Boston, Massachusetts FRIDAY, NOVEMBER 20, 2009 8:30 am – 8:35 am WElcOME

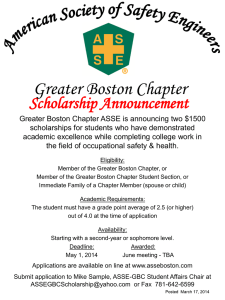

advertisement

Boston, Massachusetts FRIDAY, NOVEMBER 20, 2009 (All times Eastern Standard Time) 8:30 am – 8:35 am Welcome Presented by: Michael Caccese Mr. Caccese is one of three Practice Area Leaders of K&L Gates’ Financial Services practice, which includes the firm’s Investment Management and Broker Dealer practice groups, and sits on the firm’s Management Committee. Mr. Caccese focuses his practice in the areas of investment management, including mutual funds, closed-end funds, registered fund of hedge funds, hedge funds and separately managed accounts, in addition to advising on investment management and broker-dealer regulatory compliance. Mr. Caccese also advises on structuring investment management professional team “lift-outs” and “placement”, “soft dollar” compliance, investment performance, the Global Investment Performance Standards (“GIPS”), AIMR Performance Presentation Standards (“AIMR-PPS”), and the CFA Soft Dollar Standards and the Trade Management (Best Execution) Guidelines, along with other investment management industry standards of practice. His focus is on serving the needs of investment advisory firms of all sizes, including helping them design and comply with the investment industry’s “best practices” and policies, under GIPS, AIMR-PPS and Soft Dollar Standards. He may be reached at 617.261.3133 or michael.caccese@klgates.com.. 8:35 am – 9:15 am Overview of Investment Advisory Industry and Regulations Presented by: Rebecca O’Brien Radford and George Zornada • Investment Advisory Organizations: Advisers, Banks, Trust Companies, Insurance Companies, Broker-Dealers • Investment Vehicles: Registered Funds and ETFs, Hedge Funds, Bank Collective Funds, SMAs • Regulation of the Investment Advisory Industry: General Fiduciary Principles, Securities Laws, ERISA, Banking Regulation • The financial crisis and the regulatory response Ms. Radford is a partner in the Boston office and focuses her practice on investment management and securities law. She counsels investment companies and hedge funds on fund formation, legal, regulatory and compliance issues, including mergers, acquisitions, reorganizations and proxy statements. Ms. Radford also advises clients dealing in futures contracts and options on futures contracts on applicable provisions of CFTC and NFA regulations. She may be reached at 617.261.3244 or rebecca.radford@klgates.com. Mr. Zornada practices investment management and securities law. He regularly represents investment advisers, open- and closed-end investment companies and their boards of directors, and private investment entities such as hedge funds and funds of funds. His practice includes a broad spectrum of regulatory and transactional matters for investment advisers, investment companies, boards of directors, onshore and offshore hedge funds and funds of funds and their managers. Reach him on: 617.261.3231 or george.zornada@klgates.com. Boston, Massachusetts FRIDAY, NOVEMBER 20, 2009 (All times Eastern Standard Time) 9:15 am – 10:00 am Portfolio Valuation: Market Pricing and Fair Valuation Presented by: Mark Goshko and Mark Duggan l l l l Rule 22c-1 and forward pricing Market value and fair value under the 1940 Act Hot Topic: FAS 157, FSP 157-4 and valuing illiquid or distressed assets Hot Topic: Recent SEC enforcement actions and interest in valuation Mr. Goshko is a partner in K&L Gates’ Boston office. He focuses his practice on investment management law, including the representation of registered open- and closed-end investment companies, investment company directors, unregistered hedge funds and other private investment vehicles, investment advisers, brokerdealers and banks. He deals regularly with the SEC, the FINRA, the Commodity Futures Trading Commission, the National Futures Association, the New York Stock Exchange and other regulatory agencies and organizations. Mr. Goshko counsels hedge funds and their advisers on a broad range of issues and has extensive experience working with both onshore and offshore hedge funds, as well as a variety of master-feeder funds and funds of funds. He may be reached at 617.261.3163 or mark.goshko@klgates.com. Mr. Duggan is of counsel in the Boston office and focuses his practice on investment management and collective fund issues, including those faced by banks and trust companies and registered advisers. He has experience with advisory and other regulatory issues relating to separate accounts, bank-sponsored mutual funds, bank commingled ERISA funds, common trust funds and other collective funds, including formation, participant eligibility determinations, contract negotiations, security selection and new product development. In addition, he also advises clients with respect to regulatory investigations and examinations involving regulators such as the SEC, the DOL, the Federal Reserve and state regulators. He may be reached at 617.261.3156 or mark.duggan@ klgates.com. 10:00 am – 10:15 am BREAK Boston, Massachusetts FRIDAY, NOVEMBER 20, 2009 (All times Eastern Standard Time) 10:15 am – 11:00 am Brokerage and Trading—Best Execution, Soft Dollars, Trade Allocation, Side-by-Side Management Presented by: Michael Caccese and Peter McIsaac l l l l Best execution Soft dollars and the rise of commission sharing arrangements Trade allocation Hot Topic: The SEC’s focus on high frequency trading, flash orders, and dark pools standards Mr. McIsaac is a partner in the Boston office and concentrates his practice in investment management and securities law. He works with investment companies, broker-dealers, insurance companies, and individuals on various regulatory and compliance issues. He also advises clients on regulatory investigations and proceedings and has recently represented clients in federal and state investigations as well as in private litigation relating to: revenue sharing directed brokerage, mutual fund market timing, late trading, allocation of initial public offerings, impermissible portfolio investments, excessive advisory fees, adequacy of compliance measures, and fiduciary responsibilities. He may be reached at 617.261.3225 or peter.mcisaac@ klgates.com. 11:00 am – 11:30 am OVERVIEW OF ERISA FOR ADVISERS Presented by: Mark Duggan Coverage and Plan Assets Fiduciary status and duties l Prohibited transactions and exemptions l l 11:30 am – Noon DERIVATIVES 101 Presented by: Gordon Peery Mr. Peery is Of Counsel in the Boston office and his practice focuses exclusively on derivatives. He represents a wide range of clients in the firm’s Investment Management, Derivatives and Structured Products practice groups. Mr. Peery regularly handles matters involving Derivatives Counterparty Risk and Counterparty Insolvency Representation, Prime Brokerage, Securities Lending, Repos and Related Derivatives Documentation, Fund Crisis Management and Valuation Issues, Washington D.C. Derivatives and Structured Finance Representation, Total Return Swaps, Interest Rate Swaps, Credit Default Swaps, Equity Derivatives, Energy Derivatives, and Property Derivatives. He has also represented clients in the structuring and documentation of various funds that have focused exclusively or substantially on real estate investments. He may be reached at 617.261.3269 or gordon.peery@klgates.com. Noon – 1:00 pm Lunch Boston, Massachusetts FRIDAY, NOVEMBER 20, 2009 (All times Eastern Standard Time) Concurrent Sessions 1:00 pm – 4:00 pm Separate Hedge Fund and Mutual Fund Tracks (choose one Track) Hedge Fund Track 1:00 pm – 1:45pm HEDGE FUND INDUSTRY DEVELOPMENTS Presented by: Nicholas Hodge and Mark Goshko The aftermath of the crisis: performance challenges, massive redemptions, and restrictions on redemption l The shift in power to institutions and consultants l Trends in fee structures l Trends in fund structures, redemption rights, liquidity and lockups l Investors’ emphasis on the control and operational environment l Mr. Hodge is a partner in the Boston office and concentrates his practice in securities law with a focus on investment management, hedge funds, real estate investment trusts and partnerships, timber funds, complex partnership reorganizations, tender offers, and mergers and acquisitions. He has extensive experience in public and private offerings of securities, SEC and FINRA regulatory requirements, and Investment Company and Investment Advisers Act compliance. Mr. Hodge represents numerous domestic and offshore hedge funds, ranging from startup funds to major fund complexes. He may be reached at 617.261.3210 or nicholas.hodge@klgates.com. 1:45 pm – 2:30pm THE COMING NEW REGULATORY REGIME FOR HEDGE FUNDS Presented by: Nicholas Hodge and Rebecca O’Brien Radford Manager registration under the Advisers Act, prudential supervision and information reporting, and rules on disclosures to investors, creditors and counterparties l A focus on conflicts of interest: side letters (preferential redemption and information rights), side pockets, and side-by-side management l Insider trading and market abuse l The new custody regime l 2:30 pm – 2:45pm BREAK 2:45 pm – 3:30pm PRIME BROKERAGE ISSUES 3:30 pm – 4:00pm INVESTMENT ADVISER ADVERTISING ISSUES APPLICABLE TO HEDGE FUNDS End of Concurrent Sessions Presented by: Nicholas Hodge and Gordon Peery Presented by: Michael Caccese Boston, Massachusetts FRIDAY, NOVEMBER 20, 2009 (All times Eastern Standard Time) Concurrent Sessions 1:00 pm – 4:00 pm 1:00 pm – 1:45pm Separate Hedge Fund and Mutual Fund Tracks (choose one Track) Mutual Fund Track MUTUAL FUND BASICS Presented by: George Attisano and Trayne Wheeler Organization and Form Prospectus and Registration—New Summary Prospectus Rule l Contracts: Required Elements and Board Approval l Investment Restrictions and Capital Structure l l Mr. Attisano is counsel in the firm’s Boston office. He focuses his practice on various issues and matters under the Investment Company Act and the Investment Advisers Act. Mr. Attisano has extensive experience with a wide variety of SEC filings, including registration statements, proxies and shareholder reports. He has counseled open-end and closed-end fund boards on a variety of legal issues. He also has counseled funds and investment advisers on developing new products and in connection with SEC staff examinations, preparing responses to SEC inquiries and addressing issues raised in SEC staff deficiency letters. He may be reached at 617.261.3240 or george.attisano@klgates.com. Mr. Wheeler is an associate in K&L Gates’ Boston office. His practice focuses on advising registered and unregistered investment companies, investment advisers, broker-dealers and other financial service providers. He advises mutual fund complexes on various regulatory and compliance matters including registration, mergers and reorganizations, and negotiations with fund service-providers. He has worked on internal policies, procedures, compliance checklists, CCO policies and procedures and advisory contracts. Mr. Wheeler also has experience with the launching of new mutual funds and has drafted numerous registration statements for open- and closed-end investment companies and has assisted clients in discussions with the SEC staff. He has acted as Fund counsel and independent director counsel for various mutual fund complexes. Mr. Wheeler has also acted as special counsel organizing the launch of closed-end funds. He may be reached at 617.261.9068 or trayne.wheeler@klgates.com. 1:45 pm – 2:30 pm Fund DISTRIBUTION AND ADVERTISING Presented by: George Zornada Mutual Fund Sales Charges and Revenue Sharing Performance Advertising and Restrictions on Advertising l Advertising Rules —Rule 134, Rule 135a and Rule 482 l FINRA Role and Limitations l Distribution Financing Arrangements (Sales Loads/Rule 12b-I Plans) l Section 22(d) and Rule 12b-1 l Multiple Class/Master-Feeder Arrangements l l Boston, Massachusetts FRIDAY, NOVEMBER 20, 2009 (All times Eastern Standard Time) 2:30 pm – 2:45 pm break 2:45 pm – 3:15 pm CLOSED-END FUNDS Presented by: Clair Pagnano Ms. Pagnano is a partner in the Boston office and concentrates her practice in the investment management area. She has experience representing open and closed-end investment companies and their boards of directors. Ms. Pagnano advises mutual fund complexes on regulatory and compliance matters including registration, proxy issues, mergers and reorganizations. She has advised registered investment companies on exemptive applications and no-action letter requests to the SEC. Ms. Pagnano also has experience with Sarbanes-Oxley Act requirements for registered investment companies. She may be reached at 617.261.3246 or clair.pagnano@klgates.com. 3:15 pm – 4:00 pm COMPLIANCE PROGRAMS Presented by: George Attisano and Trayne Wheeler Conflicts of Interest Affiliated Transactions l Codes of Ethics l Foreign holdings reporting (significant shareholder reports) l l End of Concurrent Sessions CoMBINED Session 4:00 pm – 4:45 pmHot TopicS Presented by: Mark Duggan, Clair Pagnano, Rebecca O’Brien Radford and George Zornada Money Market Funds Congressional Industry Reform Efforts l New OCIE Initiatives l Short selling and derivatives: the uptick rule, the move to central clearing, and the impending reconciliation of SEC and CFTC jurisdiction l l