How to base probability theory on perfect-information games

advertisement

How to base probability theory on

perfect-information games

Glenn Shafer, Vladimir Vovk, and Roman Chychyla

Peter

$0

$25

Paul

Peter

$0

Paul

$100

$50

The Game-Theoretic Probability and Finance Project

Working Paper #32

First posted December 13, 2009. Last revised December 14, 2009.

Project web site:

http://www.probabilityandfinance.com

Abstract

The standard way of making probability mathematical begins with measure

theory. This article reviews an alternative that begins with game theory. We

discuss how probabilities can be calculated game-theoretically, how probability theorems can be proven and interpreted game-theoretically, and how this

approach differs from the measure-theoretic approach.

Contents

1 Introduction

1

2 Two ways of calculating probabilities

2.1 The problem of points . . . . . . . . . . . . . . . . . . . . . . . .

2.2 Two heads before two tails . . . . . . . . . . . . . . . . . . . . .

2.3 Why did Pascal and Fermat get the same answers? . . . . . . . .

1

2

3

5

3 Elements of game-theoretic probability

3.1 A simple game of prediction . . . . . . . . . . . . .

3.2 The interpretation of upper and lower probabilities

3.3 Price and probability in a situation . . . . . . . . .

3.4 Other probability games . . . . . . . . . . . . . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

10

13

14

4 Contrasts with measure-theoretic probability

4.1 The Kolmogorov-Doob framework . . . . . . .

4.2 Forecasting systems . . . . . . . . . . . . . . .

4.3 Duality . . . . . . . . . . . . . . . . . . . . . .

4.4 Continuous time . . . . . . . . . . . . . . . . .

4.5 Open systems . . . . . . . . . . . . . . . . . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15

16

19

21

22

23

.

.

.

.

.

.

.

.

.

.

5 Conclusion

25

References

26

1

Introduction

We can make probability into a mathematical theory in two ways. One begins

with measure theory, the other with the theory of perfect-information games.

The measure-theoretic approach has long been standard. This article reviews

the game-theoretic approach, which is less developed.

In §2, we recall that both measure theory and game theory were used to

calculate probabilities long before probability was made into mathematics in

the modern sense. In letters they exchanged in 1654, Pierre Fermat calculated

probabilities by counting equally possible cases, while Blaise Pascal calculated

the same probabilities by backward recursion in a game tree.

In §3, we review the elements of the game-theoretic framework as we formulated it in our 2001 book [21] and subsequent articles. This is the material we

are most keen to communicate to computer scientists.

In §4, we compare the modern game-theoretic and measure-theoretic frameworks. As the reader will see, they can be thought of as dual descriptions of the

same mathematical objects so long as one considers only the simplest and most

classical examples. Some readers may prefer to skip over this section, because

the comparison of two frameworks for the same body of mathematics is necessarily an intricate and second-order matter. It is also true that the intricacies of

the measure-theoretic framework are largely designed to handle continuous time

models, which are of little direct interest to computer scientists. The discussion

of open systems in §4.5 should be of interest, however, to all users of probability

models.

In §5, we summarize what this article has accomplished and mention some

new ideas that have been developed from game-theoretic probability.

We do not give proofs. Most of the mathematical claims we make are proven

in [21] or in papers at http://probabilityandfinance.com.

2

Two ways of calculating probabilities

Mathematical probability is often traced back to two French scholars, Pierre

Fermat (1601–1665) and Blaise Pascal (1623–1662). In letters exchanged in

1654, they argued about how to do some simple probability calculations. They

agreed on the answers, but not on how to derive them. Fermat’s methodology

can be regarded as an early form of measure-theoretic probability, Pascal’s as

an early form of game-theoretic probability.

Here we look at some examples of the type Pascal and Fermat discussed.

In §2.1 we consider a simple case of the problem of points. In §2.2 we calculate

the probability of getting two heads in succession before getting two tails in

succession when flipping a biased coin.

1

2.1

The problem of points

Consider a game in which two players play many rounds, with a prize going to

the first to win a certain number of rounds, or points. If they decide to break off

the game while lacking different numbers of points to win the prize, how should

they divide it?

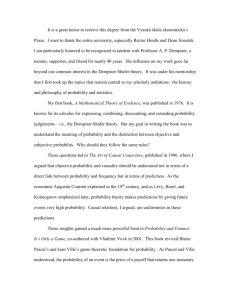

Suppose, for example, that Peter and Paul are playing for 64 pistoles, Peter

needs to win one more round, and Paul needs to win two. If Peter wins the

next round, the game is over; Peter gets the 64 pistoles. If Paul wins the next

round, then they play another round, and the winner of this second round gets

the 64 pistoles. Figure 1 shows Paul’s payoffs for the three possible outcomes:

(1) Peter wins the first round, ending the game, (2) Paul wins the first round

and Peter wins the second, and (3) Paul wins two rounds.

Peter

0

Peter

0

Paul

64

Paul

Figure 1: Paul wins either 0 or 64 pistoles.

If they stop now, Pascal asked Fermat, how should they divide the 64 pistoles? Fermat answered by imagining that Peter and Paul play two rounds

regardless of how the first comes out. There are four possible cases:

1. Peter wins the first round, Peter the second. Peter gets the 64 pistoles.

2. Peter wins the first round, Paul wins second. Peter gets the 64 pistoles.

3. Paul wins the first round, Peter the second. Peter gets the 64 pistoles.

4. Paul wins the first round, Paul the second. Paul gets the 64 pistoles.

Paul gets the 64 pistoles in only one of the four cases, Fermat said, so he should

get only 1/4 of the 64 pistoles, or 16 pistoles.

Pascal agreed with the answer, 16 pistoles, but not with the reasoning. There

are not four cases, he insisted. There are only three, because if Peter wins the

first round, Peter and Paul will not play a second round. A better way of getting

the answer, Pascal argued, was to reason backwards in the tree, as shown in

Figure 2. After Paul has just won the first round, he has the same chance as

Peter at winning the 64 pistoles, and so his position is worth 32 pistoles. At the

beginning, then, he has an equal shot at 0 or 32, and this is worth 16.

Pascal and Fermat did not use the word “probability”. But they gave us

methods for calculating probabilities. In this example, both methods give 1/4

as the probability for the event that Paul will win the 64 pistoles.

2

Peter

0

16

Paul

Peter

0

Paul

64

32

Figure 2: Pascal’s backward recursion.

Fermat’s method is to count the cases where an event A happens and the

cases where it fails; the ratio of the number where it happens to the total is the

event’s probability. This has been called the classical definition of probability.

In the 20th century, it was generalized to a measure-theoretic definition, in

which an event is identified with a set and its probability with the measure of

the set.

Pascal’s method, in contrast, treats a probability as a price. Let A be the

event that Paul wins both rounds. We see from Figure 2 that if Paul has 16

pistoles at the beginning, he can bet it in a way that he will have 64 pistoles if A

happens, 0 if A fails. (He bets the 16 pistoles on winning the first round, losing

it if he loses the round, but doubling it to 32 if he does win, in which case he bets

the 32 on winning the second round.) Rescaling so that the prize is 1 rather than

64, we see that 1/4 is what he needs at the beginning in order to get a payoff

equal to 1 if A happens and 0 if A fails. This suggests a general game-theoretic

definition of probability for a game in which we are offered opportunities to

gamble: the probability of an event is the cost of a payoff equal to 1 if the event

happens and 0 if it fails.

2.2

Two heads before two tails

Let us apply Fermat’s and Pascal’s competing methods to a slightly more difficult problem. Suppose we repeatedly flip a coin, with the probability of heads

being 1/3 each time (regardless of how previous flips come out). What is the

probability we will get two successive heads before we get two successive tails?

Fermat’s combinatorial method is to list the ways the event (two heads before

two tails) can happen, calculate the probabilities for each, and add them up.

The number of ways we can get two heads before two tails is countably infinite;

here are the first few of them, with their probabilities:

µ ¶2

1

3

µ ¶2

1

3

HH

THH

3

2

3

µ ¶3

1

2

3

3

µ ¶3 µ ¶2

1

2

3

3

µ ¶4 µ ¶2

1

2

3

3

HTHH

THTHH

HTHTHH

etc.

Summing the infinite series, we find that the total probability for two heads

before two tails is 5/21.

To get the same answer game-theoretically, we start with the game-theoretic

interpretation of the probability 1/3 for a head on a single flip: it is the price for

a ticket that pays 1 if the outcome is a head and 0 if it is a tail. More generally,

as shown in Figure 3, (1/3)x + (2/3)y is the price for x if a head, y if a tail.

head

tail

Figure 3: The game-theoretic meaning of probability 1/3 for a head.

Let A be the event that there will be two heads in succession before two tails

in succession, and consider a ticket that pays 1 if A happens and 0 otherwise.

The probability p for A is the price of this ticket at the outset. Suppose now

that we have already started flipping the coin but have not yet obtained two

heads or two tails in succession. We distinguish between two situations, shown

in Figure 4:

• In Situation H, the last flip was a head. We write a for the value of the

ticket on A in this situation.

• In Situation T, the last flip was a tail. We write b for the value of the

ticket on A in this situation.

In Situation H, a head on the next flip would be the second head in succession, and the ticket pays 1, whereas a tail would put us in Situation T, where

the ticket is worth b. Applying the rule of Figure 3 to this situation, we get

1 2

+ b.

3 3

In Situation T, on the other hand, a head puts us in Situation H, and with a

tail the ticket pays 0. This gives

a=

b=

1

a.

3

4

head

Situation H

(ticket

worth a)

tail

A happens

(ticket

worth 1)

head

Situation T

(ticket

worth b)

Situation T

(ticket

worth b)

tail

Situation H

(ticket

worth a)

A fails

(ticket

worth 0)

Figure 4: The value of a ticket that pays 1 if A happens and 0 if A fails varies

according to the situation.

Solving these two equations in the two unknowns a and b, we obtain a = 3/7

and b = 1/7.

head

Initial Situation

(ticket

worth p)

tail

Situation H

(ticket

worth a)

Situation T

(ticket

worth b)

Figure 5: The initial value p is equal to 5/21.

Figure 5 describes the initial situation, before we start flipping the coin.

With probability 1/3, the first flip will put us in a situation where the ticket is

worth 3/7; with probability 2/3, it will put us in a situation where it is worth

1/7. So the initial value is

1 3 2 1

5

· + · =

,

3 7 3 7

21

in agreement with the combinatorial calculation.

p=

2.3

Why did Pascal and Fermat get the same answers?

We will address a more general version of this question in §4.3, but on this

first pass let us stay as close to our two examples as possible. Let us treat

both examples as games where we flip a coin, either fair or biased, with a

rule for stopping that determines a countable set Ω of sequences of heads and

tails as possible outcomes. In our first example, Ω = {H,TH,TT}, where H

represents Peter’s winning, and T represents Paul’s winning. In our second

example, Ω = {HH,TT,HTT,THH,HTHH,THTT,. . . }.1

1 To keep things simple, we assume that neither of the infinite sequences HTHTHT. . . or

THTHTH. . . will occur.

5

Suppose p is the probability for heads on a single flip. The measure-theoretic

approach assigns a probability to each element ω of Ω by multiplying together

as many ps as there are Hs in ω and as many (1 − p)s as there are Ts. For

example, the probability of HTHH is p3 (1 − p). The probability for a subset A

of Ω is then obtained by adding the probabilities for the ω in A.

The game-theoretic approach defines probability differently. Here the probability of A is the initial capital needed in order to obtain a certain payoff at

the end of the game: 1 if the outcome ω is in A, 0 if not. To elaborate a

bit, consider the capital process determined by a certain initial capital together

with a strategy for gambling. Formally, such a capital process is a real-valued

function L defined on the set S consisting of the sequences in Ω and all their

initial segments, including the empty sequence 2. For each x ∈ S, L(x) is the

capital the gambler would have right after x happens if he starts with L(2) and

follows the strategy. In the game where we wait for two heads or two tails in

succession, for example, L(HTHT) is the capital the gambler would have after

HTHT, where the game is not yet over, and L(HH) is the capital he would

have after HH, where the game is over. We can rewrite our definition of the

probability of A as

P (A) := L(2), where L is the unique capital process with

L(ω) = IA (ω) for all ω ∈ Ω.

(1)

Here IA is the indicator function for A, the function on Ω equal to 1 on A and

0 on Ω \ A.

We can use Equation (1) to explain why Pascal’s method gives the same

answers as Fermat’s.

1. If you bet all your capital on getting a head on the next flip, then you

multiply it by 1/p if you get a head and lose it if you get a tail. Similarly,

if you bet all your capital on getting a tail on the next flip, then you

multiply it by 1/(1 − p) if you get a tail and lose it if you get a head.

So Equation (1) gives the same probability to a single path in Ω as the

measure-theoretic approach. For example, if A = {HTHH}, we can get

the capital IA at the end of the game by starting with capital p3 (1 − p),

betting it all on H on the first flip, so that we have p2 (1 − p) if we do get

H; then betting all this on T on the second flip, so that we have p2 if we

do get T, and so on, as in Figure 6.

2. We can also see from Equation (1) that the probability for a subset A

of Ω is the sum of the probabilities for the individual sequences in A.

This is because we can add capital processes. Consider, for example, a

doubleton set A = {ω1 , ω2 }, and consider the capital processes L1 and L2

that appear in Equation (1) for A = {ω1 } and A = {ω2 }, respectively.

Starting with capital P ({ω1 }) and playing one strategy produces L1 with

final capital I{ω1 } (ω) for all ω ∈ Ω, and starting with capital P ({ω2 }) and

playing another strategy produces L2 with final capital I{ω2 } (ω) for all

ω ∈ Ω. So starting with capital P ({ω1 }) + P ({ω2 }) and playing the sum

6

of the two strategies2 produces the capital process L1 +L2 , which has final

capital I{ω1 } (ω) + I{ω2 } (ω) = I{ω1 ,ω2 } (ω) for all ω ∈ Ω.

head

head

0

1

tail

0

head

tail

tail

head

0

tail

0

Figure 6: We get the payoff 1 if the sequence of outcomes is HTHH.

We can generalize Equation (1) by replacing IA with a real-valued function

ξ on Ω. This gives a formula for the initial price E(ξ) of the uncertain payoff

ξ(ω):

E(ξ) := L(2), where L is a capital process with

L(ω) = ξ(ω) for all ω ∈ Ω.

(2)

If ξ is bounded, such a capital process exists and is unique. Christian Huygens

explained the idea of Equation (2) very clearly in 1657 [13], shortly after he

heard about the correspondence between Pascal and Fermat.

The fundamental idea of game-theoretic probability is to generalize Equation (2) as needed to more complicated situations, where there may be more or

fewer gambles from which to construct capital processes. If we cannot count on

finding a capital process whose final value will always exactly equal the uncertain

payoff ξ(ω), let alone a unique one, we write instead

E(ξ) := inf{L(2)|L is a capital process & L(ω) ≥ ξ(ω) for all ω ∈ Ω},

(3)

and we call E(ξ) the upper price of ξ.3 In games with infinite horizons, where

play does not necessarily stop, we consider instead capital processes that equal

or exceed ξ asymptotically, and in games where issues of computability or other

considerations limit our ability to use all our current capital on each round, we

allow some capital to be discarded on each round. But Pascal’s and Huygens’s

basic idea remains.

3

Elements of game-theoretic probability

Although game-theoretic reasoning of the kind used by Pascal and Huygens

never disappeared from probability theory, Fermat’s idea of counting equally

2 This means that we always make both the bets specified by the first strategy and the bets

specified by the second strategy.

3 As we explain in §3.1, there is a dual and possibly smaller price for ξ, called the lower

price. The difference between the two is somewhat analogous to the bid-ask spread in a

financial market.

7

likely cases became the standard starting point for the theory in the 19th century

and then evolved, in the 20th century, into the measure-theoretic foundation for

probability now associated with the names of Andrei Kolmogorov and Joseph

Doob [14, 9, 22]. The game-theoretic approach re-emerged only in the 1930s,

when Jean Ville used it to improve Richard von Mises’s definition of probability

as limiting frequency [17, 18, 27, 1]. Our formulation in 2001 [21] was inspired

by Ville’s work and by A. P. Dawid’s work on prequential probability [7, 8] in

the 1980s.

Whereas the measure-theoretic framework for probability is a single axiomatic system that has every instance as a special case, the game-theoretic

approach begins by specifying a game in which one player has repeated opportunities to bet, and there is no single way of doing this that is convenient for all

possible applications. So we begin our exposition with a game that is simple and

concrete yet general enough to illustrate the power of the approach. In §3.1, we

describe this game, a game of bounded prediction, and define its game-theoretic

sample space, its variables and their upper and lower prices, and its events and

their upper and lower probabilities. In §3.2, we explain the meaning of upper

and lower probabilities. In §3.3, we extend the notions of upper and lower price

and probability to situations after the beginning of the game and illustrate these

ideas by stating the game-theoretic form of Lévy’s zero-one law. Finally, in §3.4,

we discuss how our definitions and results extend to other probability games.

3.1

A simple game of prediction

Here is a simple example, borrowed from Chapter 3 of [21], of a precisely specified game in which probability theorems can be proven.

The game has three players: Forecaster, Skeptic, and Reality. They play

infinitely many rounds. Forecaster begins each round by announcing a number

µ, and Reality ends the round by announcing a number y. After Forecaster

announces µ and before Reality announces y, Skeptic is allowed to buy any

number of tickets (even a fractional or negative number), each of which costs µ

and pays back y. For simplicity, we require both y and µ to be in the interval

[0, 1]. Each player hears the others’ announcements as they are made (this is

the assumption of perfect information). Finally, Skeptic is allowed to choose

the capital K0 with which he begins.

We summarize these rules as follows.

Protocol 1. Bounded prediction

Skeptic announces K0 ∈ R.

FOR n = 1, 2, . . . :

Forecaster announces µn ∈ [0, 1].

Skeptic announces Mn ∈ R.

Reality announces yn ∈ [0, 1].

Kn := Kn−1 + Mn (yn − µn ).

There are no probabilities in this game, only limited opportunities to bet. But

we can define prices and probabilities in Pascal’s sense.

8

The following definitions and notation will help.

• A path is a sequence µ1 y2 µ2 y2 . . ., where the µs and ys are all in [0, 1].

• We write Ω for the set of all paths, and we call Ω the sample space.

• An event is a subset of Ω, and a variable is a real-valued function on Ω.

• We call the empty sequence 2 the initial situation.

• We call a sequence of the form µ1 y1 . . . µn−1 yn−1 µn a betting situation.

• We call a sequence of the form µ1 y1 . . . µn yn a clearing situation. We write

S for the set of all clearing situations. We allow n = 0, so that 2 ∈ S.

• A strategy Sstrat for Skeptic specifies his capital in the initial situation (K0

in 2) and his move Sstrat(µ1 y1 . . . µn−1 yn−1 µn ) for every betting situation

µ1 y1 . . . µn−1 yn−1 µn .

• Given a strategy Sstrat for Skeptic, we define a function LSstrat on S by

LSstrat (2) := Sstrat(2) and

LSstrat (µ1 y1 . . . µn yn ) := LSstrat (µ1 y1 . . . µn−1 yn−1 )

+ Sstrat(µ1 y1 . . . µn−1 yn−1 µn )(yn − µn ).

We call LSstrat the capital process determined by Sstrat.4 If Skeptic follows

Sstrat, then LSstrat (µ1 y1 . . . µn yn ) is his capital Kn after clearing in the

situation µ1 y1 . . . µn yn .

• We write L for the set of all capital processes.

• Given ω ∈ Ω, say ω = µ1 y2 µ2 y2 . . ., we write ω n for the clearing situation

µ1 y1 . . . µn yn .

In the spirit of Equation (3) in §2.3, we say that the upper price of a bounded

variable ξ is

E(ξ) := inf{L(2) | L ∈ L and lim inf L(ω n ) ≥ ξ(ω) for all ω ∈ Ω}.

n→∞

(4)

We get the same number E(ξ) if we replace the lim inf in (4) by lim sup or lim.

In other words,

E(ξ) = inf{L(2) | L ∈ L and lim sup L(ω n ) ≥ ξ(ω) for all ω ∈ Ω}

n→∞

= inf{L(2) | L ∈ L and lim L(ω n ) ≥ ξ(ω) for all ω ∈ Ω}.

(5)

n→∞

n

(The inequality limn→∞ L(ω ) ≥ ξ(ω) means that the limit exists and satisfies

the inequality.) For a proof, which imitates the standard proof of Doob’s convergence theorem, see [23]. The essential point is that if a particular strategy for

4 In

[27] and [21], such a capital process is called a martingale.

9

Skeptic produces capital that is sufficient in the sense of lim sup but oscillates on

some paths rather than reaching a limit, Skeptic can exploit the successive upward oscillations, thus obtaining a new strategy whose capital tends to infinity

on these paths.

If someone from outside the game pays Skeptic E(ξ) at the beginning of the

game, Skeptic can turn it into ξ(ω) or more at the end of the game. (Here we

neglect, for simplicity, the fact that the infimum in (5) may not be attained.)

So he can commit to giving back ξ(ω) at the end of the game without risking

net loss. He cannot do this if he charges any less. So E(ξ) is, in this sense,

Skeptic’s lowest safe selling price for ξ.

We set E(ξ) := − E(−ξ) and call E(ξ) the lower price of ξ. Because selling

−ξ is the same as buying ξ, E(ξ) is the highest price at which Skeptic can buy

ξ without risking loss.

The names “upper” and “lower” are justified by the fact that

E(ξ) ≤ E(ξ).

(6)

To prove (6), consider a strategy Sstrat1 that begins with E(ξ) and returns at

least ξ and a strategy Sstrat2 that begins with E(ξ) and returns at least −ξ.

(We again neglect the fact that the infimum in (5) may not be attained.) Then

Sstrat1 + Sstrat2 begins with E(ξ) + E(−ξ) and returns at least 0. This implies

that E(ξ) + E(−ξ) ≥ 0, because there is evidently no strategy for Skeptic in

Protocol 1 that turns a negative initial capital into a nonnegative final capital

for sure. But E(ξ) + E(−ξ) ≥ 0 is equivalent to E(ξ) ≤ E(ξ).

As we noted in §2.3, probability is a special case of price. We write P(A) for

E(IA ), where IA is the indicator function for A, and we call it A’s upper probability. Similarly, we write P(A) for E(IA ), and we call it A’s lower probability.

We can easily show that

0 ≤ P(A) ≤ P(A) ≤ 1

(7)

for any event A. The inequality P(A) ≤ P(A) is a special case of (6). The

inequalities 0 ≤ P(A) and P(A) ≤ 1 are special cases of the general rule that

E(ξ1 ) ≤ E(ξ1 ) whenever ξ1 ≤ ξ2 , a rule that follows directly from (4). Notice

also that

P(A) = 1 − P(Ac )

(8)

for any event A, where Ac := Ω \ A. This equality is equivalent to E(IAc ) =

1 + E(−IA ), which follows from the fact that IAc = 1 − IA and from another

rule that follows directly from (4): when we add a constant to a variable ξ, we

add the same constant to its upper price.

If E(ξ) = E(ξ), then we say that ξ is priced ; we write E(ξ) for the common

value of E(ξ) and E(ξ) and call it ξ’s price. Similarly, if P(A) = P(A), we write

P(A) for their common value and call it A’s probability.

3.2

The interpretation of upper and lower probabilities

According to the 19th century philosopher Augustin Cournot, as well as many

later scholars [19], a probabilistic theory makes contact with the world only by

10

predicting that events assigned very high probability will happen. Equivalently,

those assigned very low probability will not happen.

In the case where we have only upper and lower probabilities rather than

probabilities, we make these predictions:

1. If P(A) is equal or close to one, A will happen.

2. If P(A) is equal or close to zero, A will not happen.

It follows from (8) that Conditions 1 and 2 are equivalent. We see from (7)

that these conditions are consistent with Cournot’s principle. When P(A) is

one or approximately one, P(A) is as well, and since we call their common value

the probability of A, we may say that A has probability equal or close to one.

Similarly, when P(A) is zero or approximately zero, we may say that A has

probability equal or close to zero.

In order to see more clearly the meaning of game-theoretic probability equal

or close to zero, let us write L+ for the subset of L consisting of capital processes

that are nonnegative—i.e., satisfy L(ω n ) ≥ 0 for all ω ∈ Ω and n ≥ 0. We can

then write

P(A) := inf{L(2) | L ∈ L+ and lim L(ω n ) ≥ 1 for all ω ∈ A}.

(9)

n→∞

When P(A) is very close to zero, (9) says that Skeptic has a strategy that will

multiply the capital it risks by a very large factor (1/L(2)) if A happens. (The

condition that L(ω n ) is never negative means that only the small initial capital

L(2) is being put at risk.) If Forecaster does a good job of pricing the outcomes

chosen by Reality, Skeptic should not be able to multiply the capital he risks

by a large factor. So A should not happen.

If an event has lower probability exactly equal to one, we say that the event

happens almost surely. Here are two events that happen almost surely in Protocol 1:

• The subset A1 of Ω consisting of all sequences µ1 y1 µ2 y2 . . . such that

n

1X

(yi − µi ) = 0.

n→∞ n

i=1

lim

(10)

The assertion that A1 happens almost surely is proven in Chapter 3 of

[21]. It is a version of the strong law of large numbers: in the limit, the

average of the outcomes will equal the average of the predictions.

• The subset A2 of Ω consisting of all sequences µ1 y1 µ2 y2 . . . such that if

limn→∞ |Jn,a,b | = ∞, where a and b are rational numbers and Jn,a,b is the

set of indices i such that 0 ≤ i ≤ n and a ≤ µi ≤ b, then

P

P

i∈Jn,a,b yi

i∈Jn,a,b yi

and lim sup

≤ b.

a ≤ lim inf

n→∞

|Jn,a,b |

|Jn,a,b |

n→∞

11

The assertion that A2 happens almost surely is an assertion of calibration:

in the limit, the average of the outcomes for which the predictions are in

a given interval will also be in that interval. See [36].

In [21], we also give examples of events in Protocol 1 that have lower probability

close to one but not exactly equal to one. One

PNsuch event, for example, is

the event, for a large fixed value of N , that N1 i=1 (yi − µi ) is close to zero.

The assertion that this event will happen is a version of Bernoulli’s theorem,

sometimes called the weak law of large numbers.

The almost sure predictions we make (A will happen when P(A) = 1, and

A will not happen when P(A) = 0) will be unaffected if we modify the game

by restricting the information or choices available to Skeptic’s opponents. If

Skeptic has a winning strategy in a given game, then he will still have a winning

strategy when his opponents are weaker. Here are three interesting ways to

weaken Skeptic’s opponents in Protocol 1:

• Probability forecasting. Require Reality to make each yn equal to 0 or

1. Then µn can be interpreted as Forecaster’s probability for yn = 1, and

the strong law of large number, (10), says that the frequency of 1s gets

ever closer to the average probability.

• Fixing the probabilities. Require Forecaster to follow some strategy

known in advance to the other players. He might be required, for example,

to make all the µn equal to 1/2. In this case, assuming that Reality is also

required to set each yn equal to 0 or 1, we have the familiar case where

(10) says that the frequency of 1s will converge to 1/2.

• Requiring Reality’s neutrality. Prevent Reality from playing strategically. This can be done by hiding the other players’ moves from Reality, or

perhaps by requiring that Reality play randomly (whatever we take this

to mean).

Weakening Skeptic’s opponents in these ways makes Protocol 1 better resemble

familiar conceptions of the game of heads and tails, but it does not invalidate

any theorems we can prove in the protocol about upper probabilities being small

(P(A) = 0, for example) or about lower probabilities being large (P(A) = 1, for

example). These theorems assert that Skeptic has a strategy that achieves

certain goals regardless of his opponents’ moves. Additional assumptions about

how his opponents move (stochastic models for their behavior, for example)

might enable us to prove that Skeptic can accomplish even more, perhaps raising

some lower prices or lowering some upper prices, but they will not invalidate

any conclusions about what happens almost surely or with high probability.

It is also noteworthy that the almost sure predictions will not be affected

if some or all of the players receive additional information in the course of the

game. If Skeptic can achieve a certain goal regardless of how the other players

move, then it makes no difference if they have additional information on which

to base their moves. We will comment on this point further in §4.5.

12

The framework also applies to cases where Forecaster’s moves µn and Reality’s moves yn are the result of the interaction of many agents and influences.

One such case is that of a market for a company’s stock, µn being the opening price of the stock on day n, and yn its closing price. In this case, Skeptic

plays the role of a day trader who decides how many shares to hold after seeing

the opening price. Our theorems about what Skeptic can accomplish will hold

regardless of the complexity of the process that determines µn and yn . In this

case, the prediction that A will not happen if P(A) is very small can be called

an efficient market hypothesis.

3.3

Price and probability in a situation

We have defined upper and lower prices and probabilities for the initial situation,

but the definitions can easily be adapted to later situations. Given a situation

s let us write Ω(s) for the set of paths for which s is a prefix. Then a variable

ξ’s upper price in the situation s is

E(ξ | s) := inf{L(s) | L ∈ L and lim L(ω n ) ≥ ξ(ω) for all ω ∈ Ω(s)}.

n→∞

This definition can be applied both when s is a betting situation (s = µ1 y1 . . . µn

for some n) and when s is a clearing situation (s = µ1 y1 . . . µn yn for some n).

We may define E(ξ | s), P(A | s), and P(A | s) in terms of E(ξ | s), just as we

have defined E(ξ), P(A), and P(A) in terms of E(ξ). We will not spell out the

details. Notice that E(ξ), E(ξ), P(A), and P(A) are equal to E(ξ | 2), E(ξ | 2),

P(A | 2), and P(A | 2), respectively.

In [23], we show that if the upper and lower prices for a variable ξ are equal,

then this remains true almost surely in later situations: if E(ξ) = E(ξ), then

E(ξ | ω n ) = E(ξ | ω n ) for all n almost surely.

The game-theoretic concepts of probability and price in a situation are parallel to the concepts of conditional probability and expected value in classical

probability theory.5 In order to illustrate the parallelism, we will state the gametheoretic form of Paul Lévy’s zero-one law [16], which says that if an event A

is determined by a sequence X1 , X2 , . . . of variables, its conditional probability given the first n of these variables tends, as n tends to infinity, to one if

A happens and to zero if A fails.6 More generally, if a bounded variable ξ is

5 In this paragraph, we assume that the reader has some familiarity with the concepts of

conditional probability and expected value, even if they are not familiar with the measuretheoretic formalization of the concept that we will review briefly in §4.1.

6 For those not familiar with Lévy’s zero-one law, here is a simple example of its application

to the problem of the gambler’s ruin. Suppose a gambler plays many rounds of a game, losing

or winning 1 pistole on each round. Suppose he wins each time with probability 2/3, regardless

of the outcomes of preceding rounds, and suppose he stops playing only if and when he goes

bankrupt (loses all his money). A well known calculation shows that when he has k pistoles,

he will eventually lose it all with probability (1/2)k . Suppose he starts with 1 pistole, and let

Y (n) be the number of pistoles he has after round n. Then his probability of going bankrupt

is equal to 1/2 initially and to (1/2)Y (n) after the nth round. Levy’s zero-one law, applied to

the event A that he goes bankrupt, says that with probability one, either he goes bankrupt,

or else (1/2)Y (n) tends to zero and hence Y (n) tends to infinity. The probability that Y (n)

oscillates forever, neither hitting 0 nor tending to infinity, is zero.

13

determined by X1 , X2 , . . . , the conditional expected value of ξ given the first

n of the Xi tends to ξ almost surely. In [23], we illustrate the game-theoretic

concepts of price and probability in a situation by proving the game-theoretic

version of this law. It says that

lim inf E(ξ | ω n ) ≥ ξ(ω)

n→∞

(11)

almost surely. If ξ’s initial upper and lower prices are equal, so that its upper

and lower prices are also equal in later situations almost surely, we can talk

simply of its price in situation s, E(ξ | s), and (11) implies that

lim E(ξ | ω n ) = ξ(ω)

n→∞

(12)

almost surely. This is Lévy’s zero-one law in its game-theoretic form.

3.4

Other probability games

The game-theoretic results we have discussed apply well beyond the simple game

of prediction described by Protocol 1. They hold for a wide class of perfectinformation games in which Forecaster offers Skeptic gambles, Skeptic decides

which gambles to make, and Reality decides the outcomes.

Let us assume, for simplicity, that Reality chooses her move from the same

space, say Y, on each round of the game. Then a gamble for Skeptic can be

specified by giving a real-valued function f on Y: if Skeptic chooses the gamble

f and Reality chooses the outcome y, then Skeptic’s gain on the round of play

is f (y). Forecaster’s offer on each round will be a set of real-valued functions

on Y from which Skeptic can choose.

Let us call a set C of real-valued functions on a set Y a pricing cone on Y if

it satisfies the following conditions:

1. If f1 ∈ C, f2 is a real-valued function on Y, and f2 ≤ f1 , then f2 ∈ C.

2. If f ∈ C and c ∈ [0, ∞), then cf ∈ C.

3. If f1 , f2 ∈ C, then f1 + f2 ∈ C.

4. If f1 , f2 , . . . ∈ C, f1 (y) ≤ f2 (y) ≤ · · · for all y ∈ Y, and limn→∞ fn (y) =

f (y) for all y ∈ Y, where f is a real-valued function on Y, then f ∈ C.

5. If f ∈ C, then there exists y ∈ Y such that f (y) ≤ 0.

Let us write CY for the set of all pricing cones on Y.

If we require Skeptic to offer a pricing cone on each round of the game, then

our protocol has the following form:

Protocol 2. General prediction

Parameter: Reality’s move space Y

Skeptic announces K0 ∈ R.

FOR n = 1, 2, . . . :

14

Forecaster announces Cn ∈ CY .

Skeptic announces fn ∈ Cn .

Reality announces yn ∈ Y.

Kn := Kn−1 + fn (yn ).

The probability games studied in [21] and in the subsequent working papers at

http://probabilityandfinance.com are all essentially of this form, although

sometimes Forecaster or Reality are further restricted in some way. As we explained in §3.2, our theorems state that Skeptic has a strategy that accomplishes

some goal, and such theorems are not invalidated if we give his opponents less

flexibility. We may also alter the rules for Skeptic, giving him more flexibility or

restricting him in a way that does not prevent him from following the strategies

that accomplish his goals.

In the case of Protocol 1, the outcome space Y is the interval [0, 1]. Forecaster’s move is a number µ ∈ [0, 1], and Skeptic is allowed to choose any payoff

function f that is a multiple of y − µ. It will not invalidate our theorems to

allow him also to choose any payoff function that always pays this much or less,

so that his choice is from the set

C = {f : [0, 1] → R | there exists µ ∈ [0, 1] and M ∈ R

such that f (y) ≤ M (y − µ) for all y ∈ [0, 1]}.

This is a pricing cone; Conditions 1–5 are easy to check. So we have an instance

of Protocol 2.

As we have just seen, Condition 1 in our definition of a pricing cone (the

requirement that f2 ∈ C when f1 ∈ C and f2 ≤ f1 ) is of minor importance;

it sometimes simplifies our reasoning. Conditions 2 and 3 are more essential;

they express the linearity of probabilistic pricing. Condition 4 plays the same

role as countable additivity (sometimes called continuity) in measure-theoretic

probability; it is needed for limiting arguments such as the ones used to prove

the strong law of large numbers. Condition 5 is the condition of coherence; it

rules out sure bets for Skeptic.

At first glance, it might appear that Protocol 2 might be further generalized

by allowing Reality’s move space to vary from round to round. This would not

be a substantive generalization, however. If Reality is required to choose from a

set Yn on the nth round, then we can recover the form of Protocol 2 by setting

Y equal to the union of the Yn ; the fact that Reality is restricted on each round

to some particular subset of the larger set Y does not, as we noted, invalidate

theorems about what Skeptic can accomplish.

4

Contrasts with measure-theoretic probability

For the last two hundred years at least, the mainstream of probability theory

has been measure-theoretic rather than game-theoretic. We need to distinguish, however, between classical probability theory, developed during the nineteenth and early twentieth centuries, and the more abstract measure-theoretic

15

framework, using σ-algebras and filtrations, that was developed in the twentieth

century, in large part by Kolmogorov [14] and Doob [9]. Classical probability

theory, which starts with equally likely cases and combinatorial reasoning as

Fermat did and extends this to continuous probability distributions using the

differential and integral calculus, is measure-theoretic in a broad sense. The

more abstract Kolmogorov-Doob framework qualifies as measure-theoretic in a

more narrow mathematical sense: it uses the modern mathematical theory of

measure.

Although there is a strong consensus in favor of the Kolmogorov-Doob framework among mathematicians who work in probability theory per se, many users

of probability in computer science, engineering, statistics, and the sciences

still work with classical probability tools and have little familiarity with the

Kolmogorov-Doob framework. So we provide, in §4.1, a concise review of the

Kolmogorov-Doob framework. Readers who want to learn more have many excellent treatises, such as [2, 24], from which to choose. For additional historical

perspective on the contributions of Kolmogorov and Doob, see [22, 12].

In §4.2 and §4.3, we discuss some relationships between the game-theoretic

and measure-theoretic pictures. As we will see, these relationships are best described not in terms of the abstract Kolmogorov-Doob framework but in terms

of the concept of a forecasting system. This concept, introduced by A. P. Dawid

in 1984, occupies a position intermediate between measure theory and game theory. A forecasting system can be thought of as a special kind of strategy for

Forecaster, which always gives definite probabilities for Reality’s next move.

The Kolmogorov-Doob framework, in contrast, allows some indefiniteness, inasmuch as its probabilities in new situations can be changed arbitrarily on any set

of paths of probability zero. The game-theoretic framework permits a different

kind of indefiniteness; it allows Forecaster to make betting offers that determine only upper and lower probabilities for Reality’s next move. In §4.2, we

discuss how the game-theoretic picture reduces to a measure-theoretic picture

when we impose a forecasting system on Forecaster. In §4.3, we discuss the duality between infima from game-theoretic capital processes and suprema from

forecasting systems.

In §4.4, we discuss how continuous time can be handled in the game-theoretic

framework. In §4.5, we point out how the open character of the game-theoretic

framework allows a straightforward use of scientific theories that make predictions only about some aspects of an observable process.

4.1

The Kolmogorov-Doob framework

The basic object in Kolmogorov’s picture [14, 22] is a probability space, which

consists of three elements:

1. A set Ω, which we call the sample space.

2. A σ-algebra F on Ω – i.e., a set of subsets of Ω that contains Ω itself,

contains the complement Ω \ A whenever it contains A, and contains the

intersection and union of any countable set of its elements.

16

3. A probability measure P on F – i.e., a mapping from F to [0, ∞) that

satisfies

(a) P (Ω) = 1,

(b) P (A ∪ B) = P (A) + P (B) whenever A, B ∈ F and A ∩ B = ∅, and

(c) P (∩∞

i=1 Ai ) = limi→∞ P (Ai ) whenever A1 , A2 , · · · ∈ F and A1 ⊇

A2 ⊇ · · · .

Condition (c) is equivalent, in the presence of the other conditions, to countable

additivity:

if A1 , A2 , . . . are pairwise disjoint elements of F, then P (∪∞

i=1 Ai ) =

P∞

P

(A

).

i

i=1

Only subsets of Ω that are in F are called events. An event A for which

P (A) = 1 is said to happen almost surely or for almost all ω.

A real-valued function ξ on the sample space Ω that is measurable (i.e.,

{ω ∈ Ω | ξ(ω) ≤ a} ∈ F for every real number a) is called a random variable. If

the Lebesgue integral of ξ with respect to P exists, it is called ξ’s expected value

and is denoted by EP (ξ).

We saw examples of probability spaces in §2. In the problem of two heads

before two tails, Ω = {HH,TT,HTT,THH,HTHH,THTT,. . . }, and we can take

F to be the set of all subsets of Ω. We defined the probability for an element ω of

Ω by multiplying together as many ps as there are Hs in ω and as many (1 − p)s

as there are Ts, where p is the probability of getting a head on a single flip. We

then defined the probability for a subset of Ω by adding the probabilities for the

elements of the subset.

In general, as in this example, the axiomatic properties of the probability

space (Ω, F, P ) make no reference to the game or time structure in the problem.

Information about how the game unfolds in time is hidden in the identity of the

elements of Ω and in the numbers assigned them as probabilities.

Doob [9] suggested bringing the time structure back to the axiomatic level

by adding what is now called a filtration to the basic structure (Ω, F, P ). A

filtration is a nested family of σ-algebras, one for each point in time. The σalgebra Ft for time t consists of the events whose happening or failure is known

at time t. We assume that Ft ⊆ F for all t, and that Ft ⊆ Fu when t ≤ u; what

is known at time t is still known at a later time u. The time index t can be

discrete (say t = 0, 1, 2, . . . ) or continuous (say t ∈ [0, ∞) or t ∈ R).

Kolmogorov and Doob used the Radon-Nikodym theorem to represent the

idea that probabilities and expected values change with time. This theorem

implies that when ξ is a random variable in (Ω, F, P ), EP (ξ) exists and is finite,

and G is a σ-algebra contained in F, there exists a random variable ζ that is

measurable with respect to G and satisfies

EP (ξIA ) = EP (ζIA )

(13)

for all A ∈ G. This random variable is unique up to a set of probability zero:

if ζ1 and ζ2 are both measurable with respect to G and EP (ξIA ) = EP (ζ1 IA ) =

EP (ζ2 IA ) for all A ∈ G, then the event ζ1 6= ζ2 has probability zero. We write

17

EP (ξ | G) for any version of ζ, and we call it the conditional expectation of ξ

given G.

In the case where each element ω of Ω is a sequence, and we learn successively

longer initial segments ω 1 , ω 2 , . . . of ω, we may use the discrete filtration F0 ⊆

F1 ⊆ · · · , where Fn consists of all the events in F that we know to have happened

or to have failed as soon as we know ω n . In other words,

Fn := {A ∈ F | if ω1 ∈ A and ω2 ∈

/ A, then ω1n 6= ω2n }.

It is also convenient to assume that F is the smallest σ-algebra containing all

the Fn . In this case, the measure-theoretic version of Lévy’s zero-one law says

that for any random variable ξ that has a finite expected value EP (ξ),

lim EP (ξ | Fn )(ω) = ξ(ω)

n→∞

for almost all ω.7 This is similar to the game-theoretic version of the law,

Equation (12) in §3.3:

lim E(ξ | ω n ) = ξ(ω)

n→∞

almost surely. In the game-theoretic version, it is explicit in the notation

that E(ξ | ω n ) depends on ω only through what is known at the end of round

n, namely ω n . In the measure-theoretic version, we know that the value

EP (ξ | Fn )(ω) of the random variable EP (ξ | Fn ) depends on ω only through

ω n because this random variable is measurable with respect to Fn .

There are additional differences between the measure-theoretic and gametheoretic concepts. In the game-theoretic picture, a variable ξ may have only

upper and lower prices, E(ξ | s) and E(ξ | s), but these are well defined even

if the probability of arriving in the situation s was initially zero. Moreover,

in the special case where upper and lower prices are equal, they behave as

expected values are supposed to behave: E(ξ1 + ξ2 | s) = E(ξ1 | s) + E(ξ2 | s),

etc. In contrast, the measure-theoretic quantity EP (ξ | Fn )(ω) is undefined (i.e.,

can be chosen arbitrarily) if ω n has initial probability zero, and the abstract

definition (13) does not guarantee that the quantities EP (ξ | Fn )(ω) will behave

like expected values when ω is fixed and ξ is varied, or even that they can be

chosen so that they do so.

The extent to which conditional expectations can fail to behave like expected

values was a matter of some consternation when it was discovered in the 1940s

and 1950s [22]. But in the end, the awkward aspects of the concept of conditional

expectation have been tolerated, because the measure-theoretic framework is

very general, applying to continuous as well as discrete time, and the usefulness

of its theorems for sensible probability models is not harmed by the existence

of less attractive models that also satisfy its axioms.

7 If we do not assume that F is the smallest σ-algebra containing the F , then we can say

n

only that limn→∞ EP (ξ | Fn )(ω) = EP (ξ | F∞ )(ω) for almost all ω, where F∞ is the smallest

σ-algebra containing the Fn . Lévy’s own statement of his law, first published in 1937 [16], was

simpler. He wrote that limn→∞ En (ξ) = ξ almost surely, where En (ξ) is ξ’s expected value

after ω1 . . . ωn are known. Lévy had his own theory of conditional probability and expected

value, slightly different from the one Kolmogorov published in 1933 [14].

18

4.2

Forecasting systems

In many applications of probability to logic and computer science, we consider

an infinite sequence of 0s and 1s. If we write µ(y1 . . . yn ) for the probability that

the sequence will start with y1 . . . yn , then we should have:

• 0 ≤ µ(y1 . . . yn ) ≤ 1, and

• µ(y1 . . . yn ) = µ(y1 . . . yn 0) + µ(y1 . . . yn 1)

for all finite sequences y1 . . . yn of zeroes and ones. Let us call a function µ

satisfying these two rules a binary probability distribution.

Standard expositions of the Kolmogorov-Doob framework show how to construct a probability space (Ω, F, P ) from a binary probability distribution µ:

• Ω is the set of all infinite sequences of zeroes and ones: Ω = {0, 1}∞ .

• F is the smallest σ-algebra of subsets of Ω that includes, for every finite

sequence y1 . . . yn of zeroes and ones, the set consisting of all ω ∈ Ω that

begin with y1 . . . yn . (In this case, we say that y1 . . . yn is a prefix of ω.)

• P is the unique probability measure on F that assigns, for every finite

sequence y1 . . . yn of zeroes and ones, the probability µ(y1 . . . yn ) to the

set consisting of all ω ∈ Ω that have y1 . . . yn as a prefix.

Given a bounded random variable ξ in (Ω, F, P ), let us write Eµ (ξ) instead of

EP (ξ) for its expected value.

Let us call a binary probability distribution µ positive if µ(y1 . . . yn ) is always strictly positive. In this case, conditional probabilities for yn given the

preceding values y1 . . . yn−1 are well defined. Let us write µy1 ...yn−1 (yn ) for

these conditional probabilities:

µy1 ...yn−1 (yn ) :=

µ(y1 . . . yn−1 yn )

µ(y1 . . . yn−1 )

(14)

for any sequence y1 . . . yn of zeroes and ones.

Now consider the variation on Protocol 1 where Reality must choose each of

her moves yn from {0, 1} (rather than from the larger set [0, 1]). In this case,

Forecaster’s move µn can be thought of as Forecaster’s probability, after he has

seen y1 . . . yn , that Reality will set yn to equal 1. This thought reveals how

Forecaster can use a positive binary probability distribution µ as a strategy

in the game: he sets his move µn equal to µy1 ...yn−1 (1). If we assume that

Forecaster plays this strategy, then we can replace him by the strategy in the

protocol, reducing it to the following:

Protocol 3. Using a positive binary probability distribution as a

strategy for bounded probability prediction

Parameter: Positive binary probability distribution µ

Skeptic announces K0 ∈ R.

FOR n = 1, 2, . . . :

19

Skeptic announces Mn ∈ R.

Reality announces yn ∈ {0, 1}.

Kn := Kn−1 + Mn (yn − µy1 ...yn−1 (1)).

The sample space for this protocol is the space we just discussed: Ω =

{0, 1}∞ . The upper price in this protocol of a bounded variable, if it is measurable, is the same as its expected value in (Ω, F, P ) ([21], Proposition 8.5).

In the case of a binary probability distribution µ that is not positive, the

denominator in Equation (14) will sometimes be zero, and so µ will not determine a strategy for Forecaster in our game. To avoid this difficulty, it is natural

to replace the concept of a binary probability distribution with the concept of

a forecasting system, which gives directly the required conditional probabilities

µy1 ...yn−1 (yn ). A binary probability distribution µ can be constructed from such

a system:

µ(y1 . . . yn ) := µ2 (y1 )µy1 (y2 ) · · · µy1 ...yn−1 (yn ).

If µy1 ...yn−1 (yn ) = 0 for some y1 . . . yn−1 yn , then the forecasting system carries

more information than the binary probability distribution.

The concept of a forecasting system generalizes beyond probability prediction (the variation on Protocol 1 where the yn are all either zero or one) to

Protocol 2. Fix a σ-algebra G on Reality’s move space Y, and write PY for

the set of all probability measures on (Y, G). Write Y∗ for the set of all finite

n

sequences of elements of Y. In symbols: Y∗ := ∪∞

n=0 Y . Then a forecasting sys∗

tem is a mapping µ from Y to PY that is measurable in an appropriate sense.

Such a system µ determines a measure-theoretic object on the one hand and

game-theoretic object on the other:

• It determines a probability measure P on the sample space Y∞ , and in

each later situation a probability measure whose expected values form

conditional expectations with respect to P and that situation.

• It determines a strategy for Forecaster in the protocol: in the situation

y1 . . . yn , Forecaster announces the pricing cone consisting of every realvalued function g on Y such that f ≤ g for some random variable g on

(Y, G) such that

Eµ(y1 ...yn ) (g) ≤ 0.

The two objects agree on global pricing: the game-theoretic upper price of a

bounded random variable on Y∞ will be equal to its expected value with respect

to P .

With respect to our game-theoretic protocols, however, the pricing cones determined by a forecasting system are rather special. In Protocol 1, for example,

Forecaster is asked to give only a single number µn as a prediction of yn ∈ [0, 1],

not a probability distribution for yn . The pricing cone thus offered to Skeptic

(tickets that cost µn and pay yn ) is much smaller than the pricing cone defined

by a probability distribution for yn that has µn as its expected value. In Protocol 2, Forecaster has the option on each move of offering a pricing cone defined

by a probability distribution for Reality’s move, but he also has the option of

offering a smaller pricing cone.

20

4.3

Duality

Using the concept of a forecasting system, we can see how game-theoretic and

measure-theoretic probability are dual to each other. The quantity E(ξ) represented in Equation (4) as an infimum over a class of capital processes is also a

supremum over a class of forecasting systems.

As a first step to understanding this duality, consider how pricing cones on

Y are related to probability measures on Y. For simplicity, assume Y is finite,

let G be the σ-algebra consisting of all subsets of Y, and again write PY for the

set of all probability measures on (Y, G). Given a pricing cone C on Y, set

PC := {P ∈ PY | EP (f ) ≤ 0 for all f ∈ C}.

(15)

Given a real valued function ξ on Y, we can show that

C = {f : Y → R | EP (f ) ≤ 0 for all P ∈ PC }

(16)

and that

sup{EP (ξ)|P ∈ PC }

= inf{α ∈ R | ∃f ∈ C such that α + f (y) ≥ ξ(y) for all y ∈ Y}

= inf{α ∈ R | ξ − α ∈ C}.

(17)

Equations (15) and (16) express one aspect of a duality between pricing cones

and sets of probability measures. Equation (17) says that an upper price defined

by taking an infimum over a pricing cone can also be obtained by taking a

supremum over the dual set of probability measures.8

The concept of a filtration, because of the way it handles probabilities conditional on events of probability zero, does not lend itself to simple extension

of (17) to a probability game with more than one round. Simple formulations in

discrete time are possible, however, using the concept of a forecasting system.

For simplicity, assume again that Y is finite, and let us also assume that the

game ends after N rounds. Write Y∗ for the set of all finite sequences of elements

−1 n

of Y of length less than N . In symbols: Y∗ := ∪N

n=0 Y . A forecasting system

∗

with horizon N is a mapping from Y to PY . Here, as in the binary case we just

studied more closely, a forecasting system µ determines a probability measure

Pµ on YN that has the probabilities given by µ as its conditional probabilities

when these are well defined. Let us write FY,N for the set of all forecasting

systems with horizon N .

We modify Protocol 2 by stopping play after round N and fixing a strategy

for Forecaster, say Fstrat, that ignores the moves by Skeptic and chooses Cn

based only on Reality’s previous moves y1 . . . yn−1 ; this means that Fstrat is a

mapping from Y∗ to CY . Since Forecaster’s strategy is fixed, we may remove

him from the protocol, writing it in this form:

8 Because of the finiteness of Y and Condition 4 in our definition of a pricing cone, the

infimum and the supremum in (17) are attained.

21

Protocol 4. Finite horizon & fixed forecasts

Parameters: N , Reality’s move space Y, Forecaster’s strategy Fstrat

Skeptic announces K0 ∈ R.

FOR n = 1, 2, . . . , N :

Skeptic announces fn ∈ Fstrat(y1 . . . yn−1 ).

Reality announces yn ∈ Y.

Kn := Kn−1 + fn (yn ).

In this finite-horizon protocol, Ω = YN , and our definition of the upper price of

a variable ξ, (4), simplifies to

E(ξ) := inf{L(2) | L ∈ L and L(ω) ≥ ξ(ω) for all ω ∈ Ω}.

We can show that

E(ξ) = sup{Eµ (ξ) | µ ∈ FY,N and

µy1 ...yn ∈ PFstrat(y1 ...yn ) for all (y1 . . . yn ) ∈ Y∗ }.

This is the duality we announced at the outset: the infimum over initial stakes

for different capital processes available to Skeptic that attain ξ equals the supremum over expected values of ξ for different forecasting systems that respect the

offers made to Skeptic. See [6] for proofs and further comments on this duality.

4.4

Continuous time

It would be out of place to emphasize continuous-time processes in an introduction to game-theoretic probability for computer scientists. But these processes

are very important in the measure-theoretic framework, and we would be selling

the game-theoretic framework short if we did not take the time to point out that

it can make a contribution in this domain.

How can we adapt the idea of a probability game to the case where Reality chooses a continuous-time path yt instead of merely a sequence of moves

y1 y2 . . . ? One answer, which uses non-standard analysis, was developed in [21].

In more recent work, which seems more promising, one supposes that Skeptic

divides his capital among many strategies, all of which make bets at discrete

points in time, but some of which operate at a much higher frequency than

others. This approach has been dubbed high-frequency limit-order trading by

Takeuchi [25].

Some of the continuous-time results require surprisingly little structure: we

merely assume that Reality outputs a continuous path yt that Skeptic observes

as time passes, and that and at each time t Skeptic is allowed to buy an arbitrary

number of tickets (negative, zero, or positive) that will pay him St0 − St at a

future time t0 of his choice. (Imagine that St is the price at time t in a security

traded in an idealized financial market.) This assumption, combined with our

definition of almost sure (an event happens almost surely if there is a strategy

for Skeptic that multiplies the capital it risks by an infinite factor when the event

fails) allows us to derive numerous qualitative properties that have been proven

22

for Brownian motion and other martingales in the measure-theoretic framework.

For example, we can show that St almost surely has no point of increase [33].9

We can also show that St will almost surely have the jaggedness of Brownian

motion in any interval of time in which it is not constant [34, 25, 32].10 It appears

that volatility is created by trading itself: if the price is not constant, there

must be volatility. In general, a result analogous to that obtained by Dubins

and Schwarz in 1965 for continuous martingales in measure-theoretic probability

holds in this game-theoretic picture for St : any event that is invariant under

transformations of the time scale has a game-theoretic probability, which is

equal to its probability under Brownian motion [10, 31].

We can add additional structure to this game-theoretic picture by adding

another player, Forecaster, who offers Skeptic additional betting opportunities.

In this way, we can construct game-theoretic analogs to well known stochastic processes, including counting processes and Brownian motion [28]. The

game-theoretic treatment of stochastic differential equations, sketched using

non-standard analysis in [21] has yet to be undertaken in the high-frequency

limit-order trading model.

The contribution here goes beyond showing that game-theoretic probability

can obtain results already obtained by measure-theoretic probability. The gametheoretic approach clarifies the assumptions needed: the notion that Reality

behaves stochastically is reduced to the assumption that Skeptic cannot multiply

the capital he risks by a large or infinite factor. And because Skeptic tests

Reality by betting at discrete points of time, the game-theoretic approach makes

the continuous-time picture directly testable.

4.5

Open systems

An important aspect of the game-theoretic framework for probability is the

open character of the protocols with which it works. Our protocols require only

that the three players move in the order given and that Skeptic see the other

players’ moves. The players may receive other information, some of it private.

Our theorems, such as the law of large numbers and Lévy’s zero-one law, are

not affected by such additional information.

In some applications, it is useful to make additional information explicit. We

sometimes elaborate Protocol 2, for example, by having Reality give the other

players information xn before they move on the nth round. If we write X for

the space from which this information is drawn, the protocol looks like this:

Protocol 5. Prediction with auxiliary information

9 We say that t is a point of increase for S if there exists δ > 0 such that S

t

t1 < St < St2

for all t1 ∈ (t − δ, t) and t2 ∈ (t − δ, t). In 1961 Dvoretzky, Erdős, and Kakutani [11] proved

that Brownian motion almost surely has no point of increase, and in 1965 Dubins and Schwarz

[10] noticed that this is true for any continuous martingale. The game-theoretic argument in

[33] imitates the measure-theoretic argument given in 1990 by Burdzy [4].

10 This is made precise in different ways in the different references cited. In [32], a measuretheoretic construction by Bruneau [3] is adapted to show that the p-variation index of St is

equal to 2 almost surely if St is not constant.

23

Parameters: Reality’s information space X, Reality’s move space Y

Skeptic announces K0 ∈ R.

FOR n = 1, 2, . . . :

Reality announces xn ∈ X.

Forecaster announces Cn ∈ CY .

Skeptic announces fn ∈ Cn .

Reality announces yn ∈ Y.

Kn := Kn−1 + fn (yn ).

Putting the protocol in this form allows us to discuss strategies for Forecaster

and Skeptic that use the xn , but it does not invalidate the theorems for Protocol 2 that we have discussed. These theorems say that Skeptic can achieve

certain goals using only the information about past yn , regardless of how his

opponents move and regardless of their additional information.

In many scientific and engineering applications of probability and statistical

theory, only certain aspects y1 y2 . . . of a process are given probabilities, while

other aspects x1 x2 . . . , although they may affect the probabilities for the y, are

not themselves given probabilities. Examples include:

• Quantum mechanics, where measurements yn have probabilities only after

we decide on the circumstances xn under which we make measurements.

See section 8.4 of [21].

• Genetics, where probabilities for the allele yn of the next child are specified

only after the next parents to have a child, xn , are specified.

• Decision analysis, where in general outcomes yn have probabilities only

after decisions xn have been made.

• Regression analysis, where each new outcome yn is modeled only conditionally on a vector xn of predictor variables.

In these examples, we can say we are using measure theory. Our model,

we can say, is a class of probability measures – all the probability measures for x1 y1 x2 y2 . . . in which the conditional probabilities for yn given

x1 y1 . . . xn−1 yn−1 xn satisfy certain conditions, the conditional probabilities for

xn given x1 y1 . . . xn−1 yn−1 not being restricted at all. This formulation is,

however, pragmatically and philosophically awkward. Pragmatically awkward

because many results of mathematical statistics are applied in this way to situations where they do not necessarily hold. Philosophically awkward because

we may not really want to say that the xn follow some completely unknown or

unspecified probability model. What is the content of such a statement?

The game-theoretic approach deals with these examples more straightforwardly. We specify bets on each yn based on what is known just before it is

announced. Using Cournot’s principle we can give these bets an objective interpretation: no opponent will multiply the capital they risk by a large factor.

Or we can settle for a subjective interpretation, either by weakening Cournot’s

principle (we believe that no opponent will multiply the capital they risk by a

24

large factor) or by asserting, in the spirit of de Finetti, that we are willing to

make the bets. There is no need to imagine unspecified bets on the xn .

5

Conclusion

In this article, we have traced game-theoretic probability back to Blaise Pascal, and we have explained, with simple examples, how it generalizes classical

probability. In particular, we have stated game-theoretic versions of the strong

law of large numbers, Lévy’s zero-one law, and the law of calibration. We have

also spelled out various relationships with the measure-theoretic framework for

probability.

When a field of mathematics is formalized in different ways, the different

frameworks usually treat topics at the core of the field similarly but extend

in different directions on the edges. This is the case with the game-theoretic

and measure-theoretic frameworks for probability. They both account for the

central results of classical probability theory, and the game-theoretic framework

inherits very naturally the modern branches of measure-theoretic probability

that rely on the concept of a martingale. But outside these central topics, the

two frameworks offer more unique perspectives. Some topics, such as ergodic

theory, are inherently measure-theoretic and seem to offer little room for fresh

insights from the game-theoretic viewpoint. In other areas, the game-theoretic

framework offers important new perspectives. We have already pointed to new

perspectives on Brownian motion and other continuous-time processes. Other

topics where the game-theoretic viewpoint is promising include statistical testing, prediction, finance, and the theory of evidence.

In the thesis he defended in 1939 [27], Jean Ville explained how we can

test a probabilistic hypothesis game-theoretically. The classical procedure is to

reject the hypothesis if a specified event to which it assigns very small probability happens. Ville pointed out that we can equivalently specify a strategy

for gambling at prices given by the hypothesis and reject the hypothesis if this

strategy multiplies the capital it risks by a large factor. In other words, we

reject the hypothesis if a nonnegative capital process – a nonnegative martingale, in the now familiar terminology that Ville introduced – becomes many

times as large as its initial value. Ville also pointed out that we can average

martingales (this corresponds to averaging the gambling strategies) to obtain a

more or less universal martingale, one that becomes very large if observations

diverge from the probabilities in any important way. In the 1960s, Per MartinLöf and Klaus-Peter Schnorr rediscovered and developed the idea of a universal

test or universal martingale. The game-theoretic framework allows us to make

these ideas practical. As we showed in [21], we can construct martingales that

test violations of classical laws. The notion of a universal test is only an ideal

notion; Martin-Löf’s universal test and Schnorr’s universal martingale are not

computable. But by combining gambling strategies that test classical laws implied by a statistical hypothesis, we can construct martingales that are more or

less universal in a practical sense.

25

In 1976 [15], Leonid Levin realized that for any test, including any universal

test, there is a forecasting system guaranteed to pass the test.11 So there is

an ideal forecasting system, one that passes a universal test and hence passes

every test. Like the universal test that defines it, Levin’s ideal forecasting

system is not computable. But in game-theoretic probability, we can implement

practical versions of Levin’s idea. For a wide class of prediction protocols, every

computable game-theoretic law of probability defines a computable forecasting

system that produces forecasts that conform to the law. By choosing suitable

laws of probability, we can ensure that our forecasts agree with reality in all the

ways we specify. We call this method of defining forecasting strategies defensive

forecasting. It works well in many settings. It extends to decision problems,

because the decisions that are optimal under forecasts that satisfy appropriate

laws of probability will have satisfactory empirical performance, and it compares

well with established methods for prediction with expert advice [36, 29, 30, 5].

We noted some of game-theoretic probability’s implications for the theory

of finance in §4.4. Other work has shown that versions of some of the standard

results in finance can be obtained from the game-theoretic framework alone,

without the introduction of stochastic assumptions. In [35], an empirical version

of CAPM, which relates the average returns from securities to their correlations

with a market portfolio, is derived game-theoretically. In [26], asymmetries in

the movement of stock prices up and down are tested game-theoretically. In [37],

observed correlations in stock returns are subjected to purely game-theoretic

tests, and it is concluded that apparent inefficiencies are due to transaction

costs.

A central question in the theory of evidence is the meaning and appropriateness of the judgements involved in updating and the combination of evidence.

What judgements are involved, for example, when we use Bayes’s theorem,

Walley’s rule for updating upper and lower probabilities, or Dempster’s rule

for combining belief functions? A game-theoretic answer to these questions is

formulated in [20].

Acknowledgments

We are grateful to Yuri Gurevich and Akimichi Takemura for encouragement.

References

[1] Laurent Bienvenu, Glenn Shafer, and Alexander Shen. On the history of

martingales in the study of randomness. Electronic Journal for History of

Probability and Statistics, 5(1), June 2009.

11 Levin’s terminology was different, of course. His picture was not game-theoretic; instead

of a forecasting system, he considered something like a probability measure, which he called

a semimeasure. He showed that there is a semimeasure with respect to which every sequence

of outcomes looks random.

26

[2] Patrick Billingsley. Probability and Measure. Wiley, New York, third edition, 1995. Previous editions appeared in 1979 and 1986.

[3] Michel Bruneau. Sur la p-variation des surmartingales. Séminaire de

probabilités de Strasbourg, 13:227–232, 1979. Available free of charge at

http://www.numdam.org.

[4] Krzysztof Burdzy. On nonincrease of Brownian motion. Annals of Probability, 18:978–980, 1990.

[5] Alexey Chernov and Vladimir Vovk. Prediction with expert evaluators’

advice. In Ricard Gavaldà, Gábor Lugosi, Thomas Zeugmann, and Sandra

Zilles, editors, Proceedings of the Twentieth International Conference on

Algorithmic Learning Theory, volume 5809 of Lecture Notes in Artificial

Intelligence, pages 8–22, Berlin, 2009. Springer. Full version: Technical report arXiv:0902.4127 [cs.LG], arXiv.org e-Print archive, February 2009.

[6] Roman Chychyla. On the duality between game-theoretic and measuretheoretic probability. http://probabilityandfinance.com, Frequently

Asked Question #5, 2009.

[7] A. Philip Dawid. Statistical theory: the prequential approach. Journal of

the Royal Statistical Society A, 147:278–292, 1984.

[8] A. Philip Dawid. Calibration-based empirical probability (with discussion).

Annals of Statistics, 13:1251–1285, 1985.

[9] Joseph L. Doob. Stochastic Processes. Wiley, New York, 1953.

[10] Lester E. Dubins and Gideon Schwarz. On continuous martingales. Proceedings of the National Academy of Sciences, 53:913–916, 1965.

[11] Aryeh Dvoretzky, Paul Erdős, and Shizuo Kakutani. Nonincrease everywhere of the Brownian motion process. In Proceedings of the Fourth Berkeley Symposium on Mathematical Statistics and Probability, volume II (Contributions to Probability Theory), pages 103–116, Berkeley, CA, 1961. University of California Press.

[12] Ronald Getoor. J. L. Doob: Foundations of stochastic processes and probabilistic potential theory. Annals of Probability, 37:1647–1663, 2009.

[13] Christian Huygens. De ratiociniis in ludo aleae. 1657.

[14] Andrei N. Kolmogorov. Grundbegriffe der Wahrscheinlichkeitsrechnung.

Springer, Berlin, 1933. English translation: Foundations of the Theory of

Probability. Chelsea, New York, 1950.

[15] Leonid A. Levin. Uniform tests of randomness. Soviet Mathematics Doklady, 17:337–340, 1976.