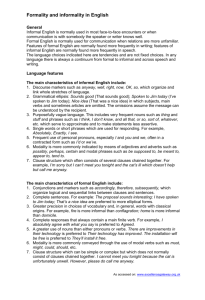

Informality: Exit and Exclusion OVERVIEW

advertisement