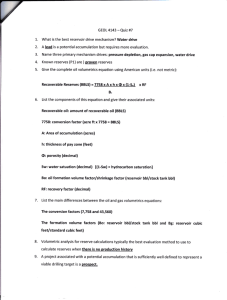

Guidelines for Application of the Petroleum Resources Management System

advertisement