From: AAAI Technical Report WS-02-06. Compilation copyright © 2002, AAAI (www.aaai.org). All rights reserved.

Price-oriented, Rationing-free Protocol: Guideline for Designing

Strategy/False-name Proof Auction Protocols

Makoto Yokoo and Yuko Sakurai

Kenji Terada

NTTCorporation

NTTCorporation

NTr CommunicationScience Laboratories

NTTInformation Sharing Platform Laboratories

2-4 Hikaridai, Seika-cho

3-9-11 Midori-cho

Soraku-gun, Kyoto 619-0237 Japan

Musashino, Tokyo 180-8585, Japan

email: {yokoo,yuko}@cslab.kecl.ntt.co.jp

email: terada.kenji @lab.ntt.co.jp

http’J/www.kecl.ntt.co.jp/csl/ccrg/members/{yokoo, yuko}

Abstract

to profit from submitting false bids madeunder fictitious

names, e.g., multiple e-mail addresses (Sakurai, Yokoo,

& Matsubara 1999; Yokoo, Sakurai, & Matsubara 2001b).

Sucha dishonestaction is very difficult to detect since identifying each participant on the Internet is virtually impossible. Comparedwith collusion (Klemperer1999), a falsenamebid is easier to execute since it can be done by someone acting alone. Wecan consider false-name bids a very

restricted subset of general collusion.

Yokooet al. have been conducted a series of works on

false-name bids. Their results can be summarizedas follows.

Weidentify a distinctive class of combinatorial

auctionprotocols called a Price-oriented, Rationing-free(PORF)

protocol, whichcan be used as a guideline for developing

strategy/false-name proof protocols. APORF

protocol is

automaticallyguaranteedto be strategy-proof,i.e., for each

agent,declaringits true evaluationvaluesis an optimalstrategyregardlessof the declarationsof other agents. Furthermore,if a PORF

protocolsatisfies additionalconditions,the

protocolis also guaranteed

to be false-name-proof,

that is, it

eliminatesthe benefits fromusingfalse-name

bids, i.e., bids

submittedundermultiplefictitious namessuch as multiple

e-mailaddresses.ForIntemetauctionprotocols,beingfalsename-proof

is importantsince identifyingeachparticipanton

the Intemetis virtuallyimpossible.

Thecharacteristics of a PORF

protocol are as follows. For

each agent, the price of eachbundleof goodsis presented.

Thisprice is determined

basedon the declaredevaluationvalues of otheragents,whileit is independent

of its owndeclaration. Then,eachagent can choosethe bundlethat maximizes

its utility independently

of the allocationsof otheragents(i.e.,

mOoning-free).Weshowthat an existing false-name-proof

protocol can be representedas a PORF

protocol. Furthermore,wedevelopa newfalse-name-proofPORF

protocol.

¯ The generalized Vickrey auction protocol (GVA)(Varian

1995), whichis strategy-proof, individually rational, and

Pareto efficient, if there exists no false-namebid, is no

longer strategy-proof whenfalse-namebids are possible,

i.e., the GVA

is not false-name-proof(Sakurai, Yokoo,

Matsubara 1999; Yokoo,Sakurai, & Matsubara 2000).

¯ There exists no false-name-proof combinatorial auction

protocol that simultaneously satisfies Pareto efficiency

and individual rationality (Sakurai, Yokoo,&Matsubara

1999; Yokoo,Sakurai, & Matsubara2000).

Introduction

Internet auctions have becomean especially popular part of

Electronic Commerce(EC). Amongvarious studies related

to Interact auctions, those on combinatorial auctions have

lately attracted considerable attention (Fujishima, LeytonBrown, & Shoham1999; Klemperer 1999; Sandholm 1999;

Lehmann, O’Callaghan, & Shoham1999). Although conventional auctions sell a single item at a time, combinatorial auctions sell multiple items with interdependentvalues simultaneously and allow the bidders to bid on any

combination of items. In a combinatorial auction, a bidder can express complementary/substitutable preferences

over multiple bids. By taking into account complementary/substitutable preferences, we can increase the participants’ utilities and the revenueof the seller.

However,the possibility of a newtype of cheating called

false-namebids has been pointed out, i.e., an agent maytry

Copyright© 2002, American

Associationfor Artificial Intelligence(www.aaai.org).

All rights reserved.

119

¯ A false-name-proofcombinatorial auction protocol called

the LDSprotocol (Yokoo, Sakurai, & Matsubara 2001b)

and a false-name-proofmulti-unit auction protocol called

the IR protocol (Yokoo, Sakurai, & Matsubara 2001c)

were developed.

Developinga strategy/false-name proof protocol has been

a difficult task. In this paper, we identify a distinctive

class of combinatorial auction protocols called a Priceoriented, Rationing-free (PORF)protocol. The notion

a PORFprotocol can be used as a guideline for developing strategy/false-name protocols. Morespecifically, if a

protocol can be represented as a PORFprotocol, it is automatically guaranteed to be strategy-proof. Furthermore,

if a PORF

protocol satisfies additional conditions, it is also

guaranteed to be false-name-proof.

In a PORF

protocol, for each agent, the price of each bundle of goods is presented. This price is determined based

on the declared evaluation values of other agents, while it

must be independent of its own declarations. Then, each

agent can choosethe bundle that maximizesits utility based

on the presented prices, independentlyof the allocations of

other agents.

A PORFprotocol is different from a normal fixed-price

mechanism,where fixed prices of goods/bundles are determined, and agents choose one or a set of bundles they are

willing to buy, then the auctioneertries to ration the allocation, e.g., to choosewinners by using a lottery. In a PORF

protocol, the auctioneer doesnot try to ration the allocation,

i.e., if an agent is willing to buya bundle,the agent is guaranteed to obtain the bundle regardless of the allocations of

other agents. In a PORF

protocol, the auctioneer must carefully determinethe prices so that a feasible allocation, i.e.,

the allocation wherethe samegoodis not allocated to different agents, can be obtained without using a lottery.

Weshow that various protocols, including the existing false-name-proof protocol called LDSprotocol (Yokoo,

Sakurai, & Matsubara2001b) can be represented as a PORF

protocol. Furthermore, we develop a new false-name-proof

PORFprotocol and compareit with the LDSprotocol.

Preliminaries

Here, we introduce several basic terms and concepts.

Weconcentrate on private value auctions (Mas-Colell,

Whinston, & Green 1995). In private value auctions, each

agent knowswith certainty its ownevaluation values of

goods, which are independent of the other agents’ evaluation values. Wedefine an agent’s utility as the difference

betweenthis private value of the allocated bundle, i.e., a

set of goods, and its payment.Such a utility is called a

quasi-linear utility (Mas-Colell, Whinston,&Green 1995).

These assumptions are commonlyused for makingtheoretical analyses tractable. Formally, we assumethat for each

agent i, its type Oi is drawnfrom a set O. The utility of

agent i, whoobtains bundle B and an amountof moneyt~,

is represented

as v ( B, Oi) +ti, wherev ( B, Oi) representsthe

private value of agent i for bundle B.

In a traditional definition (Mas-Colell, Whinston,

Green1995), an auction protocol is (dominant-strategy) incentive compatible(or strategy-proof)if biddingthe true private values of goods is a dominantstrategy for each agent,

i.e., an optimal strategy regardless of the actions of other

agents. Therevelation principle states that in the design of

an auction protocol we can restrict our attention to incentive compatible protocols without loss of generality (MasColell, Whinston, & Green 1995; Yokoo, Sakurai, & Matsubara 2000). In other words, if a certain property (e.g.,

Pareto efficiency) can be achieved using someauction protocol in a dominant-strategyequilibrium, i.e., a combination

of dominantstrategies of agents, the property can also be

achieved using an incentive compatibleauction protocol.

In this paper, we extend the traditional definition of incentive compatibility so that it can address false-namebid

manipulations, i.e., we define that an auction protocol is

(dominant-strategy)incentive compatibleif bidding the true

private values of goodsby using the true identifier is a dominant strategy for each agent. To distinguish the traditional

and extendeddefinition of incentive compatibility, we refer

to the traditional definition as strategy-proof and to the extended definition as false-name-proof.

Wesay an auction protocol is Pareto efficient whenthe

sumof all participants’ utilities (including that of the auctioneer), i.e., the social surplus, is maximized

in a dominantstrategy equilibrium. An auction protocol is individually

rational if no participant suffers any loss in a dominantstrategy equilibrium, i.e., the paymentnever exceeds the

evaluation value of the obtained goods. In a private value

auction, individual rationality is indispensable; no agent

wants to participate in an auction whereit might be charged

moremoneythan it is willing to pay. Therefore, in this paper, werestrict our attention to individually rational protocols.

Price-oriented,

Rationing-free Protocol

Weshow the overview of a PORFprotocol.

¯ Weassume there is a set of goods M= {1, 2,..., m}.

For each bundle B C M, each agent declares its (not

necessarily true) evaluation value.

¯ For each agent i, the price of each bundleB is calculated.

This price can be a differentialprice, i.e., the price of the

samebundlecan vary for different agents. Also, the price

for bundleB does not necessarily haveto be additive, i.e.,

the sumof the prices of the goodsin the bundle. The price

can be super-additive (morethan the sum) or sub-additive

(less than the sum).

¯ Theprice for agent i is totally independentof its owndeclared evaluation values, while it is basedon the declared

evaluation values of the agents other than i.

¯ For agent i, a bundlethat maximizes

its utility is allocated

underthe given prices. If there exist multiple bundlesthat

maximizei’s utility, the auctioneer can coordinate the allocation and choosesa feasible allocation, i.e., the allocation wherethe samegoodis not allocated to different

agents.

¯ Unless agent i is totally indifferent amongmultiple bundies, the auctioneer does not coordinate the allocation,

i.e., the bundle allocated to agent i is determinedindependently of the allocations of the other agents. Wecall

this propertyrationing-free.

Formally, a PORFprotocol can be described as follows.

¯ Eachagent i declares its (not necessarily true) type/~i.

assumean agent can declare multiple types using multiple

identifiers.

¯ Weassume a PORFprotocol is an anonymousprotocol,

where permuting agents’ identifiers does not change the

outcome. Let us represent a set of agents other than

agent i as X and the set of declared types of X as

Ox. The price of agent i for bundle B is represented

as Pn(ex), i.e., the function of ex.

For agent i whodeclares its type as 0i, the auctioneer

chooses a bundle B*, where B* = axgmaxn v(B, 0i)

PB(OX). Such a bundle might not be determined

uniquely. Let us represent the set of such bundles as SB~..

The auctioneer determines an allocation,

g = (B1, B2,...),

where Bi SB* and fo r al l i

120

j, Bi O Bj = 13. If the prices are determined appropriately, we can guarantee that the auctioneer is able to

choosesuch a feasible allocation.

If there exists no false-namebid, i.e., an agent can use

only one identifier, it is obvious that a PORF

protocol is

strategy-proof. For agent i, its price for a bundle is determinedindependentlyof its declared type. Also, the protocol

is rationing-free, i.e., the bundleallocated to agent i is determined so that its utility is maximized,independently of

the allocations of other agents. Therefore,over-declaringits

evaluation value for bundle B, so that other agents’ prices

for bundle B would increase and they would give up the

idea of buyingB, is totally useless.

Onthe other hand, the auctioneer must set the prices appropriately so that he/she can choosea feasible allocation

without rationing. Wecan see an interesting relationship between a PORFprotocol and a traditional protocol, where a

feasible allocation is determinedfirst, and then the payment

of each agent is determinedbasedon the allocation. In a traditional protocol, it is obviousthat the obtainedallocation is

feasible, but the auctioneer must determinethe paymentappropriately so that the protocol is strategy-proof. In a PORF

protocol,it is obviousthat the protocolis sta’ategy-proof,but

the auctioneer must determine prices appropriately so that

he/she can choosea feasible allocation without rationing.

agent i whenagent i does participate and obtains bundle/3.

In the GVA,we can assumeeach agent is required to pay the

decreased amountof social surplus for other agents caused

by its participation.

The GVAcan be represented as a PORFprotocol, where

PB(OX),i.e., the price of agent i for bundle B, is represented as follows.

PB(OX) = V*(X, M) - V*(X, M

It is straightforwardto showthat the auctioneer can choosea

feasible allocation, whichalso maximizesthe social surplus,

in this PORF

protocol.

Bundle-size Ordered Protocol

Wedescribe a new PORFprotocol that is false-name-proof.

Wecall this protocol Bundle-size Ordered(BSO)protocol.

OverviewThe overview of the BSOprotocol is as follows.

¯ The auctioneer determines the reservation price rj for

each goodj, i.e., the auctioneer will not sell goodj for

less than rj. For simplicity, we assume that all goods

have the same reservation price r. Relaxing this condition is rather straightforward.

¯ Theprice of agent i for bundle/3is determinedas follows.

Let us assumek is the size of bundle B, i.e., the number

of goods in/3. Weassumethe reservation price of bundle

/3 isr x k.

Let us assume/3~represents the bundle that satisfies the

followingconditions.

1. There exists at least one commongood between/3 and

BI, i.e.,/3 O/3’ ~ O.

2. For agent j ¢ i, whosedeclared type is 6, v(B’, ~)

r x k~, wherek’ is the size of Bt, i.e., there exists an

agent whoseevaluation value for/3’ is larger than (or

equal to) the reservation price of/3~.

3. k~ is largest within the bundles that satisfy the above

two conditions.

4. v(/3’, ~.) is largest within the bundlesthat satisfy the

abovethree conditions.

Examples of PORF Protocols

GVA

In the Vickreyauction protocol for a single-item single-unit

auction, the agent whodeclares the highest evaluation value

obtains the goodby payingthe price that is equal to the second highest evaluation value. This protocol can be described

as a PORF

protocol as follows. For agent i, the price of the

goodis the highest evaluationvalue of agents other than i. It

is clear that only one agent is willing to buythe goodexcept

for the case of randomtie-breaking, wherethe utility of the

winneris 0.

In the generalized Vickrey auction protocol (GVA)(Varian 1995), whichcan be used for a combinatorialauction, the

goodsare allocated in a waythat maximizesthe obtained social surplus, i.e., the sumof all participants’utilities including the auctioneer.

To simplify the protocol description, we introducethe following notation. For a set of agents X and a set of goods

S, we define V*(X, S) as the sum of the evaluation values of X when S is allocated optimally amongX. To be

precise, for a possible allocation g ----- (/31,/3%...), where

Uj~x Bj = S and for all x # y, B~ n/3v = O, V*(X, S) is

defined as max9 ~-~d~xv(/3j, Oj), where~ is the declared

type of agent j.

The paymentof agent i whoobtains bundle/3 is represented as follows, whereX is the set of agents other than

i:

V*(X, M) - V*(X, M \

The first term of this formula represents the optimal social surplus whenagent i does not participate in the auction.

Thesecondterm represents the optimal social surplus except

Now,the price of agent i for bundle/3 is defined as follows:

when k~ > k: oo,

when k’ = k: v(B’, ~),

whenk~ < k: r x k.

In short, whenanother agent is willing to pay morethan the

reservation price for bundle B~, whichis larger than/3 and

conflicting with B, i.e., B and B’ have a common

good, then

agent i cannot buy/3. If the sizes are the same, the agent

declaring the highest evaluation value can buy the bundle

with the secondhighest evaluation value. If nobodyis willing to pay morethan the reservation price for a conflicting

bundle with the sameor larger size, then the agent can buy

the bundleat the reservation price.

Example1 Let us assume there are three goods a, b, and

c, and the reservation price for each is 100. There are two

121

agents, agent 1 and agent 2, whosetypes are 01,02, respectively. Theevaluationvalue for a bundlev( B, Oi ) is determinedas follows.

O1

02

(a)

0

0

(b)

0

110

(c) (a,b)

0 210

110 110

(b,c) (a,c)

0

0

110 110

210

110

meve1111

abcd,

j

level 2

level 3

level 4

[ {(a,b,c)}, {(b,c,d)}, {(a,c,d)}

[ {(a,b),(c,d)}, {(a,c),(b,d)}, {(a,d),(b,c)}

[ {(a),(b),(c),(d)}

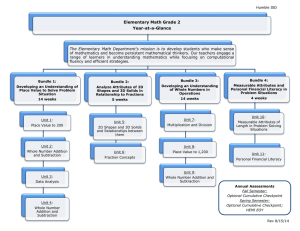

Figure 1: Exampleof Leveled Division Sets

These evaluation values meanthat agem1 needs both a and

b at the sametime, while agent 2 needseither b or c but not

both at the sametime. In this case, the price of agent I for

bundle(a, b), i.e., P(a,b)({ 02} ), 200, i.e ., the reservation

price, the price of agent2 for b, i.e., P(b)( { 01}), is oodue

agent I’s evaluationvalue for (a, b), andthe price of agent2

for¢ i.e., P(e)({01}), is 100, i.e,, the reservationprice. As

a result, agent 1 obtains bundle (a, b) for 200 and agent 2

obtains c for 100.

Example2 The numberof goods and reservation prices are

identical to Example1. Thereexist three agents whosetypes

are as follows.

(a)

(b)

(c) (a,b) (b,c) (a,c)

0

0

0

210

0

0

210

01

0

0

0

0

205

0

02

205

0

0 150

150

03

0

150

150

Agent 1 needs both a and b at the same time and agent 2

needs both b and c at the same time, while agent 3 needs

only a In this case, the price of ageml for bundle(a, b)

205due to agent 2’s evaluation value for (b, c), the price

agent 2for bundle (b, e) is 210 due to agent l’s evaluation

value for (a, b), andthe price of agent 3for c is co due

agent 2"s evaluation value for (b, c). As a result, agent

obtains bundle(a, b) for 205, while c cannotbe allocated.

Allocation Feasibility Here, we showthat the auctioneer

can alwayschoosea feasible allocation in the BSOprotocol.

Morespecifically, we showthat for any bundle that contains

gooda, there exists at mostone agent whois willing to buy

such a bundle, except whenmultiple agents are willing to

buy the bundlebut the utilities of these agents are 0. If the

utility of an agent is 0, the agent is indifferent betweenobtaining and not obtainingthe bundle. Therefore, the auctioneer can coordinate and choosea feasible allocation.

First, let us choosethe bundleBm~xthat satisfies the followingconditions.

1. B,,,,,x contains gooda.

2. For agent i, whosetype is 0i, v(Braax, Oi) > r x kmax,

where kma x is the size of Bmax . We assumeeach agent is

declaringits true type since the protocolis strategy-proof.

3. k,n~, is largest within the bundlesthat satisfy the above

twoconditions.

4. v(Bmaz,Oi) is largest within the bundles that satisfy the

abovethree conditions.

For agent j where j # i, the price of agent j for bundle B

that contains a is determinedas follows. Let us represent the

size of B as k. If v(B, 0j) _> r x k, by this wayof choosing

Bmaz, kmaz >_ k holds.

122

whenkr,,a~ > k: co,

when kmax= k: v(Brnax, Oi),

whenk,,,~ < k: r x k.

Whenkmax > k, it is clear that nobody wants B at this

price. Whenk,~x = k, since B,~ is chosen so that

v(Bm~,0i) is maximized,the utility of agent j cannot be

positive by obtaining B at this price, whenk,,,,~ < k, the

utility of agent j cannot be positive since v(B, Oj) < r x

LDS Protocol

In the LDSprotocol, the auctioneer needs to define not only

the reservation price, but also the methodfor dividing goods

into bundles. Thisdescription is called a leveled division set.

Figure 1 showsan exampleof a leveled division set where

there are four goods(a, b, c, and d).

Eachlevel contains a set of divisions, wherea division is

a set of mutually exclusive bundles. The LDSprotocol basically apply the GVA

using divisions from level 1, level 2,

and so on, until someagent can afford to buy a bundle by

paying more than the reservation price. A leveled division

set must be defined so that a union of multiple bundles in

one division is alwaysincluded in a division of an earlier

level. For example,in level 4 of Figure 1, there is a division

{(a),(b),(c),(d)}. Wecan see that all unions of multiple

dies, e.g., {(a,b)}, {(a,b,c)}, appear in earlier levels.

condition is required to makethe protocol false-name-proof.

Please consult (Yokoo,Sakurai, &Matsubara2001b) for details of the LDSprotocol.

The LDSprotocol can be described as a PORFprotocol.

The price of bundle B for agent i is defined as follows. AssumeB is included in a division of level l. If B is not included in any division, the price is co. Also, let us assume

l,mn represents the earliest level, whereanother agent wants

to buya bundle in level lm~nby paying morethan the reservation price.

when lmin < l: co,

whenlmin = l: the price for B is determinedby the same

method as the GVA,where possible allocations are restricted by the divisions of level l,

whenlmin > l: the reservation price.

Dueto space limitations, we omit a detailed explanation,

but wecan showthat by using this protocol description, the

obtained results are identical to that by the LDSprotocol

presented in (Yokoo, Sakurai, &Matsubara2001b).

False-name-proof PORFProtocol

Weshow that a PORFprotocol is false-name-proof if the

protocol satisfies followingtwo additional conditions.

monotonleprice increase: Whenthe number of other

agents increases, the price of an agent does not decrease.

Formally,for any set of agent X, agent i whois not in X,

and any bundle B, PB(Ox) <_ PB(OXU {01}) holds.

-= f I-°-LDS

no sulmr-additiveprice increase: For any mutually exclusive bundles B, B~, /any set of agents X, and agents i, i

whoare not in X, PB(OXO {0¢ }) + P/3, (Ox 13 {0i})

PBtm,(Ox)holds. The first term in the left side represents the price of agent i for bundle13, the secondterm in

the left side represents the price of agent i I ~,

for bundleB

and the right side represents the price for bundlet3 u B’

for agent i (or i’) whenagents other than i (or i’) are

X.

I f

-~

I

-k

/

Here, we showthat a PORF

protocol that satisfies the above

two conditions is false-name-proof. Assumeagent i uses

twoidentifiers i, i’. If the agent obtains bundle/7only with

one identifier, say, i, then by the condition of monotonic

price increase, the price of i for bundle/3 decreases or remains the same when agent i refrains from using another

~.

identifieri

On the other hand, if the agent obtains bundle t3 under

identifier i and bundleB’ underidentifier i’, by the condition

of no super-additiveprice increase, if the agent uses a single

identifier, the price of B 13 B~ becomessmaller than (or the

sameas) the sumof the prices for B and/3’.

Whenan agent uses three or more identifiers, by using

a similar argumentwe can showthat the agent’s utility increases or at least remains the same when the agent uses

onlyone identifier.

Now,let us showthat the BSOprotocol satisfies these two

conditions. It is obviousthat the protocol satisfies the condition of monotonicprice increase. For the condition of no

super-additiveprice increase, it is clear that the conditionis

satisfied whenPBt.tB’ ({~X) is the reservationprice, since the

price of a bundleis never less than the reservation price. On

the other hand, if Pooo, (Ox) is not the reservation price,

i.e., it is larger than the reservation price, then, there exists a bundle B’~ that has at least one commongood with

B 13 BI, wherethe size of B" is larger than or the sameas

B U/3’ and the evaluation value for B’~ of one agent in X is

larger than or equal to the reservation price. Therefore, either PB(OxO {Ov}) or PB,(Ox 13 {Oi}) becomesoo, thus

the conditionof no super-additive price increase holds.

On the other hand, the GVA

fails to satisfy both conditions. Therefore, as shownin (Sakurai, Yokoo,&Matsubara

1999; Yokoo,Sakurai, & Matsubara 2001b), an agent can

decrease its paymentby using false-names and splitting its

bid.

Evaluations

Wecomparethe obtained social surplus of the BSOprotocol

and that of the LDSprotocol using a simulation.

For each agent i, we determine bundle/3 required by

agent i and v(B, Oi) by the following method.

t First, we determinek, whichrepresents the size of bundle

B, by using an exponential distribution de(k) = -pk

(Fujishima, Leyton-Brown, & Shoham1999). By using

123

<o.1:

i

0

.,

i

,

I.

i

i

,

,

I

,

0.5

1

Reservation Price

1.5

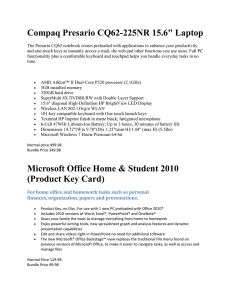

Figure 2: Comparisonof Social Surplus

this distribution, manysmall bundles are created. The

provability that a size k bundleis created is ep times larger

than that of a size k + 1 bundle.

¯ Next, we randomly choose k goods included in/3 and

choose randomlyv(B, 0~) from within the range of

[(1 - q)k, (1 + q)k]. Weassumethat the evaluation values

of an agent are all-or-nothing, i.e., the evaluationvalue for

a bundlethat does not include all of the goodsin/3 is 0.

In the LDSprotocol, the auctioneer must determinea leveled division set. In this evaluation, we construct a leveled

divisionset similar to that in Figure1, i.e., at level 1, weput

a division that contains a single bundle of mgoods. Then,

at level 2, we put m- I divisions, each of whichcontains a

bundle of m- 1 goods, and so on. Morespecifically, we put

divisions that contain size m- 1 + 1 bundles at level l. If

possible, we combinemultiple bundles in a single division,

as shownin level 3 and level 4 in Figure 1. By using this

method,we can put all small bundles in the leveled division

set.

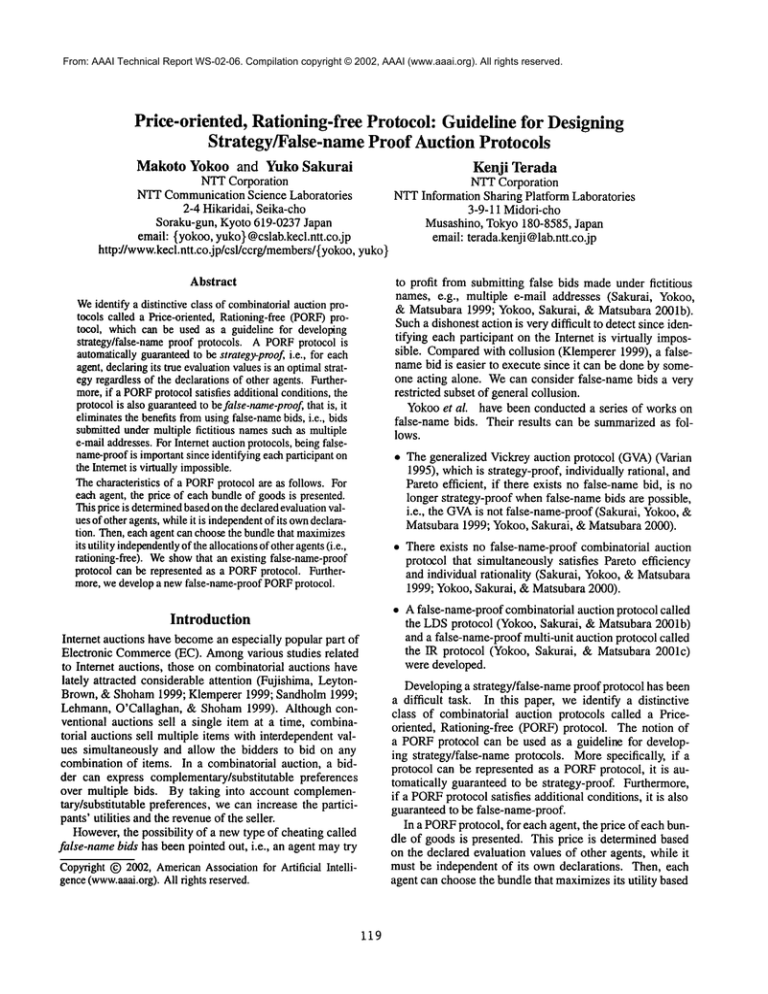

Figure 2 showsthe average ratio of the obtained social

surplus to the Pareto efficient social surplus by varying the

reservation price. In Figure 2, we set the numberof goods

m = 100, the numberof agents n = 100, p = 1, and q --0.5. Eachdata point represents the average of 100 problem

instances.

As shownin Figure 2, by setting the reservation price

within the range of [0.75, 0.98], the obtained social surplus

of the BSOprotocol can reach 70%of the Pareto efficient

social surplus. Onthe other hand, in the LDSprotocol, the

obtained social surplus becomesat most 11%.

In this problemsetting, most bundles consist of one or

two goods, while there are a few bundles with size 7 or 8.

Whenthe reservation price is very small, both protocols sell

a size mbundle to a single agent. By increasing the reservation price, the BSOprotocol can allocate multiple bun-

o I LDSl/

/

1.2 -o-

~0.9

¯ ~0.7

0.2~

0"10

0

I

/

However,as in the case of the GVA,LDS,and BSOprotocols, wecan describe a protocol either as a PORF

protocol or

as the traditional mannerin whichan allocation of goodsis

determined, then the paymentsare calculated based on the

allocation. Wecan assume that the description of a PORF

protocol is not for an actual implementationbut for a normativeguideline for provingcharacteristics of a protocol.

As far as the authors are aware, all knownfalse-nameproof protocols, including the IR protocol (Yokoo, Sakurai, &Matsubara2001c)for multi-trait auctions, can be described as a PORF

protocol. Aninteresting open question is

whether any false-name-proofprotocol can be described as a

PORF

protocol that satisfies the aboveadditional conditions.

In comparing the LDSand BSOprotocols, we can see

that each protocol has its merits and demerits. In the previous section, we assumethat the auctioneer does not have

goodknowledgeof the possible evaluation values of agents.

Therefore, the auctioneer mustuse a leveled division set that

contains all possible small-sized bundles. Onthe other hand,

when the auctioneer has good knowledgeof the possible

evaluation values of agents, the auctioneer can construct a

more specialized leveled division set using the methoddescribed in (Yokoo, Sakurai, &Matsubara 2001a). In this

case, the social surplus obtained by the LDSprotocol becomesclose to a Pareto efficient social surplus, whichwould

be muchbetter than that of the BSOprotocol.

While the LDSprotocol is based on the GVA,the BSO

protocol is similar to a greedy protocol for single-minded

bidders described in (Lehmann, O’Callaghan, & Shoham

1999). A single-mindedbidder is an agent whois interested

in only one particular bundle. In the BSOprotocol, when

determiningthe price of an agent, the protocol treats other

agents as if they are a collection of single-mindedbidders

without considering the substitutable preferences of these

agents.

\_

\

0.5

1

Reservation Price

1.5

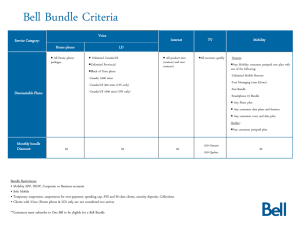

Figure 3: Comparisonof Revenue

dies with different sizes to different agents. Onthe other

hand, in the LDSprotocol, even whenthe reservation price

increases, the goodsare sold at the level wherebundles contain 7 or 8 goods, thus the LDSprotocol can allocate only a

few bundles and the obtained social surplus cannot increase

very much.

Evaluations

Figure 3 showsthe average ratio of seller’s revenue to the

revenue obtained by using the GVAassumingthere exists no

false-namebids. Parametersettings are identical to Figure 2.

Wecan see that trends are almost identical to that of the

social surplus, with a notable exception that the ratio can

be morethan 1, i.e., the BSOprotocol can obtain a better

revenuethat that of the GVA,whenthe reservation prices

are set appropriately.

Conclusions

In this paper, we introducedthe conceptof a Price-oriented,

Rationing-free (PORF)protocol. Weshowedthat if a protocol can be represented as a PORFprotocol, the protocol

is automatically guaranteed to be strategy-proof. Also, we

showedthat if the protocol satisfies additional conditions,

the protocol is also guaranteed to be false-name-proof. We

showedthat existing protocols, such as the GVAand LDS,

can be formalized as PORFprotocols.

Furthermore, we developed a new false-name-proof

PORFprotocol called the BSOprotocol and compared it

with the LDSprotocol. Weshowed that the BSOprotocol

can obtain a better social surplus and better revenue than

that of the LDSprotocol whenthe auctioneer does not have

a goodmodelof possible evaluation values of agents.

Discussions

Designinga protocol that is guaranteedto be strategy/falsenameproof has beena difficult task. If the protocol can be

represented as a PORFprotocol, the protocol is automatically strategy-proof. Furthermore,if the protocol satisfies

additional conditions, the protocol is guaranteedto be falsename-proof.

Of course, we need to prove that a PORFprotocol can

obtain a feasible allocation. However,this tends to be much

easier than provinga protocol is false-name-proof,since we

can assumeeach agent declares its true type using a single

identifier.

As for the computationalcost of executing a protocol, a

naive implementationof a PORFprotocol requires calculating prices for all bundles of all agents. Whenthe number

of goods/agents becomeslarge, this computational cost becomesprohibitively high.

References

Fujishima, Y.; Leyton-Brown,K.; and Shoham,Y. 1999.

Tamingthe computation complexity of combinatorial auctions: Optimal and approximate approaches. In Proceedings of the Sixteenth International Joint Conferenceon Artificial Intelligence (IJCAI-99),548-553.

124

Klempcrer,E 1999. Auction theory: A guide to the literature. Journal of EconomicsSurveys 13(3):227-286.

Lehmann,D.; O’Callaghan, L. I.; and Shoham,Y. 1999.

Truth revelation in approximatelyefficient combinatorial

auction. In Proceedings of the First ACMConference on

Electronic Commerce(EC-99), 96-102.

Mas-Colell, A.; Whinston, M. D.; and Green, J. R. 1995.

MicroeconomicTheory. Oxford University Press.

Sakurai, Y.; Yokoo,M.; and Matsubara, S. 1999. A limitation of the Generalized Vickrey Auction in Electronic

Commerce:Robustness against false-name bids. In Proceedings of the Sixteenth NationalConferenceon Artificial

Intelligence (AAAI-99), 86-92.

Sandholm,T. 1999. An algorithm for optimal winner determination in combinatorial auction. In Proceedings of

the Sixteenth International Joint Conferenceon Artificial

Intelligence (IJCAI-99), 542-547.

Varian, H. R. 1995. Economicmechanismdesign for computerized agents. In Proceedingsof the First UsenixWorkshop on Electronic Commerce.

Yokoo,M.; Sakurai, Y.; and Matsubara,S. 2000. The effect

of false-name declarations in mechanismdesign: Towards

collective decision makingon the Internet. In Proceedings

of the Twentieth International Conferenceon Distributed

ComputingSystems ( ICDCS-2000),146-153.

Yokoo, M.; Sakurai, Y.; and Matsubara, S. 2001a. Bundle design in robust combinatorialauction protocol against

false-namebids. In Proceedingsof l 7th International Joint

Conferenceon Artificial Intelligence (1JCAI-2001),10951101.

Yokoo,M.; Sakurai, Y.; and Matsubara, S. 2001b. Robust

combinatorial auction protocol against false-name bids.

Artificial Intelligence 130(2): 167-181.

Yokoo, M.; Sakurai, Y.; and Matsubara, S. 2001c. Robust multi-unit auction protocol against false-name bids.

In Proceedingsof 17th International Joint Conferenceon

Artificial lntelligence ( IJCAI-2001),1089-1094.

125