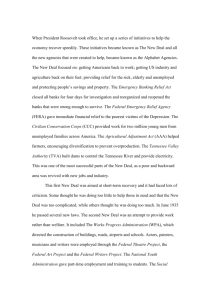

Did the New Deal save Democracy and Capitalism? Century John Joseph Wallis

advertisement