EASTERN MICHIGAN UNIVERSITY DEPARTMENT OF POLITICAL SCIENCE PLS 540, FALL 2013

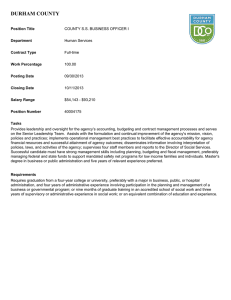

advertisement

EASTERN MICHIGAN UNIVERSITY DEPARTMENT OF POLITICAL SCIENCE INTRODUCTION TO PUBLIC/NONPROFIT BUDGETING PLS 540, FALL 2013 Dr. Joe Ohren 734-487-1452; 487-3113; Fax 487-3340 Office Hours: M and W 8-9am, 11am-Noon 601K Pray-Harrold, Faculty Office johren@emich.edu Wednesday, 5 – 6pm OBJECTIVES This is the first of a required two-course sequence in budgeting in the MPA program. It presumes a familiarity with governmental structures and processes in this country, including the role of public administration therein, but only a limited background in accounting, economics, public finance or public budgeting. Students who have had an introductory course in public administration are no doubt familiar with the topic in a general way, and all students may benefit from a cursory glance at any introductory public administration text to get a feel for the subject matter as a whole, especially if it has been some time since you have had an introductory course. Specific course objectives include: To understand the concepts of public/nonprofit budgeting; To explain the background and development of public budgeting in the US; To understand the impact of the economy on public and nonprofit budgets as well as the impact of budgets on the economy; To examine the political context of budgeting, including actors, roles and strategies; To determine the characteristics of a “good” public revenue system; To identify different “perspectives” on and describe different approaches to “doing” budgeting; and To link theory and practice in public/nonprofit budgeting through the use of exercises and cases. FORMAT The class will follow the outline below, recognizing the need for flexibility. Assigned readings should be completed prior to class since a lecture/discussion format will be used, including liberal use of discussion questions, in-class exercises and brief papers designed to stimulate thinking about and understanding of the budget process. Since class is almost three hours in length, we will break at an appropriate time and arrange for treats (a shared responsibility). GRADING Grading will be based on two take-home examinations (40% Midterm and 50% Final) and class participation and exercises (10%). Exams are intended to measure mastery of terminology and concepts as well as ability to analyze, integrate, develop and apply ideas drawn from course materials. Class attendance and active participation in class discussion are expected; note that there are several exercises in the outline and while not graded they will be collected and counted toward the participation grade. Exams are due as noted in the outline; late papers will be accepted only for “cause,” which will be determined by the instructor upon presentation of adequate documentation or other evidence at the sole discretion of the instructor (does this sound like administrative due process?). TEXTBOOK AND READINGS The text is available at local campus bookstores. Lee, Johnson and Joyce, Public Budgeting Systems, 9th Edition This is one of the premier texts on the subject, emphasizing primarily public budgeting; the text will be used in both 540 and the follow-up, 615, so don’t be put off by the cost. I will provide a number of handouts throughout the term to take advantage of other specialized literature, especially that addressing local government and nonprofit applications, and for those interested in additional readings, I will be happy to suggest some titles and provide materials from my personal library. There are also several readings, noted in the outline, that I will post on the course website. You will also find it valuable to read a daily newspaper to keep abreast of budget issues—many are covered regularly and address the particular issues facing the state and local governments and nonprofit organizations around us—and they will be used as a springboard for class discussion. And, while I am not asking you to do a term paper, it will be useful for you to review the budget from your own local government or nonprofit (most are easily accessible from websites and offer a glimpse of the issues facing your unit). Feel free to share your perspectives on those issues during the term (hint, participation credit). ACADEMIC INTEGRITY Academic dishonesty, including all forms of cheating and/or plagiarism, will not be tolerated in this class. Penalties for an act of academic dishonesty may range from receiving a failing grade for a particular assignment to receiving a failing grade for the entire course. In addition, you may be referred to the Office of Student Judicial Services for discipline that can result in either a suspension or permanent dismissal. The Student Conduct Code contains detailed definitions of what constitutes academic dishonesty, and it can be accessed online at www.emich.edu/sjs CLASSROOM MANAGEMENT ISSUES Students are expected to abide by the Student Conduct Code and assist in creating an environment that is conductive to learning and protects the rights of all members of the University community. Incivility and disruptive behavior will not be tolerated and may result in a request to leave class and referral to the Office of Student Services (SJS) for discipline. Examples of inappropriate classroom conduct include repeatedly arriving late to class, using a cellular phone, or talking while others are speaking. STUDENTS WITH DISABILITIES If you wish to be accommodated for your disability EMU Board of Regents policy #8.3 requires that you first register with the Access Services Office (ASO) in room 203 King Hall. You may contact ASO by telephone at (734) 487-2470. Students with disabilities are encouraged to register with ASO promptly as you will only be accommodated from the date you register with them forward. No retroactive accommodations are possible. 2 OUTLINE Date 9/4-11 Topic and Assignment Public budgeting--concepts, process and products; issues in public budgeting; differences between public, nonprofit and private sector budgeting; what constitutes “good” budgeting? The evolution of public budgeting Lee, Johnson and Joyce, Chapter 1 Handout 1 Ohren’s Rules for Essays White, “Making Common Sense of Federal Budgeting” The Costs of Budget Uncertainty We will devote some time in these first two classes to “Ohren’s” approach to the teaching-learning process (see Ohren’s Rules for Essays). As you will note in the material below, I have identified course objectives, expectations and assignments for the term. I have also provided detailed outlines of and sets of discussion questions on the several major topics to be covered this term. They are intended to guide your reading and preparation for class and facilitate your note taking in class. We will not necessarily be following a specific outline in any given class session, although my “roadmaps” will become familiar to you, but over the term you will see that we have touched on just about every item. And, the discussion questions preview exam questions—you know what you have to do, now go ahead and do it. 9/18-25 Overview of governmental revenues, spending, and borrowing; Intergovernmental aspects of public budgeting: fiscal federalism; budget cycles. Lee, Johnson and Joyce, Chapter 2, 4 How to Read a Budget Exercise 1: Go online and find the budget for your local government or for a nonprofit organization (the latter are less likely to be available but if you work with a nonprofit you might be able to get access); save it to a flash drive and bring it to class with you on the 18th. I will ask several of you to share your budgets with the class and we will use those to learn about “reading and understanding” a budget. You might want to read the article, How to Read a Budget, noted above and found on the course website in anticipation of the discussion. 10/2-9 Economics and public budgeting—a public finance primer. The role of government; the interaction between the economy and public budgeting Lee, Johnson and Joyce, Chapter 3 Handout 2 Exercise 2: Estimating the impact of the economy on governmental budgets and vice-versa; there are two exercises included on Handout 2 to be completed and submitted on 10/9. We will discuss your responses in class on the 9th. 3 10/16 Revenue structure and administration: what are the sources of revenue that are used to support government activities? How would you evaluate a source of revenue? Lee, Johnson and Joyce, Chapter 5-6 Handout 3 What's Wrong with Kansas' Tax Reform? Revenue Limits in MI Property Tax, 1-4 The Income Tax Rebellion: Can It Work? 10/23 No class; midterm distributed 10/16, due 10/30, discussed in class 11/6 10/30 Budget decision-making: incrementalism and rationality in budgeting; analysis and strategies in decision-making. Chapter 1 in the text includes a brief discussion of the key concepts Handout 4 Schick, “The Road to PBB” (on the course webpage); Wildavsky, “The Budgetary Process”; “A Budget for All Seasons.” Keith and Schick, “Introduction to the Federal Budget Process.” Exercise 3: Understanding budget roles and strategies, the politics of budgeting (see Handout 4); Exercise 3, due 11/6, asks you to describe the roles and strategies of various actors in a local government or a nonprofit organization. We will discuss this in class on the 30th and perhaps 11/6, but please complete the exercise for the 30th. 11/6-20 Budget preparation: budget constraints; formal and informal actors in budget preparation; alternative budget formats. Budget preparation: roles of departments, the central budget office, and the chief executive; top-down and bottom-up budgeting. Lee, Johnson and Joyce, Chapter 7-8 Handout 5 Washtenaw Budget Message; Washtenaw Board of Commissioners, 2012/13 Strategic Priorities And Budget Decision Principles City of Baltimore, Maryland, Ten-Year Fiscal Forecast, FY2013-FY2022 Owosso’s Budget Woes The Human Side Of Budgeting Exercise 4: Preparing personnel budgets; in Handout 5 I have inserted a brief budget estimating problem. Complete the assignment, due 11/20, to be discussed in class. 11/27 No class, Thanksgiving Holiday, 11/28 4 12/4-11 Legislative review and approval at all levels of government; purposes, processes, products; recent legislative reforms at the national level. Lee, Johnson and Joyce, Chapter 9-10 Handout 6 Washtenaw 2012-13 Budget Resolution The Politics Of Local Government Budgeting The Perils of Automatic Budgeting City of Midland Michigan Budget Resolution 12/18 Final Exam, distributed on 12/4 due 12/18 5