Tampa Bay Comprehensive Economic Development Strategy

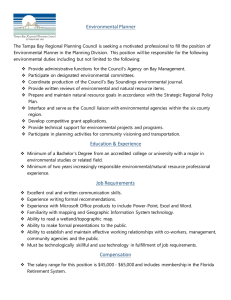

advertisement