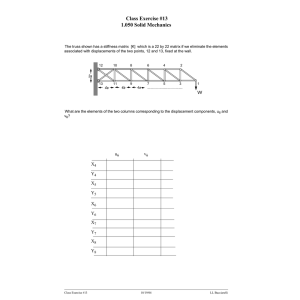

1 Investment

advertisement

1

Investment

• Neo-Classical (Jorgenssen)

• irreversability (Bentolila-Bertola / Bertola-Caballero)

• Fixed costs (Caballero-Engle)

— firm level

— aggregation

— general equilibrium

2

User Cost

Value with complete markets

X

t,st

¡ ¢ ¡ ¢

qt0 st dt st

¡ ¢

¡ ¡

¢ ¢

¡ ¡

¢

¡ ¢

¢

¡ ¢ ¡ ¢

dt st = π kt st−1 , st − c kt st−1 , it st , st − pt st it st

¡ ¢

¡

¢

¡ ¢

kt+1 st = (1 − δ) kt st−1 + it st

subsituting

¡ ¢

¡ ¡

¢ ¢

¡ ¡

¢

¡ ¢

¡

¢

¢

dt st = π kt st−1 , st − c kt st−1 , kt+1 st − (1 − δ) kt st−1 , st

|

{z

}

“blat (st )”

• value

¡

¡ ¢

¡

¢¢

−p (st ) kt+1 st − (1 − δ) kt st−1

X

t,st

¡ ¢¡

¡ ¢

¡ ¢¡

¡ ¢

¡

¢¢¢

qt0 st blat st − pt st kt+1 st − (1 − δ) kt st−1

1

• if pt+1 (st+1 ) = pt (st ) then

¡ ¢

¡ ¢ X 0 ¡ t+1 ¢

¡ ¢

qt+1 s

(1 − δ) kt+1 st

qt0 st kt+1 st −

st+1

¶

1−δ

Rt,t+1 (

st )

¡ ¢¡ ¡ ¢

¢

q 0 (st )

= t t kt+1 st R st − 1 + δ

R (s )

X ¡ ¢

¡ ¢¡ ¡ ¢

¢

qt0 st kt+1 st R st − 1 + δ

=

µ

¡ t¢

¡ t¢

0

= qt s kt+1 s

1−

st+1

• where risk-free rate

• or at t + 1 simply

¡ ¢

R st = P

qt0 (st )

0

t+1 )

st+1 qt+1 (s

¡ ¢¡ ¡ ¢

¢

kt+1 st R st − 1 + δ

• user cost (rental rate)

¡ ¢

¡ ¢¡ ¡ ¢

¢

ν st ≡ pt st R st − (1 − δ)

• assume pt (st ) 6= pt+1 (st , st+1 ) = pt+1 (st , ŝt+1 )

i.e. prices are not constant but predictable

¡ ¢ ¡ ¢

¡ ¢ X

¡

¢

¡

¢

¡ ¢

pt st qt0 st kt+1 st −

pt+1 st+1 qt0+1 st+1 (1 − δ) kt+1 st

st+1

¶

µ

¡ t¢

¡ t¢

¡ t¢

¡ t+1 ¢ 1 − δ

0

= qt s kt+1 s

pt s − pt+1 s

R (st )

X

¡ t+1 ¢

¡ ¢¡ ¡ ¢ ¡ ¢

¡

¢¢

0

=

qt+1

s

kt+1 st R st pt st − (1 + δ) pt+1 st+1

st+1

• user cost (rental rate)

¶

µ

¡ t¢

¡ t¢

¡ t¢

pt+1 (st+1 )

ν s ≡ pt s

R s − (1 − δ)

pt (st )

→ physical and economic depreciation

2

• thus...

¡ ¢

¡ ¡

¢ ¢ ¡ ¡

¢

¡ ¢

¢ ¡ ¢¡

¡ ¢

¡

¢¢

dt st = π kt st−1 , st −c kt st−1 , it st , st −p st kt+1 st − (1 − δ) kt st−1

...equivalent to

¡ ¢

¡ ¡

¢ ¢

¡ ¡

¢

¡ ¢

¢

¡

¢

d˜t st = π kt st−1 , st − c kt st−1 , it st , st − ν (st ) kt s

t−1

3

Irreversability or Costly Reversability

Discrete example (see Dixit-Pindyck)

• three periods t = −1, 0, 1

t = −1 invest k0

t = 0 invest k1

• at t = 0 learn A1 ∈ {AH , AL }

• irreversability

k1 ≥ k0 (1 − δ)

• risk neutral pricing

¡ ¢

¡ ¢

qt0 st ≡ R−t Pr s

t

• constant user cost v

Firm problem

µ

µ

−1

p

max A0 F (k0 ) − vk0 + R

k0

max

k1 ≥k0 (1−δ)

equivalently

¡ H

¢

A F (k1 ) − vk1 + (1 − p)

max A0 F (k0 ) − vk0 + R−1 E V (k0 , A1 )

k0

V (k, A) =

max AF (k 0 ) − vk0

k0 ≥k(1−δ)

• unconstrained optimum

max

AF (k0 ) − vk0

0

k

¢

¡

⇒ AF 0 k# (A) − v = 0

3

max

k1 ≥k0 (1−δ)

¶¶

(AL F (k1 ) − vk1 )

• if k1∗ (AL ) = k0 (1 − δ)

AF 0 (k1 ) − v ≤ 0

⇒A0 F 0 (k0 ) − v +

1−p

(AL F 0 (k1 ) − v) (1 − δ) = 0

{z

}

R |

−

⇒

k0∗

<

k0#

(A0 )

• another way of seeing this:

A0 F 0 (k0 ) − v + E [Vk (k0 , A1 )] = 0

but Vk ≤ 0 and Vk < 0 in some state...

• irreversability

⇒ lower investment

• if kt ∈ {0, 1} ⇒ option value intuition [Dixit&Pyndick]

• Q: lower average capital?

A: NO

• investment rule

k0 ≥ k1∗ → don’t invest

k0 < k1∗ → invest until k1 = k1∗

→ barrier control

• costly reversability

capital sells at discount

→upper barrier control

• comparative statics

increase uncertainty

4

4

Bentolila and Bertola

• homogenous return

π (k, z) = k α z 1−α

• Bellman

V (k− , z− ) = E

½

¾

max [π (k, z) − rk + βV (k, z)]

k≥(1−δ)k−

• guess

µ

¶

µ ¶

k

k

V (k, z) = zV

, 1 = zv

z

z

½ µ µ

¶

¶

∙ µ

¶¸¾

µ

¶

k

k

k

k−

z π

,1 −r

+ βE zV

,z

z− V

,1 = E

max

z k

k

z−

z

z

z

≥(1−δ) − −

z

z z−

• normalized

v (k− ) = E ε max[π (k) − rk + βv (k)]

k

k ≥ ε−1 (1 − δ) k−

s.t.

• FOC

π 0 (k∗ ) = r − βV 0 (k∗ )

• lower investment

V 0 (k) ≤ 0 ⇒ k∗ < k#

• Example:

ε = { b , g }

prob. λ, 1 − λ

• no adjustment ⇒

k = (1 − δ) ε−1 k−

then

g b

(1 − δ)2 = 1 ⇒

g

=

−1

b

(1 − δ)−2

keeps us on a grid

k∗ , k∗

−1

b

(1 − δ)−1 , k ∗

k ∗ ( b (1 − δ))−n

5

−2

b

(1 − δ)−2 , ...

n = 0, 1, 2, ...

• invariant

pn = (1 − λ) pn+1 + λpn−1

p0 = (1 − λ) p1 + (1 − λ) p0

• solving

1 = (1 − λ)

n = 1, 2, ...

p1

p1

λ

+ (1 − λ) ⇒

=

p0

p0

1−λ

substituting

pn+1

pn−1

pn+1

λ

+λ

⇒

=

pn

pn

pn

1−λ

µ

¶n

λ

⇒ pn = p0

1−λ

1 = (1 − λ)

• costly reversability:

regulate k from above as well

• from Bertola-Bentolila

Figure removed due to copyright restrictions.

See Figure 1 on p. 388 in Bentolila, Samuel, and Giuseppe Bertola.

"Firing Costs and Labour Demand: How Bad is Eurosclerosis?"

Review of Economic Studies 57, no. 3 (1990): 381-402.

• Abel and Eberly (1999; JME)

6

5

Labor: Firing Costs

• effects of firing costs on labor demand?

• Bertola and Bertolila (1990)

• Hopenhayn and Rogerson (1993)

Figure removed due to copyright restrictions.

See Figure 2 on p. 392 in Bentolila, Samuel, and Giuseppe Bertola.

"Firing Costs and Labour Demand: How Bad is Eurosclerosis?"

Review of Economic Studies 57, no. 3 (1990): 381-402.

Figure removed due to copyright restrictions.

See Figure 3 on p. 392 in Bentolila, Samuel, and Giuseppe Bertola.

"Firing Costs and Labour Demand: How Bad is Eurosclerosis?"

Review of Economic Studies 57, no. 3 (1990): 381-402.

7

Higher uncertainty

Figure removed due to copyright restrictions.

See Figure 4 on p. 393 in Bentolila, Samuel, and Giuseppe Bertola.

"Firing Costs and Labour Demand: How Bad is Eurosclerosis?"

Review of Economic Studies 57, no. 3 (1990): 381-402.

• Hopenhayn-Rogerson → ergodic distribution of shocks

• entry and exit of firms

• ergodic distribution of labor demand

• compare steady states with and without

6

Aggregate Shocks

• concerted shocks in z

• distribution is state variable

• average reaction depends on distribution

7

Fixed Costs

• fixed cost if it > 0

8

• don’t invest unless its important

→ innaction (fixed cost is irreversable)

• avoid fixed costs:

lump investment (no small investments)

•

Ss rule

• other end: generalized Ss

8 Generalized Hazard

Caballero-Engle

• probability of investing

depends on distance from preferred point

• previous case: discontinuous hazard

• Calvo: constant hazard

• example 1

aggregate firms with different sS rules

• example 2

firms with random fixed cost

9 Aggregation

• state: distribution of firms

• evolution of distribution

aggregate vs. idiosyncratic shocks

• non-linear response

• history matters

9

10

General Equilibrium

Julia Thomas → small effects in GE

Bachman-Caballero-Engle → large in recalibrated model

10