Regional Competitiveness in the Pioneer Valley

advertisement

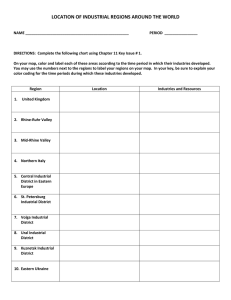

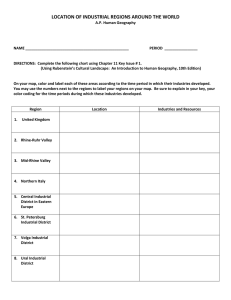

Regional Competitiveness in the Pioneer Valley Professor Michael E. Porter Institute for Strategy and Competitiveness Harvard Business School Pioneer Valley Regional Competitiveness Council Meeting MassMutual Learning & Conference Center Chicopee, MA October 10, 2003 This presentation draws on ideas from Professor Porter’s articles and books, in particular, The Competitive Advantage of Nations (The Free Press, 1990), “Building the Microeconomic Foundations of Competitiveness,” in The Global Competitiveness Report 2002, (World Economic Forum, 2002), “Clusters and the New Competitive Agenda for Companies and Governments” in On Competition (Harvard Business School Press, 1998), and ongoing research on clusters and competitiveness. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means - electronic, mechanical, photocopying, recording, or otherwise - without the permission of Michael E. Porter. Further information on Professor Porter’s work and the Institute for Strategy and Competitiveness is available at www.isc.hbs.edu Sources of Prosperity Prosperity Prosperity Productivity Productivity “Competitiveness” Innovative Innovative Capacity Capacity z The most important sources of prosperity are created not inherited z Productivity does not depend on what industries a region competes in, but on how it competes z The prosperity of a region depends on the productivity of all its industries z Innovation is vital for long-term increases in productivity RCC Pioneer Valley 10-10-03 CK RB3 2 Copyright © 2003 Professor Michael E. Porter Productivity, Innovation, and the Business Environment Context Contextfor for Firm Firm Strategy Strategy and andRivalry Rivalry z Factor Factor (Input) (Input) Conditions Conditions z Presence of high quality, specialized inputs available to firms –Human resources –Capital resources –Physical infrastructure –Administrative infrastructure –Information infrastructure –Scientific and technological infrastructure –Natural resources z z z z A local context and rules that encourage investment and sustained upgrading –e.g., Intellectual property Demand protection Demand Conditions Meritocratic incentive systems Conditions across all major institutions Open and vigorous competition z Sophisticated and demanding local among locally based rivals customer(s) z Local customer needs that anticipate those elsewhere Related and Related and z Unusual local demand in specialized Supporting segments that can be served Supporting Industries nationally and globally Industries Access to capable, locally based suppliers and firms in related fields Presence of clusters instead of isolated industries • Successful economic development is a process of successive economic upgrading, in which the business environment in a nation or region evolves to support and encourage increasingly sophisticated ways of competing RCC Pioneer Valley 10-10-03 CK RB3 3 Copyright © 2003 Professor Michael E. Porter Composition of Regional Economies United States Traded Traded Clusters Clusters Local Local Clusters Clusters Natural Natural ResourceResourceDriven Driven Industries Industries 31.6% 31.6% 1.7% 1.7% 67.6% 67.6% 2.8% 2.8% 0.8% 0.8% -1.0% -1.0% $46,596 $46,596 133.8 133.8 5.0% 5.0% $28,288 $28,288 84.2 84.2 3.6% 3.6% $33,245 $33,245 99.0 99.0 1.9% 1.9% 144.1 144.1 79.3 79.3 140.1 140.1 Patents per 10,000 Employees 21.3 21.3 1.3 1.3 7.0 7.0 Number of SIC Industries 590 590 241 241 48 48 Share of Employment Employment Growth, 1990 to 2001 Average Wage Relative Wage Wage Growth Relative Productivity Note: 2001 data, except relative productivity which is 1997 data. Source: Cluster Mapping Project, Institute for Strategy and Competitiveness, Harvard Business School Specialization of Regional Economies Select U.S. Geographic Areas Seattle-BellevueSeattle-BellevueEverett, Everett,WA WA Aerospace AerospaceVehicles Vehiclesand and Defense Defense Fishing Fishingand andFishing Fishing Products Products Analytical AnalyticalInstruments Instruments Denver, Denver,CO CO Leather Leatherand andSporting SportingGoods Goods Oil and Gas Oil and Gas Aerospace AerospaceVehicles Vehiclesand andDefense Defense Chicago Chicago Communications CommunicationsEquipment Equipment Processed ProcessedFood Food Heavy HeavyMachinery Machinery Wichita, Wichita,KS KS Aerospace AerospaceVehicles Vehiclesand and Defense Defense Heavy HeavyMachinery Machinery Oil Oiland andGas Gas Pittsburgh, Pittsburgh,PA PA Construction ConstructionMaterials Materials Metal MetalManufacturing Manufacturing Education Educationand andKnowledge Knowledge Creation Creation San San FranciscoFranciscoOakland-San Oakland-San Jose Jose Bay Bay Area Area Communications Communications Equipment Equipment Agricultural Agricultural Products Products Information Information Technology Technology Los Los Angeles Angeles Area Area Apparel Apparel Building Building Fixtures, Fixtures, Equipment Equipment and and Services Services Entertainment Entertainment Boston Boston Analytical AnalyticalInstruments Instruments Education Educationand andKnowledge KnowledgeCreation Creation Communications CommunicationsEquipment Equipment Raleigh-Durham, Raleigh-Durham,NC NC Communications CommunicationsEquipment Equipment Information InformationTechnology Technology Education Educationand and Knowledge KnowledgeCreation Creation San SanDiego Diego Leather Leatherand andSporting SportingGoods Goods Power Generation Power Generation Education Educationand andKnowledge Knowledge Creation Creation Houston Houston Heavy HeavyConstruction ConstructionServices Services Oil and Oil andGas Gas Aerospace AerospaceVehicles Vehiclesand andDefense Defense Atlanta, Atlanta,GA GA Construction ConstructionMaterials Materials Transportation Transportationand andLogistics Logistics Business Services Business Services Note: Clusters listed are the three highest ranking clusters in terms of share of national employment Source: Cluster Mapping Project, Institute for Strategy and Competitiveness, Harvard Business School RCC Pioneer Valley 10-10-03 CK RB3 5 Copyright © 2003 Professor Michael E. Porter Massachusetts Life Sciences Cluster Health Healthand and Beauty Beauty Products Products Cluster Cluster Organizations Organizations MassMedic, MassMedic, MassBio, MassBio,others others Health Health Services Services Provider Provider Surgical Surgical Instruments Instruments and Suppliers and Suppliers Specialized Specialized Business Business Services Services Medical Medical Equipment Equipment Dental Dental Instruments Instruments and and Suppliers Suppliers BiopharmaBiopharmaceutical ceutical Products Products Biological Biological Products Products Banking, Banking, Accounting, Accounting, Legal Legal Specialized Specialized Risk Risk Capital Capital Ophthalmic Ophthalmic Goods Goods VC VC Firms, Firms, Angel Angel Networks Networks Diagnostic Diagnostic Substances Substances Specialized Specialized Research Research Service Service Providers Providers Containers Containers Analytical Analytical Instruments Instruments RCC Pioneer Valley 10-10-03 CK RB3 Research Research Organizations Organizations Laboratory, Laboratory, Clinical Clinical Testing Testing Educational Educational Institutions Institutions Harvard Harvard University, University, MIT, MIT, Tufts Tufts University, University, Boston University, UMass, others Boston University, UMass, others 6 Copyright © 2003 Professor Michael E. Porter Traded Clusters Overlap Textiles Apparel Footwear Leather and Sporting Goods Chemical Products Financial Services Agricultural Products Publishing and Printing Fishing & Fishing Products Education and Knowledge Creation Information Technology Tobacco Transportation and Logistics Entertainment Communications Equipment Aerospace Vehicles & Defense Aerospace Engines Lightning & Electrical Equipment Metal Manufacturing Power Generation Distribution Services Sporting, Business Services Note: Clusters with overlapping borders or identical shading have at least 20% overlap (by number of industries) in both directions RCC Pioneer Valley 10-10-03 CK RB3 Prefabricated Enclosures Automotive Hospitality and Tourism Jewelry & Precious Metals Heavy Construction Services Medical Devices Analytical Instruments Furniture Building Fixtures, Equipment and Services Oil and Gas Pharmaceuticals Forest Products Processed Food Construction Materials Plastics 7 Recreation and Production Technology Heavy Machinery Motor Driven Products Children’s Goods Copyright © 2003 Professor Michael E. Porter The Evolution of Regional Economies San Diego Hospitality and Tourism Climate Climate and and Geography Geography Sporting and Leather Goods Transportation and Logistics Power Generation Communications Equipment Aerospace Vehicles and Defense U.S. U.S. Military Military Information Technology Analytical Instruments Education and Knowledge Creation Medical Devices Bioscience Bioscience Research Research Centers Centers 1910 RCC Pioneer Valley 10-10-03 CK RB3 1930 1950 Biotech / Pharmaceuticals 1970 8 1990 Copyright © 2003 Professor Michael E. Porter Institutions for Collaboration Selected Massachusetts Organizations. Life Sciences Life Life Sciences Sciences Industry Industry Associations Associations University University Initiatives Initiatives Harvard Harvard Biomedical Biomedical Community Community zz MIT MIT Enterprise Enterprise Forum Forum zz Biotech Biotech Club Club at at Harvard Harvard Medical Medical School School zz Technology Technology Transfer Transfer offices offices Massachusetts Massachusetts Biotechnology Biotechnology Council Council zz Massachusetts Massachusetts Medical Medical Device Device Industry Industry Council Council zz Massachusetts Massachusetts Hospital Hospital Association Association zz zz General General Industry Industry Associations Associations Informal Informal networks networks Associated Associated Industries Industries of of Massachusetts Massachusetts zz Greater Greater Boston Boston Chamber Chamber of of Commerce Commerce zz High High Tech Tech Council Council of of Massachusetts Massachusetts Company Company alumni alumni zz Venture Venture Capital Capital community community zz University University alumni alumni zz zz Economic Economic Development Development Initiatives Initiatives Joint Joint Research Research Initiatives Initiatives Massachusetts Massachusetts Technology Technology Collaborative Collaborative zz Mass Mass Biomedical Biomedical Initiatives Initiatives zz Mass Mass Development Development zz Massachusetts Massachusetts Alliance Alliance for for Economic Economic Development Development New New England England Healthcare Healthcare Institute Institute zz Whitehead Whitehead Institute Institute For For Biomedical Biomedical Research Research zz Center Center for for Integration Integration of of Medicine Medicine and and Innovative Technology (CIMIT) Innovative Technology (CIMIT) zz RCC Pioneer Valley 10-10-03 CK RB3 zz 9 Copyright © 2003 Professor Michael E. Porter Influences on Competitiveness Multiple Geographic Levels World Economy Groups of Neighboring Nations Nations States, Provinces Metropolitan Areas Smaller Cities and Counties RCC Pioneer Valley 10-10-03 CK RB3 10 Copyright © 2003 Professor Michael E. Porter Massachusetts Regional Competitiveness Council Regions Regional Competitiveness Councils and Town/City Borders RCC Pioneer Valley 10-10-03 CK RB3 11 Copyright © 2003 Professor Michael E. Porter Regional Competitiveness Pioneer Valley z Foundations of Regional Competitiveness z Assessing the Competitiveness of the Pioneer Valley z Action Agenda RCC Pioneer Valley 10-10-03 CK RB3 12 Copyright © 2003 Professor Michael E. Porter Economic Performance Pioneer Valley z Wages are below the US average and most Massachusetts regions, and lag both in growth z Employment has been growing at 1.3% annually over the last five years, far below the US and Massachusetts average z Pioneer Valley registered by far the lowest rates of establishment growth of all Massachusetts regions – Establishment size is above average z Patenting rates of 6.3 patents per 10,000 employees in 2001 put Pioneer Valley in the lower group of Massachusetts regions RCC Pioneer Valley 10-10-03 CK RB3 13 Copyright © 2003 Professor Michael E. Porter Comparative Performance of Regions Wage Growth and Wages 9.0% 8.0% Greater Boston Northeast 7.0% CAGR of Average Wage, 1997–2001 6.0% Cape and Islands Central 5.0% US Average Wage Growth: 4.56% Southeast 4.0% Pioneer Valley Represents employment of 250,000 in 2001 Berkshire 3.0% US Average Wage: $34,669 2.0% 25,000 30,000 35,000 40,000 45,000 50,000 55,000 60,000 Average Wage, 2001 Data: private, non-agricultural employment Source: Cluster Mapping Project, Institute for Strategy and Competitiveness, Harvard Business School RCC Pioneer Valley 10-10-03 CK RB3 14 Copyright © 2003 Professor Michael E. Porter Wages in Traded and Local Industries Massachusetts Regions $45,000 US Average Traded Wage: $44,956 Greater Boston $40,000 Massachusetts, all regions $35,000 Average Local Wage, 2001 Southeast $30,000 Northeast Central Cape and Islands $25,000 $20,000 $30,000 US Average Local Wage: $28,288 Pioneer Valley Berkshire $35,000 $40,000 $45,000 $50,000 $55,000 $60,000 $65,000 $70,000 $75,000 $80,000 Average Traded Wage, 2001 Source: Cluster Mapping Project, Institute for Strategy and Competitiveness, Harvard Business School RCC Pioneer Valley 10-10-03 CK RB3 15 Copyright © 2003 Professor Michael E. Porter Comparative Performance of Regions Wage Growth and Employment Growth 9.0% 8.0% Greater Boston 7.0% Northeast CAGR of Average Wage, 6.0% 1997–2001 Cape and Islands Central Southeast 5.0% 4.0% Represents employment of 250,000 in 2001 US Average Wage Growth: 4.56% Pioneer Valley 3.0% US Average Employment Growth: 2.21% Berkshire 2.0% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% CAGR of Employment, 1997–2001 Data: private, non-agricultural employment Source: Cluster Mapping Project, Institute for Strategy and Competitiveness, Harvard Business School RCC Pioneer Valley 10-10-03 CK RB3 16 3.0% 3.5% Copyright © 2003 Professor Michael E. Porter Job Creation Massachusetts Regions 60,000 Net Net job job creation creation in in traded traded clusters, clusters, 1997-2001: 1997-2001: +535 +535 Job Creation, 1997-2001 50,000 Net Net job job creation creation in in local local clusters, clusters, 1997-2001: 1997-2001: +10,274 +10,274 40,000 30,000 20,000 10,000 Central Berkshire Pioneer Valley Pioneer Valley Southeast Cape and Islands Northeast -10,000 Greater Boston 0 Data: private, non-agricultural employment. Note: Regional data does not total precisely to statewide data due to omissions for confidentiality in the regions. Source: Cluster Mapping Project, Institute for Strategy and Competitiveness, Harvard Business School RCC Pioneer Valley 10-10-03 CK RB3 17 Copyright © 2003 Professor Michael E. Porter Comparative Performance of Regions Establishment Formation in Traded Clusters 4.5% US Average Employees per Traded Establishment: 23.8 4.0% Northeast Central 3.5% CAGR of Traded Establishments, 1997–2001 US Average Rate of Traded Establishment Formation: 2.79% 3.0% Berkshire Greater Boston 2.5% Cape and Islands Southeast 2.0% Represents 4,000 traded establishments in 2001 1.5% Pioneer Valley 1.0% 5 10 15 20 Employees per Traded Establishment, 2001 25 30 Source: Cluster Mapping Project, Institute for Strategy and Competitiveness, Harvard Business School RCC Pioneer Valley 10-10-03 CK RB3 18 Copyright © 2003 Professor Michael E. Porter Comparative Performance of Regions Wages and Patenting Rates 60,000 US Average Patenting Rate: 7.71 per 10,000 Workers 55,000 Greater Boston 50,000 Average Wage, 2001 Northeast 45,000 40,000 US Average Wage: 34,669 35,000 Central Southeast Pioneer Valley 30,000 Represents 500 patents in 2001 Berkshire Cape and Islands 25,000 20,000 0 5 10 15 Patents per 10,000 Workers, 2001 20 Source: Cluster Mapping Project, Institute for Strategy and Competitiveness, Harvard Business School RCC Pioneer Valley 10-10-03 CK RB3 19 Copyright © 2003 Professor Michael E. Porter Patents by Organization Pioneer Valley Region Organization Patents Issued from 1997 to 2001 1 SPALDING SPORTS WORLDWIDE, INC. 83 2 LISCO, INC. 39 3 REXHAM GRAPHICS INC. 28 4 UNIVERSITY OF MASSACHUSETTS 26 5 SMITH & WESSON CORP. 14 6 UNITED TECHNOLOGIES CORPORATION 13 7 BAYER CORPORATION 12 8 COMBUSTION ENGINEERING INC. 11 9 MONSANTO COMPANY, INC. 9 10 RESEARCH CORPORATION TECHNOLOGIES, INC. 8 11 AVERY DENNISON CORPORATION 6 12 SOLUTIA INC. 6 13 SPECIALTY LOOSE LEAF, INC. 6 14 TAPESWITCH CORPORATION OF AMERICA 6 15 OTIS ELEVATOR COMPANY 5 16 DIESEL ENGINE RETARDERS, INC. 4 17 PRESSTEK, INC. 4 18 HARDIGG INDUSTRIES, INC. 4 19 THOMCAST COMMUNICATIONS, INC. 4 20 NEW ENGLAND SCIENCE & SPECIALTY PRODUCTS, INC. 4 21 MILLA COMPANY INC 4 22 KOLLMORGEN CORPORATION 4 Note: The USPTO assigns location based on the inventor’s address rather than that of the institutional owner. Source: Cluster Mapping Project, Institute for Strategy and Competitiveness, Harvard Business School RCC Pioneer Valley 10-10-03 CK RB3 20 Copyright © 2003 Professor Michael E. Porter Composition Pioneer Valley z Pioneer Valley has a very strong position in sporting, recreational, and children’s goods and in leather and related products, with national employment shares up to ten times higher than expected given the region’s size – Other significant clusters include publishing and printing, plastics, production technology, and education and knowledge creation z The Pioneer Valley is strengthening its position in a number of its strong clusters, especially in building fixtures and in leather and related products – More than 60% of employees in clusters with a higher than expected presence in the region and above national average wages are in clusters growing share z Wages in the region lag the state average across all clusters with significant employment RCC Pioneer Valley 10-10-03 CK RB3 21 Copyright © 2003 Professor Michael E. Porter Specialization By Traded Cluster Pioneer Valley Region 3.0% Sporting, Recreational and Children’s Goods 2.5% 2.0% Share of National Cluster Employment in 2001 1.5% Leather and Related Products Publishing and Printing 1.0% Production Technology Forest Products Plastics 0.5% Region’s Share of National Employment: 0.205% Building Fixtures, Equipment & Services 0.0% -0.4% -0.2% 0.0% 0.2% 0.4% 0.6% 0.8% Change in Share, 1997–2001 = 0–499 = 500–2,499 = 2,500–7,999 = 8,000+ Source: Cluster Mapping Project, Institute for Strategy and Competitiveness, Harvard Business School RCC Pioneer Valley 10-10-03 CK RB3 22 Copyright © 2003 Professor Michael E. Porter Specialization By Traded Cluster Pioneer Valley Region 0.60% Publishing and Printing 0.50% Plastics Production Technology 0.40% Share of National Cluster Employment in 2001 Education and Knowledge Creation Aerospace Engines 0.30% Financial Services Metal Manufacturing Region’s Share of National Employment: 0.205% Communication Equipment 0.20% Processed Food Lighting and Electrical Equipment 0.10% Automotive 0.00% -0.06% Entertainment Business Services -0.04% Transportation and Logistics Construction Materials Hospitality and Tourism Analytical Instruments Distribution Services Apparel Medical Biopharmaceuticals Devices -0.02% 0.00% 0.02% 0.04% 0.06% Change in Share, 1997–2001 = 0–499 = 500–2,499 = 2,500–7,999 = 8,000+ Source: Cluster Mapping Project, Institute for Strategy and Competitiveness, Harvard Business School RCC Pioneer Valley 10-10-03 CK RB3 23 Copyright © 2003 Professor Michael E. Porter Employment By Traded Cluster Pioneer Valley Region Financial Services Education and Knowledge Creation Publishing and Printing Business Services Plastics Hospitality and Tourism Metal Manufacturing Sporting, Recreational and Children's Goods Production Technology Forest Products Processed Food Building Fixtures, Equipment and Services Distribution Services Heavy Construction Services Leather and Related Products Transportation and Logistics Entertainment Communications Equipment Analytical Instruments Automotive Information Technology Apparel Chemical Products Aerospace Engines Construction Materials Textiles Motor Driven Products Lighting and Electrical Equipment Medical Devices Aerospace Vehicles and Defense Biopharmaceuticals Furniture Heavy Machinery Agricultural Products Jewelry and Precious Metals Tobacco Prefabricated Enclosures Power Generation and Transmission Oil and Gas Products and Services Footwear Fishing and Fishing Products Rank in MA 4 2 2 4 2 5 2 1 3 1 3 2 5 5 1 5 4 5 5 4 5 5 5 2 5 4 3 5 5 2 4 6 5 6 3 . . . . . . 0 2,000 4,000 6,000 8,000 10,000 12,000 Employment, 2001 l - Indicates expected employment at rates in the state benchmark for traded clusters. Rank is across 7 state regions. Source: Cluster Mapping Project, Institute for Strategy and Competitiveness, Harvard Business School RCC Pioneer Valley 10-10-03 CK RB3 24 Copyright © 2003 Professor Michael E. Porter RCC Pioneer Valley 10-10-03 CK RB3 25 -1,500 Forest Products Automotive Business Services Publishing and Printing Metal Manufacturing Sporting, Recreational and Children's Goods Lighting and Electrical Equipment Textiles Motor Driven Products Information Technology 1,000 Furniture 1,500 Processed Food Chemical Products Production Technology Apparel Heavy Machinery Transportation and Logistics Jewelry and Precious Metals Construction Materials Aerospace Vehicles and Defense Aerospace Engines Entertainment Agricultural Products Financial Services Medical Devices Communications Equipment Biopharmaceuticals Heavy Construction Services Analytical Instruments Hospitality and Tourism Plastics Distribution Services Leather and Related Products Building Fixtures, Equipment and Services Education and Knowledge Creation Job Creation, 1997-2001 Job Creation By Traded Cluster Pioneer Valley Region 2,000 Net Net job job creation creation in in traded traded clusters clusters from from 1997-2001: 1997-2001: +535 +535 500 0 -500 -1,000 Indicates expected job creation at rates achieved in national benchmark clusters, i.e. % change in national benchmark times initial employment Source: Cluster Mapping Project, Institute for Strategy and Competitiveness, Harvard Business School Copyright © 2003 Professor Michael E. Porter Relative Cluster Performance 0.205% of U.S. Employment 1.8 Pioneer Valley Region Apparel 26.4% of traded employment 16.9% in clusters gaining share 9.5% in clusters losing share 1.6 Relative Cluster Wage, 2001 Metal Manufacturing 1.4 Heavy Construction Services Processed Food 1.2 Building Fixtures, Plastics Equipment & Services Education and Knowledge Creation Sporting, Recreational and Children’s Goods (14.2, 1.32) Leather and Related Products (6.66, 1.10) Forest Products 1.0 Publishing and Printing Production Technology 0.8 Aerospace Engines Hospitality and Tourism Financial Biopharmaceuticals Services 0.6 U.S. average cluster wage Entertainment 0.4 Agricultural Products 0.2 0.0 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 Relative Cluster Employment, 2001 = 0–499 = 500–2,499 = 2,500–4,999 Red = Gaining Share = 8,000+ Black = Loosing Share Note: US wage and employment benchmarks Data points that fall outside the graph are placed on the borders with their values given in parentheses (Employment, Wage) Source: Cluster Mapping Project, Institute for Strategy and Competitiveness, Harvard Business School RCC Pioneer Valley 10-10-03 CK RB3 26 Copyright © 2003 Professor Michael E. Porter RCC Pioneer Valley 10-10-03 CK RB3 27 Local Food and Beverage Processing and Distribution Local Utilities Local Household Goods and Services 2,000 Local Financial Services 2,500 Local Logistical Services Local Industrial Products and Services Local Entertainment and Media Local Education and Training Local Retail Clothing and Accessories Local Motor Vehicle Products and Services Local Personal Services (Non-Medical) Local Commercial Services Local Community and Civic Organizations Local Health Services Local Hospitality Establishments Local Real Estate, Construction, and Development Job Creation, 1997-2001 Job Creation By Local Cluster Pioneer Valley Region 3,000 Net Net job job creation creation in in local local clusters, clusters, 1997-2001: 1997-2001: +10,274 +10,274 1,500 1,000 500 0 -500 -1,000 -1,500 -2,000 Indicates expected job creation at rates achieved in national benchmark clusters, i.e. % change in national benchmark times initial employment Source: Cluster Mapping Project, Institute for Strategy and Competitiveness, Harvard Business School Copyright © 2003 Professor Michael E. Porter Wages By Traded Cluster Pioneer Valley Region with State Benchmarks Information Technology Financial Services Aerospace Vehicles and Defense Forest Products Business Services Aerospace Engines Plastics Analytical Instruments Heavy Construction Services Medical Devices Distribution Services Sporting, Recreational and Children's Communications Equipment Metal Manufacturing Automotive Transportation and Logistics Chemical Products Production Technology Publishing and Printing Apparel Processed Food Heavy Machinery Building Fixtures, Equipment and Services Education and Knowledge Creation Biopharmaceuticals Construction Materials Lighting and Electrical Equipment Motor Driven Products Textiles Leather and Related Products Furniture Jewelry and Precious Metals Entertainment Hospitality and Tourism Agricultural Products Region’s average traded wage: $41,569 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 Wages, 2001 l - Indicates Massachusetts average wage in the cluster. Source: Cluster Mapping Project, Institute for Strategy and Competitiveness, Harvard Business School RCC Pioneer Valley 10-10-03 CK RB3 28 Copyright © 2003 Professor Michael E. Porter Leading Sub-Clusters by Location Quotient Pioneer Valley Region, 2001 Clus te r Fina ncia l S e rvice s Educa tion a nd Knowle dge Cre a tion P ublis hing a nd P rinting P la s tics Hos pita lity a nd Touris m Me ta l Ma nufa cturing S porting, Re cre a tiona l a nd Childre n's Goods P roduction Te chnology Fore s t P roducts P roce s s e d Food Building Fixture s , Equipme nt a nd S e rvice s Le a the r P roducts Tra ns porta tion a nd Logis tics Communica tions Equipme nt Ana lytica l Ins trume nts Automotive Appa re l Che mica l P roducts Ae ros pa ce Engine s Cons truction Ma te ria ls Te xtile s Motor Drive n P roducts Biopha rma ce utica ls Lo c atio n Quo tie nt S ubc lus te r Ins ura nce P roducts Educa tiona l Ins titutions P a pe r P roducts S pe cia lty P a pe r P roducts P hotogra phic Equipme nt a nd S upplie s P la s tic Ma te ria ls a nd Re s ins P la s tic P roducts Touris m Attra ctions S a w Bla de s a nd Ha nds a ws P re cis ion Me ta l P roducts Me ta l P roce s s ing Ga me s , Toys , a nd Childre n's Ve hicle s S porting a nd Athle tic Goods Ma chine Tools a nd Acce s s orie s P roce s s Ma chine ry P a pe r P roducts P a pe r Indus trie s Ma chine ry P a pe r Conta ine rs a nd Boxe s Milk a nd Froze n De s s e rts Fa brica te d Ma te ria ls He a ting a nd Lighting Re la te d P roducts Bus Tra ns porta tion Ele ctrica l a nd Ele ctronic Compone nts Optica l Ins trume nts P roduction Equipme nt Knitting a nd Finis hing Mills S pe cia l P a cka ging Aircra ft Engine s Wood P roducts S pe cia lty Appa re l Compone nts Applia nce s Conta ine rs 1.95 2.26 14.74 2.91 2.52 4.64 1.76 1.99 54.48 2.76 1.78 44.00 7.54 8.30 1.64 7.95 7.18 2.38 1.97 7.96 3.22 10.57 4.64 2.10 7.40 2.01 1.53 7.94 1.97 2.18 4.66 2.00 1.75 S hare o f Natio nal Emplo yme nt 0.40% 0.46% 3.02% 0.60% 0.52% 0.95% 0.36% 0.41% 11.17% 0.57% 0.36% 9.02% 1.55% 1.70% 0.34% 1.63% 1.47% 0.49% 0.40% 1.63% 0.66% 2.17% 0.95% 0.43% 1.52% 0.41% 0.31% 1.63% 0.41% 0.45% 0.95% 0.41% 0.36% Rank amo ng Mas s ac hus e tts Re g io ns 3 2 1 1 4 1 2 2 1 2 3 1 2 1 4 1 2 1 3 1 2 1 1 5 4 2 4 1 2 1 3 1 2 Emplo yme nt 4,791 7,597 2,642 356 255 1,491 2,202 1,135 941 641 983 1,967 1,023 1,456 271 1,683 194 1,009 310 911 272 1,678 235 694 346 560 273 175 325 255 266 232 128 Source: Cluster Mapping Project, Institute for Strategy and Competitiveness, Harvard Business School RCC Pioneer Valley 10-10-03 CK RB3 29 Copyright © 2003 Professor Michael E. Porter Sole Proprietorship Employment and Growth Pioneer Valley Region Sole Proprietorship Employment 2001 7,000 6,000 Sole Soleproprietorships: proprietorships: Sole proprietorships: as % as totalemp: emp: as %%of ofoftotal total emp: CAGR 1998-2001: CAGR 1998-2001: CAGR 1998-2001: Professional, scientific, and technical services 37,648 37,648 13.0% 13.0% 0.51% 0.51% Construction 5,000 Other services Health care and social assistance 4,000 Real estate and rental and leasing Retail trade 3,000 Arts, entertainment, and recreation Administrative, support and waste mgmt and remediation services 2,000 1,000 Finance and insurance Wholesale trade Accommodation and food services Manufacturing 0 -5% -4% -3% -2% -1% 0% Educational services Agriculture, forestry, Transportation and fishing and hunting warehousing Information services and publishing 1% 2% 3% 4% 5% Compound Annual Growth Rate (CAGR) of Sole Proprietorship Employment, 1998–2001 Note: Data available on county basis only; the allocation to Massachusetts regions is only approximate. Source: U.S. Census Bureau, Nonemployer Statistics RCC Pioneer Valley 10-10-03 CK RB3 30 Copyright © 2003 Professor Michael E. Porter Business Environment Pioneer Valley z Pioneer Valley compares favorably to the Massachusetts state average on most dimensions of the business environment – Particular strengths include the low cost of living and doing business, and the quality of the transportation infrastructure – Skill availability gets average grades, with room for improvement especially in vocational schools z Despite their satisfaction with most elements of the business environment, business leaders in the Pioneer Valley are critical towards the overall attractiveness of their region z A key concern is the responsiveness and overall role of the state in economic development – Pioneer Valley executives see the lack of business-friendly policies as key barrier to growth, and report regulations and the lack of policy predictability as a key concern RCC Pioneer Valley 10-10-03 CK RB3 31 Copyright © 2003 Professor Michael E. Porter Regional Comparisons Availability of Inputs Strongly Disagree 1 Strongly Agree Mean Agreement 2 3 4 5 6 7 The overall quality of life in your region makes recruitment and retention of employees easy The communications infrastructure in your local region fully satisfies your business needs Advanced educational programs provide your business with high quality employees Specialized facilities for research are readily available The cost of living in your region makes recruitment and retention of employees easy Qualified scientists and engineers in your local region are in ample supply The overall quality of transportation is very good relative to other regions The overall quality of the K-12 education system is high The available pool of skilled workers in your region is sufficient to meet your growth needs Basic education and English language instruction for immigrant workers meet the needs of my organization The cost of doing business is low relative to other regions Access to risk capital (e.g. venture capital, angel capital) is easy The institutions in your local region that perform basic research frequently transfer knowledge to your industry Berkshire Central Northeast Southeast Source: Professor Michael E. Porter and Monitor Group RCC Pioneer Valley 10-10-03 CK RB3 32 Cape and Islands Greater Boston Pioneer Valley Massachusetts Copyright © 2003 Professor Michael E. Porter Regional Comparisons Institutions & Education How satisfied are you with the impact of the following institutions, in your region, on your company? Strongly Disagree 1 Strongly Agree Mean Agreement 2 3 4 5 6 7 Community Colleges Universities Industry or Cluster Trade Associations Business Assistance Centers Business Incubators Public or Private Research Organizations How would you best describe the quality of new workers from these sources? Mean Rating Inadequate 3 Superior 2 1 Private universities Public universities Community colleges Other private or non-profit training providers Vocational schools Source: Professor Michael E. Porter and Monitor Group RCC Pioneer Valley 10-10-03 CK RB3 33 Berkshire Cape and Islands Central Northeast Southeast Greater Boston Pioneer Valley Massachusetts Copyright © 2003 Professor Michael E. Porter Regional Comparisons Regional Strategy & Summary of the Regional Business Environment Strongly Disagree Does your local region have a well articulated economic strategy and are you an active participant in it? Strongly Agree Mean Agreement 1 2 3 4 1 2 3 4 5 6 7 My organization can contribute significant value to an economic development strategy. My organization is an active participant in the execution of this strategy. Local business and government leaders have articulated a clear strategy for promoting the economic development of the local region. The state has articulated a clear strategy for the region. Summary of the Regional Business Environment 5 6 7 Overall, this region in Massachusetts is a good place for my company to do business. Overall, my region has strengths in my industry compared to other regions in Massachusetts. Berkshire Central Northeast Southeast Source: Professor Michael E. Porter and Monitor Group RCC Pioneer Valley 10-10-03 CK RB3 34 Cape and Islands Greater Boston Pioneer Valley Massachusetts Copyright © 2003 Professor Michael E. Porter Regional Comparisons Future Threats in the Local Business Environment 0% Percent of Respondents which Ranked Characteristic Among the Top Five Greatest Threats 100% Cost of doing business (e.g. real estate, wages, utilities, etc) State government's overall responsiveness to the needs of business Available pool of skilled workforce Predictability of state government policies State regulations for production processes and products/services State environmental/safety regulations Quality of local K-12 schools Quality of transportation (e.g. ease of access, traffic) Access to capital Level of locally-based competition in your industry Predictability of local government policies Local government's overall responsiveness to the needs of business Overall quality of life for employees Berkshire Central Northeast Southeast Source: Professor Michael E. Porter and Monitor Group RCC Pioneer Valley 10-10-03 CK RB3 35 Cape and Islands Greater Boston Pioneer Valley Massachusetts Copyright © 2003 Professor Michael E. Porter Regional Comparisons Priorities for Government Not at All Important 1 Critically Important Mean Importance 2 3 4 5 Promote world-class primary and secondary education Simplify compliance procedures for government regulations (e.g. one-stop filing, websites, etc) Promote specialized education and training programs to upgrade worker skills Improve state government support for transportation and other physical infrastructure Improve information and communications infrastructure Implement tax reform to encourage investment in innovation (e.g. R&D tax credits) Improve local government support for transportation and other physical infrastructure Promote universal computer literacy Support the particular needs of start-up companies (access to capital, incubators, management training) Catalyze partnerships among government agencies, industry and universities Speed-up regulatory approval process in line with product lifecycles Assist in attracting suppliers and service providers from other locations Increase funding for university-based research Increase government support for funding of specialized research institutes, labs, etc. Provide services to assist and promote local exports Source: Professor Michael E. Porter and Monitor Group RCC Pioneer Valley 10-10-03 CK RB3 36 Berkshire Cape and Islands Central Northeast Southeast Greater Boston Pioneer Valley Massachusetts Copyright © 2003 Professor Michael E. Porter Regional Competitiveness Pioneer Valley z Foundations of Regional Competitiveness z Assessing the Competitiveness of the Pioneer Valley z Action Agenda RCC Pioneer Valley 10-10-03 CK RB3 37 Copyright © 2003 Professor Michael E. Porter Shifting Responsibilities for Economic Development Old Old Model Model New New Model Model •• Government Government drives drives economic economic development development through through policy policy decisions decisions and and incentives incentives RCC Pioneer Valley 10-10-03 CK RB3 •• Economic Economic development development is is aa collaborative collaborative process process involving involving government government at at multiple multiple levels, levels, companies, companies, teaching teaching and and research research institutions, institutions, and and institutions institutions for for collaboration collaboration 38 Copyright © 2003 Professor Michael E. Porter Role of the Private Sector in Economic Development • • • • • • • • • A company’s competitive advantage is partly the result of the local environment Company membership in a cluster offers collective benefits Private investment in “public goods” is justified Take an active role in upgrading the local infrastructure Nurture local suppliers and attract new supplier investments Work closely with local educational and research institutions to upgrade quality and create specialized programs addressing cluster needs Provide government with information and substantive input on regulatory issues and constraints bearing on cluster development Focus corporate philanthropy on enhancing the local business environment An important role for trade associations – Greater influence – Cost sharing RCC Pioneer Valley 10-10-03 CK RB3 39 Copyright © 2003 Professor Michael E. Porter Public / Private Cooperation in Cluster Upgrading Minnesota’s Medical Device Cluster Context Contextfor for Firm Firm Strategy Strategy and andRivalry Rivalry Factor Factor (Input) (Input) Conditions Conditions • Joint development of vocationaltechnical college curricula with the medical device industry • Minnesota Project Outreach exposes businesses to resources available at university and state government agencies • Active medical technology licensing through University of Minnesota • State-formed Greater Minnesota Corp. to finance applied research, invest in new products, and assist in technology transfer RCC Pioneer Valley 10-10-03 CK RB3 • Aggressive trade associations (Medical Alley Association, High Tech Council) • Effective global marketing of the cluster and of Minnesota as the “The Great State of Health” • Full-time “Health Care Industry Specialist” in the department of Trade and Economic Development Demand Demand Conditions Conditions • State sanctioned reimbursement policies to enable easier adoption and reimbursement for innovative products Related Relatedand and Supporting Supporting Industries Industries 40 Copyright © 2003 Professor Michael E. Porter Towards an Action Agenda for the Pioneer Valley z Mount cluster development efforts, especially around the region’s strong traded clusters z Improve the communication between business and government in setting economic policy RCC Pioneer Valley 10-10-03 CK RB3 41 Copyright © 2003 Professor Michael E. Porter