EIIA New International Travel Program EIIA Member’s Webinar

advertisement

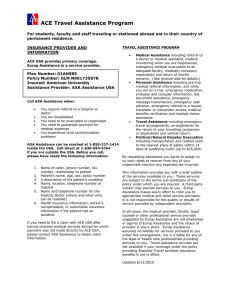

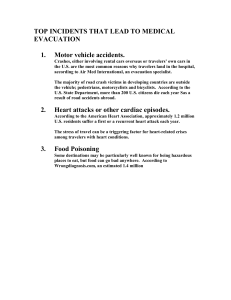

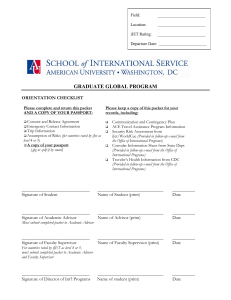

EIIA New International Travel Program EIIA Member’s Webinar Monday, May 18, 2015 Hosted by: Mary Ellen Moriarty Vice President for Property & Casualty EIIA International Travel Program Who: Students, Faculty, Staff, Alumni, Volunteers, Chaperones, Board members, “Other Participants”, third-country nationals, and Spouses and Children while accompanying covered travelers. When: For injury, or illness experienced when on an institution-sponsored trip (or immediately before, after, or during such a trip - “insured journey” or sojourn) Where: Coverage is worldwide EXCEPT the U.S. and its territories/ possessions (Puerto Rico, Guam, etc) Coverage does not apply to travelers when they are in their home country 2 EIIA International Program Structure EIIA Travelers participate in over 20,000 trips per year All Assistance The Goal – One phone number for all incidents Europ Assistance +1-240-330-1551 Int’l GL, Auto and WC Medical Political/Natural Disaster Evac. AXIS Kidnap & Ransom Aircraft (NOA) StarNet Insurance Company 3 EIIA International Travel Program Part I: Coverage Protecting the Institutions Part II: Emergency Services Protecting your travelers Part III: Kidnap & Ransom Part IV: Non-owned Aircraft 4 Part I: Employee Foreign Protection Navigators Insurance Company Section I Foreign Voluntary Compensation Statutory benefit Section II Employers Liability $1,000,000 limit for damages Workers Compensation Benefits: From State of Hire Note the following under the Employee Foreign Protection Cover: - Covers travel outside country of citizenship or residence and within "coverage territory" plus unlimited personal deviation - "Coverage Territory" means anywhere in the world, including international waters or airspace, but excluding the following: U.S. and its territories and possessions, or Puerto Rico - Definition of Employee is amended to include the following: Students, Alumni, Chaperones, Board Members and Trustees. Regarding the 71 local nationals, AXIS confirmed cover would be extended while traveling outside of their country of domicile during "temporary business travel". 5 Part I: General Liability Navigators Insurance Company • Per Occurrence Limit $1,000,000 • Aggregate Limit $2,000,000 • Damage, Premises Rented to You $1,000,000 • Personal & Advertising Injury $1,000,000 • Medical Expense Limit $50,000 • Crisis Communication Mgmt. $25,000 Students are named insureds only while directly involved in educational activity. Yes: Student on faculty-led trip to museum accidentally causes damage to art No: Student smashes a car windshield with a fire-ax while drunk 6 Part I: Automobile Coverage Navigators Insurance Company • Liability Limit $1,000,000 / accident • Medical Expense Limit $25,000 • Physical Damage Limit on Owned Autos $10,000 /accident, $100,000 aggregate • Physical Damage Limit on Hired Autos $25,000 / accident • Deductible, Comprehensive or Collision $1,000 / auto Liability Comprehensive Collision Owned Autos (scheduled) Hired Autos Non-Owned Autos EIIA and likely the country of hire requires that your travelers always purchase local rental insurance. 7 Part II: Service Provides for Emergency Services Protecting your Travelers AXIS Accident & Health Insurance Company: Is a subsidiary of AXIS Capital which is a Bermuda-based global provider of specialty insurance and services. AXIS Capital and its operating subsidiaries have been assigned a rating of A+ by both Standard & Poor’s and A.M.Best. Europ Assistance: Europ Assistance USA (EA) is a part of the Europ Assistance Group, the oldest and most experienced travel assistance network in the world EA has a network of 40 always-open multilingual assistance centers and 420,000 partners in 208 countries throughout the world. 8 Part II: Emergency Services • Policy Period: August 1, 2015 to August 1, 2018 • Policy Terms : 3 year policy term • Insured Persons: Students, Faculty, Staff, Alumni, Volunteers, Chaperones, Board Members, “Other Participants”, third-country nationals other than their country of citizenship or residence, Spouses and Children while accompanying covered travelers. 9 Part II: Emergency Services Exclusions • Excluded activities: skydiving/parachuting; hang gliding; bungee jumping; mountain climbing; pot-holing; zip-lining; motorcycle riding; and scuba diving – unless scuba diving is assigned as part of the curriculum of study for course credit • Excluded causes of loss: suicide; AIDS; routine or elective medical care; normal dental; acne; pregnancy or pregnancy related procedures including abortion; and loss due to participation in Specified Athletic Sporting Events 10 Part II: Emergency Accident & Sickness Coverage Comparison Emergency Accident & Sickness UnitedHealthcare Europ Assistance Emergency Accident & Sickness $100,000 $100,000 Deductible $250 No Deductible Emergency Medical for Pre-Existing Conditions $3,000 $25,000 Deductible $500 No Deductible Emergency Medical Evacuation $1,000,000 per person $1,000,000 per person Emergency Medical Repatriation $1,000,000 per institution $1,000,000 per incident Political Evacuation $100,000 per Person 100% of Usual and Customary Costs Political Evacuation $100,000 per Event 100% of Usual and Customary Costs Natural Disaster Evacuation $50,000 all participating Institution $100,000 per person Natural Disaster $50,000 all participating Institution $1,000,000 Aggregate Emergency Family Travel $5,000 per incident/$300 per day $5,000 per incident - airfare only 11 Part II: Accidental Death & Dismemberment Coverage Comparison UnitedHealthcare Europ Assistance Principal Sum Principal Sum Accidental Death & Dismemberment $200,000 per person $200,000 per person AD&D Aggregate $2,000,000 Per Accident $252,000,0000 Aggregate Air Risk Only $252,000,000 War Risk Felonious Assault - On or Off Premises Coverage not included 10% of Principal Sum subject to a $25,000 maximum Bereavement or Trauma Benefit Coverage not included $250 per session/Maximum Sessions - 10 Carjacking Benefit Coverage not included 10% of Principal Sum subject to a $25,000 maximum Coma Coverage not included 1% of Principal Sum - first 11 months; 100% in the 12th month Home Alteration/Vehicle modification Coverage not included 10% of Principal Sum subject to a $25,000 maximum Rehabilitation Coverage not included 10% of Principal Sum subject to a $25,000 maximum Seatbelt Coverage not included 25% of Principal Sum subject to a $50,000 maximum Airbag Coverage not included 10% of Principal Sum subject to a $25,000 maximum Psychological Treatment Benefit Coverage not included 10% of Principal Sum subject to a $25,000 maximum 12 Part II: Miscellaneous Services Coverage Comparison UnitedHealthcare Europ Assistance Trip Cancellation Coverage not included $2,000 per person/per year - Lifetime Maximum $2,000 Trip Interruption Coverage not included $2,000 per person/per year - Lifetime Maximum $2,000 Checked, Lost, Stolen Baggage Coverage not included $500 - excludes jewelry, watches, cameras, video recording equipment, I Pads, I Phone, Cell Phones, and all other electronic equipment Loss of Travel Documents Coverage not included $1,000 ID Theft Expense Benefit Coverage not included $1,000 Personal Sojourn Unlimited Unlimited War Risk Cover Coverage not included Yes Pre-Trip Assistance Yes Yes Translation Services Yes Yes Cash Advance Yes Yes Identification of Overseas Legal Services Identification Only Identification Only 13 International Program What ISN’T covered? • Specific sports when representing the institution – football, boxing, gymnastics, ice hockey, lacrosse, basketball, baseball, martial arts, rodeo, skiing (water/snow), surfing, swimming, diving, wrestling, or equestrian. Pick-up games are okay. • Specific hazardous activities any time – skydiving, parachuting, hang gliding, bungee jumping, mountain climbing, caving, zip-lining, motorcycle riding; scuba diving unless part of curriculum. • Medical costs associated with suicide attempts • Reimbursement for lost/stolen/damaged personal belongings • Trips for which the educational or missionary purpose is not primary • Evacuation not arranged by Europ Assistance; housing during evacuation • “Grounding” stays – stranded or unable to be medically evacuated home • Medical Companion coverage not medically necessary/required by doctor 14 International Program What Drives Claims? TOP 10 LOSSES, COST/CLAIM TOP 10 LOSSES, FREQUENCY • • • • • • • • • • • • • • • • • • • • Eye injury Vehicle-related Mental Health Heart-related Allergies Blood clots General Liability Infection/Inflammation Stroke Cyst Gastro-intestinal Infection/Inflammation Strains/Sprains/Bone breaks/Cuts Tropical Illnesses Mental Health Organs Allergies Animals/Bugs Assault Vehicle-related Incurred total for 105 Claims, March 2012 – July 2014 15 Institution Student Orientation Tools • Risk Management University (RMU) videos • Coverage Outline versus Coverage Comparison • One Page Coverage Summary • Brochures 16 Risk Management University • International Travel - Insurance Basics Description: This is the first of two courses on institution-sponsored international travel. This course focuses on the key components of the EIIA international travel program, including emergency medical expenses and different types of evacuations. There is also an RMU course on pre-travel planning, which covers best practices when preparing for travel, legal responsibilities of the institution and the need to report all claims immediately. Course Run Time: 13 Minutes URL: http://hosting.desire2learncapture.com/eiiarmu/1/Watch/90.aspx 17 Risk Management University • International Travel - Risk Management Considerations Description: This course covers pre-travel planning for international travel, including best practices, legal responsibilities of the institution and the need to report claims immediately. There is also an RMU course on the key components of the EIIA international travel program, including emergency medical expenses and different types of evacuations. Course Run Time: 14 Minutes URL: http://hosting.desire2learncapture.com/eiiarmu/1/Watch/91.aspx 18 Emergency Accident & Sickness Coverage Emergency Accident & Sickness Europ Assistance Emergency Accident & Sickness $100,000 Deductible No Deductible Emergency Medical for Pre-Existing Conditions $25,000 Deductible No Deductible Emergency Medical Evacuation $1,000,000 per person Emergency Medical Repatriation $1,000,000 per incident Political Evacuation 100% of Usual and Customary Costs Political Evacuation 100% of Usual and Customary Costs Natural Disaster Evacuation $100,000 per person Natural Disaster $1,000,000 Aggregate Emergency Family Travel $5,000 per incident - airfare only 19 Accidental Death & Dismemberment Coverage Accidental Death & Dismemberment Europ Assistance Accidental Death & Dismemberment $200,000 per person AD&D Aggregate $252,000,0000 Aggregate Air Risk Only $252,000,000 War Risk Felonious Assault - On or Off Premises 10% of Principal Sum subject to a $25,000 maximum Bereavement or Trauma Benefit $250 per session/Maximum Sessions - 10 Carjacking Benefit 10% of Principal Sum subject to a $25,000 maximum Coma 1% of Principal Sum - first 11 months; 100% in the 12th month Home Alteration/Vehicle modification 10% of Principal Sum subject to a $25,000 maximum Rehabilitation 10% of Principal Sum subject to a $50,000 maximum Seatbelt 25% of Principal Sum subject to a $25,000 maximum Airbag 10% of Principal Sum subject to a $25,000 maximum Psychological Treatment Benefit 10% of Principal Sum subject to a $25,000 maximum 20 Miscellaneous Services Coverage Miscellaneous Services Europ Assistance Trip Cancellation $2,000 per person/per year - Lifetime Maximum $2,000 Trip Interruption $2,000 per person/per year - Lifetime Maximum $2,000 Checked, Lost, Stolen Baggage $500 - excludes jewelry, watches, cameras, video recording equipment, I Pads, I Phone, Cell Phones, and all other electronic equipment Loss of Travel Documents $1,000 ID Theft Expense Benefit $1,000 Personal Sojourn Unlimited War Risk Cover Yes Pre-Trip Assistance Yes Translation Services Yes Cash Advance Yes Identification of Overseas Legal Services Identification Only 21 Miscellaneous Services One Page Coverage Summary 22 23 24 EIIA Communication Materials EIIA website – Update for new program – Mid June 2015 Europ Assistance security database – Launch Date – Mid June 2015 EIIA brochures – Mailing Date – May 25, 2015 Daily global travel updates Mobile Application 25 EIIA Website 26