Document 13612501

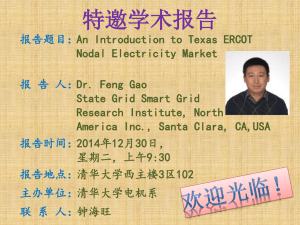

advertisement