Transco Winter Operations Meetings Insert full-screen image and send to back.

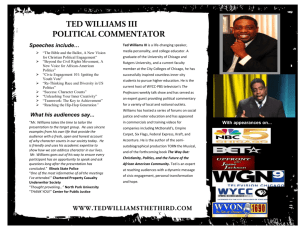

advertisement