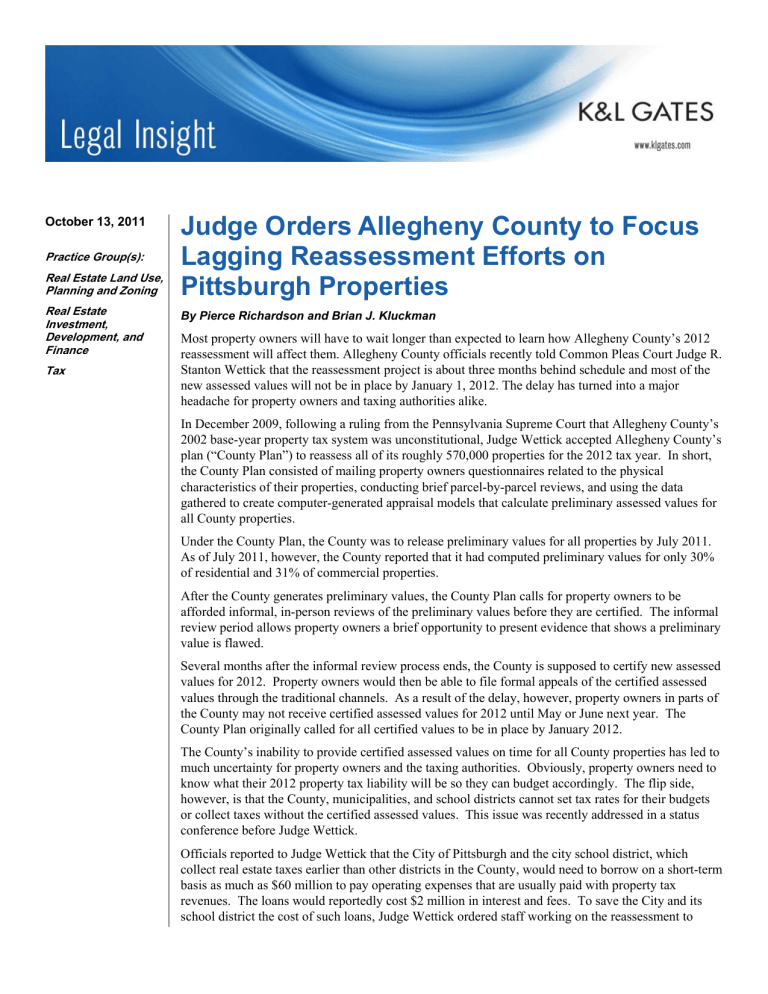

Judge Orders Allegheny County to Focus Lagging Reassessment Efforts on Pittsburgh Properties

October 13, 2011

Practice Group(s):

Real Estate Land Use,

Planning and Zoning

Real Estate

Investment,

Development, and

Finance

Tax

Judge Orders Allegheny County to Focus

Lagging Reassessment Efforts on

Pittsburgh Properties

By Pierce Richardson and Brian J. Kluckman

Most property owners will have to wait longer than expected to learn how Allegheny County’s 2012 reassessment will affect them. Allegheny County officials recently told Common Pleas Court Judge R.

Stanton Wettick that the reassessment project is about three months behind schedule and most of the new assessed values will not be in place by January 1, 2012. The delay has turned into a major headache for property owners and taxing authorities alike.

In December 2009, following a ruling from the Pennsylvania Supreme Court that Allegheny County’s

2002 base-year property tax system was unconstitutional, Judge Wettick accepted Allegheny County’s plan (“County Plan”) to reassess all of its roughly 570,000 properties for the 2012 tax year. In short, the County Plan consisted of mailing property owners questionnaires related to the physical characteristics of their properties, conducting brief parcel-by-parcel reviews, and using the data gathered to create computer-generated appraisal models that calculate preliminary assessed values for all County properties.

Under the County Plan, the County was to release preliminary values for all properties by July 2011.

As of July 2011, however, the County reported that it had computed preliminary values for only 30% of residential and 31% of commercial properties.

After the County generates preliminary values, the County Plan calls for property owners to be afforded informal, in-person reviews of the preliminary values before they are certified. The informal review period allows property owners a brief opportunity to present evidence that shows a preliminary value is flawed.

Several months after the informal review process ends, the County is supposed to certify new assessed values for 2012. Property owners would then be able to file formal appeals of the certified assessed values through the traditional channels. As a result of the delay, however, property owners in parts of the County may not receive certified assessed values for 2012 until May or June next year. The

County Plan originally called for all certified values to be in place by January 2012.

The County’s inability to provide certified assessed values on time for all County properties has led to much uncertainty for property owners and the taxing authorities. Obviously, property owners need to know what their 2012 property tax liability will be so they can budget accordingly. The flip side, however, is that the County, municipalities, and school districts cannot set tax rates for their budgets or collect taxes without the certified assessed values. This issue was recently addressed in a status conference before Judge Wettick.

Officials reported to Judge Wettick that the City of Pittsburgh and the city school district, which collect real estate taxes earlier than other districts in the County, would need to borrow on a short-term basis as much as $60 million to pay operating expenses that are usually paid with property tax revenues. The loans would reportedly cost $2 million in interest and fees. To save the City and its school district the cost of such loans, Judge Wettick ordered staff working on the reassessment to

Judge Orders Allegheny County to Focus Lagging

Reassessment Efforts on Pittsburgh Properties

focus all efforts on determining certified values for Pittsburgh and Mount Oliver properties (which fall within the city school district), at the exclusion of doing work on other County properties. Under this approach, the County should release certified assessed values for Pittsburgh properties by January

2012.

Judge Wettick’s decision to focus all efforts on Pittsburgh properties likely saved the City and its school district from incurring substantial borrowing costs; but, how will it affect the other municipalities and school districts in the County? The focus on Pittsburgh properties will likely push calculation of certified values in other areas of the County back until May or June 2012.

Municipalities, however, are required by state law to finalize budgets and set millage rates by

February 15. This puts those municipalities in a bind, and may require them to borrow money— paying interest and fees—to avoid the same situation the City of Pittsburgh and its school district faced.

The predicament has left the taxing bodies with no clear way forward. Some may seek to secure costly loans. Some may seek exemption from the state budget deadlines. It has even been reported that some are considering mailing out tax bills based on 2011 values. The legality of this solution is questionable, however, and would lead to an administrative nightmare in terms of collecting additional taxes and giving rebates after the 2012 numbers are certified.

Further complicating the state of property taxation in Allegheny County are the ongoing battles being fought at the local and state levels to halt the 2012 reassessment in its entirety. Many County legislators feel that the state Supreme Court unfairly singled out Allegheny County and its base-year system and have vowed to stop the reassessment. They have sought to do so via threat of lawsuits, statewide legislative initiatives, and even a suggestion by a candidate for the County Executive seat that he would refuse to mail the new tax bills if elected—at the risk of being jailed!

It is difficult to forecast how the final stages of the reassessment will play out. For now, owners of property in Pittsburgh or Mount Oliver can expect to receive notice of the preliminary values assigned to their properties in the near future. This will be followed by the informal review period discussed above, with certified values to follow by January 2012. Owners of property elsewhere in the County should expect the same process, but on a schedule delayed by up to three or four months. Whenever the preliminary and certified values start to roll in, each commercial property owner should carefully evaluate whether the new assessed value is above current market value. If it is, property owners should evaluate whether an appeal is necessary to avoid being overtaxed in 2012 and beyond.

K&L Gates’ team of real estate and property tax attorneys would be happy to assist commercial property owners in evaluating their situation. Please contact us as soon as possible to provide ample time to advise you and to avoid missing any mandatory appeal deadlines.

Authors:

Pierce Richardson pierce.richardson@klgates.com

+1.412.355.6786

Brian J. Kluckman brian.kluckman@klgates.com

+1.412.355.8246

2

Judge Orders Allegheny County to Focus Lagging

Reassessment Efforts on Pittsburgh Properties

3