Potential and Risks of a Financial Transaction Tax August 2010

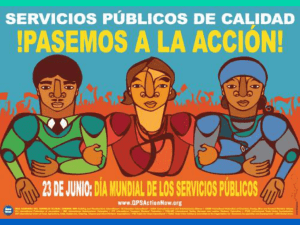

advertisement