varied the initial conditions

and verified the results of Tables 2.1 and 2.2. With respect to the relative performance of the inversion

methods, these results remained qualitatively almost completely unchanged when the initial conditions

were varied within the Heston model. Setting the initial volatility at 0.6 rather than 0.3 shows again that

the MLIV method performs best and was very close to the benchmarks (17) and (21), while HI

performs slightly worse and the other two methods much worse. On the other hand, the increase in the

initial volatility state had a significant effect on the level of correlations of the implied prices with the

underlying price. For instance, for MLIV the aggregate implied price correlation increased from 0.12 to

0.19, as predicted by relation (17) in Lemma 2. The same relation also explains the decrease in

correlation from 0.12 to 0.04 when the initial stock price is set at 20 instead of 100. To conclude, we

investigated the impact of the change in the tick rule, to 0.05 (0.01) for options priced above (below)

$3. For MLIV the same aggregate implied price correlation increases as a result of the change, from

2 42

0.12 to 0.28, which is again consistent with relation (17) because of the decrease in the variance TS

.

Finally, changing the initial conditions brought little or no improvement in the results achieved by the

42

The full results for changing the initial conditions are available in our online supplement.

31

polynomial fitting of the RIV method. Since this method involves a heavy computational burden for

data smoothing, we ignore it henceforth in our results.

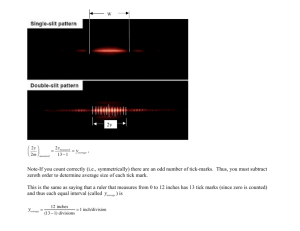

Figure 1 provides a graphic real data example of the implied prices derived by the HI and MLIV

methods compared to the LIV method.

The figure also plots the midpoints of the option and

underlying prices. It is clear from the figure that the HI and MLIV implied prices change only because

of the changes in the option price as we may expect a priori, while it is apparent that the implied price

for the LIV method contains variability not justified by the option dynamics. For instance, we observe

a large variability in the implied price for the LIV inversion for the flat segments in the option price;

we also observe directional changes for this method when the changes in the call price conform to short

lived demand/supply imbalances resulting in the widening or narrowing of the bid-ask spread shown in

the graph as the call price bounces back and forth around the same level. These anomalies, which

clearly do not reflect the option dynamics, don’t appear in the implied prices derived by the HI or

MLIV methods.

From the simulated option prices we may now estimate the VECM model (4) and the ensuing IS or CS.

Since the conclusions are similar for both metrics, we report the results only for the former quantity. In

the base case with the use all 18 option contracts the simulated IS midpoint was 25.2, 0.9 and 13.6%

respectively for the HI, LIV and MLIV methods. When we increased the initial volatility state to 60%

(decreased the option tick size), the corresponding estimates were 33.6, 0.8 and 18.9% (48.6, 0.5 and

42.1%). When we decreased the number of option contracts to four near ATM calls for the two nearest

maturities with the other parameters as in the base case, the respective estimates were 7.9, 1 and 3.2%.

These simulated results show that for the HI and MLIV inversions the increases or decreases in IS are

as predicted from the earlier discussion, with the metric increasing with volatility and decreasing with

32

tick size, and also increasing in the number of contracts for reasons discussed in Section IV. For the

LIV method, on the other hand, the behavior is erratic and often contrary to theoretical predictions.

[Fig 1 approximately here]

III. Data

Data for this study cover a 13 month period spanning from January 2007 to March 2008 inclusive, and

includes tick by tick quotes on options and their underlying securities. Our main data set is comprised

of 20 option classes out of 24 included in the second CBOE pilot program and their corresponding

underlying securities. Two option classes, namely Dendreon Corp. (ticker DNDN) and Financial

Select Sector SPDR (ticker XLF), were dropped from the sample because a substantial number of days

were missing in the CBOE tape. In addition, the Dow Jones (ticker DJX) and the mini S&P 500 (ticker

XSP) option classes were also dropped because the underlying data is reported approximately every 10

to 15 seconds, which precludes applying the VECM model on a one-second interval. Moreover, the

assets underlying the last two option classes are non-tradable, whereas our study focuses only on

options with publicly tradable underlying assets.

We included in our sample options maturing between 8 and 120 days. The data was first screened for

standard arbitrage violations, excessive bid-ask spreads and excessive implied volatility.43 Also, we

screen out the contracts for which in a substantial proportion of quotes we observe cA S A X cB or

pA X S B pB , since the option prices whose bid and ask prices bracket the early exercise value are

not informative. Since in our final sample we included only close to ATM options, the above screening

took place only for a limited number of close to maturity contracts. Note also that the presence of

43

Our screens resulted in discarding less than 0.5% of the option quotes.

33

dividends has little effect in our data since the only optimal time to exercise a call option is at the end

of the last cum dividend day.

One-second time series were then constructed for options and their underlying securities. Gaps in the

data were filled out with the last available quote. Finally, implied prices were derived for the three

nearest to the money call or put options for each maturity within the above limits. The final restriction

limited the moneyness of the included contracts, defined as the daily mean of the ratio of the strike to

the underlying prices, to a range of 0.9 to 1.1. Altogether, the data includes 273 trading days or 13

calendar months. More specifically, for the period before (after) the policy change, the data includes

146 (127) trading days, 2940 (2520) company-days and 38673 (36470) option contracts.44 Table 3.1

presents the description of the underlying securities in our sample.

A comparison sample was also constructed using the same sampling approach.

This comparison

sample was composed of the same number of randomly selected option classes where all available

classes in the Option Metrics database were first filtered according to the following criteria: i. the total

volume of transactions of the option class is no higher than that of the most traded class in the main

sample and no lower than that of the least traded, ii. the class remains actively traded during the entire

period under study.

[Table 3.1 approximately here]

Table 3.2 presents the descriptive statistics of the main and control samples for the 7 months before and

the 6 months after the minimum tick size reduction was implemented. We first note that there were

large and systematic differences in volume between the main and control samples before and after the

tick size change for both equities and ETFs, implying that volume size may have been a factor for

44

To derive the IS or CS we reduced the number of contracts. See the following section.

34

inclusion of an option series in the pilot program. 45 There was also an increase in volume in the postchange period, which appears small but was statistically significant: 0.24 (t-stat 4.06) and 0.34 (t-stat

7.77) for the main and control samples respectively for equities, and 0.57 (t-stat 5.80) for the main

sample ETFs, with the control sample’s volumes being approximately equal before and after the

change.

From the point of view of liquidity, the table shows that both quoted and effective spreads declined in a

statistically significant manner after the minimum tick size reduction was implemented. It is important

to note that prior to the change the differences in spreads between the main and control samples were

not statistically significant either for quoted or for effective spreads. These last results provide further

evidence of the effect of the minimum tick size reduction on transaction costs in option markets.

Overall, these findings are consistent with those reported for equity markets (e.g. Henker and Martens

(2005)) and for futures markets by Kurov (2008).46 The reductions in spreads were accompanied by

corresponding reductions in the sizes of the quotes. More specifically, the table shows that both the bid

and ask quote sizes of the option classes included in the pilot project decreased significantly after the

minimum tick size reduction was implemented, while the corresponding sizes increased moderately

and non-significantly for the option classes in the control sample.

[Table 3.2 approximately here]

These introductory results indicate the importance of the tick size change on transaction costs and the

efficiency of trading. Note also in Table 3.2 that the pilot and comparison samples exhibit small but

45

Note that our control sample selection was based on the best volume match in the three months prior to the period of

study. The fact that that sample’s volume remained much lower than the main sample’s indicates that the options in the

latter sample were heavily traded during the study period.

46

On the other hand, Bollen and Busse (2006), Chakravarty et al (2004), Graham et al (2003), Jones and Lipson (2001) and

Harris (1994) suggest that the reduction in tick size can increase the cost for liquidity providers thus adversely affecting the

bid-ask spread. These suggestions are not confirmed by our results.

35

statistically significant differences in their implied volatility levels prior to the tick size change, while

these levels increase sharply, especially for the control sample, after the tick change; these levels

reflect the general market environment at the time of the pilot project’s implementation. A similar

effect is observed in the comparison between realized volatilities in the underlying markets, which

were approximately equal for both main and control samples prior to the change, while in the later

period the realized volatility of the control sample is much higher than that of the main sample for both

equities and ETFs. The widening differences in both implied and observed volatilities between main

and control samples after the tick size change merit further research that requires a much larger sample

and transcends the purpose of this paper.

IV. Empirical analysis: inversion methods, IS and CS before and after the tick size change

To derive our main results we use a five-minute moving window (or lag) of data for the estimation of

the parameters of the inversion methods. Results for other time-frames are presented as robustness

checks. To derive the option implied price which enters the VECM model (4), we aggregate the prices

implied by four ATM call options47 with the two nearest maturities that exceed the applied screen of

eight days.

In view of Proposition 1, the number of options used to derive the implied price plays a role in deriving

the IS. If the implied prices are perfectly correlated then their aggregation will not affect the variance

of the microstructure noise and, therefore, the size of IS. Unfortunately this is not the case in practice,

since the tick size, for instance, has a different impact on each option, implying that the aggregation

will have a diversification effect and increase the IS. There are, therefore, important reasons to limit the

number of options used to derive the implied price. First, a large number of option contracts will

47

Anand and Chakravarty (2007) argue that near-term ATM equity call options contain a large proportion of the

information of the option market.

36

introduce an upward bias in IS through diversification effects, even though additional option contracts

may or may not introduce any additional information.48 Second, the economic analysis of the

comparisons of IS across underlying securities in Section V is more reliable if it is done for an equal

number of similar option contracts for every security. We present the results for all option contracts

which passed our screens as a robustness check.

4.1 Accuracy of Inversion Methods

In this section we present the accuracy of the inversion methods relative to the two benchmarks,

expressed by relation (21) and the inequality of the correlations of Lemma 4. Apart from assessing the

merits of the two methods proposed in this paper relative to LIV, the empirical results are of some

interest since to our best knowledge our study is the first to assess the implied price a priori. Both

inequalities apply to the instantaneous measures of the indicated variables, which vary continuously.

We estimate the benchmarks, the RHS of (21) for put options49 and the correlation ˆ fS for call options,

from the equivalent sample estimates in the sample of one-second interval observations in each day.50

In Table 4.1 we present the summary statistics for the performance of the inversion methods applied in

this study for a five-minute moving window or lag used to derive the inversion parameters, with the

results aggregated for implied prices specific to each appropriate option contract; specifically, the

correlation statistics are derived for call options and the volatility statistics for put options, with four

48

This argument is corroborated by simulations results in section 2.4 that show increases in IS as the number of aggregated

implied prices increases, even though there is little incremental information from these additional prices.

49

As with the call options, we include four ATM contracts for the two nearest maturities.

50

For the RHS of (21) we use the sample volatility to estimate ˆ f and the daily median of the values of the factor

St /( ft Xft

(X )

) , with ft

(X )

estimated from (A6). Although the accuracy of the benchmark estimate cannot be assessed, any

possible bias would not affect the comparative performances of the volatility inversion methods.

37

contracts for each option type per firm day.51,52 We present the results for both our main and control

samples separately for equities and for Exchange Traded Funds (ETFs) because of significant

differences between these two groups in the main quantities of interest, as discussed in the following

subsection. In addition, we split the results around the date for which the tick policy change occurred.

We also show in the table the proportion of cases for which relation (21) and Lemma 4 were satisfied

in our data. For descriptive purposes, we also present the proportion of cases for which two null

hypotheses, H 0 : ρIS ≥ ρfS and H 0 : σI ≤ [RHS of (21)] were not rejected with a p-value of at least

0.1.53

[Table 4.1 approximately here]

The results in Table 4.1 show clearly that both the HI and MLIV inversion methods outperform the

LIV method in all cases. Further, the performance of LIV inversion worsened after the decrease in the

tick size uniformly across equities and ETFs and for both main and control samples. Out of the two

proposed inversion methods, MLIV outperforms HI in all cases, especially with respect to the volatility

benchmark (21), while their performances regarding the correlation benchmark of Lemma 4 are closer.

The performance statistics for our main and control samples before and after the policy change indicate

that the two groups are quite similar, especially for the equity group.

[Table 4.2 approximately here]

[Table 4.3 approximately here]

51

To derive the results in table 4.1 we used 9344 (8128) options contracts of each type before (after) the policy change for