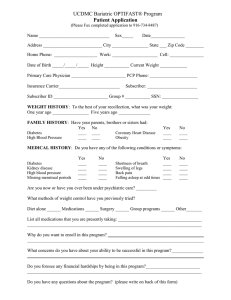

Indian Mobile Industry

advertisement

Indian Mobile Industry INTRODUCTION TO THE WORLD’S FASTEST GOWING TELECOM MARKET 2 THE WORLD’S SECOND LARGEST MARKET Area – 3,287,263 Square kilometers Population (July 2005) – 1.08 Billion 22 National Recognized Languages Literacy Rate (2005) – 65% Average Annual Growth Rate – Population – 1.4% – Labour Force – 2.5% – GDP Growth- 6.7% Trade (2004) – Total Exports (FOB) – USD 76 Billion – Total Imports (CIF) – USD 97 Billion Forex Reserves (including gold) =USD 155 Billion Source : The World Bank Group 3 ….& ONE OF THE FASTEST GROWING ONES One of the fastest growing economies in Asia. Annual GDP growth rate of ~8% over next 5-10 years Set to emerge as 3rd largest economy in the world by 2020 Major global hub for IT & IT enabled services Mobile telephony transforming people’s lives 4 Background of Mobile Revolution in Indian Telecom 5 ! $ "# ) " # ! % & ' ( ! * ! * + . 1 ! ! ! , ( / " % ,) 1 " 2 0 ! ! 0 ! 0 0 ! $ 3 6 ! " # $ % & ' ) ( & " # " * " ( + , " " $ ! ( " ! , , , ! " $ 7 Policy announced for additional licenses in Basic and Mobile Services (Jan 2001). Entry fee: – Basic Services: US$ 0.2mn – US$ 25.5mn (+ Bank Guarantees = 4 times entry fee for rollout obligations) – GSM Mobile Services (4th Operator bid): US$ 0.2mn – US$ 45mn License fee (revenue share) reduced from provisional 15% to 12%, 10% & 8%. Limited Mobility allowed to Basic Services (CDMA spectrum allotted to BSOs). Rollout Obligations to cover Urban / Semi-Urban / Rural areas in equal proportion. New licenses awarded in Jul - Sep 2001 : Basic (25), GSM Mobile (17). 8 ( ! $ . # " / # . )* / 2 6 3 ! 7 3, , , #7 # 0110$ 377 " , 4 5 $ ! ! " , $ * : 8 3, *83 # ! " 9 9 ( " 9 $ $ 9 MOBILE – MAJOR CONTRIBUTOR TO TELE DENSITY 14 Total – 12.3% 12 10 Mobile – 7.5 % 8 6 Fixed – 4.8 % 4 2 0 1997 1998 1999 2000 2001 2002 2003 2004 Feb' 06 Cellular constitutes ~61% of current national tele density – has played an important role in taking overall tele density from 0.8 in 1994 to 12.3 in Feb’06. 10 GSM DRIVING MOBILE GROWTH 70 GSM Subscribers in Million 60 CDMA 65 50 41 40 26 30 20 19 13 10 8 6 11 2 1 2 4 1999 2000 2001 0 1 2002 2003 2004 2005 Feb' 06 Year Ended March GSM driving growth of Indian market with nearly 80% market share & about 75% of new additions 11 IN SYNC WITH WORLDWIDE TRENDS Worldwide GSM constitutes 75% of the subscriber base and 80% of the monthly additions. 1800 GSM Subscribers in Million 1600 CDMA 1400 1200 1000 800 600 400 200 0 1992 1993 1994 1995 1996 1997 1998 1999 Year Ended December 2000 2001 2002 2003 2004 Jan' 06 12 INDIAN GROWTH FUELLED BY INCREASED COVERAGE 6000 Number of Cities & Towns 5048 5000 4000 3076 3000 2000 1575 918 1000 0 249 421 Dec' 98 Jun' 99 Nov' 00 1743 1116 Apr' 01 Sep' 02 Sep' 03 Dec' 04 Dec' 05 • Estimated that service providers will cover 5,000 towns by mid 2006 • Ubiquitous coverage holds the key to future growth of mobile industry 13 AND CONTINUOUSLY IMPROVING AFFORDABILITY 0.07 Effective Tariffs – 400 Minute Basket 0.06 USD per minute 0.05 0.04 0.03 0.02 0.01 D ec -0 4 Ju n04 M ar -0 4 D ec -0 3 S ep -0 3 Ju n03 M ar -0 3 D ec -0 2 S ep -0 2 Ju n02 M ar -0 2 D ec -0 1 S ep -0 1 Ju n01 M ar -0 1 D ec -0 0 0 In last 3 years alone, effective local call cellular tariffs have plummeted by 80% from USD 0.06 / minute in December 2000 to USD 0.01 / minute in December 2004. During 2005, tariffs have declined further by ~ 37% Source:TRAI Quarterly Performance Indicators, March 2005 14 INDIAN MOBILE INDUSTRY – CURRENT STATUS 2006 133 state-of-the art Networks (GSM + CDMA) on Air: 91 on GSM Total Investments ~ USD 15 billion Nearly 85 million mobile subscribers (GSM + CDMA) – end February 2006 – with GSM accounting for ~80% of the subscribers base. 4-5 million new mobile phone subscribers added every month, Total adds in 2005 ~28 million, showing growth of almost 60% in last 12 months Services in ~ 5000 cities & towns & ~1 lakh villages Fixed Mobile Crossover in October 2004, GSM Fixed Crossover in April 2005 Mobile the primary driver of growth, accounts for 7% tele density 15 GROWING SUBSCRIBER BASE 50 Prepaid 45 Postpaid 40 Million 35 30 25 20 15 10 5 0 1999 2000 2001 2002 2003 2004 2005* • Subscriber growth predominantly on the prepaid plank • Allows even credit challenged subscribers to take advantage of benefits of connectivity • Mobile connectivity a common feature amongst blue collar segment COAI-PWC Benchmarking Reports * COAI Estimates 16 …IMPROVED AFFORDABILITY Blended Airtime Rate 0.1 0.08 USD / minute 0.1 0.06 0.1 0.04 0.0 0.036 0.02 0.0 0.0 1USD=Rs. 44.3 0.0125 2000 COAI-PWC Benchmarking Reports *TRAI Report Dec-05 2001 2002 2003 2004 2005* 17 GROWING MINUTES OF USE 393 400 Minutes/Subscriber/Month 350 287 300 245 250 200 204 220 192 175 150 100 50 0 1999 COAI-PWC Benchmarking Reports *TRAI Report on GSM 2000 2001 2002 2003 2004 2005* 18 DECLINING ARPUS 32 29.3 USD/Subscriber/Month 26.1 24 18.4 16.5 16 11.4 8.7 8.2 8 0 1USD=Rs. 44.3 1999 2000 2001 2002 2003 2004 2005* • Increased subscriber base accompanied by constantly declining ARPUs – demonstrating the increased acceptance of mobile services amongst low end consumers. COAI-PWC Benchmarking Reports *TRAI Report 19 REDUCED OPEX PER SUBSCRIBER 22.4 19.1 USD/Subscriber 20 10.2 10 7.4 6.5 4.7 0 1USD=Rs. 44.3 1999 2000 2001 2002 2003 2004 3.6 2005* • Opex per subscriber brought down by 80% in last 5 years • Result of better improved efficiency by operators as well as the benefits of economies of scale COAI-PWC Benchmarking Reports * COAI Estimates 20 COMPOSITION OF NET SERVICE REVENUES Gross IUC Revenue, 15% Other Revenues, 3% Airtime, 28% Other VAS, 5% SMS Revenues, 4% Roaming Revenues, 12% Rentals, 13% Activation & Processing fees, 20% Airtime Rentals Activation & Processing fees Roaming Revenues SMS Revenues Other VAS Other Revenues Gross IUC Revenue Roaming Revenues 12%; SMS Revenues 4%; Other VAS 5% Source: Price Waterhouse Benchmarking Study, December 2004 21 REVENUES FROM VALUE ADDED SERVICES 10% 8% As a %age of Service Revenues VAS Composition Others 34% 10% Postpaid 12% SMS 54% 8% CLIP 12% 6% CLIP 0% 2% Prepaid 4% Others 17% SMS 83% 0% • Prepaid subscribers are increasingly taking to value added services, Percentage of Revenues from VAS for prepaid subscribers has gone up from 3% in 2003 to 8% in 2004. • Overwhelming proportion of this comes from SMS, which is the VAS of choice for prepaid subs. Source: COAI-Price Waterhouse Benchmarking Study, December 2004 22 GROWTH IN VALUE ADDED SERVICES 23 REVENUES FROM VAS “Revenue from the VAS segment is growing at the rate of 30 to 40 percent annually. At present, this segment accounts for 10 to 13 percent of the total revenue of a service provider,” - Tim DeLuca Smith, Communications Manager, SmartTrust. “Market for mobile VAS is currently about USD 85 million and it is expected to grow around 800 million by 2010.” - Arun Gupta, CEO Mauj Telecom Daily downloads of around 1 million ringtones and ringback tones. – average cost: Rs 9 per ringtone. During festive season the figures skyrocket….. – This Diwali, there was a six fold increase in value added service downloads, over a normal day. – Delhi circle alone saw 8.5 million SMSs being exchanged on Diwali day as against 5.5 million last year. 24 REVENUE GENERATED FOR OPERATORS FROM VARIOUS APPLICATIONS Charges Application (in USD) Estimated monthly downloads Operator Revenue Share (in million) 2G – SMS 0.02– 0.11 1,100 90% 2G – P2A/ A2P 0.05 – 0.23 50 70-75% 2.5G Messaging 0.07/MMS; 2.23 unlimited for 1 month 5 80-90% CRBT 0.14-0.34 7 50-60% Wallpapers 0.23 14 50-60% Games 1.13-3.39 14 25-50% IVRS 0.07-0.14/minute, voice + transaction charges 1USD=Rs. 44.3 Source: Global Equity Research 25 REVENUES FROM SMS 200 180 180 SMS Volumes in billion 160 140.2 140 120 100 89.4 80 50.7 60 40 20 12.3 20.6 33.1 0 2004 2005 2006 2007 2008 2009 2010 Expected to grow in the next five years due to – falling prices, increasing mobile penetration, widening user demographic and increasing number of SMS based services. Source: Portio Research 26 CONSUMER AWARENESS FOR DATA SERVICES IN INDIA Roaming 90 Voice Mail 76 Call Waiting 62 Email 27 Instant Access 10 Data Services 7 M-banking 5 MMS 4 0 20 40 60 80 100 27 Source: Portio Research INDIA’S PLACE IN ASIA PACIFIC 28 ARPU 35 ARPU Average 30 25 USD 20 15 10 5 0 Malaysia Philippines Indonesia Thailand China Singapore Australia India INDIA • ARPUs well below Asia Pac average • Market driven by volumes not margins COAI PWC Benchmarking Study, December 2004 29 MINUTES OF USE 350 ARPU Average Minutes/Subscriber/Month 300 250 200 150 100 50 0 Malaysia China Singapore Australia India INDIA • One of the most talkative markets in the region • Increased use a direct result of affordability of service COAI PWC Benchmarking Study, December 2004 30 COST OF CUSTOMER ACQUISITION 120 100 Cost of Customer Acquisition Average USD 80 60 40 20 0 Malaysia Philippines Indonesia* Thailand* Singapore Australia India INDIA • One of the lowest costs of customer acquisition in the region * For the year 2002 COAI PWC Benchmarking Study, December 2004 31 MONTHLY CHURN 9% 8.0% 8% 6.7% 7% 6% 5% 4% 3% 2% 2.0% 1.9% 1.0% 1% 1.2% 1.5% 1.4% Singapore Australia 0% Malaysia Philippines Indonesia Thailand China India INDIA • The highest Churn in the Asia Pac Region – demonstrating existence of an intensely competitive & vibrant mobile market COAI PWC Benchmarking Study, December 2004 32 BAD DEBTS AS A % OF NET SERVICE REVENUES 4% 3.1% 3% 3.0% 2.8% 3% 2% 1.6% 2% 1.3% 1.1% 0.9% 1% 1% 0% Malaysia Philippines Thailand China Singapore Australia* India INDIA • Bad Debts above Asia Pac averages; need to be brought under control COAI PWC Benchmarking Study, December 2004 33 EBITDA 70% 60 EBITDA Average 60% 50 50% 40 40% 30 30% 20 20% 10 10% 0% 0 Malaysia Philippines Indonesia Thailand China Singapore Australia India INDIA • Lowest EBITDA in Asia Pac Region; Combined effect of lowest tariffs & highest costs COAI PWC Benchmarking Study, December 2004 34 PAST PERFORMANCE AND FUTURE AHEAD 35 Convergence of Tariffs and Growth of mobile services Full Mobile (Rs./min) Mobile Subscriber base (Millions) Lowering of ADC from 30% to 10% of sector revenue Effective charge (in Rs. per min.) 18.00 16.00 100 89.54 90 NTP ' 99 14.00 CPP introduced Telecom Tariff Order 12.00 80 70 10.00 3rd & 4th cellular operator 8.00 52.17 CDMA introduced 50 40 6.00 33.60 30 4.00 2.00 60 20 0.88 0.00 Mar-98 1.20 1.88 Mar-99 Mar-00 3.58 Mar-01 13.00 10 0.90 1.18 0 6.50 Mar-02 Mobile subscriber base (in Million) Fixed (Rs./min.) Limited Mobile (Rs./Min) Mobile growth and effective charge per minute Steps taken for increasing growth Mar-03 Mar-04 Mar-05 Mar-06 36 Falling ARPU vs. Rising Subscriber Base 100 90 89.54 80 70 60 51.57 50 40 30 29.77 20 10 33.6 25.12 3.58 19.95 6.5 14.31 13 10.59 9.19 7.90 0 1.88 Mar-00 Mar-01 Mar-02 Mar-03 Mar-04 Mar-05 Mar-06 ARPU(in $) * ARPU of March-06 are Estimated Subs. in (Mn) 37 Urban/Rural income-wise distribution of households Income Group Rural Households Urban Households Lower 60 (43.48%) 10 (18.52%) Lower Middle 56 (40.58%) 20 (37.04%) Middle to High 22 (15.94%) 24 (44.44%) Total 138 (100%) 54(100%) 38 Effect of CPP Regime Thousands Additions in Mobile CPP Introduced 2500 2000 1500 1000 500 0 Feb03 Mar03 Apr-03 May- Jun-03 Jul-03 03 ! " #$%& ' ! 39 DECLINING ARPUS 32 29.3 26.1 USD/Subscriber/Month 24 18.4 16.5 16 11.4 8.7 8.5 8 7.0 6.5 6.0 5.0 0 1999 1USD=Rs. 44.3 2000 2001 2002 2003 2004 2005* 2006* 2007* 2008* 2009* • Increased subscriber base accompanied by constantly declining ARPUs – demonstrating the increased acceptance of mobile services amongst low end consumers. To achieve the required growth, the focus will shift to villages with low teledensity, and ARPU will be going sub $5 mark I next few years. COAI-PWC Benchmarking Reports * Estimates 40 Past Growth and future Expectations 20% 16 14 12 10 10% 8 6 4 2 0% Growth Mar-06 2 (" )$& ' " % ,$" . */ / Dec-05 1 ,(& * +' + Sep-05 ! -* Jun-05 Mar-05 Millions 0 % Growth *+" .0 41 Growth (Estimates) 1 % " 4 M illio n s 350 %& 1 300 3 " # ,% -4 3 ' #, 250 200 5#& 150 100 50 0 2003 2004 2005 2006 2007 2008 2009 2010 42 !" # 35 Teledensity (%) 30 25 20 15 10 5 0 1997 1998 1999 2000 Urban 2001 2002 Rural 2003 2004 2005 2006 2007 Total 43 Enhancement of Rural Density 35 31.1 30 26.2 25 21.3 20 15 10 5 0 6.9 2.3 0.5 1999 8.2 10.4 3.6 2.9 0.9 0.7 2000 2001 Rural • 14.3 12.2 5.1 4.3 1.5 1.2 2002 2003 Total 7.04 1.7 2004 9.08 9.86 1.74 Source: TRAI 1.94 2005 Jul-05 Urban To bridge the Urban-Rural divide, Cost to Serve the Rural area should be reduced Impact of CDMA on India’s Wireless Industry Tariffs Subscribers (Millions) Rs.0.40/min. Voice Tariffs 90 Rs.1.00/min. Voice Tariffs 80 70 60 50 40 30 Rs.4.00/min. Voice Tariffs 20 CDMA Limited Mobility Introduced with competitive Service Offerings 10 Sources: TRAI study 83 million net wireless sub adds since competition from CDMA Limited Mobility was introduced 05 4 20 05 Q 3 20 05 Q Q 1 2 20 20 05 04 Q 4 20 04 Q 20 3 Q 2 20 04 04 Q 20 1 Q 4 20 03 03 Q 3 20 03 Q 2 20 03 Q 1 20 02 Q 4 20 02 Q 3 20 02 Q 2 20 02 Q 1 20 01 Q 4 20 01 Q Q 3 20 01 20 2 Q Q 1 20 01 0 45 FUTURE GROWTH POTENTIAL 46 Urban population -Indian Census 2001: Agewise distribution 80+ 70-74 Age Groups 60-64 50-54 40-44 30-34 20-24 10-14 0-4 0 50 100 150 200 250 300 350 Population in lac 8 ! , 7 , " # ," 5 / %1 # ; " ) 4 5 5 , ! # ! , 47 The next generation People born in 1980’s & 90’s – Majority of these young people will be in their early twenties and thirties in the next ten to fifteen years General profile of next generation – Just started working or would start in near future – Single or just married with high disposable incomes – High Lifestyle Aspirations 48 !" # $% /0 " "10-, 2 ! # $% & & & ' ( ) & ' ( ) ' ( ) ' ( ) ' ( ) *" +, + + , ."Growth has been accelerating in each decade Industry + services (78% of GDP) growing at +8% Impact of agriculture on overall growth is steadily reducing Per capita income has grown by 7% CAGR over the past decade and is projected to cross $1,000 by the end of the decade 49 Break up betw een Basic and Non Basic Household Expenditure 2002-03 2001-02 2000-01 1999-00 1998-99 1997-98 1996-97 1995-96 1994-95 1993-94 1992-93 0% 10% 20% 30% 40% 50% Basic 60% 70% 80% 90% 100% Non-Basic Moving away from basic necessities Aspirations given wings by higher Disposable Income’s have changed consumption patterns Decrease in outlay on basic: 16% Increase in non-basic items: 39% 50 SUBSCRIBER BASE & MOBILE PENETRATION 350 100% 316 Subscriber Base 92% Mobile Penetration 300 90% 88% 80% Million 250 70% 60% 58% 200 50% 150 40% 40% 36% 100 30% 25% 50 32 14 20% 48 29 12% 27 4 0 Malaysia Philippines Indonesia Thailand China 18 Singapore Australia 10% 4.50% 0% India INDIA • 2nd largest market in Asia Pac, in absolute terms • With a mobile tele density of only 4.5% (now 6%) – the one with the highest untapped potential COAI PWC Benchmarking Study, December 2004 51 FUTURE SUBSCRIBER GROWTH 500 China COAI Projections Actual Million 400 300 200 100 0 9 10 11 12 13 Year Ended December 14 15 16 Year 9 10 11 12 13 41 15 16 India 2003 2004 2005 2006 2007 2008 2009 2010 Sub (MLN) Actual 31 48 76 Sub (MLN) Projected 28 48 81 130 207 290 377 471 1996 1997 1998 1999 2000 2001 2002 2003 6.8 13.2 24 43 85 145 207 279 China Subs (MLN) 52 The tariff drivers 53 , ! ! ! 0 ! 6 ! 5 ! ! ! , ! ! ! ! ' ! 54 Shift in tariff paradigms of cellular services 3 , ) ( ., ( 8" ! " " ! " :9 ! ! " < ,! ! , (# " ! $ ,# , # , " ," , / ! "! ! $ ! $ ! < " , $ , , $ , 55 What’s next $ ! * ! ! 8 , ' ! , ! :4 .+ , ! ! ! ! 4 9 ! 9 ! 1 , $ ; ;! 7 $ ! ' 3 39 5 $ <)3 ! 56 Shift in tariff paradigms of cellular services 3 , ) ( ., ( 8" ! " :9 ! " ! ! " " < ,! ! , (# " ! ,# , $ # , " ," , / ! "! ! $ ! $ ! < " , $ , , $ , 57 Thank you. S D Saxena Director (Finance), Bharat Sanchar Nigam Limited sdsaxena@bsnl.in +91 11 23714141 58