The University is legally accountable to the sponsor as the... or cooperative agreement; however, the principal investigator/ project director (PI),... Roles and Responsibilities

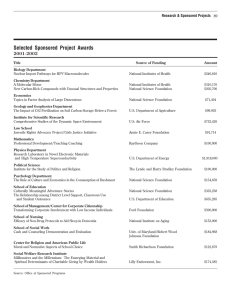

advertisement