Case Match Reduction through the Integration of

advertisement

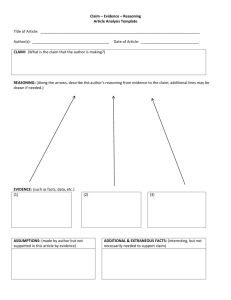

Case MatchReduction through the Integration of Rule-based and Case-based Reasoning Procedures Huei-Pi (Ruby) Chen, Larry J. Wilkinson NewcastleBusinessSchool,University of Northumbriaat Newcastle Newcastle UponTyne, NE18ST, England hpchen@msl.showtower.com.tw; l.j~wilkinson@unn.ac.uk Abstract Case-basedreasoning utilizes past experiences as a key data resource for future problem solving and is considered an innovativetechniquein the development of Artificial Intelligence. However, the large storage requirements needed for such proceduresresult in a heavyload in the ease base and indeed, problemsof efficiency arise in case retrieval. The proposed methodaimsto improvecase retrieval throughreducingthe case memoryload. The authors propose a cognitive notion as a framework for reducing case match. Using a cognition framework,objective knowledge is representedin the rule-based part of the systemsand subjective knowledgein the case-based reasoningpart. In this way,the comparisonsin case matchcan be significantly reduced. A loan authorisation system, ECLAS, demonstratesthe feasibility of the cognitive framework,the significanceboth of the efficiencyof systemperformance and the reductionin the calculationof the case matches. Keywords.case-based-reasoning,rule-based-reasoning, expertsystems,case-match-reduction. Introduction Case-based reasoning (CBR) uses periodic experiences stored in cases as a basis for decisions and has been implemented in a wide range of fields (Kolodner 1993; Aamodt & Plaza 1994; Watson 1997). A large number of cases are used in order to increase confidence in the solution. The more cases gathered, the better that past experience is utilized. Manycorporations develop largescale or multiple case-based systems. In such situations the case base load may becomehuge. Inevitably this has stimulated research into increasing problem solving efficiency in large case-based problems. Researchers who focus on representation aim to organize and classify the case base in order to efficiently point to an appropriate case (Kolodner 1983a; 1983b; Koton 1989; Schank 1982)n. For example, Category-ExemplarModel(Bareiss 1988, Porter, Bareiss, & Holte 1990)~ structured the case base in a semantic networkby using categories, indexes pointers and cases. Similar cases are assembled under a category. t Theoriesof Bareiss1988;Kolodner 1983a;1983b;Koton1989;Porter. Baxeisss.&Holte1990;Schank 1982drawnfromWatson &Marir1994; Aamodt &Plaza 1994. 33 An index maypoint to a case or a category. The indexes maybe features linked from problem descriptors to a case or a category, from categories to their cases or from categories to the adjacent cases. The well inter-linked networkefficiently supports case matchin case retrieving. Others, workingon similarity assessment attempt to efficiently cluster fewer cases as the initial partial match (Kolodner 1993). A measure of the difference between two cases is calculated; cases with the smallest difference are considered most similar. The difference is the sum of the distance of features between the new case and one retrieved case. A numberof strategies strive to provide increasingly close estimation of differences betweencases. Yet other approachesfocus on constraint satisfaction problems aiming at reducing the amount of conflict checking and, thereby reducing the numberof new choices provided. Huang & Miles (1996) feature a case-based travel reservation system embeddinga rule-based modelto specify constraints before reasoning with the case base. For example,a special offer is only available for a specific duration in a non-peak season. The special offer is a static constraint which specifies duration and price of a tour. The dynamic constraints are features changed over time such as customer requirements, number of people, tour duration, flight, and accommodation...etc.. These dynamicconstraints, e.g. accommodation,are specified by the static constraint, e.g. hotel in grade 4, before recalling cases from the large case base. The heuristic limits the number of recalled cases. In the above-mentioned approaches, system efficiency is ameliorated from one to another, but the problem of case memorydoes not come under consideration. Proposed System The case match reduction approach suggested here proposes to increase the speed of case-based reasoning by effectively reducing case memory. In the traditional ¯ scenario, CBRcarries out an initial mappingof the new case onto the prior cases to generate a cluster of similar cases and then; keeps comparingthe similarities of these cases to those of the newcase. This results in a geometric increase of the comparisonsof the similarities of features. The case matchreduction alternative is therefore suggested in order to reduce the number of comparisons to each similar case in the mapping process. The suggested process reduces the cluster of the comparisonsrequired for new cases. It greatly reduces the complexity of the case matchand increases the efficiency of the matchingprocess. Since CBRis a cognitive oriented technique, the suggested procedure is designed in terms of cognitive psychology. Objective knowledge is distinguished from subjective knowledge. Objective knowledge is logical, explicit, and rational (has a definite answer). In contrast, subjective knowledgeis implicit, uncertain, and imprecise (has a complex inter-relationship). The approach represents objective knowledge in a logical rule-based reasoning process ’and subjective knowledgein case-based reasoning one. Definition of the Objective Characteristics. 1. Strong theory domain: These statements (such as financial principles or banking regulations) can be proved true or false (Aamodt1994). For example, the total net worth of a corporate applicant is lower than the bank’s aggregate lower limit in a loan granting system. The size of the company is too small to be accepted. Thus the loan application obviously will not be approved. 2. Rationality: Procedures or algorithms that provide unequivocal results (a computational function or mathematical model). Applying these rules or procedures producesrational as opposedto subjective or bias decisions (Brown 1987). For example, Since 1968, the Z-Score model has been developed as an index of financial vulnerability by using a combinationof traditional financial ratios and statistical techniques. The equation involves five standard categories of corporate performance, which are given relative importanceby different weights, to find the discriminatingvalue of failure. 3. Explicitness : This criteria is complementary to the strong theory domain. The behavior of some properties cannot be adequately estimated, but the influence can be explicitly known by some specific contexts or can be definitively distinguished. For example, the results of the influence can be represented by tendency, e.g. good, indifferent, and bad. For example, if the Z Score is 1.8 or less, the result wouldsignify a very higher probability of insolvency. If the Z score is between 1.81 and 2.99, the probability of failure cannot be certain. Whenthe Z score is 3.0 or higher, the companyis unlikely to fail (Altman 1968). Therefore, whenthe Z score is 1.8 or less, the result can be determined as unacceptable. A primary decision will be derived. Whenthe Z score is higher than 1.8, the results will be further investigated. 4. Direct influence on the final solution : The objective features should be features directly influencing the final solution. If features are explicit, rational, or have strong theory but do not havea direct influence on the final decision, the features are not categorized as objective knowledge.For example, current ratio has a strong theory, a value of 1 normally indicates good financial health. However, current ratio is combined with quick ratio, receivables, payables, and turnovers to define a criterion of liquidity, whichforms the feature whichhas a direct effect on the final decision. Thus current ratio is not an objective feature in this formulation. Definition of the Subjective Characteristics. 1. Weaktheory domains: Statements are moreor less critical, and more strongly or moreweaklybelieved, rather than proved true or false (Aamodt 1993). For example, financial leverage can only be identified as "the less, the better". There is no determining value for good or bad leverage. 2. Uncertainty, unknownor anomaly : Knowledgein the criteria usually can be inferred and explained by the surrounding contexts or the features under the same criterion. For example, when a feature of liquidity is unknown,the features in the criterion of liquidity such as inventory, receivables, payables can be usedto replace the mainfeature of liquidity. 3. Semantic relationship : The representation paradigm in this criterion is not primarily a syntactic problem, but one of a semantic structure (Aamodt1993). Understanding this inter-relationship is important in obtaining a final solution. For example, the quality of liquidity refers to the quality of receivables, of payables, of turnover, and other factors. The quality of receivables depends on days of receivables and percentage of sales to receivables. Likewise, the quality of payables dependson days of payables and percentage of sales to payables. Similarly, the quality of turnover depends on days of turnover and percentage of sales to turnover. Input data Objective knowledge In Rule-Based Reasoning Subjective knowledge In Case-Based Reasoning Proposed Solution j Figure1 SystemIntegration Integration. The proposed method merges the rule-based system and the case-specific knowledge system into an integrated system (Figure 1). The rule-based process initially infers objective knowledge and determines a primary decision. If objective knowledgeis sufficient to draw out a final decision, the primary decision will be 34 determined. For example, a credit card application will be denied right awayif a prior record of a substantial unpaid balance within the past six months is found for the applicant. In some cases, it will not be necessary to perform further analysis. If objective knowledgepasses the primary examination in the rule-based reasoning part of the system, a more in-depth investigation will be undertaken in the case-based reasoning part. The casebased reasoning procedure continues to infer subjective knowledgeand generates a final conclusion. For example, if the credit card applicant meets the minimumincome requirements, e.g. the minimumrequirement for a gold card is a yearly income of GBP15,000(USD25,000), and has no prior record of unpaid balances or other such history, the application would be provisionally accepted. The credit union still needs to investigate the applicant’s monthly financial burden, e.g. car loan, housing loan, or other credit card payments. The features of the monthly financial burden cot~Id be examinedusing the case-based reasoning part of system. The case-based reasoning process infers the features of subjective knowledgeand concludesif the applicant is qualified to receive a credit card. The rule-based process and the case-based process therefore are vertically integrated. Loan Authorization System A loan authorization system is used to demonstrate the feasibility of distinguishing objective and subjective judgements. The domain knowledge is acquired from a globally centralized credit analysis process in a French bank. The branch evaluated only lends to corporate customers. A credit control procedure summarizes the figures of last year in the credit proposal into eight financial criteria which depict the company’s debt serviceability. Each criterion takes a value of 0 or 1. The total score marksfor the criteria range from 0 (worst) to 8 (best) on the financial health of a company. 1. Total Exposure: Lender’s total exposure/tangible net worth < 50%= 1 2. Gearing1 : (STL2+bonds)/tangiblenet worth < 3 (times) = 1 3. Gearing 2 : 3 + off-balance sheet (Gearing 1 + LTD activities4)/tangible net worth < 4 (times) 1 4. FEYFN" Financial expenses/turnover < 6% = 1 5. LTD/CF: 1 Long term debt/cash flow < 5 (years) 6. WorkingCapital : Working Capital > 0 (positive) = 7. STD/MTN: ST borrowings/monthly turnover < 5 (times) = 8. STLAJARI: (ST borrowings - Liquid Assets) / (Account Receivables + Inventory) < 70% = Determining Objective and Subjective Features The demonstration system determines the objective and subjective features based on these eight criteria. The sum of the eight criteria evaluates total performance of the company which has a direct impact on the loan authorisation. For example,if the score is only 2, the loan application normallywill not be accepted. Total Exposure : The maximumlending amount should be no more than 50%of the borrower’s net worth. This assesses the value of the company’sequity from the point of view of risk. In the case of bankruptcy, will the amountof equity be sufficient to repay the loan to the lender ? Gearing 1 and Gearing 2 : These evaluate the borrower’s net worth in order to assess whether they will be able to repay the borrowed principal. The larger the borrowed sum, the greater the risk for the lender. Gearing1 discusses the ability to pay the short-term debts, including short-term loans and bonds, in net worth terms. Extending Gearing 1, long-term borrowings, occasional expenditures in the off-balance sheet are also considered in Gearing 2. The short-term borrowings are acceptable whenthey are less than 3 times the borrower’s net worth, and all borrowings together with the short-term and longterm debts must be less than 4 times. For instance, for Gearing1 if the ratio is 1.5 then Gearing1 obtains a score of 1. The repayment of short-term loans by the company using net worth can be guaranteed. FE/TNand LTD/CF: FE/TNestimates the ability to repay the interest expenses using the company’sturnover in the short term. For a wholesaler bank, the interest is always a large amount at each drawndown,e.g. monthly interest could be as substantial as GBP2,000for a working capital borrowing in the amount of GBP2,000,000from a securities house. Whenfinancial expenses and turnover both increase and the score of FE/TNstill is 0, the situation should be further discussed. For example, increasing turnover also makes the interest expenses increase. In fact, it is goodto increase turnover. If turnover increases, S decrease, the profitability and but net result and EBITDA the solvencyare still suspicious. LTD/CFassesses the borrower’s ability to annually compensate the debts. The greater the cash flow, the stronger the company’s ability to meet payments. LTD/CF illustrates howmanyyears cash flow will take for the long-term debts. The ratio of LTD/CF uses the idea of the amortization of depreciation to consider amortizing the long-term debts using cash flow. For example, the ratio of LTD/CFis 2. It means the cash flow of the applicant 5 EBITis an abbreviate of Earning Before Interest and Tax. 2 ST=Short-term, STL= Short-term loans. 3 LTD= Long-term debts. 4 Activities not included on balance sheet e.g. unreported expenditures. EBIT= Net result + Financial interests + Taxes. EBITDA = EBIT + Depreciation Amortization. 35 can repay the long-term debts in 2 years. Working Capital, STD/MTNand STLAJARI: The three features explore the liquidity in the short term. When WorkingCapital is negative, the score for this component is zero. However, as long as the STD/MTNand STLAJARIratios are satisfactory, then liquidity is considered acceptable. It means monthly turnover can still service short-term debts and even if liquid assets are not considered, the short-term debts can be recovered through the company’saccount receivables and inventory¯ If the trend of WorkingCapital is declining, other factors in the criteria of STD/MTN and STLA/ARI,like inventory, receivable and payables should be considered before makinga decision. When Working Capital is positive: if STD/MTN obtains a score of 0, it indicates that the short-term loans are more than 5 times the profitability of turnover. Therefore, the decision maker should look into the ¯ relationship betweenthe loans maturedwithin one year and turnover which is presented in the item of Treasury Pass.6/Turnover. The item of Treasury Pass./Turnover shows the numberof days in which turnover can be used to repay the loans matured in one year. The greater the numberof days, the moredifficult turnover can recover the loans maturedin one year. WhenWorking Capital is positive but STLA/ARI gets a score of 0, it showsthat the short-term loans minus liquid assets are higher than 70%of the account receivables and inventory. Ratios like inventory/turnover, (inventory + receivable)/turnover, and suppliers/turnover provide the decision makerwith sufficient information to have a better appreciation of the liquidity situation. The smaller the three ratios represent, the better the workingcapital is put to use~ For instance, a manufacturer’s turnover can pay inventory in 80 days, pay inventory plus receivables in 90 days and suppliers in 75 days. The liquidity can last around 80 days and wouldbe acceptable in a short term. Total Exposure, Gearing 1, and Gearing 2 can be seen as banking regulations from head office. Headoffice has precise standards on the first three criteria for a loan applicant. They can be judged definitely since they can be determined precisely from the answers and they have a direct influence on the final decision. WorkingCapital can also be identified as influential in the final decision. Despite WorkingCapital having an effect on the seventh and eighth criteria, it has a strong influence on primary decision-making. The Headof Credit indicates that Total Exposure, Gearing 1 and Working Capital are the most important features amongthe eight criteria. They will not look further if a loan applicant concurrently fails to pass the requirement of the first three features. The four criteria, Total Exposure, Gearing I, Gearing 2 and Working Capital are identified as the objective features. On the other hand, FF_dTN, LTD/CF,STD/MTN and STLA/ARI are determined as the subjective features. The four criteria have a complex relationship with other 6 Treasury Pass = Short-term loans + Current portion of long-term debts. financial factors¯ For example,FE, fI’N is related to net result and EBITDA.LTD/CFis associated with the net result, STD/MTNto Treasury Pass.fl’urnover and STLA/ARIto the inventory, receivables and payables. The four criteria mayall be subject to exceptions from time to time. The humanexpert must use subjective judgement to examinethe situations whilst consulting the four criteria. Expert Case-based Loan Authorisation (ECLAS) System ~ I Initial ns I (SG Limit ! net worth < 50%) [TotalExposure ] (Working capital > 0) [W°rkinl~Capital (Gearing 1 < 3) >=0 ~ i =3 I i (Gearing 2 < 4) Figure in the <0 [ ..° [Gearing2 <50~ I I J [ <4 I >=4 I [ 2. Part Rule-Based of Remarks: u =underlimit up =positive underlimit St =Short-term Lt =Long-term s =safe ss =a safe short-term Ioar Knowledge Base Reasoning Process The Headof Credit ranks the significance of the features on lending decisions as Total Exposure, WorkingCapital, Gearing 1, Gearing 2, PT_/I’N, LTD/CF,STD/MTN,and STLAJARI.The former four features are dealt with using objective judgements and the latter four by subjective judgements. The loan authorisation system, which integrates rule-based reasoning and case-based reasoning procedures, is modeledin a powerful expert system shell, 7. called wxClips The knowledgebase in the rule-based reasoning is partitioned into four layers - TotalExposure, WorkingCapital, Gearingl and Gearing2 in the sequence of their importance(Figure 1). A hierarchical tree determines an appropriate branch whenthe system receives an answer from the user. For example, the first question asks "How muchis the total exposure requested ?". If the answer is less than "50" (percentage), the system chooses the left branch and determines"underlimit" as a current state of the layer of "TotalExposure" and the system’ prunes another sub-tree. Next, the second question "Howmuch is the working capital of the company?" is posted out. Given that the amountof workingcapital is greater than "0", the system points to the left branch. Once "positive-u" is selected as the state of the layer of "WorkingCapital". Thus, the system asks "How much is Gearing 1 of the company ?". Suppose the value of Gearing 1 is not 7 Homepage of WxClips:http://web.ukonline.co.uk/julian.smart/wxclips. 36 greater than "3" which satisfied the system requirement, "St-s-up" is chosenas the state of the layer of "Gearing1". The last question is "How much is Gearing 2 of the company?". If the value of Gearing 2 is less than "4", the system moves to "Lt-s-ss-up". Once the system finds out enough information to extract a conclusion, a primary decision is achieved. In this case, the loan application is initially approved and it is allowed to go for further examination in a CBRprocess. On the other hand, if the system reach a primary decision of "rejected", the investigation of the loan application will cease at this stage. The ECLASsystem integrates the rule-based part system and a case-based reasoning part. Rule-based reasoning filters out the failure features as a primary decision (Figure 2). Only applicants who satisfy the requirements of the primary decision will be considered for further analysis using subjective decision-making.The loan applicants failing the investigation of the primary decision are dropped now. unsatisfactory ~ satisfactory objective judgement unsatisfactory satisfactory Figure 3. Integration System The cases to be examinedin the case-based reasoning system are divided into two categories: Authorised - the bank agrees to the loan application with reference to a good companyperformance. Denied - applicants in this category are considered highly risky due to their poor financial positions. The loan authorisation uses a case-based reasoning technique based on the nearest-neighbor matching method (Kolodner 1993; Watson 1997). The distance score represents howclose a base case is to the target case. The smaller distances signify better matches and the one with the minimum distance is recognized as the nearest neighbor. The case base is serially indexed and each case is composed of the four subjective features. The expert allocates the features weights from 4 (mostsignificant) to (least) with respected to the influence of the investigated conclusion. The sequence arranged from the most weighty to the least is b-F_ZI’N, LTD/CF,STD/MTN and STLA/ARI.The system first and foremost tallies distance for each of the features on a scale from 0 to 5, with 0 symbolizing no difference and 5 symbolizing maximum difference. After working-out the individual distances, the system weights those distances by the relevant weightings and averages them out to find an overall distance. The formula (Sinha, & Richardson 1996) the systemuses is: 37 n d = ~ Wi* dista" (target, case base) i=1 where d = distance of case base from target Wi = weight of feature i disti (target, casebase) = distance of case base from target on feature i. If only one minimumcase is retrieved, the system next makes an authorizing decision based on the outcome of the neighbor. If the nearest neighbors are a set of cases, the decision follows the outcome in accordance with a majority of results from morethan 50%of the neighbors. The similarities assessment needs at least 1 rule to count the distance from the new case to the case base using a most elementary distance calculation method, e.g. the nearest-neighbor matching method shown in the ECLAS system. The distance of each feature in a case is estimated using the distance formula once. ECLAS separates 4 objective features from the case-based reasoning system. Therefore, 20,000 calculations are avoided for features in a case base containing 5,000 examples. This simultaneously reduces by one half the memorystorage requirement from 40,000 features of the case base to 20,000. The system performance verifies the efficiency of the approach. The proposed case match reduction technique appears to geometrically reduces the numberof the features to be calculated whenthe numberof cases increases. Conclusion Case-based reasoning stores past experiences on cases to draw resolutions. In practice the number of eases used should be quite large in order to win credence with users. In this situation case memorywill become massive. The case match reduction method proposed is based on a cognitive hypothesis. The hypothesis suggests that the objective and subjective knowledgeshould be represented by different techniques. For example, logicality, simplicity and ability of obtaining an exact answerin rulebased reasoning are appropriate for objective knowledge which is dealt with in the RBRcycle. Onthe other hand, case completeness, dynamismover time and the ability of case justification are more suitably represented by subjective knowledge in the CBRcycle. Implementing the representation schemeof rule-based reasoning requires comparatively speaking less memorythan that of casebased reasoning, which in turn will allow for reduction of total memorystorage. The feasibility of implementingthe objective features in the rule-based reasoning and the subjective features in the case-based reasoning has been demonstrated in the ECLAS system. The number of calculations are estimated to be reduced by 20,000 for 5,000 case comparisons whenthe four features employedin the casebased reasoning are movedto the rule-based reasoning. When the number of case comparisons and features increases, the number of calculations and storage requirement will geometrically decrease and the benefits of the proposed approach increase. Watson, I., & Marir, F. 1994. Case-BasedReasoning: A Review. The KnowledgeEngineering Review 9(4). Also available on internet at http://www.ai-cbr.org/classroorn/cbr-review.htm#CaseBased Reasoning Techniques. Watson, I. 1997 Applying Case-Based Reasoning. Morgan KaufmannPublishers, Inc. References Aamodt, A. 1993. Explanation-Driven Case-Based Reasoning. In Topics in Case-BasedReasoning,edited by S. Wess, K. Althoff, M. Richter. Proceedings of First European Workshop, EWCBR93, Kaiserslautern, Germany. pp. 274-288. Aamodt, A. 1994. A Knowledge Representation System for Integration of General and Case-Specific Knowledge. Proceedingsof lEEEConferenceon Tools for Artificial Intelligence. Aamodt,A., & Plaza, E. 1994. Case-Based Reasoning: Foundational Issues, MethodologicalVariations, and System Approaches. AI Communications7(i): 39-59. Alsoavailable on internet at http:// www.iiia.csic.es/People/enric/AICom.html#RTFToC1. Appendix 1. Integration name/category: Rule-based reasoning (RBR)and case-based reasoning (CBR)procedures. 2. Performance Task: Retrieval. A demonstration is built in the banking loan authorization domain. Altman, E. 1968. Details drawn from Failure Prediction Model(1996) Presentation Notes of Cooperate Decline and Turnaround,in the evaluated bank. Bareiss, E.R. 1988. PROTOS: A Unified Approach to ConceptRepresentation, Classification, and Learning, Ph.D. thesis, Dept. of ComputerScience, University of Texas, Technical Report CS 88-10, Dept. of Computer Science, Nashville, TN:Vanderbilt University. Brown, H. I. 1987. Objectivity. Observation and Objectivity. OxfordUniversity Press Inc., 191-230. Huang, Y., & Miles, R. 1996. Using Case-Based Techniquesto EnhanceConstraint Satisfaction Problem Solving. Applied Artificial Intelligence: 307-328. Kolodner, J.L. 1983a. Maintaining Organization in a Dynamic Long-Term Memory. Cognitive Science (7). Kolodner, J.L. 1983b. Reconstructive Memory,a Computer Model. Cognitive Science (7). Kolodner, J. L. 1993. Case-based Reasoning. Morgan KaufmannPublishers, Inc. Koton, P. 1989. Using Experience in Learning and Problem Solving, MassachusettsInstitute of Technology, Laboratory of ComputerScience (Ph.D. thesis, October 1988). M1T/LCS/TR-441. Porter, B.; Bareiss, R.; &Holte, R. 1990. ConceptLearning and Heuristic Classification in WeakTheory Domains. Artificial Intelligence, 45(1-2): 229-263. Schank, R. 1982. DynamicMemory; A Theory of Reminding and Learning in Computersand People. CambrigeUniversity Press. Sinha, A., & Richardson, M. A. 1996. A Case-Based Reasoning System for Indirect Bank Lending. Intelligent Systems in Accounting, Finance and Management(5):229240. 38 3. Integration Objective: A case match reduction approach. Representing features in RBRrequires comparatively speaking less memorythan that in CBR,which in turn allows for a reduction of total memorystorage. The integration of RBR and CBR improves system efficiency, case memory economy and user comprehension of explanations. 4. Reasoning Components: RBRfor pre-screening, followed by CBR. 5. Control Architecture: Sequential. 6. CBRCycle Step(s) Supported: Pre-processing in RBRand then retrieval in CBR. 7. Representations: Representing objective features in RBRand subjective features in CBR. The proposed method suggests that objective and subjective knowledge should be represented by different techniques. For example, RBRis appropriate for objective knowledge (logicality, simplicity and ability of obtaining an exact answer.) CBRis used to represent subjective knowledge. 8. Additional Reasoning Components: Nil. 9. Integration Status: Demonstrator of an Expert Case-based Loan Authorization System (ECLAS), which demonstrates the feasibility of distinguishing objective and subjective judgements. 10. Priority future work: Empirical evaluation. The demonstration system takes into account only eight typical features. It is intended to extend the core model ECLASto a full-scale production version by means of other complementary sub-dimensions.