Dynamic Speculative Behaviors and Mortgage Bubbles in the Real Estate Market

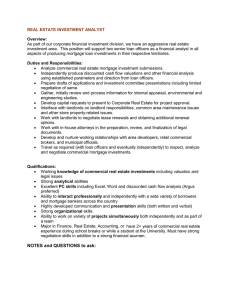

advertisement