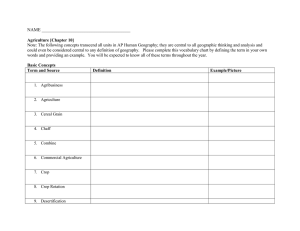

Initial grain marketing knowledge of participants in the Montana MarketManager... by Brian Keith Dennis

advertisement