Competing by Saving Lives: How Pharmaceutical and Medical Device Companies Create

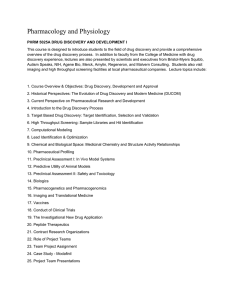

advertisement