The Power to Enforce The Regulator, Legislator and the Judiciary

advertisement

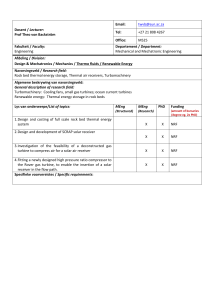

The Power to Enforce The Regulator, Legislator and the Judiciary ITU 8 March, 2005 Sandro BAZZANELLA Regulatory Affairs Director European Competitive Telecoms Association (ECTA) ECTA § The European Competitive Telecommunications Association is the leading pan-European trade association serving the alternative telecommunications industry. § ECTA has some 150 member companies, operators and service providers as well as national associations of such. § ECTA objectives are to: − Work for a fair regulatory environment which allows all electronic communications providers to compete on level terms in order to multiply investment and innovation throughout an effective European internal market. − Represent the telecommunications industry to key government and regulatory bodies − Maintain a forum for networking and business development throughout Europe. 1 Competition is Key § ECTA believes that effective competition is key to unlocking the potential of the electronic communications sector because: • it drives innovation • it drives down prices • it stimulates investment • it boosts broadband penetration and adoption § The single most important way of achieving the benefits of competition is through effective implementation of the new regulatory framework (NRF) The (New) Regulatory Framework (I) § The NRF is theoretically elegant: • Competition law principles for market definition and finding SMP • Technology neutral § The NRF • • • • • Framework Directive (2002/21/EC) Access and Interconnection Directive (2002/19/EC) Authorisation Directive (2002/20/EC) Universal Service Directive (2002/22/EC) ePrivacy Directive (2002/58/EC) • Recommendation on Relevant Markets C(2003)497 • ERG Common Position on the approach to appropriate remedies in the new regulatory framework (April 2004) 2 The (New) Regulatory Framework (II) § Key to its success is full and rapid implementation § Transposition of Directives is still not completed in all Member States (25 July, 2003 deadline!) § Moreover, effective implementation still varies significantly across Member States and is not compliant with the Directives in some cases § This leads to significant discrepancies that do not benefit end -users and can impact growth Regulatory Effectiveness Regulatory effectiveness still varies significantly across Member States Regulatory Scorecard Results United Kingdom 384 318 Ireland Denmark 309 293 Italy 276 Sweden The Netherlands 267 257 Spain 253 France Belgium 215 200 Germany 0 100 200 300 400 3 NRF: main differences SMP designation (> 25%) Predifined markets Imposition of a set of remedies EC Recommendation Feb 2003 18 relevant markets Based Segúnon EC Directrices Guidelines de la CE July 2002 Competition assessment Set of remedies listed in EC Directives Designation of SMP (dominance) Criteria established in EC Directives List of possible remedies CONTROL & COORDINATION Mechanisms (NRAs,EC, ...) Selection of the remedie(s) Justification and implementation The liberalisation process is NOT complete § Lisbon Strategy Mid-term review: the Kok Report “…the regulatory framework for electronic communications adopted in 2002 should be fully implemented and strictly enforced, so that competition is more effective in driving down prices for consumers and businesses.” § OFCOM Strategic Review • UK market has 20 years of liberalisation, and NRF more substantially implemented than in any other member state • “The market has made good progress, however, its foundations are unstable”. Bottlenecks still exist (local loop) Regulation is still needed and OFCOM plans to reinforce its efforts to prevent discrimination by the incumbent Non-discrimination is a key element of the NRF and probably the best tool to ensure effective competition • • 4 OFCOM Strategic Review Real Equality of Access § Altnets should have access to: • The same or similar set of regulated wholesale products as incumbents’ own retail activities • At the same prices as incumbents’ own retail activities • Using the same or similar transactional processes as incumbents’ retail activities § Incumbents would have to: • Implement a significant shift at an organisational level in the product development process • Change the management structures, incentives and business processes. The current processes are the result of incumbents’ historical structure as vertically-integrated operators • Introduce transparency to demonstrate the level of equivalence within the organisation Key to fostering competition (I) 1. Securing implementation of the framework • In some cases the Directives have not been accurately transposed, leading to uncertainty and less harmonisation • Many countries have yet to complete the market reviews. • The Directives call for the reviews to be completed by July 2003 or ‘as soon as possible’ thereafter which has given rise to legal uncertainty • If necessary this provision should be revisited or clarified to provide an end-date • There remains a lack of clarity about what the Commission intends to do to pursue individual Member States beyond taking infringement proceedings for failed transposition in a minority of countries (Effective Implementation Issues) 5 Keys to fostering competition (II) 2. Ensuring equivalence of access • Non-discrimination is not always understood or effectively enforced • Need for clarification and effective enforcement • Need for development of best practice by the European Regulators Group (ERG) followed by Commission Guidance • Key to relaxing burden of regulation is creating a compliance culture • Need to assess and embrace incentives, penalties and organisational structures which entrench compliance • Ensure that competition is maintained and enhanced with the transition to converged ‘next generation’ networks (legacy assets will still be fundamental). Keys to fostering competition (III) 3. Ensure independence of regulatory decision-making: • • Independence from the incumbent and from the government There is strong evidence to suggest that government ownership in the incumbent or direct intervention in regulatory issues hampers the proper workings and effectiveness of regulation and competition Establish ‘KPIs’ for regulatory and competitive effectiveness It may be helpful for the Commission to develop, with input from NRAs, guidance as to specific measures which may provide an indication of regulatory and competitive effectiveness 4. Addressing lengthy appeals procedures • • In some countries appeals are lodged as a matter of course and take up to 5 years rendering the regulatory process ineffectual Action is needed by Member States to establish deadlines and ensure effective appeals process. 6 New Member States: another answer? § The majority of incumbent operators among the new EU 10 Member States have to varying degrees significant shareholdings by the incumbents from the original EU-15 § Know-how transfers between incumbents is quicker than between regulators (through the ERG) § Altnets invest where a return on capital is possible within an effective regulatory framework (i.e. ladder of investment) § A regulatory approach that is adapted specifically for the new EU-10 would be counterproductive to the single market. The NRF must be effectively implemented for all 25 Member States Conclusion Incumbent and new entrant investment follows similar pattern: highest in “best” regulated (most competitive) markets Investment as % of GFCF Relationship between Regulatory Scorecard and Investment as Percentage of GFCF 8 UK 6 NL 4 2 DE 0 200 BE FR ES SE 250 DK IT IE 300 350 400 Regulatory Scorecard Source: JonesDay & SPC Network (Regulatory Scorecard) 7 Sandro BAZZANELLA sbazzanella@ectaportal.com +32 (0)2 282 18 36 European Competitive Telecoms Association 8