Roberta D. Anderson, Michael A. Kotula, Richard C. Mason,

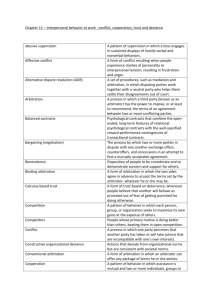

advertisement