Front-running and post-trade transparency

advertisement

Front-running and post-trade transparency

Corey O. Garriott†

Bank of Canada

Post-trade transparency is thought to increase the potential for

costly front-running, but order management can circumvent frontrunning and can even make it welfare-improving. This weakens

the critique of efforts to increase post-trade transparency. Frontrunning is indeed harmful to traders who must transact at a

fixed and future time. Competition among front-runners improves welfare, and front-running tends to attract competition

since it causes observable price momentum.

Part of the business of professional trading is to construct a position

without disclosing the intention to do so. If it becomes obvious someone is

buying, others might buy to raise prices and then sell at them. The practice

of moving prices ahead of future flows and trading against the flows is called

front-running.1 Market participants who cannot disguise their trading intentions can suffer higher transactions prices; after the London whale incident

in 2012, Reuters wrote: “Whenever a trader has a large and known position,

the market is almost certain to move violently against that trader.”2

Financial institutions have used the potential for front-running to argue

against increasing post-trade transparency.3 They point out there is “information leakage” in the record of trade that can be used to infer their future

trading intentions and that if they are front run they are likely to supply

less liquidity.

In a trading game I present, information leaked to front runners is instead

good for market quality and for individual market participants. The game’s

front runner knows another market participant must transact a large “block”

quantity. The trader who must transact the block has the freedom to choose

the number and the timing of its transactions. If the block trader uses a good

order management strategy, it can circumvent front-running. The strategy

†

Contact: cgarriott@bankofcanada.ca. 234 Wellington St., Ottawa, Canada, K1N 5E6.

For a broker to trade ahead of its own clients’ orders is illegal in many jurisdictions,

but it is both legal and common for market participants to anticipate order flows by other

means, such as the history of trade. See Harris (2003, chap. 11, “Order Anticipators”)

2

“JP Morgan: When basis trades blow up.” Felix Salmon, 10 May 2012, Reuters.

3

For example, “OTC Derivatives Reform: A Discussion of OTC Markets in the Canadian Context.” CanDeal, June 2012.

1

1

is to distribute its trades in such a way as to motivate the supply of liquidity.

The presence of agents who have knowledge about future flows can hence

be welfare-improving. Front-running is costly to traders only if they must

trade at fixed and future times.

In the game, agents may buy and sell an asset in a dealer-intermediated

market. One of the agents present is a front runner. The front runner has

special information about future trading flows. If it knows the future flows

are to arrive at fixed and future times, the runner exploits its knowledge by

trading to move prices against the flows. The runner starts moving prices

immediately, well in advance of a future flow, because it pays equilibrium

transactions costs on which it can economize by trading incrementally. The

runner is successful in moving prices against future flows, and so it extracts

a rent.

In contrast, if the runner knows the future flows are to come not at fixed

future times but at times chosen by a “block trader” agent, who has an

exogenous need to construct a given block position, the runner’s presence

is instead welfare-improving. The runner would still like to push prices

against the block trader, but the block trader responds opportunistically.

The block trader distributes its trades through time in a way that motivates

the runner to supply liquidity. The strategy is (in part) to do the front

runner’s front-running for it, incentivizing the runner to trade against the

flows.

The policy implication is that traders (at least in this model’s market

structure) should not fear information leakage but in fact should prefer the

trading record be as transparent as possible so as to attract liquidity supply. Empirically some traders do in fact employ transparency to source

liquidity—whence the practice of sunshine trading, the announcement that

a particular agent is going to place a large trade. There are some caveats

to the model’s result. The model market is assumed to be intermediated by

anonymous and competitive dealers. If a block trader must trade bilaterally with one dealer in a noncompetitive setting, it is likely the block trader

would receive poor prices.

1.1

Contribution

The theoretical literature on front-running has focused on a conflict of interest posed by “dual trading” broker-dealers and brokers who internalize

(Röell 1990, Fishman and Longstaff 1992, Sarkar 1995). There could be a

conflict because dual-trading brokers often trade against their own clients.

But in some cases internalization in a competitive brokerage market can ac2

tually benefit uninformed traders. The reason is that verifiably uninformed

order flow is a commodity for which brokers compete. The older literature

did not endow agents with information about future flows. Bernhardt and

Taub (2008) did, and it is the paper most related to this one. They study

a two-period model in which the direction of liquidity trading persists. Liquidity traders are front-runned, and the runner extracts a rent. The case

that Bernhardt and Taub study is similar to the first case studied in this

paper, in which flows must arrive at a fixed future time.

Past literature has not focused on the time-series structure of frontrunning (and of avoiding being front-run), which is the focus here. In addition past literature studied running under the assumption of asymmetric

information about value, which was assumed because it enables the order

flow to impact prices. In contrast in this paper price impact derives from

limited capacity to bear risk, which dispenses with the need for private information about value. A pure-liquidity Kyle (1985) model is novel.

1.2

Structure of the paper

The model is defined in section two. Section three gives equilibrium outcomes under two different assumptions about what a front runner knows. In

the first version of the model (section 3.1) the front runner knows the order

flow will arrive at fixed future times. In the second version of the model

(section 3.2) the front runner knows future order flow is being managed by

a rational block trader who can choose the times and quantities at which it

trades. In section 4 the paper gives conclusions.

2

Model

There are T periods of trade indexed by t ∈ {1, 2, ..., T }.

There is one asset, infinitely divisible and in infinite supply. The asset

trades at price pt at time t. At the end of the game the asset pays a cash

dividend ν that is random and follows the normal distribution with constant

mean scaled to zero (without loss of generality),

ν ∼ N (0, σ).

(1)

There is one “front runner” agent. A front runner maximizes trading

profits by choosing signed trades xt to maximize the risk-neutral objective

" T

#

X

E −

p t xt .

(2)

t=1

3

There is a unit measure of “dealer” agents. They are infinitesimal, have

identical properties, and behave identically in equilibrium, so I do not index

them. They choose signed trades yt to maximize the CARA objective

"

!#

T

X

E − exp −YT ν +

,

(3)

pt yt

t=1

P

where Yt = tτ =1 yτ is the dealers’ inventory at the end of period t. Dealers

begin the game with zero inventory of the asset, Y0 = 0.

There is one “liquidity trader” agent that chooses signed trades zt . This

paper will study the model’s equilibrium outcome for two versions of the

liquidity trader. In the first version, the liquidity trader is a typical microstructure noise trader that draws zt from a normal distribution,

zt ∼ N (0, σz )

(4)

In the second version, the liquidity trader is a “block trader” who must

end the game with the inventory objective Q, which can be negative. The

block trader chooses signed trades zt to maximize the risk-neutral objective

function

" T

#

X

E −

pt zt

(5)

t=1

s.t. ZT = Q,

Pt

where Zt = τ =1 zτ is the block trader’s inventory at the end of period t.

The information sets are as follows. All agents in period t are aware of

the history of past prices ht = {pτ }t−1

τ =1 and the dealers’ initial inventory

Y0 . In addition, the runner has special knowledge about future flows in its

information set I. In the first version of the model, the version with a noise

trader, a runner knows the noise trader’s flows:

I = {zt }Tt=1 .

(6)

In the second version of the model, the version in which there is a block

trader, a runner knows the block trader’s inventory objective:

I = Q.

(7)

The mechanism of trade is the idealized Kyle (1985) batch-order market.

Accordingly xt and zt are interpreted as market orders, and the sum of

4

market orders is interpreted as the order flow.4 The dealers’ yt is interpreted

as orders filled by the dealers.5 The timing every period is as follows. First

the front runners and liquidity trader post market orders to the dealers.

Then the dealers form a price pt competitively. Then the dealers choose to

fill a quantity of the posted orders yt . Last the order flow and the dealers’

fill is executed at the price pt .

3

Equilibrium

Definition A competitive equilibrium is a sequence of prices and trades

{pt , xt , yt , zt }Tt=1 for which xt and yt maximize (2) and (3), and if the liquidity

trader is a block trader zt maximizes (5), and prices motivate dealers to fill

unmatched orders, yt = xt + zt .

Proposition 1 The equilibrium price sequence (in both model versions) is

pt = σYt

(8)

= σ (Yt−1 + xt + zt )

All proofs are in the appendix.

The prices exhibit a time-varying inventory premium, which is the difference between the equilibrium prices pt and E[ν]. The premium is an

inventory premium because the asset price increases with volatility if dealers are long whereas the price decreases with volatility if dealers are short.

The premium is linear in the dealers’ inventory and linearly increasing in

the order flow. The premium persists from period to period, compensating

dealers for bearing risk. Since prices increase linearly in the order flow, the

front runner pays a transactions cost that is quadratic.

3.1

Equilibrium with a noise trader

Suppose zt is drawn using (4).

Proposition 2 The front runner’s equilibrium market order sequence is

T

X

xt = −αt Yt−1 − αt zt + αt

β τ zτ

(9)

τ =t+1

where αt = 1/(T + 2 − t) and βτ = T + 1 − τ .

4

For a discussion of the definitions of market order and order flow, see Harris (2003).

Due to the interpretation of yt as a filled order, the sign of the dealers’ trades is

inverted: positive yt are dealer sells. The convention keeps all signs in the model positive.

5

5

To understand the front runner’s behavior, consider three extreme cases.

First suppose the noise trader only trades once and at the beginning of the

game, so zτ = 0 for τ > 1. In such a case the front runner has nothing

to front run, so it merely arbitrages the price toward E[ν]. It absorbs a

constant quantity of the dealers’ inventory every period, xt = −z1 /(T + 1).

The runner absorbs the dealers’ inventory incrementally and in equal pieces

rather than all at once so as to economize on the quadratic transaction costs.

Next suppose the noise trader only trades once but at the end of the

game, so zτ = 0 for τ < T . Now the front runner slowly moves prices

toward an ideal period-T execution price. Every period before T it trades a

constant quantity αt (zT − Yt−1 ), which guides Yt−1 to the value zT at rate

αt , and hence guides the price toward σzT . As before, the runner trades

incrementally so as to economize on the quadratic transaction costs.

Last suppose the noise trader only trades twice, at two different times t1

and t2 . Now the front runner trades off the transaction costs necessary to

move the time-t1 price toward its ideal with the transaction costs necessary

to move the time-t2 price toward its ideal.

Definition “Prices exhibit momentum” at time t if the sign of the price

change at time t − 1 is expected to persist in period t,

sgn (E [∆pt |ht ]) = sgn (∆pt−1 )

(10)

and “prices exhibit a reversal” if the equality does not hold.

Proposition 3 For some quantity γt < 1 given in the appendix, for times

t < T prices exhibit momentum if

|pt−1 | > γt |pt−2 |

(11)

and if not, they exhibit a reversal.

A peculiarity of the runner’s strategy against a noise trader is that the

strategy induces price momentum, i.e. a persistence in the first differences

of prices, which is empirically observable. Price momentum is an artifact of

the runner’s decision to trade incrementally and well in advance of future

flows. Since price momentum is observable to third parties it stands to

reason other agents might monitor the order flow for signs of front-running

and trade on the information. Front-running tactics suffer from their own

form of information leakage. The information leaked by a front-runner’s

own trading behavior would attract the entry of additional front-runners.

6

Proposition 4 The entry of additional runner agents is welfare-improving

for the noise trader (assuming the noise trader’s utility is increasing in

wealth).

Additional front runners are welfare-improving for the same reason that

additional Cournot oligopolists are welfare-improving. Multiple runners

would like to coordinate to split the surplus of front-running but their individual incentives are not sufficiently well-aligned to sustain cooperation.

Because their incentives to cooperate are weak they are more prone to arbitrage the price (and absorb dealer inventory) relative to the behavior of a

single, “monopolist” front-runner.

3.2

Equilibrium with a rational block trader

In contrast to section 3.1, suppose zt is instead chosen as the arg max of (5).

Proposition 5 The block trader prefers the runner agent be present.

The block trader benefits by the runner agent because it can induce the

runner agent to supply liquidity. The technique it uses to win liquidity from

the runner is to partition its orders into many small pieces.

It might seem the timing of flows should make a negligible difference

to the runner, who should be interested mostly in the total quantity. The

timing makes a difference because the block trader is doing the running

for the front runner. Suppose the block trader were to trade its entire

quantity in the last period of trade. The front runner would react as it

does in section 3.1, incrementally moving prices against the flow until the

final period, when it executes against the flow. Since prices are going to go

up anyway, the block trader may as well move prices itself because it can

construct some of its position along the way. In such a case the front runner

would do nothing until the final period.

In fact, the block trader goes a step further than moving prices for the

runner. If it trades more than the front runner would in order to move

prices, it can induce the front runner to supply it liquidity along the way,

which further reduces the block trader’s price impact. The dynamics of the

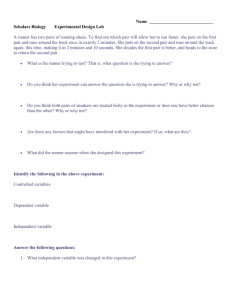

block trader’s strategy are presented in figure 1.

4

Conclusions

The model shows it is not obvious that information leakage about future

trading intentions is bad for a block trader or for market quality. One

7

common critique of increasing post-trade transparency—that it will cause

information leakage—is of questionable concern in market structure design

at least in market structures with dealers who compete for client orders.

Trading professionals are aware of countermeasures against front-running.

So why do many in the finance industry oppose increasing post-trade transparency? It is possible the industry opposes post-trade transparency not

because it leaks information about future trading intentions but because it

leaks commercial information, such as a company’s view on fundamentals

or the composition of its clientele, both of which are outside the scope of

this model. The protection of commercial information is a motive that is

less likely to arouse the sympathy of regulators.

The paper has an additional policy implication unrelated to post-trade

transparency. The model contributes to the explanations for the “excess

volatility” in stock prices by introducing dealer inventory as a pricing factor. Intermediaries move prices away from fundamentals as compensation

for bearing risky inventory. The price movements are akin to the “persistent,

but transitory, disparities between prices and fundamental values” observed

by Poterba and Summers (1988). Dealers’ inventories add variation in prices

that is not sourced from dividends, and front running can both amplify and

dampen the variations. The volatility of prices decreases as the market’s

risk-bearing capacity increases. Price movements associated with trading

are more volatile in markets that struggle to bear risk, so rulemakers should

carefully study the impact of rules such as the Volcker rule that discourage risk-bearing liquidity suppliers in core funding markets from holding

positions.

5

Appendix

Proposition 1

Proof It is necessary to solve backward in order to resolve expectations about the

price path including the way yt affects future prices. The dealers’ final-period value

function (with market-clearing condition) is

UT (YT −1 ) = max − exp (−(YT −1 + yT )ν + pT yT ) pT s.t. yT = xT + zT

yT

= − exp YT2−1 σ/2 exp −(xT + zT )2 σ/2

8

so the market-clearing price pT is as given in (8). Solving backward, the period-t

value function is

Ut (Yt−1 ) = max max EUt+1 (Yt ) pt s.t. yt = xt + zt

yt

yt+1

P

T

2

= − exp Yt−1

σ/2 E exp − τ =t (xτ + zτ )2 σ/2

for which the period-t price is as given in (8). The value functions are globally

concave in the choice variable yt , so equilibrium prices are unique.

Proposition 2

Proof Guess the front runner’s value function has a quadratic form,

PT

2

V̂t (Yt−1 ) = At Yt−1

+ Yt−1 τ =t Bt,τ zτ + Ct

where Ct includes all terms that have derivatives with respect to xt equal to 0.

Maximize the value function substituting the quadratic form,

Vt (Yt−1 ) = max − pt xt + V̂t+1 (Yt )

xt

2 PT

=

4(σ − At+1 ) = V̂t (Yt−1 )

τ =t+1 Bt+1,τ zτ + Yt−1 + zt σ

which identifies the system of difference equations

At =

σ

σ

4 σ − At+1

Bt,τ = 2At Bt+1,τ , t < τ

and boundary values Bτ,τ = 2At . The front runner’s final-period value function is

2

VT (YT −1 ) = max {−pT xT } = (YT −1 + zT ) σ/4

xT

which identifies boundary value AT = σ/4. Hence the coefficients equal

for t ≤ T

At = αt βt σ/2

for t ≤ τ ≤ T.

Bt,τ = αt βτ σ

The market order at time t is the argmax of V̂t using control xt .

Proposition 3

Proof Prices pt yield a noisy signal st of present and future order flows,

PT

st = pt /(σαt ) − βt Yt−1 = τ =t βτ zτ = st+1 + βt zt ,

that is ordered by Blackwell’s criterion for the ordering of information structures

(Blackwell and Girschick, 1954). Given pt and Yt−1 the history ht is uninformative

about zτ for τ ≥ t.

9

Using the signal-slope coefficients

λt,τ =

cov (pt , zτ )

σ 2 αt βτ

6βτ

1

=

,

PT 2 =

2

3

var (pt )

βt (1 + 2βt ) σ

σ αt i=t βi

the posterior means of future liquidity flows zτ , τ ≥ t, can be written

E [zτ |pt ] = λt,τ (pt − E [pt |Yt−1 ])

= λt,τ (pt − (1 − αt )pt−1 ) ,

where the second expectation is taken conditional on only Yt−1 using Blackwell’s

ordering. The posterior mean of ∆pt is

E [∆pt |ht ] = δ1 pt−1 − δ2 pt−2

where δ1 = 1 − 6/(2T + 5 − 2t) and δ2 = 1 − 6/(T + 3 − t) + 6/(2T + 5 − 2t). The

term γt mentioned in the statement of the proposition satisfies γt = δ1 /δ2 . The

term δ1 > 0 only for t < T , so (11) holds for t < T .

Proposition 4

Proof The dealers’ problem does not change substantially, so pt = σYt still.

It is sufficient to show the total rents extracted by N front runners is decreasing

in N . All rents are extracted from the noise trader since the dealers are competitive.

If the noise trader has any structure of utility that decreases in rent paid, it prefers

more runners.

From one front runner’s perspective, dealer inventory evolves as Yt = Yt−1 +

xt + (N − 1)x̄t + zt , where x̄t is the market order of the other runners held constant.

Maximizing the same value function form as in proposition 2,

Vt (Yt−1 ) = max − pt xt + q V̂t+1 (Yt )

xt

2

Pk

(σ − qA) σ(Yt−1 + zt ) + qN τ =1 Bτ zt+τ

=

= V̂t (Yt−1 ),

2

(σ + N (σ − 2qA))

in which x̄t has already been set to the arg max. The maximum identifies the

system of difference equations and boundary conditions,

σ 2 (σ − At+1 )

(σ + N (σ − 2At+1 ))2

σ2

AT (N ) =

(N + 1)2

At (N ) =

Bt,τ (N ) =

2N At Bt+1,τ

σ

Bτ,τ (N ) = 2Aτ

PT

2

τ =t N Bt,τ zτ /σ)

For the proof I employ the substitution At = σ2 − for some ∈ (0, σ2 ). The satisfies its bounds because if At+1 ∈ (0, σ2 ) then At does too, and AT = σ/(N +1)2 .

σ/2+

σ

The proof is that if At+1 = σ2 − ˆ, 0 < At = σ2 σ2 (σ/2+N

ˆ)2 < 2 .

Ct = Ct+1 + At (σzt +

10

PT

Total rents equal N At (N )Yt2 + N Yt τ =t Bt (N )zt + N Ct (N ). First N AT (N ) is

obviously decreasing in N . The term N At (N ) is decreasing in N since N At (N ) =

2

(σ/2+)

(N +1)σ 2 (σ/2+)

σ 2 (σ/2+)

N σ(σ+4N

)2 = N (N +1)(σ 2 +4N σ+16N 2 2 ) > (N + 1) (σ 2 +4(N +1)σ+16(N +1)2 2 ) = (N +

1)At (N + 1). It follows immediately that N Bτ,τ (N ) is decreasing in N . Since

N Bt (N ) is composed of τ − t multiples of At and N , it is decreasing in N . Since

N Ct is composed of terms N At (N ) and N Bt,τ (N ), it is decreasing in N .

Proposition 5

Although the agents’ value functions are identifiable in closed form, the difference

equation governing the value of their coefficients is not susceptible to proof. The

value function can be identified for games of finite length T computationally.

Proof Denote by Wt (Yt , Zt ) the block trader’s value function. If there is no runner,

it is easy to solve for W :

Wt (Yt , Zt ) = −σYt Zt − σZt2 /(2αt βt )

If there is a front runner, guess the runner’s value function Vt (Zt , Yt ) and the block

trader’s value function Wt (Zt , Yt ) both have quadratic forms,

V̂t (Yt , Zt ) = At Yt2 + Bt Zt Yt + Ct Zt2

Ŵt (Yt , Zt ) = Dt Yt2 + Et Zt Yt + Ft Zt2

and as before solve for the system of difference equations that govern the values of

At , Bt , Ct , Dt , Et , and Ft . The system is6

Ft−1 = (ot + 4Ft2 jt + mt − it n2t )σ/c2t

Et−1 = 2(Ct + it )(4Ft ht − lt nt )σ/c2t

Ct−1 = (Bt2 ft + 2Bt et ft + e2t ft − Ct d2t )σ/c2t

Dt−1 = (Ct + it )(4Dt Ft − lt2 )σ/c2t

Bt−1 = −2(Ct at dt + Bt bt ft + bt et ft )σ/c2t

At−1 = (Ct a2t + b2t − At b2t )σ/c2t

Clearly the system is too complicated to admit of general properties, but it is

easy to identify the value function coefficients computationally.

The object of interest is to compare the value funciton W1 to Ŵ1 for various game lengths T . Since the dealer starts with no inventory, comparing the

two reduces to comparing −σαt βt /2 to Ft . The graph below compares the two.

6

Define constants at = 1 − 2Dt + Et , bt = 1 + Et − 2Ft , ct = −3 + 2Dt − 3Et + 4Ft +

Bt at + 2At bt , dt = −3 + 2At + 2Dt − Et , et = Et − 2Ft , ft = At − 1, gt = 2At + Et − 1,

ht = At + Dt − 1, it = Dt − Et − 1, jt = 2At + Dt − 2, kt = 2At + Dt − 3, lt = 1 + Et ,

mt = −Ft (Et2 + 2Bt gt + 4Et jt − 4Dt kt ), nt = Bt + Et , ot = (3 − 2At )2 Ft .

11

References

D. Bernhardt and B. Taub. Front-running dynamics. Journal of Economic Theory,

138(1):288–296, 2008.

D. Blackwell and M.A. Girschick. A Theory of Games and Statistical Decisions.

Wiley, 1954.

M.J. Fishman and F.A. Longstaff. Dual trading in futures markets. Journal of

Finance, pages 643–671, 1992.

L. Harris. Trading and exchanges: Market microstructure for practitioners. Oxford

University Press, USA, 2003.

A.S. Kyle. Continuous auctions and insider trading. Econometrica: Journal of the

Econometric Society, pages 1315–1335, 1985.

J.M. Poterba and L.H. Summers. Mean reversion in stock prices* 1:: Evidence and

implications. Journal of Financial Economics, 22(1):27–59, 1988.

A. Röell. Dual-capacity trading and the quality of the market. Journal of Financial

Intermediation, 1(2):105–124, 1990.

A. Sarkar. Dual trading: winners, losers, and market impact. Journal of Financial

Intermediation, 4(1):77–93, 1995.

12