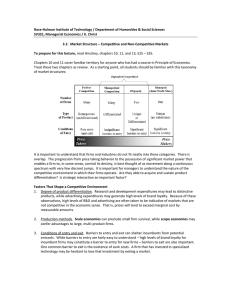

Patterns of Firm Entry and Exit in U.S. Manufacturing Industries

advertisement